Rare Earth Metal Pricing Skyrockets, May Result in Higher Electronics Pricing

Logistics and politics turn a bad situation into a worse one

The semiconductor industry is one of the most complex ventures on the planet, with a supply chain relying heavily on natural resources. Nikkei reports that we are at an inflection point for the semiconductor industry - mostly due to its most basic prime matter, rare earth metals (such as copper, lithium, or tin), which are used as elements for the manufacturing of semiconductors, having seen tremendous price increases in the last year. An interplay between COVID-19-weakened supply chains, soaring demand, and political tensions between the US and China are being pointed as major forces behind the increases.

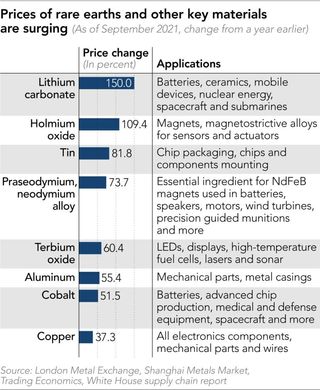

A look at the yearly price action for some such rare-earth metals showcases just how much more expensive any sort of manufacturing that uses them has become in the past year. The fact that lithium dioxide has increased around 150% YoY can be identified in the increasing popularity of electric cars. However, lithium isn't alone in its upwards price run; copper (one of the most common conductors) has seen price increases to the tune of 37%; aluminium, which enables lightweight metals and is commonly found on computing's cases, has increased by 55%; and tin has increased 82%. Even relatively niche rare earth metals such as neodymium (commonly found in audio drivers and related electronics) and praseodymium (used as an alloying agent for magnesium in aircraft engines and other applications), have increased by almost 74 percent YoY. Several other rare-earth metals have also increased in pricing.

The price increase for these most elementary elements in almost anything technologically-related will (and likely already is) leading to increased end-user pricing. There is only so much that the manufacturing and supply chains can absorb before they hit the red zone. However, as is always the case, it's the small players being affected first. Electronics suppliers for hardware assembly and manufacturing giants such as Lenovo, HP, Apple and Samsung face a notoriously unforgiving competitive landscape, and they can't easily transfer the increased component costs to their global clients.

A perfect storm of COVID-19 and its interaction with supply chain logistics is one of the reasons for this price increase, as well as the currently ongoing (and seemingly never-ending) component shortages. Coupled with soaring demand from multiple technological inflection points (such as vehicle electrification and machine learning as well as the increasing demands for data volume processing) also led to supply-chain management problems and skyrocketing prices for some of the major industry players' products, as we've extensively reported.

However, another major element is also a part of the equation: geopolitics. China currently stands as the only country with a fully integrated, in-territory supply chain that covers everything in the production of rare earth metals, from extraction to refinement and eventual processing. As of last year, China was responsible for around 55% of global rare earth mining output, and 85% of all rare earth minerals have to go through China in one way or another throughout their manufacturing process. This gives China powerful leverage in its relationship to the global economy. Potential tightening when it comes to China's export controls was enough to partly fuel price increases.

Angela Chang, an analyst with the Industry, Science and Technology International Strategy Center (ISTI) at the Industrial Technology Research Institute broached the subject with Nikkei Asia.

"China has the upper hand and dominated production and refining of global key rare earth materials, and it also controls some other key metals that are all needed for building not only civilian, and industrial devices but military and aerospace equipment," she told the publication. "The Chinese advantage has become a key bargaining chip for Beijing to negotiate with Washington."

Even as both superpowers vie for economic supremacy, with China's control of the rare metal earths and the US' blacklisting of several China-based companies and even China-bound exports, the escalating tension between them likely will only push prices of those key materials higher in the long term, Chang added.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

gargoylenest yeah, I think we can see a pattern here... Wind blew on the wrong side of the factory, chip price hike...too much sun, chip price hike...wife of ceo was in a bad mood this morning, chip price hike...They just chose to raise the price, now they are telling us its not greed, its everybody else's fault. They do the same with gaz, electricity, milk, etc.Reply -

fball922 Reply

I mean, these are commodities where pricing is very publicly visible. When the cost of inputs rise, so does the price of the output...gargoylenest said:yeah, I think we can see a pattern here... Wind blew on the wrong side of the factory, chip price hike...too much sun, chip price hike...wife of ceo was in a bad mood this morning, chip price hike...They just chose to raise the price, now they are telling us its not greed, its everybody else's fault. They do the same with gaz, electricity, milk, etc. -

gargoylenest What I mean is, they are not just passing the cost down to the customer. They take advantage of a very small rise in input material price to make it a medium rise in output material price. I mean, there is not 200g of copper per chip. The main cost of a chip is the technology, knowledge and research. Material price can not be more than the weight of the chip, and most of it is silicon.Reply -

spongiemaster Reply

Ok, and what prices increases are you specifically talking about? Despite all the talk of price increases, Ryzen 5000 CPU's are as cheap now as they have ever been, selling below list usually. Most Intel CPU's are selling at list or below as well.gargoylenest said:What I mean is, they are not just passing the cost down to the customer. They take advantage of a very small rise in input material price to make it a medium rise in output material price. I mean, there is not 200g of copper per chip. The main cost of a chip is the technology, knowledge and research. Material price can not be more than the weight of the chip, and most of it is silicon. -

InvalidError Reply

CPUs contain very little valuable raw material: a few grams of copper in the IHS and substrate, that's about it, only a few dimes worth. Most of the value comes from all of the transformation steps required to make them so AMD and Intel can easily afford to eat the minute raw material cost increase on fat-margins $150+ parts.spongiemaster said:Ok, and what prices increases are you specifically talking about? Despite all the talk of price increases, Ryzen 5000 CPU's are as cheap now as they have ever been, selling below list usually. Most Intel CPU's are selling at list or below as well.

GPU board manufacturers on the other hand are using raw material cost increases as an excuse for jacking up most of their SKUs' MSRP by $100+ over their usual markups over the new post-covid AMD/Nvidia MSRPs despite the true raw material cost increasing by less than $5 if we assume the whole GPU's weight is copper, the most valuable element present in a meaningful quantity.

What will hurt the worst a few months from now will be TSMC's 10% and 20% because-we-can greed tax on sub-7nm and 12nm respectively. -

bigdragon Hey, these price increases need to stop. Grocery stores and electronics manufacturers are telling me I need to go job hunting for a higher salary or go back to "college years behaviors" given all the inflationary cost increases this year. I don't know about the rest of you, but I'm really noticing these recent price spikes. One would hope that the increased costs are actually going to the employees, but people are as disgruntled as ever right now.Reply

Rare earth metals, oil, meat production, farming, chip shortages, covid....it all feels like companies are seeking the ceiling of what people can pay now. Customers and employees be screwed -- gotta get those investors all the money. -

Tac 25 that's grim news...Reply

just when the price of 1660 Super lowered from 600 usd to 500 usd over here in my country... I thought things were getting better.

now, prices might go up again..

need gather funds more quickly to get one asap.. -

spongiemaster ReplyInvalidError said:CPUs contain very little valuable raw material: a few grams of copper in the IHS and substrate, that's about it, only a few dimes worth. Most of the value comes from all of the transformation steps required to make them so AMD and Intel can easily afford to eat the minute raw material cost increase on fat-margins $150+ parts.

The person I quoted said "chip." Then, as you said he mentioned how little of the cost is for raw materials cost to begin with compared to other factors. Chips have not seen any really increase in prices at the consumer level, so I asked for examples, and you gave non relevant ones.

GPU board manufacturers on the other hand are using raw material cost increases as an excuse for jacking up most of their SKUs' MSRP by $100+ over their usual markups over the new post-covid AMD/Nvidia MSRPs despite the true raw material cost increasing by less than $5 if we assume the whole GPU's weight is copper, the most valuable element present in a meaningful quantity.

GPU manufacturers have given multiple reasons for board cost increases, not just raw materials, but that has no real relevance to anything. Firstly, in the current market, except for FE cards, it's pretty difficult to figure out what actually is MSRP for a GPU right now. There is no way for us to know who in the chain is increasing prices and by how much. 2ndly, as you said, pretty much any reason they give is an excuse. No board partner is going to publicly state that the market is completely jacked up right now, and we want a piece of that so we're increasing our prices. I have no problem with any of them actually doing that, from a smart business perspective, they should be doing that. IMO, it is ridiculous that scalpers are pulling in more profits per board than the board partners and Nvidia/AMD, but again, no company is going to send out a press release that that's what they're doing. So, AIB's can say prices are going up because raw materials are more expensive, but whatever public excuse they come up with doesn't matter. If they weren't saying raw material costs increases, they would come up with something else. -

Jim90 Replyspongiemaster said:Ok, and what prices increases are you specifically talking about? Despite all the talk of price increases, Ryzen 5000 CPU's are as cheap now as they have ever been, selling below list usually. Most Intel CPU's are selling at list or below as well.

FOR. THE. NOW...!!!

Most Popular