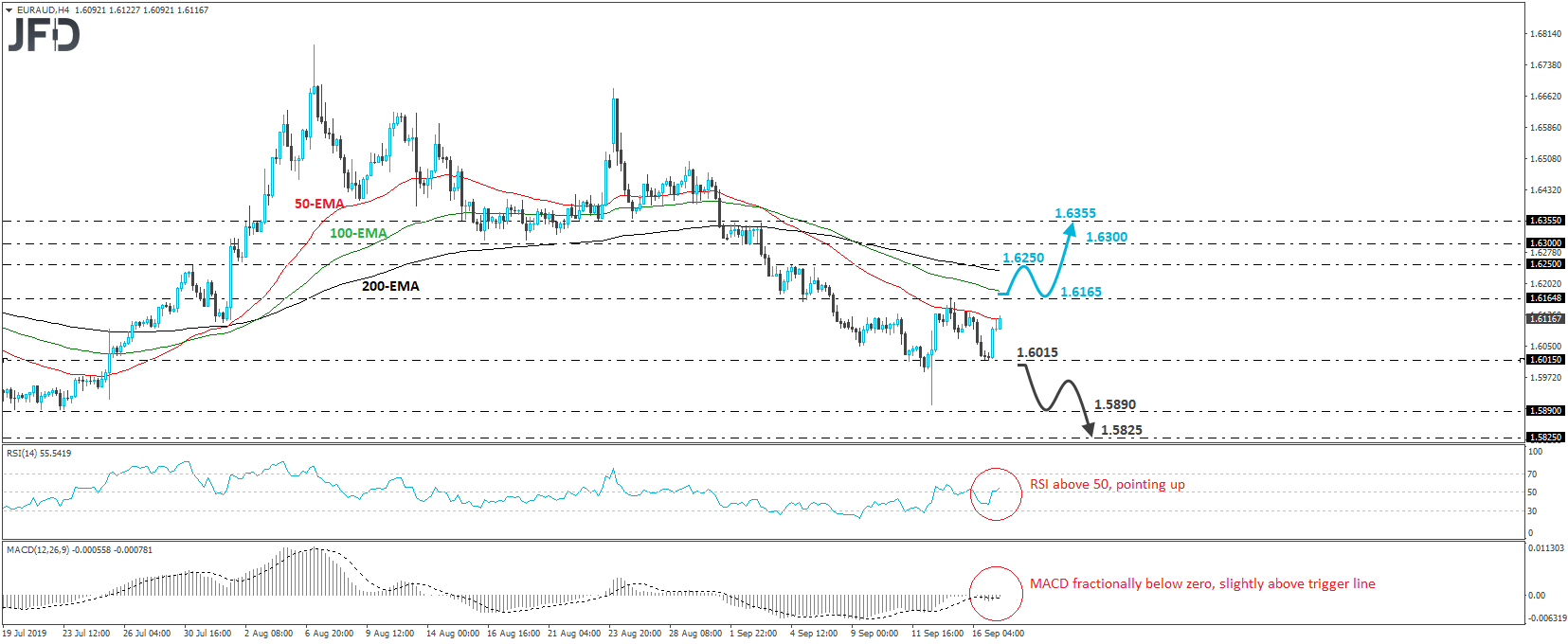

EUR/AUD traded higher today, after it hit support near the 1.6015 zone. The move has confirmed a higher low on the 4-hour chart, but the pair has yet to signal a higher high. Thus, bearing in mind that a positive reversal is not fully completed yet, we would adopt a cautiously-bullish stance for now.

The move that would complete the reversal, in our view, is a clear break above Friday’s peak, at around 1.6165. Such a move could confirm a failure swing bottom formation and may initially pave the way towards the 1.6250 zone, marked as a resistance by the peak of September 4th. The rate may stall around there, or even correct back down. But as long as it would be trading above 1.6165, we would see decent chances for the bulls to re-enter the game. The next positive leg may drive the rate above the 1.6250 hurdle, something that may allow buyers to target the 1.6300 area or the 1.6355 zone, between which the pair traded from August 30th until September 3rd.

Shifting attention to our short-term oscillators, we see that the RSI rebounded and crossed above its 50 line, while the MACD, although negative, lies above its trigger line and looks ready to obtain a positive sign soon. These indicators suggest that the rate may have started picking up upside speed and support the case for some more near-term advances.

On the downside, we would like to see a clear dip back below 1.6015 before we totally abandon the bullish case. Such a dip could initially aim for the 1.5890 zone, which is slightly below Thursday’s low and provided decent support between July 19th and 23rd. If the bears are not willing to stop there, then a break lower may extend the slide towards the 1.5825 zone, near the low of April 30th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.