The venture capital market is racing ahead, foot on the gas, middle finger out the window, hair on fire. That’s our read of the Q2 2021 data released thus far concerning how much money venture capitalists deployed around the world during the second three months of the year.

Startups have never had it this good when it comes to accessing private-market funds.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The second quarter of 2021 was the biggest quarter for venture capital activity ever, measured by dollars invested. The wave of funding led to a quarterly record of new unicorns — startups that reach the $1 billion valuation threshold — born in the United States, Asia, Europe and Canada, according to CB Insights data reviewed by The Exchange.

Data from FactSet concerning the quarter agrees. The second quarter was a record-breaker in terms of dollars invested, even if total deal volume eased some from the first quarter’s tally.

The impact of the deluge of capital is what you’d expect: Round values are rising. Deals worth $100 million are setting records. Around the world, technology hubs are enjoying a flurry of high-priced deals that are enriching startups and providing them with capital at earlier stages that used to be reserved for IPOs and other seminal funding events.

So today we’re talking through the numbers. Next week, we’ll publish a host of geography-focused notes and reactions from investors and founders in the U.S. startup ecosystem, along with similar entries concerning the Asian and European startup markets.

So today we’re talking through the numbers. Next week, we’ll publish a host of geography-focused notes and reactions from investors and founders in the U.S. startup ecosystem, along with similar entries concerning the Asian and European startup markets.

Chatting with venture capitalists in recent months led us to expect strong second-quarter results; investors have spoken about ever-faster follow-on rounds and the explosion of high-priced, big-dollar deal-making from Tiger. SoftBank’s second vision fund is active. And there are myriad seed, early-stage, late-stage and crossover funds all competing with each other both inside and outside their normal investing stage bands in hopes of either accreting earlier, larger ownership than a bigger investing group might have in years past or working to defend early ownership past where earlier-stage firms used to exit stage left.

But enough words. Let’s get into the numbers. We’ll start with an overview of global results before diving into U.S. and Silicon Valley tallies, Europe and Asia’s performances, and new data concerning venture capital activity in Africa.

Buckle up.

A monster quarter

We’re pulling from a number of sources this morning, but for global data, we’re leaning on CB Insights, Crunchbase News and FactSet.

CB Insights has $156 billion on the books for global venture capital activity in the second quarter, up from $60.7 billion in Q2 2020. That’s a gain of 157% on a year-over-year basis. A FactSet chart indicates around $150 billion was raised in the second quarter, up a similar percentage from its year-ago result as what CB Insights counted.

For the first half of 2021, inclusive of the record second-quarter tally, the data is similarly shocking. Crunchbase News counts $288 billion invested during the first and second quarters of the year. CB Insights reckons the number of $292.4 billion. FactSet comes to a number that it describes as “over $280 billion.”

Those are all close enough for us, and they say the same thing: Global startups raised either as much, or very nearly as much, in the first two quarters of 2021 as they did in all of 2020.

As a reference point, Crunchbase News notes that the first half of 2021 crushed the second half of 2020 by $110 billion, in terms of global capital raised.

But what about round counts? Was all that capital concentrated in a few investments, or did the money flow freely to more startups than ever? Here, things get a little tricky. CB Insights data states that there were 7,751 startup deals in the second quarter, an all-time high. FactSet counts 5,400, far from its recorded record. At this juncture we’re seeing discrepancies in how different data-focused firms count; Alex was party to similar conversations during his time at Crunchbase and is sympathetic to the difficulty of deciding what to include and not in these types of surveys.

But even FactSet data indicates that the second quarter was the second-best three-month period for venture round counts since the start of 2019. No matter how you count, then, the data indicates lots of deals — and even more dollars.

A unicorn stampede

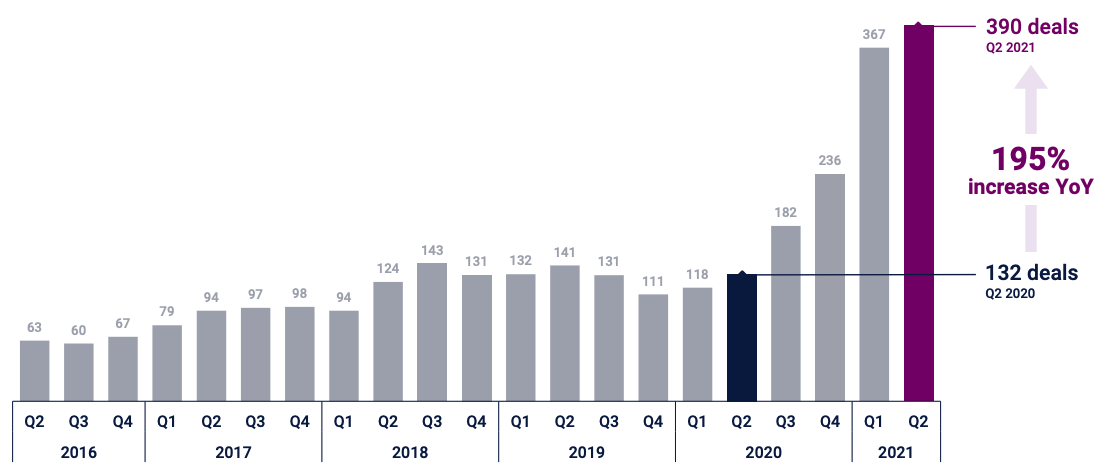

The trend that more and more venture capital funding is being deployed into late-stage startups did not halt in the second quarter. Observe the following excerpt from CB Insights’ report, counting the number of deals worth $100 million or more, tallied on a quarterly basis since early 2016:

Image Credits: CB Insights

As you can see, the second quarter of 2020 was not a particularly impressive period for such investments in historical, comparative terms; COVID-19 was also in its earlier stages during the period, which could have impacted deal-making. But what matters is both the absolute gain in mega-rounds in Q2 2021 compared to Q2 2020, and the fact that there have been regular gains in the number of such deals since the end of 2019.

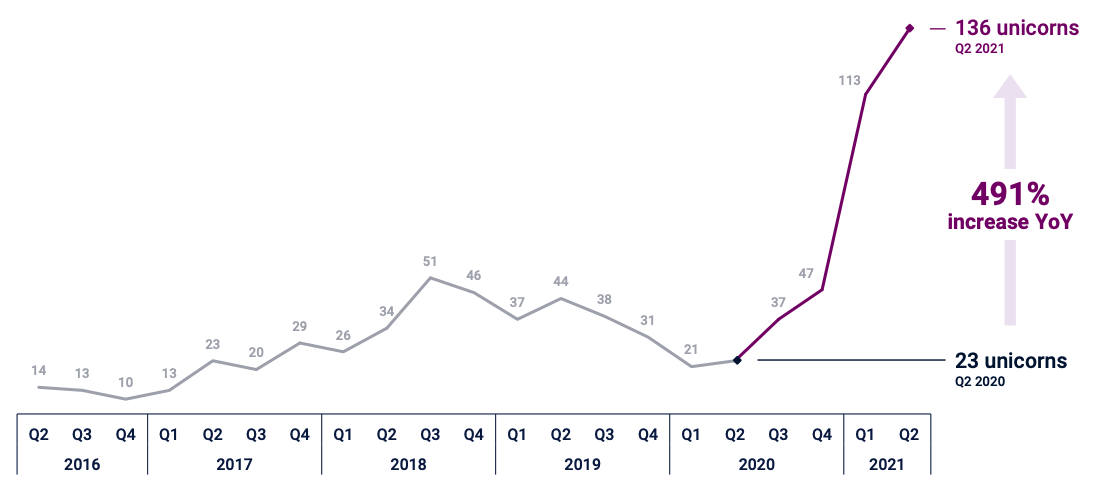

All those huge rounds are creating unicorns at a machine-gun pace. From the same CB Insights report, one more excerpt to explain the unicorn boom:

Image Credits: CB Insights

You will note that the two charts’ curves line up with one another, though the impact of more $100 million rounds seems to have had an outsized impact on unicorn creation. Regardless, with 136 new private companies valued at $1 billion or more during the second quarter, we saw around 1.5 new unicorns created every day of the second quarter, counting weekends and holidays.

Exits are looking good as well, helping the current influx of capital into startups seem reasonable; Crunchbase News counts, for example, eight venture-backed companies with public-market flotations at a valuation of $10 billion or more in the second quarter, and 16 for the year. That figure was 13 in 2020, and 16 in nearly the preceding decade.

Where did all the money flow? Into every stage: Citing Crunchbase data, the firm’s news arm notes record late-stage deals and dollars in the second quarter, with 848 global rounds leading to nearly $104 billion in total capital raised. Early-stage rounds per the same source had a huge quarter, with 1,976 rounds leading to $43.3 billion in capital raised.

CB Insights reports that fintech companies had a record quarter in dollar terms, raising $33.7 billion, up from a Q1 2021 all-time high of $25 billion. Last year, fintech startups only managed to raise $11.6 billion. The same dataset indicates similar records for e-commerce funding ($16.3 billion raised from 401 deals, both quarterly records), digital health startups ($14 billion raised from 625 deals, both quarterly records), and cybersecurity ($6.7 billion raised from 214 deals, the most capital ever raised by the sector in a quarter from the second-highest deal volume).

Everywhere you look, the data shows a frantic push by private investors to deploy more capital, in larger chunks, more quickly. And the impacts can be felt around the world.

Regional superlatives

Let’s start with the United States and its constituent hubs.

According to the CB Insights report, the United States saw $70.4 billion raised in the second quarter from 2,718 deals. That’s about as much capital that was raised in both Europe and Asia combined, albeit at a lower round count than what those two areas managed in the second quarter. In contrast, the first quarter — and prior record-holder — saw $68.5 billion raised in the United States from a slightly greater 2,816 deals.

The United States has now recorded venture capital activity worth $138.9 billion in 2021, better than any year before aside from 2020, which saw $149.3 billion raised. This year’s domestic numbers will crush that figure, leading to new yearly records for the U.S.

In terms of rounds worth $100 million or more, the United States just bested its Q1 2021 record of 200, with 204 in the second quarter. And the second quarter included the second-most venture-backed exits in a single quarter, with 1,171, just missing the first quarter’s tally of 1,199.

The impact of the flood of funding is higher startup prices in the United States. Median Series E and later rounds now value startups at $1.544 billion, per CB Insights, a record. Series D median valuations have reached $485 million. The numbers for Series C ($258 million), Series B ($124 million) and Series A ($42 million) also appear to be records.

Ample capital, big rounds, hot prices. It’s a good time to be a startup looking for capital in the United States.

Asia overview

According to CB Insights, Asia was the second-largest recipient of VC funding in the first half of the year. With a total of $84.5 billion to date, it lags behind the U.S. but is ahead of Europe, and not far from the region’s 2020 yearly total ($103.2 billion). It is also worth noting that Q2 accounts for the majority of this semester’s deals: 2,577 deals out of 5,007, for a quarterly total of $42.4 billion.

However, a deeper look at the region reveals a more contrasted reality. For one, the number of mega-rounds is down across the region, with “only” 92 such deals in the second quarter, its first drop since the beginning of 2020. But more importantly, China and the rest of Asia seem to be on diverging paths.

As a matter of fact, the Q2 venture capital tally into Chinese startups was actually down 18% from the fourth quarter of 2020, CB Insights reports. That brought it to $22.8 billion, down from a record $27.7 billion in Q4 and $26.5 billion in Q1. This is a concern in light of Didi’s woes.

In contrast, VC funding for Indian startups hit a quarterly record in Q2, reaching $6.3 billion, a steep increase from its previous $4.5 billion record in Q1. While early-stage deals still account for the biggest deal share, Zomato’s IPO plans are yet another sign of the Indian market’s growth and maturation.

While Europe only comes in third place by total dollars raised in the quarter, it was the fastest-growing region for VC investment so far this year, Dealroom reports. According to its data, European startups attracted €49 billion (approximately $58 billion) in VC funding in the first six months of the year. While FactSet’s estimate is slightly lower at “nearly $50 billion,” closer to CB Insights’ $50.8 billion estimate, both also confirm the trend, with FactSet noting that this already “surpasses the $38 billion raised in all of 2020.”

Interestingly, this windfall is also more distributed than we might have anticipated. Sure, the vast majority of the money went to five countries: the U.K., Italy, Germany, France and Sweden. But the fact that Sweden is showing up on the list doesn’t only reflect Klarna’s and NorthVolt’s giant rounds; there are other signs that the Nordics overall are growing fast. And more generally, there are deals of note in many markets and cities across Europe.

As FactSet points out, “smaller emerging markets like Romania, Croatia, and Greece have also benefited from this capital investment growth.” Meanwhile, Dealroom notes that there are 65 cities across Europe that are home to at least one unicorn — out of a global total of 170 such cities.

It is worth mentioning that we are talking about Europe as a region here — so including the U.K. And from that perspective, London is still Europe’s unicorn leader, with a total of 71 — more than three times the number in Paris, Dealroom notes.

Africa booms

You’ve likely noticed more coverage of African startups on TechCrunch in recent months. Yes, we’re paying more — and belated! — attention to the continent, but others are as well. Investors, for example.

Dealroom cited Nigeria, for example, as a company with rapidly rising venture capital activity in a recent report. Indeed, the data source notes that Nigerian startups have raised $1.9 billion since 2015, a huge $474 million of which came so far in 2021.

The Big Deal, a Substack publication that focuses on African startup activity, reports that African startups have raised $1.14 billion in rounds worth $1 million or more so far this year. That’s up from $531 million in the first half of 2020 and $454 million during the same period of 2019.

Kaboom, in other words.

What’s next?

What’s ahead for the global startup market, from a venture capital perspective? More of the same. The underlying conditions that are driving more money into startups have yet to change. Interest rates, to pick one factor, are still low, making a host of traditional investing opportunities less attractive to the yield-conscious. That should ensure continued LP interest in venture capital funds, allowing the money spigot to stay wide open.

And with the IPO market remaining hot, there are plenty of exits coming to keep the investment flywheel spinning. Sure, the global economy is not fully recovered from its COVID-related shocks, but even when those impacts were more severe, tech startups were busy raising more capital than ever. Why would the pace slow down when things have, in fact, improved?

We don’t know if Q3 2021 can best the simply enormous Q2 2021 venture capital result set. But it probably won’t be far behind if it cannot. So, onward. We’re all going to remain very busy.