Virtual Banks Could Serve a Quarter of Hong Kong’s Population by 2025

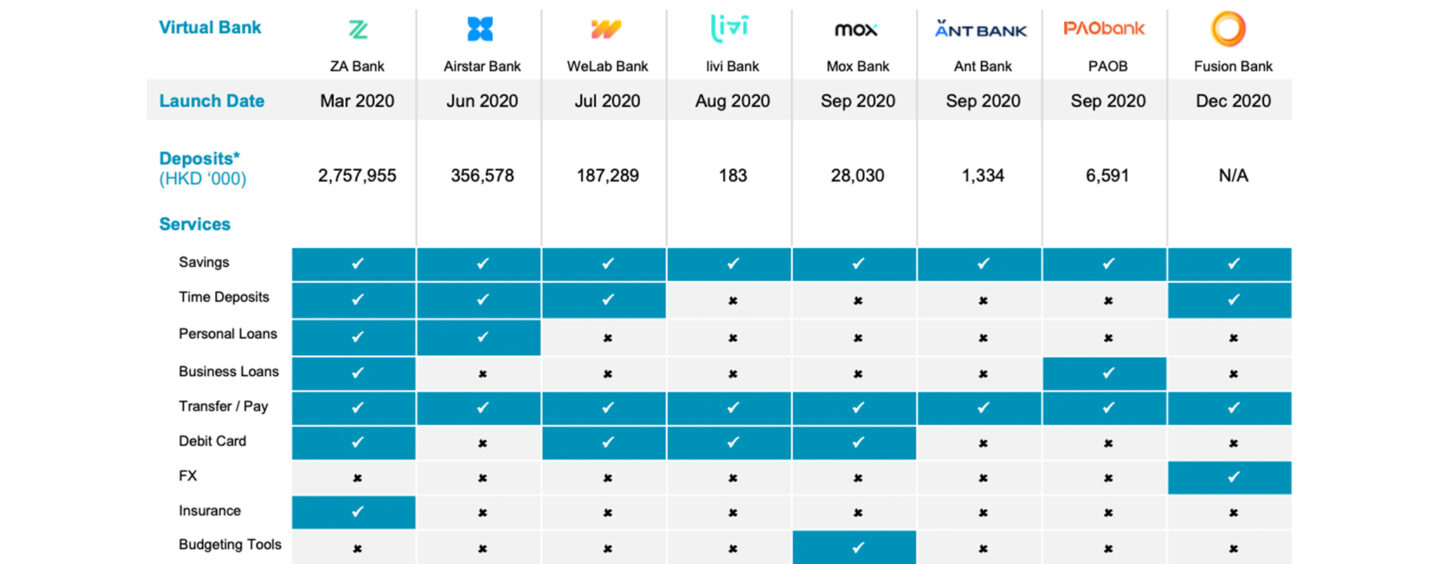

by Fintech News Hong Kong March 26, 2021By 2025, virtual banks could be serving a total of 1.9 million customers, or 24.9% of the Hong Kong population, and hold a combined revenue market share of 19.3%, estimates Quinlan and Associates. Though not insignificant, the consulting firm forecasts industry consolidation in the years to come with only a handful of players truly thriving.

These estimates were shared in a new report titled Branching Off: The Outlook for Hong Kong’s Virtual Banks, which looks in detail at the outlook for the Hong Kong virtual bank ecosystem in coming years.

According to the analysis, by 2025, there will be a revenue opportunity of HKD 76 billion (US$9.7 billion) per annum (p.a.) up for grabs by the virtual banks in Hong Kong. This represents an average annual revenue opportunity of HKD 9.5 billion (US$1.2 billion) and equates to an average revenue market of about 2.4% per virtual bank.

Hong Kong’s new virtual banks are competing not only with existing legacy banks but also between themselves in a region home to roughly 7.5 million inhabitants and some 340,000 small and medium-sized enterprises (SMEs), the report notes.

In their initial years, the focus will be put on acquiring new customers and building up a sizeable user base. But when cash burn rates become unsustainable and shareholders’ patience begins wearing thin, exit might be on the cards for those that had been unable to accumulate a critical mass of users and adequately monetize them.

“Hong Kong’s virtual banks are a catalyst for change; accelerating digital innovation and enhancing customer experience. While they are not expected to completely pull the rug from underneath their brick-and-mortar rivals, leading firms will able to capture a meaningful revenue opportunity, with long-term profitability hinging on their ability to rapidly amass a sizeable customer base, commercialise user data, leverage cross-selling of products and services, form a robust ecosystem that goes beyond financial services, and build a trusted franchise. While a combined HKD 76 billion local revenue pool by 2025 may not provide a big enough monetary opportunity for all eight virtual banks to thrive, the report concludes that there is scope for a handful of players to flourish.”

said Benjamin Quinlan, CEO, & Managing Partner, Quinlan and Associates

Virtual bank revenue potential (2025E), Source: Branching Off: The Outlook for Hong Kong’s Virtual Banks, Quinlan and Associates, March 2021

In 2019, the Hong Kong Monetary Authority licensed eight virtual banks. All of them launched during 2020 and so far have found a receptive user base in Hong Kong.

WeLab Bank, Hong Kong’s only homegrown virtual bank, picked up 10,000 new accounts within just ten days of opening to the public. The fintech unicorn, founded in 2013, started out in the consumer lending sector before branching out. In 2020, WeLab’s user base soared 20%, bringing its accumulative user base as of March 2021 to 50 million.

ZA Bank, run by a unit of China’s ZhongAn Online P&C Insurance, said earlier this week that it had gained 300,000 customers, and disbursed more than HKD 650 million in loans.

Mox Bank, the virtual bank backed by Standard Chartered in partnership with HKT, PCCW and Trip.com, has amassed 80,000 customers and HKD 5.1 billion (US$660 million) in deposits since it started operating in September.

Focusing on hyper-personalization and the adoption of new technologies, virtual banks are acting as a catalyst for innovation in the banking sector, bringing to the public rapid account opening, remote banking services and tailor-made products, as well as waiving many fees and minimum balance requirements.

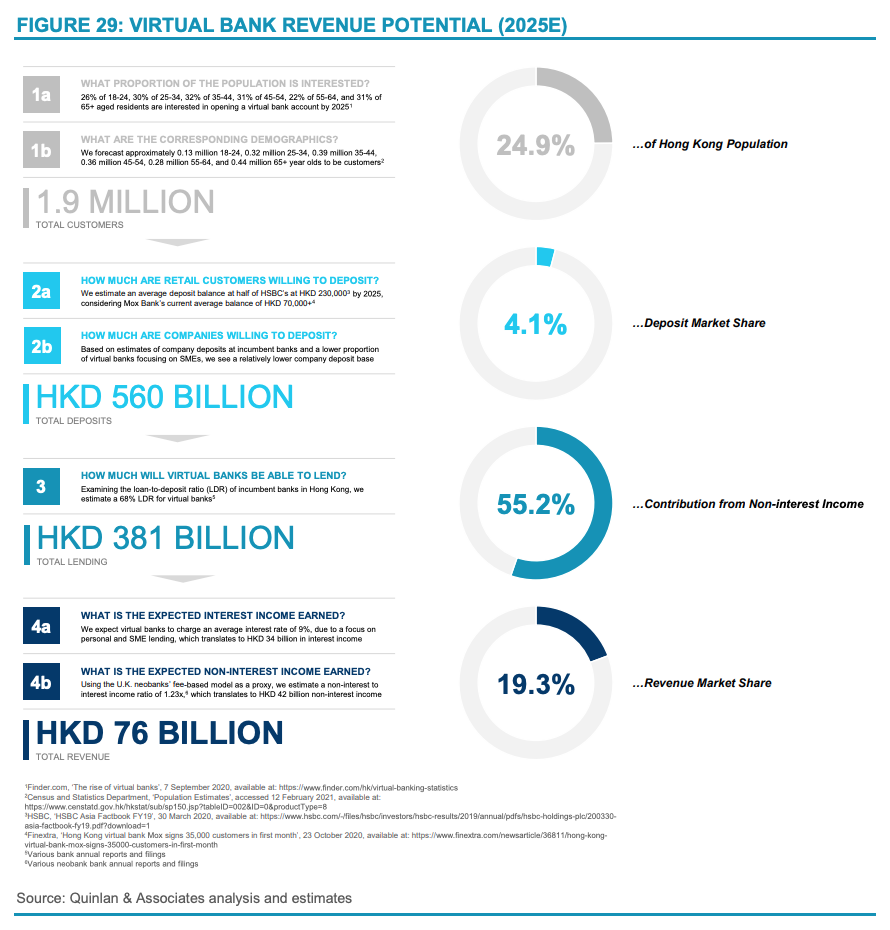

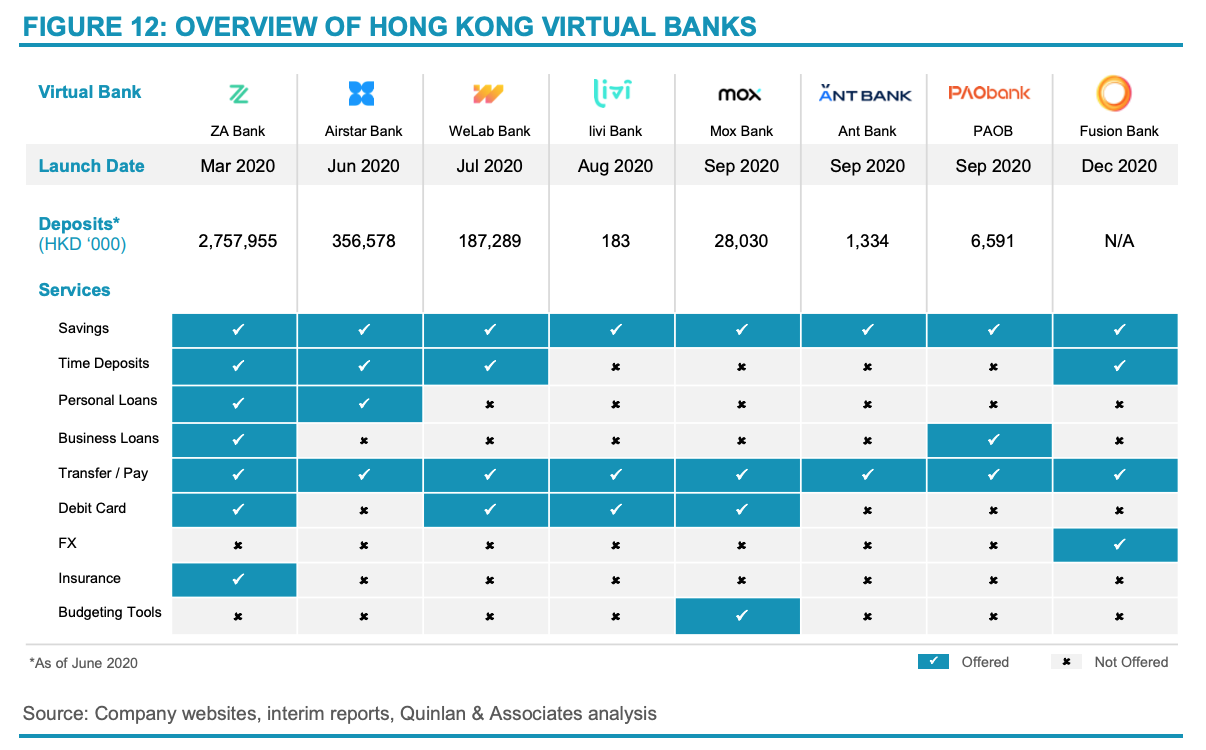

Hong Kong’s virtual banks

At present, Hong Kong’s virtual banks provide relatively basic products and services, such as savings accounts and payment capabilities, the Quinlan and Associates analysis found. They also typically offer highly competitive lending and deposit rates, free of charge digital and QR-code payments and transfer capabilities, along with free budgeting tools. This focus on no cost services suggests a clear first priority on scaling their customer base by attracting consumers looking for low-cost financial services.

Currently, ZA Bank has the widest range of offerings, the analysis found. ZA Bank was recently granted an insurance agency license by the Hong Kong Insurance Authority, signaling its entrance into the insurance business.

Mox Bank has plans to issue a credit card later this year, Standard Chartered’s chief executive in Hong Kong and chairwoman of the virtual bank said earlier this month. It also wants to add personal loans and wealth management services by mid-2022.

Overview of Hong Kong virtual banks, Source: Branching Off: The Outlook for Hong Kong’s Virtual Banks, Quinlan and Associates, March 2021

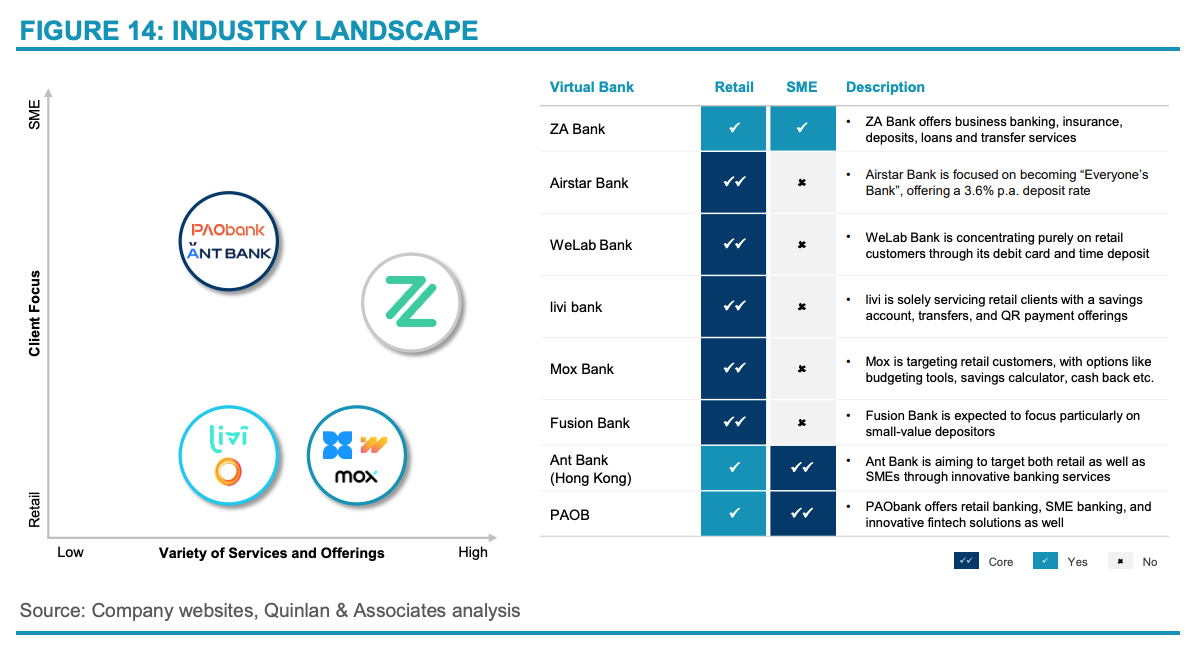

While Hong Kong’s virtual banks currently offer a similar suite of services mainly comprised of savings accounts, transfer and payment capabilities, and a debit card, the range of offerings and client focus differ between virtual banks.

Mox Bank, for example, is primarily targeting the retail banking segment and is the only player providing innovative budgeting tools, while Ping An OneConnect Bank (PAOB) has a stronger focus on SMEs. PAOB and ZA Bank are currently the only virtual banks in Hong Kong that offer business loans.

Industry landscape, Source: Branching Off: The Outlook for Hong Kong’s Virtual Banks, Quinlan and Associates, March 2021

KPMG expects more virtual banks to step into the SME banking space in 2021 with products and services focused on treasury management, payroll and payment functions, and more.

This push from both traditional and virtual banks will make the SME banking industry in Hong Kong more digitalized and competitive in the year ahead, the firm said in the Hong Kong Banking Outlook 2021 report.