Despite impressive improvements in passenger vehicle emissions over the last two decades in particular, the International Energy Agency (IEA) puts the annual rate of increase in truck and bus emissions since 2000 at 2.2%. With ever-more stringent regulations being introduced in the major trucking markets, however, changes in the way commercial vehicles (CVs) are powered could be more rapid over the next decades than in the light vehicle sector.

Like the vehicles themselves, regulations on CV emissions and fuel economy are region-specific, further complicating their already highly application-specific nature. Truck makers, suppliers and fleets understandably struggle to see a clear timeline from now, with diesel dominating across the CV spectrum, to what looks like near-fleetwide electrification by mid-century.

It’s business time

According to the European Automobile Manufacturers’ Association (ACEA), “98.3% of all heavy and medium trucks (above 3.5 tonnes) on Europe’s roads today run on diesel. Electrically-chargeable vehicles account for a negligible share of all trucks in circulation (0.01%, or one out of every 10,000 vehicles), and around 0.4% of all trucks in the EU run on natural gas.”

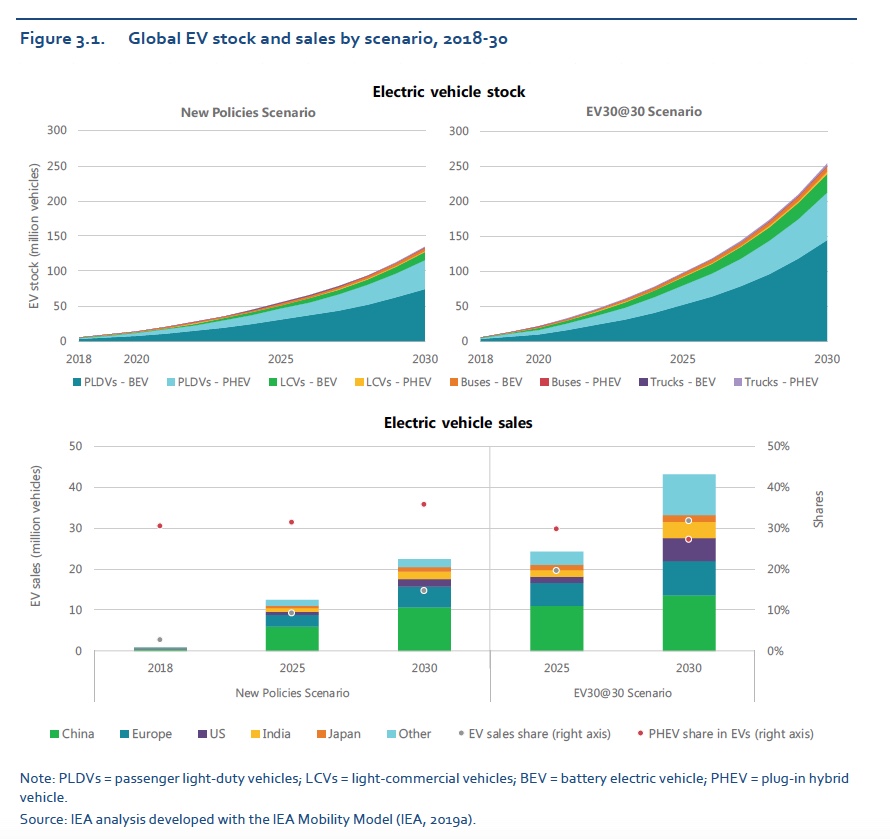

In freight transport, the IEA notes, “electric vehicles (EVs) were mostly deployed as light-commercial vehicles (LCVs), which reached 250,000 units in 2018, up 80,000 from 2017.” Medium truck sales were in the range of 1,000 to 2,000 units in 2018, the majority sold in China. In its ‘Global EV Outlook 2019’, the IEA identifies China as the leading electric light commercial vehicle (LCV) market worldwide, at 138,000 vehicles in 2018 accounting for 57% of the global fleet. Europe is second, a 92,000 strong fleet in 2018 making up 38%. The US electric CV market makes up a tiny percentage of the global electric CV market, with eCVs currently accounting for less than 1% of the country’s CV market. Clearly, electric CV adoption rates will look impressive, thanks to a very low base.

Many ways to electrify

Discussion of CV electrification requires a recognition of the application-specific nature of this broad sector. Add to this the fact that, despite intensive efforts to develop solutions for electrification, truck and engine manufacturers also believe they can still further improve combustion engine technology, and it is easy to see why the transition to battery electric vehicles (BEVs) appears so slow.

The light end of the CV market offers the greatest potential for battery electric vans, with viability stretching into medium duty trucking in certain use cases, namely for refuse collection and package delivery. Furthermore, 99% of electric LCVs registered to date are BEVs, the IEA notes. The Washington, DC-headquartered International Council on Clean Transportation (ICCT) puts the number of electric CVs in Europe and North America at around 70,000 and 100,000 respectively, with most of those vehicles being electric LCVs.

Urban buses, too, offer considerable scope for battery electric propulsion, with the fixed-route nature of their use making an easy business case.

In Europe, new trucks will be required to achieve a 15% CO2 reduction by 2025, and a 30% reduction by 2030

As will be seen, it is at the heavy end of trucking where electrification becomes a much more complex and highly cost sensitive issue, and where alternative fuel and alternative propulsion technologies still win many viability arguments.

The clock is ticking

According to a report by ResearchAndMarkets, the global electric CV market is set to reach almost 261,000 units this year, and then grow more than sevenfold over the next seven years. “The electric commercial vehicle market, by volume, is projected to be 260,777 units in 2020. It is projected to grow at a CAGR of 32.7% from 2020 to 2027, to reach a volume of 1,890,430 units by 2027.” The report also identifies the electric van segment as the fastest growing electric CV sector, the market “driven by high demand from the logistics sector, especially in Europe.”

Not surprisingly, the largest eCV market by 2027 will be Asia Pacific, notes the report, thanks primarily to the dominance of China’s electric bus market, as well as “favourable regulations for electric commercial vehicles, and a rapidly growing logistics sector”. The fastest regional growth in eCVs will be seen in Europe, thanks to demand for electric vans and the focus on electrification in public transportation.

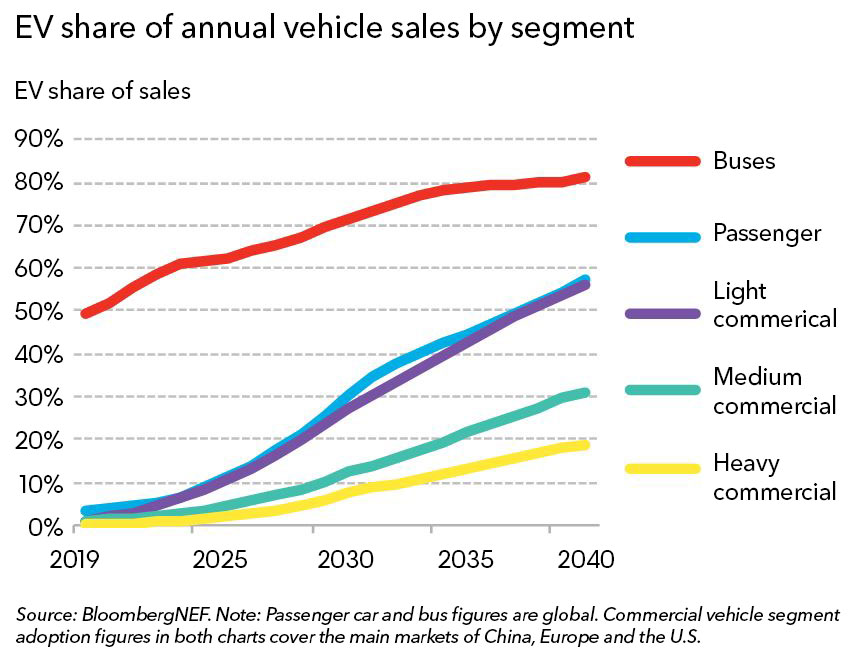

Bloomberg’s research service Bloomberg NEF (BNEF) agrees with the rapid increase in electric van sales in particular. In its ‘Electric Vehicle Outlook 2019’, BNEF writes: “By 2040, we expect 56% of light commercial vehicle sales and 31% of medium commercial vehicles in China, the US, and Europe to be electric.”

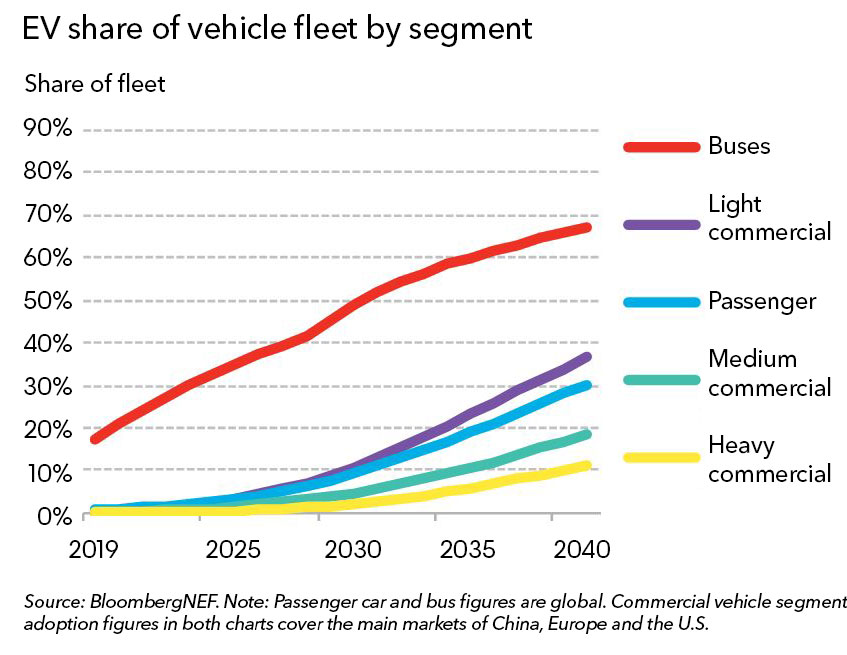

BNEF forecasts 508 million passenger EVs on the road globally by 2040, interestingly a more conservative forecast than the 559 million units it forecast a year earlier. A total electric fleet of 550 million units in 2040 will include 41 million electric commercial vehicles.

However, BNEF also notes that “heavy trucks will prove the hardest segment for electrics to crack, with the latter’s sales limited to 19% in 2040”.

Other forms of propulsion?

What happens in the heavy and long-haul part of the trucking industry will make for fascinating viewing over the next decade. Fixed route, fixed payload haulage over shorter distances may enable some BEV use at the heavy end of the sector, but it is difficult to imagine a 40t truck making its way over a mountain pass on battery power. BNEF agrees: “Long haul, heavy duty trucks will be harder to electrify; there, natural gas and hydrogen fuel cells will also play a role.”

By 2040, we expect 56% of light commercial vehicle sales and 31% of medium commercial vehicles in China, the US, and Europe to be electric

According to Bernd Heid, McKinsey’s head of commercial vehicle activities, “In long haul applications, fuel cell electric trucks are better than both battery electric trucks and diesel trucks in terms of total cost of ownership. It is ultimately the best solution.”

Heid suggests that for HD trucking applications, battery electric propulsion is being deployed as an interim to fuel cell technology. The absence of the necessary scale for fuel cell electric trucks is “why a lot of the truck OEMs start with electrification—this is a step they need to make either way—and then later on when fuel cell electric trucks become TCO competitive, they can more or less switch from battery electric to fuel cell electric. It will be a gradual transition from one solution to the other.”

On the buses

There is considerable momentum in the electrification of buses, where silent, vibration- and emission-free travel appeals to passengers and municipal rulemakers alike. The regular duty cycles and fixed back-to-base routes facilitate charging planning, and vehicle design conveniently accommodates batteries. Furthermore, operating in low and zero emission zones necessitates electric drivetrains. Predicting a sharp increase in electric buses is to some extent forecasting what’s already happened—according to BNEF, 400,000 electric buses are already in service globally.

Municipal bus fleets present an easy opportunity for authorities to mandate electric vehicles, and as one leading electric bus manufacturer points out, within a decade it will be difficult to imagine any bus fleet purchasing manager still considering diesel. Factor in the average bus lifetime of 7.5 years, according to the International Association of Public transport (UITP), and the propulsion strategy of a fleet by any given date needs to be in place several years earlier.

Planning for the long-term…and for the near-term

The truck manufacturers find themselves stretched, developing combustion engine-based propulsion technology for the next few years and various forms of electrification for the longer term. In Europe, new trucks will be required to achieve a 15% CO2 reduction by 2025, and a 30% reduction by 2030. Traton, which includes Scania and MAN, has said the 2025 target can be met “largely with conventional engine technology”, but the group believes the 2030 target “will require significant sales of alternative drivetrains, mainly battery electric”.

Some major orders have been placed, with start-ups in particular securing significant media coverage: UPS has ordered at least 10,000 electric vans from Arrival; Amazon has ordered 100,000 electric vans from Rivian; Tesla has secured hundreds of orders for its electric Semi; and Nikola has secured upwards of 14,000 orders for its battery electric and fuel cell electric trucks, which it claims will be out on the road from 2021, with all existing orders in service by 2028.

Once the realm of the start-up, however, electric trucking is becoming an accepted part of mainstream manufacturers’ future portfolios, a fact borne out by a number of recent launches by the major players, from electric LCVs to electric refuse trucks. Indeed, in 2019, Daimler Trucks North America’s Chief Executive Roger Nielsen said, “The road to emissions-free driving will be driven by battery electric vehicles.”

A timeline with a hard stop: 2050?

30 years to go electric—that’s the view of the ICCT, which believes electrification is inevitable: “Long-term planning scenarios indicate that the global vehicle fleet will have to be almost entirely made up of electric vehicles, powered mostly by renewable sources, by 2050 if the world is to avoid worst-case global climate-change scenarios.”

The global vehicle fleet will have to be almost entirely made up of electric vehicles, powered mostly by renewable sources, by 2050 if the world is to avoid worst-case global climate-change scenarios

Fleets cannot afford to be without electric trucks to meet CO2 emissions reductions, says McKinsey’s Heid, adding, “This is why most manufacturers are starting with the electrification of the various different truck segments, from distribution to long-haul tractors. But the heavier the truck, the greater the share we will see being fuel cell electric.”

Setting a timeline may seem ambitious right now, but by the mid-2030s, battery electric and fuel cell electric trucks will count for a significant proportion of new truck sales, and fleets will need to be ramping up their e-truck acquisitions in the years from 2040 if, as the ICCT suggests, they are to electrify their fleets by 2050.

A timeline to 2050 provides some clarity for fleets, truck makers and suppliers, and gives them the ability to plan. However, as we’ve seen from failed attempts in countries such as India and the UK to mandate electrification deadlines, or to bring them forward, there’s nothing like a hastily conceived government policy to derail a plan. And as the boxer Mike Tyson once pointed out, everyone has a plan until they get punched in the mouth.