Independents Grew Fastest on Spotify in 2019, But There’s a Twist

Tomorrow (Wednesday 29th April) Spotify announces its Q1 2020 results, at which point we will find out whether it had a COVID-bounce like Netflix did (adding 15.8 million subscribers in Q1) or whether growth slowed. But before that, there is one little detail from Spotify’s 2019 Annual Report which warrants a closer look. Hidden away in the commentary there is this innocuous looking line:

“For the year ended December 31, 2019 [Universal Music Group, Sony Music Entertainment, Warner Music Group, and Merlin] accounted for approximately 82% of music streams.”

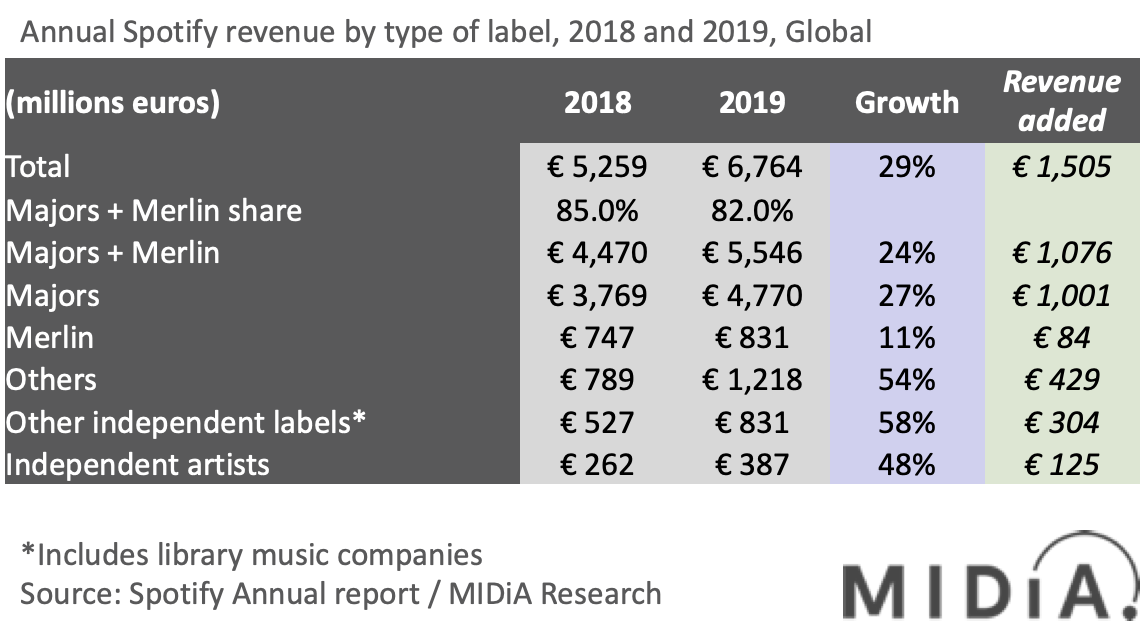

The same line is in Spotify’s 2018 Annual Report with the figure at 85%. So, the majors and Merlin indies saw their share of Spotify streams decline by three percentage points in 2019. That in itself is interesting and builds on the narrative of the streaming tail getting longer and fatter, with the superstars losing share. But with a little creative thinking we can do a lot more with this three percentage points shift.

Using MIDiA’s label market shares data for FY 2019 we can do a full breakdown of Spotify’s streaming revenue. Applying shares for streaming volumes to streaming revenue, and shares for the total streaming market to Spotify is not methodologically pure and has margins of error, but it is a broadly sound approach and lets us do the following:

Featured Report

Q3 2024 music metrics Maturation effect

This report presents MIDiA consumer data for key music consumer behaviours and company financials for Q3 2024.Consumer data covered includes, streaming app usage, music behaviour and streaming activities....

Find out more…- First we apply the percentage share to Spotify’s annual revenue

- Next, we take the majors’ share of streaming revenues for 2019 and apply them to Spotify’s streaming revenue

- We can then deduct the majors from the majors + Merlin total to leave us with Merlin’s revenue

- Then we apply the independent artists streaming share to the Spotify revenue which leaves us with one remaining segment: ‘other independent labels’

What emerges is a hierarchy of dramatically different growth rates, ranging from just 11% for Merlin labels through to a dramatic 48% for independent artists and an even more impressive 58% for ‘other independent labels’. This provides further evidence of the way in which (much of) the independent sector continues to thrive during streaming’s continuing ascendancy.

Most intriguing is the 58% growth for ‘other independent labels’. I am using the quote marks because this is essentially an ‘all others’ bucket and so captures music entities that don’t fit the traditional classification of ‘label’. This includes AI generative music and of course library music companies like Epidemic Sound.

It is of course important to consider that growth rates are not absolute growth – the majors still added much more new Spotify revenue in 2019 (€1 billion) than all of the rest put together. Nonetheless, the difference in growth rates is stark and only Spotify will be able to answer questions about how much of this is organic versus how much of this is driven by the way that it engineers its recommendations and programming.

Whatever the causes, the effect is clear: streaming benefits everyone but it benefits some more than others.

There is a comment on this post, add your opinion.