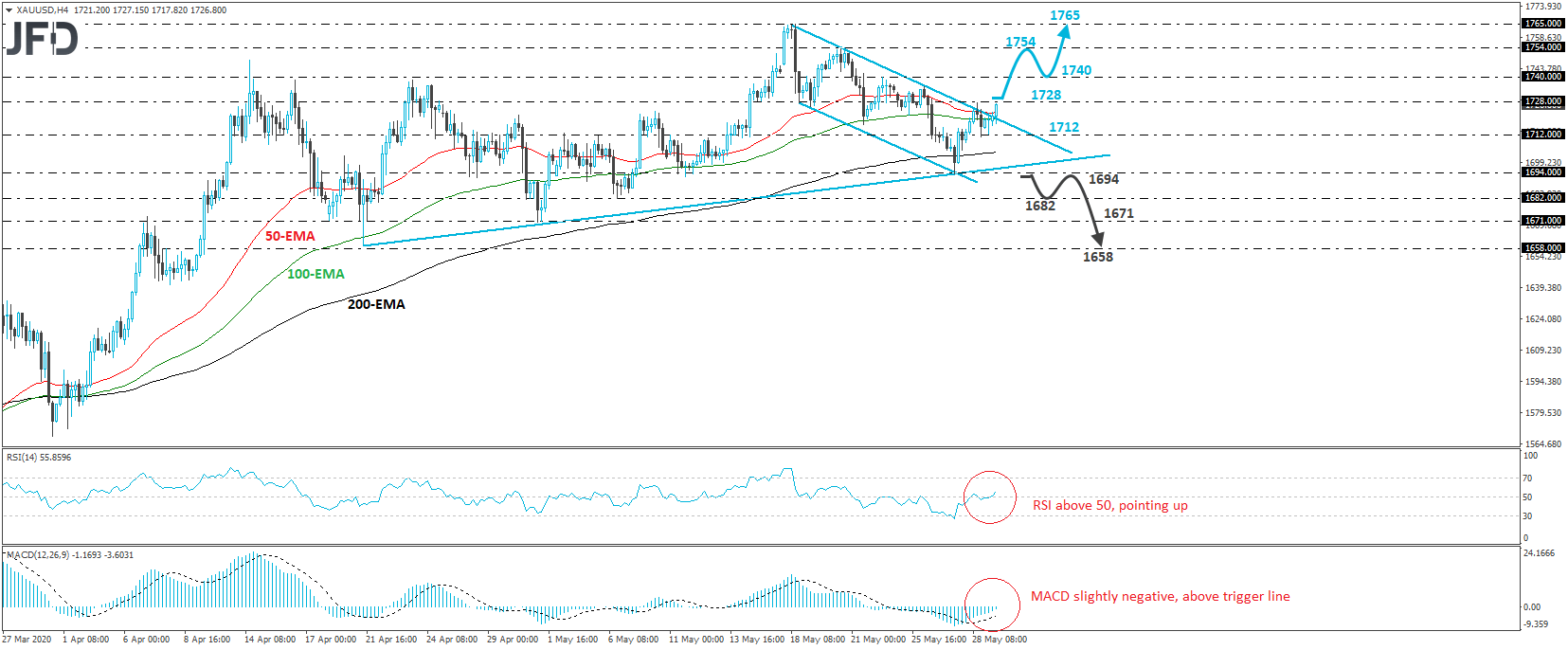

XAU/USD traded higher on Friday, after it hit support near the 1712 level. The recovery drove the price above the downside resistance line drawn from the high of May 18th, which combined with the fact that the precious metal continues to trade above the upside support line taken from the low of April 21st, suggests that more advances may be on the cards for now.

If the bulls manage to overcome yesterday’s high of 1728, then we may see them aiming for the peak of May 22nd, at 1740, where another break may extend the gains towards the high of May 21st, at 1754. The bulls may decide to take a break after hitting that zone, thereby allowing the price to correct lower. However, as long as it remains above the aforementioned diagonal lines, we would see decent chances for another leg north and a break above 1754. This may encourage the bulls to put the 1765 zone on their radars, which is the peak of May 18th.

Looking at our short-term momentum studies, we see that the RSI rebounded back above its 50 line and now points up, while the MACD, although slightly negative, lies above its trigger line, pointing up as well. Both indicators suggest that the yellow metal may have started gaining upside speed, which corroborates our view for some further near-term advances.

The move that would convince us that the bears have stolen the bulls’ swords is a dip below 1694. This would drive the metal below the upside support line drawn from the low of April 21st and may initially aim for the 1682 level, which is the low of May 6th. If that level fails to withhold the pressure, then we may see extensions towards the low of May 1st, at 1671. Another dip, below 1671, could allow the slide to continue towards the low of April 21st, near the 1658 zone.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.