TechCrunch held events in China as recently as 2019, following several years of hosting conferences in the country’s hardware capital, Shenzhen. In the wake of today’s news, TechCrunch.com is no longer available for regular access in China.

How quickly things change.

This morning, global media noted weekend news that Yahoo, TechCrunch’s parent company, is pulling its remaining services from China. The move follows decisions by other major American companies to also end certain operations from China, including Microsoft and Epic Games.

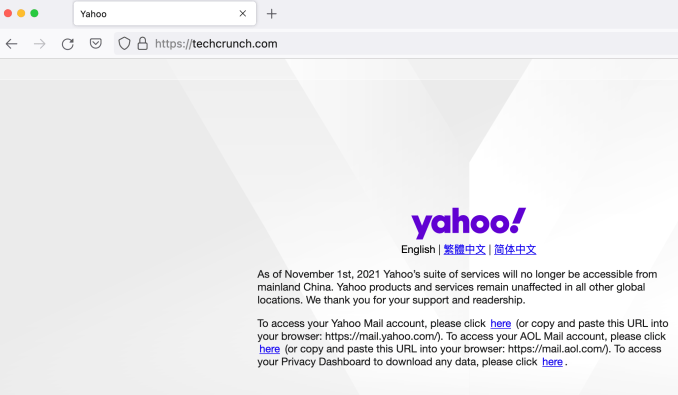

According to an official Yahoo statement, due to an “increasingly challenging business and legal environment in China, Yahoo’s suite of services will no longer be accessible from mainland China” as of the start of the month. The news was first disclosed over the weekend, albeit to muted note and coverage.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Yahoo added in the same comment that it “remains committed to the rights of our users including a free and open internet” — about as direct a dig against the Chinese government that you will find from a corporation that operates globally.

The recent decisions to limit or end the availability of certain international products in China’s mainland area follows a deluge of regulatory changes aimed at curbing the power of domestic technology companies, changes to rules regarding media and more. The revamps include changes to video game access for youths, the culture of celebrity fan clubs and for-profit educational products aimed at students not yet in university.

In recent quarters, the Chinese market has seen its openings narrow. Films that might have found a release window in the country are failing to make it to market, for example. The context for Yahoo’s decision to leave the country, then, is both broad and deep.

In recent quarters, the Chinese market has seen its openings narrow. Films that might have found a release window in the country are failing to make it to market, for example. The context for Yahoo’s decision to leave the country, then, is both broad and deep.

China’s “increasingly challenging business and legal environment”

There’s plenty to choose from when trying to identify what created an “increasingly challenging business and legal environment” for Yahoo. But the fact that it’s closing the curtains this month points at a blatant culprit: the Personal Information Protection Law of the People’s Republic of China (PIPL), which came into effect on November 1.

While it makes sense to compare the PIPL to the EU’s General Data Protection Regulation (GDPR) in terms of what it takes for foreign companies to comply, the comparison only goes so far. Indeed, storing data in the country or having to “pass a security assessment organized by the national cybersecurity authority” before transferring information across borders doesn’t have the same implications when the country in question is China.

Add in the broader flurry of regulatory changes, and it is not hard to see why Epic Games is pulling the plug on Fortnite in China, or why Microsoft earlier announced it was pulling LinkedIn from the Chinese market. In a blog post, the professional network was described as “facing a significantly more challenging operating environment and greater compliance requirements in China” — wording that echoes Yahoo’s statement this weekend.

In Yahoo’s case, the fact that several of its remaining services were media outlets or media-adjacent was likely an important factor at a time when “more stringent regulation is likely coming to China’s already highly restrictive media landscape.” As the Wall Street Journal noted, our parent company had started shutting down services in China in 2013 but still offered access to its Weather app and to news articles.

This is no longer the case, and both the English version of our sister publication Engadget and our own site Techcrunch.com are no longer accessible from China, redirecting to Yahoo’s statement.

Image Credits: Yahoo

A broader decoupling

Any matter we’ve discussed today might be dismissible by itself. “The Eternals” not showing in the country due to its director not finding favor with the Chinese government, for example. Or Microsoft pulling LinkedIn. Or Fortnite’s exit.

When taken as a whole, it’s clear that international business and media and the Chinese market are decoupling at an increasingly rapid clip. The Exchange would not be surprised to read similar exit news from remaining American companies that offer digital services in China.

Apple will find itself stretched between a key manufacturing hub for its global business and its American roots — doubly so for a company that champions privacy as a core tenet of its consumer value proposition.

There’s a startup story in the mix. Following a summer blast of regulatory actions that undercut various Chinese technology industries, The Exchange wrote that the country was kneecapping some of its largest and most successful firms. We expected such rapid and caustic changes to the business climate — even if some of the changes were legitimately antitrust in nature and thus for the public good in substance and not merely name — would impact China’s venture capital and startup scene.

We were wrong. Our expectation was predicated on the fact that investors dislike uncertainty, especially business risk that could lead to an industry previously viable from a financial perspective becoming radioactive overnight. And yet, venture capital activity in China has remained resilient.

But that doesn’t mean international interest in Chinese startups will reach prior levels of investment over time, or that Chinese startups will be able to access the global markets as easily as they once did. Or that American IPOs will prove possible, let alone be as winsome as they once were.

Generally speaking, international startups will, we expect, avoid the hard work required to offer their goods or services in the Chinese market. Hard barriers to an uncertain market don’t make for easy business on-ramps. And with India nearby with a similarly sized market, there are options in Asia for startups looking to grow their international footprint.

What’s next?

We expect more businesses to leave the Chinese internet, the end of digital services in the Chinese market from external companies and continued government intervention into Chinese business and media to the point where more and more activity in the country fits into larger governmental priorities.

For industries in China that happen to align with central objectives, tailwinds will be plentiful. For those running at an angle to the government’s goals, headwinds abound. And for any company willing to set off orthogonally to China’s government-directed priorities, extinction.

For Chinese citizens, an increasingly one-note media and business landscape.

And, for TechCrunch and our Yahoo parent, the end of what was once an ability to bring news, information and analysis to the Chinese population.