The 4 Best Apps For The Stock Market That Simplify Investing

If been looking for something to do with your money then you realize there are a breadth of options available – today, we’re going to look at the best apps for the stock market that allow you to put your money to work. While there are plenty of institutional apps like Etrade and Merrill Lynch, among others, we’re going to look at public-facing apps that make it easy to get into trading.

Though financial service professionals have mixed feelings about these apps, you need to dig into the “why” of their reservations. In reality, the modern apps which we’ll cover later in the piece are sophisticated, intuitive and most importantly, you can legitimately put your money to work.

Complexities of investing and why apps for the stock market are the way to go

It takes years of studying and toiling to achieve success in the stock market. You’re certainly already aware that it’s a complex animal and as such, we can’t cover all the intricacies that savvy investors use in a short blog. Because of this fact, apps for the stock market are useful for those who want to do more with their money but don’t want to spend the time manually trading stocks.

Traders and other financial professionals know that to earn substantial amounts of money, a few things historically have needed to happen. Enough money needs to be fronted, you should have deep insight into the companies you choose to invest in or, you need to be good enough at cheating!

In a general sense, today’s apps for the stock market work more like mutual funds where you generally buy categories for example, by industry or by an investment “style” where you simply choose to invest in long-term, stable investments or higher risk with better payouts. Trading with apps is more automated and mostly hands-off – the backend analytics work in conjunction with AI to make solid recommendations and place your money where it will typically earn money and not set you back.

As these are real investments, know that there is still some risk. However, most apps do a great job of allocating your funds such that you won’t lose. Just know that, unless you’re really lucky, this isn’t a way to get rich quick.

The 4 best apps for the stock market

Check out any (or all) of these apps if you’re looking to invest your spare change, make a modest investment or something in between. Note that all apps use a secure service to link banks, like Plaid, and are either FDIC or SIPC insured.

1. Acorns

The Acorns app is a super user-friendly app that makes getting into investing fun. You can get started by seeding your Acorns account with a little money then choose to further invest by linking a bank account where it can draw additional funds plus, you can link a debit card where it rounds up and uses your additional change to supplement your account.

During the initial setup, you can choose how you want to invest. It gives you the option of doing everything from long-term stable investing to higher risk styles with better payouts with a few options in between.

Acorns also offers a slew of financial planning services that allow users to grow their knowledge as well as networks people with valuable offers such as the ability to explore and set up IRA accounts, among other features. Acorns can work as a hub for finance controls or it can act as just a place to invest in stocks, depending on user preference.

Get in on the App Store or Google Play.

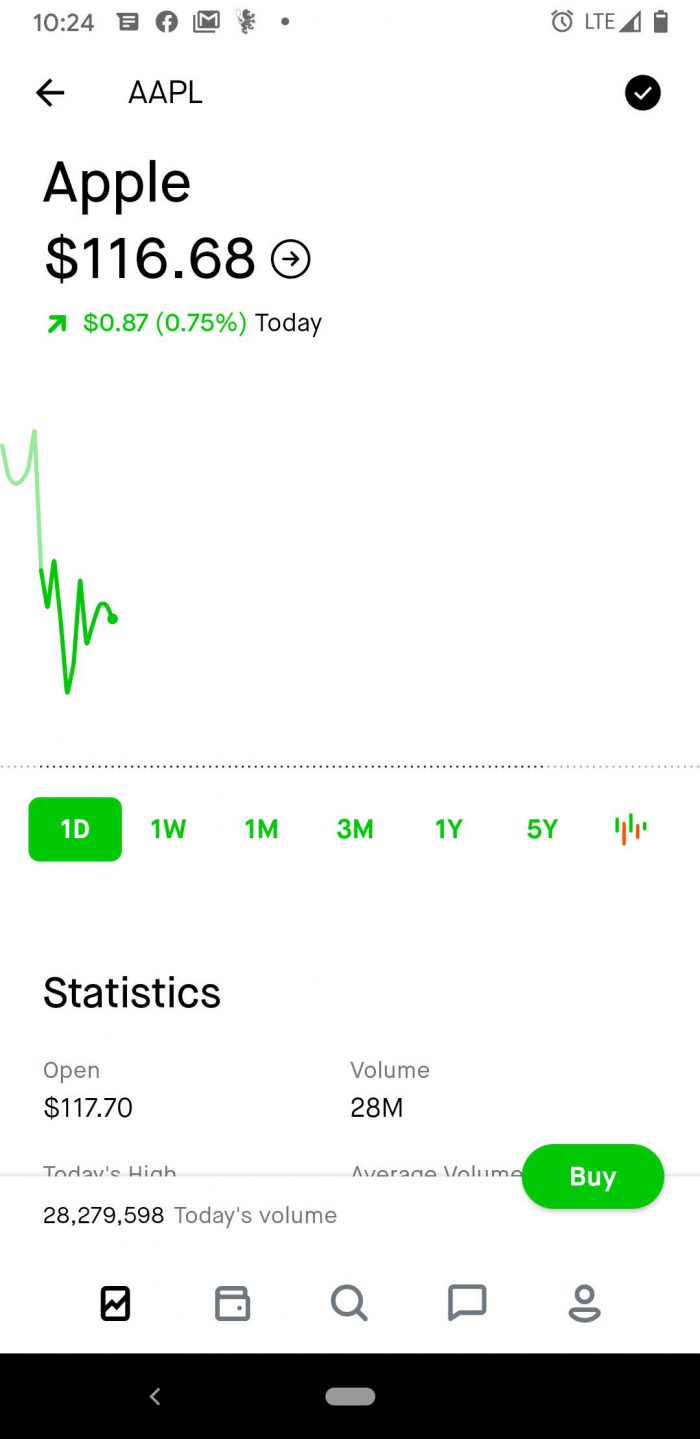

2. Robinhood

As one of the most popular apps for the stock market on the marketplaces today, Robinhood offers a great UX for commission-free stock trading. Unlike Acorns, you can’t opt to make more mutual fund-like investments by putting a few dollars into your account. Instead, you can make full-on purchases of stocks which is ideal for people who want a real trading experience that have more working capital.

Robinhood is having an interesting impact on the stock market, thanks in large part to the COVID-19 pandemic. In the first quarter of 2020, over three million users signed up and began using Robinhood to either learn how to trade stocks or to capitalize on their knowledge of the stock market.

One other really neat thing about Robinhood is the ability to buy a sell a variety of popular cryptocurrencies. Your Robinhood account can serve as your primary place to manage and invest from your crypto wallets with just a few taps.

Get it on the App Store or Google Play.

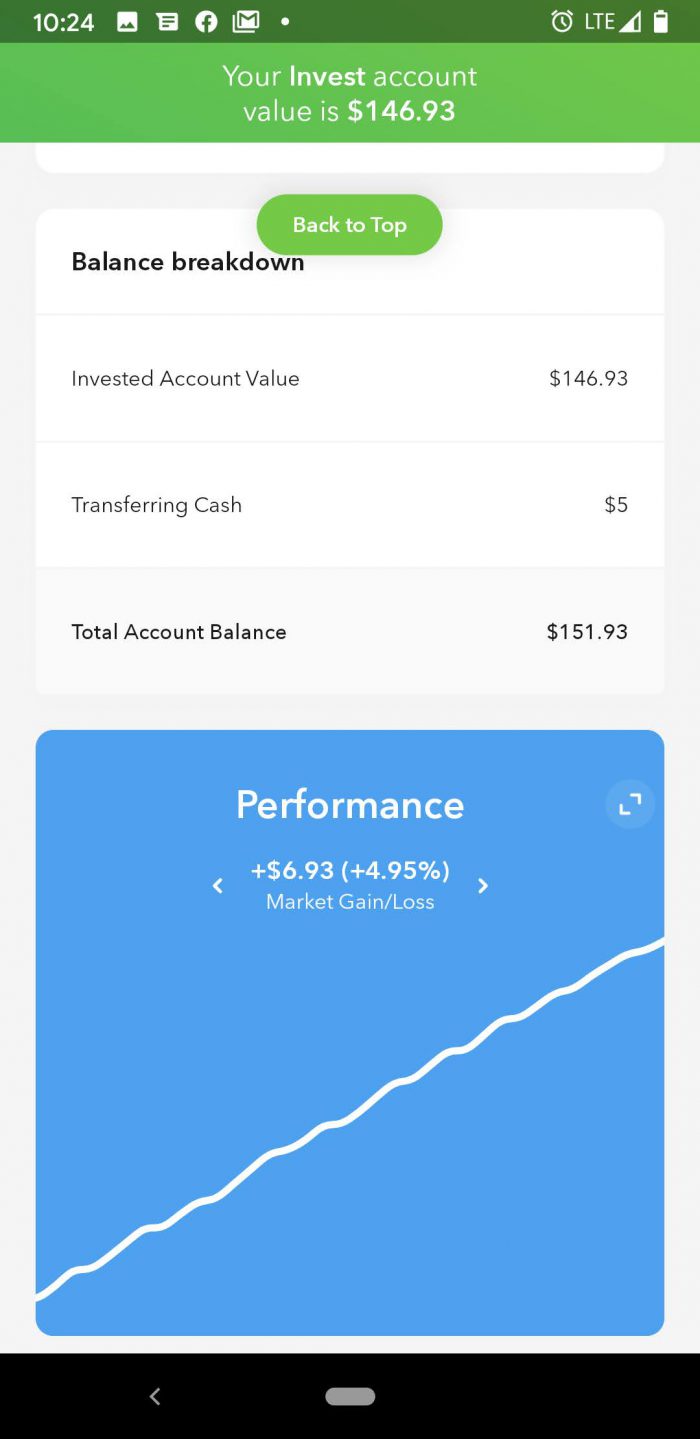

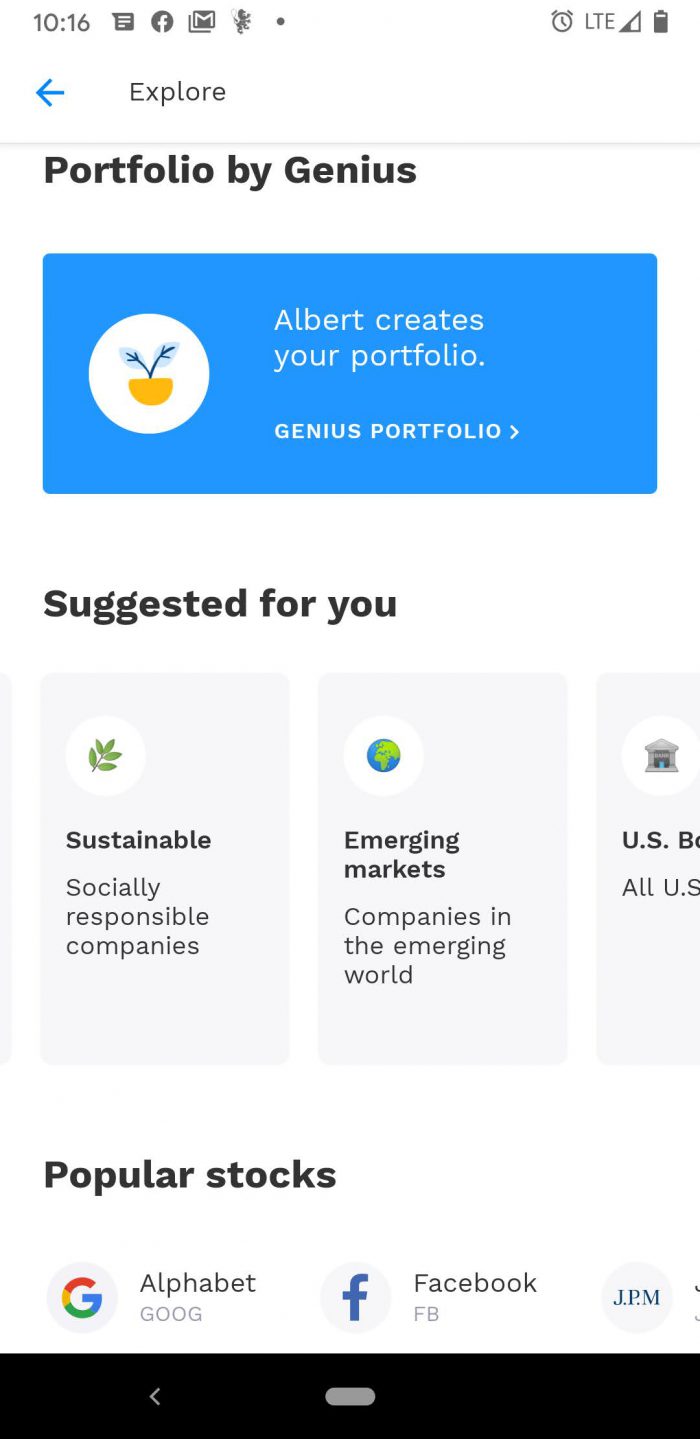

3. Albert

This app’s main selling point is it’s financial planning services. Albert users can link their bank accounts and use the app to create budgets that are easy to interact with via the app’s dashboards. For users with direct deposit, it also lets you borrow up to $100, interest-free if you’re in pinch between paychecks.

Albert uses an AI called Genius that helps guide users with various aspects of financial planning and investing. When turned on, each “side” of Genius works in tandem by helping users identify then apply funds to move around as well as provides investing insights. The only catch is that you have to pay for the Genius portion but it gives you the option of paying what you “think is fair,” starting at $4 a month.

On the investing end, Albert uses a simplified version of what you’d find in Acorns or Robinhood. With as little as one dollar, you can get started in investing by selecting an industry or narrower market like for example, the emerging market of cannabis, where you’d like to allocate your money. Like Robinhood, you can also select stocks from your dashboard and outright purchase them at face value.

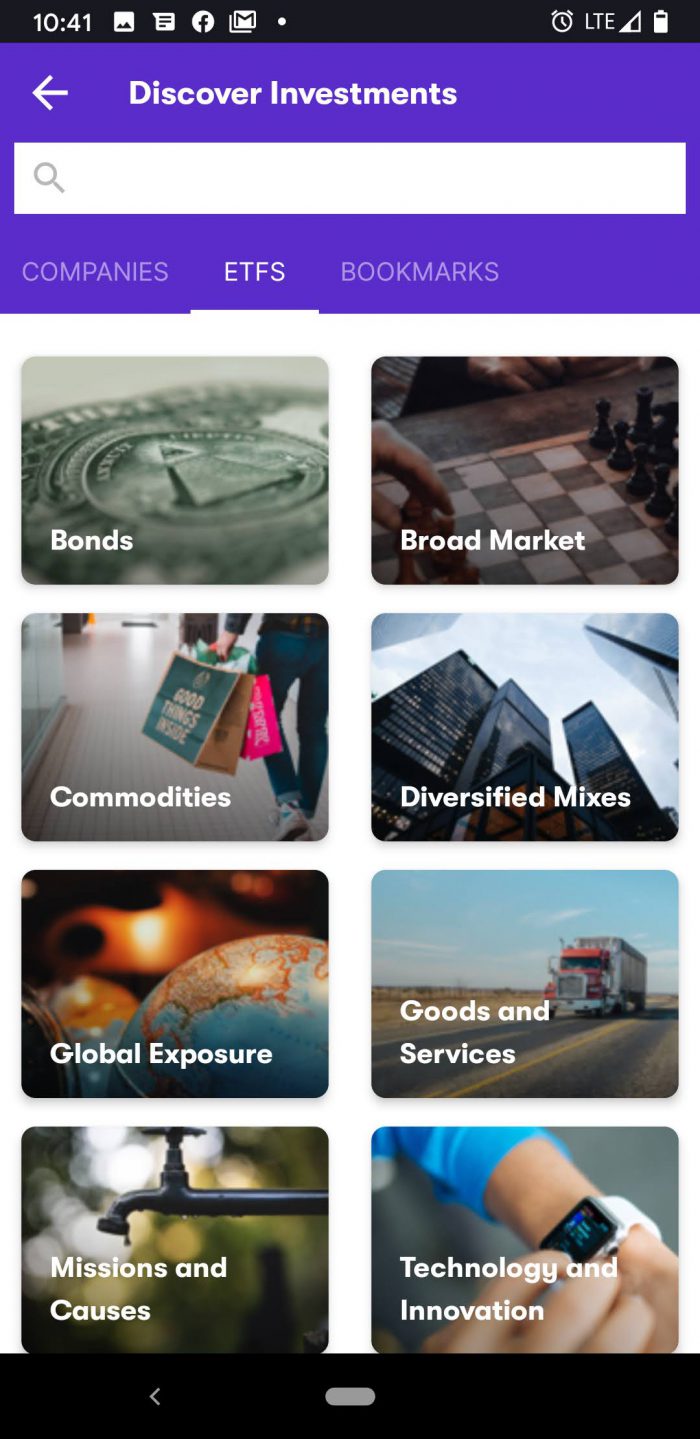

4. Stash

As one of the more popular banking and investing apps on the market, Stash does an excellent job of incorporating all the elements from the above-mentioned apps. Stash requires a subscription fee where minimal features can be unlocked with as little as $1 a month for their Beginner tier of service.

On the investing end, Stash works more like Acorns in the sense that buy a predefined category where you’ll see basic information about the chunk of stocks available for purchase. Everything goes together in one easy to view dashboard – users can get into the specifics when needed and make adjustments accordingly.

Blue Label Labs can build a financial app that delights your end-users

Blue Label Labs disrupts evolving marketplaces by building products that flow with the current of digital trends. As noted in the section about Robinhood, usage of this and other apps for the stock market increased substantially in recent times, making them a great idea for investors looking to build a valuable app. Feel free to reach out to Blue Label Labs to learn more.