Behavioral Shopping: This Is Why You May Be Spending More

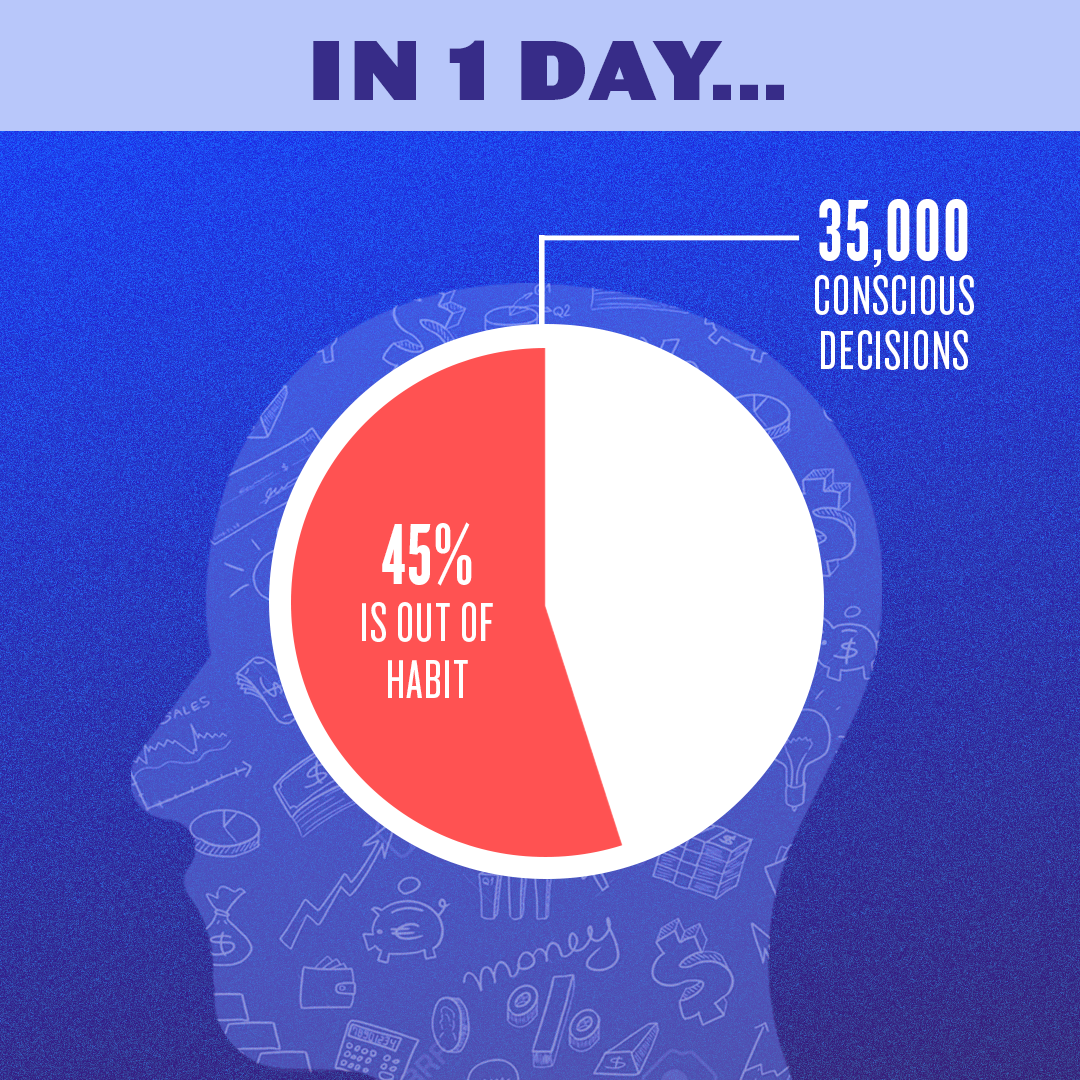

You enter your neighborhood supermarket, and make your way to the aisle with dishwashing soap. Amid the rows of hyper-colored liquids in plastic bottles, you reach for the one with the familiar shape and packaging. Wonder why you choose the same brand by default? While we make 35,000 conscious decisions in a given day, it turns out that about 45 percent of what we do is rooted in habit.

A recent study by the Harvard Business Review on shopping decisions by U.S. consumers found that 83 percent of shopping trips consists of repeat purchases. People tend to buy similar items or are looking to replace something they already have. While the tried-and-true works, it may not always provide the best value or there may be better alternatives on the market.

Here’s how habits play into what we buy — and how we can break a bad spending habit.

The study “The Habitual Consumer,” by Wendy Wood and David T. Neal, points to the notion that habits are developed when linked to a specific context, our response in that context, and the associations made in our memory. Over time, our habits are formed with repetition. The more we do something in a particular context, the more it becomes our default action. That’s why a certain habit becomes the overriding response in a given situation.

Habits are also activated by the sequence of actions leading up to the behavior. If you typically buy stuff you see on Instagram, you might be more prone to buying threads from your favorite fashion influencer’s account. Or when hit by a spell of boredom, you’ll purchase a handful of items in your “saved” cart on Amazon, anticipating the package delivered to your door.

Have you ever been distracted while shopping? Maybe preoccupied by some drama at work earlier that day, it lowers your ability to decide on something different or override old tendencies. If you don’t have the mental bandwidth to consider the alternatives, you’ll opt for what’s tried-and-true.

Let’s say you have a tendency to stock up on items you haven’t run out of. If you’re trying to break that old inclination, next time you shop, try to focus on the end goal, which is not buying 40 rolls of toilet paper. By paying attention to this goal and mindlessly filling your cart, over time you could break the habit.

According to “The Habitual Consumer” study, if you’re pressed for time, your brain will reduce the steps leading up to a decision. You’ll spend less time on the nitty-gritty details, and more on the big picture. And you’ll rely more greatly on your default actions. For example, you’re driving down the highway and run out of gas. You pull over to the shoulder. When you trek over to the nearest gas station, you reach for the first can you see. If you were shopping for a gas can at your leisure, you might do some comparison shopping online, reading reviews and checking prices before you push the “add to cart” button.

Your ability to control your thoughts, feelings, and actions functions like a muscle, according the American Psychological Association. It’s depleted with use. To regenerate, you need to rest. When you’re tired or stressed, you don’t have as much energy to control your impulses. What’s more, you won’t be able to override an old habit. That’s why when you have low self-control, you’re more inclined to cave in to impulse purchases. Studies show that mental fatigue can lead to impulse shopping. When we’re mentally tired after a long day of work, we lack the capacity for self-control.

If you have a habit of indulging in a strawberry milkshake when you’re stressing over work deadlines, or resort to retail therapy after you get into a fight with your partner, you’ll continue to do so when you’re tired. On the flip side, if you have developed a good habit of spending only a set amount when you shop for groceries, after a long day of work, you’ll still stick to that inclination.

Trying to change a bad spending habit? Maybe you are oftentimes inclined to buy stuff you don’t need or you go overboard during sales. To break bad habits, begin with simply acknowledging that we know we're more likely to make bad spending decisions when we're pressed for time, lacking willpower, or are distracted, explains Sarah Von Bargen, writer, blogger, and educator of Yes and Yes.

“Once you've acknowledged that to yourself, come up with a contingency plan or a different way to deal with those spending triggers,” says Von Bargen.

As she explains: If you know you've got a long week coming up and you know you're likely to want to reward yourself with takeout several times throughout that week, make a plan now. Meal prep so you'll have food on hand or buy a bunch of delicious frozen meals from Trader Joe's.

You also might need to make more substantive changes. Research by the Common Cents Lab, encouraging people to eat out less, reveals that we can interrupt sticky spending habits for a short period of time; however, your behavior will probably revert back unless you make greater structural changes. For instance, put your eating-out budget on a separate debit card. Or take a new route to work so you don’t pass by your favorite coffee shop. Stop following your favorite fashion Instagrammers or gearhead newsletters altogether.

Or, if you know you're absolutely going to purchase an item anyway, patience is a virtue — and will payoff, big-time.

Wait until said item goes on sale or use Honey's Droplist, which alerts you of price drops on selected items.

In the past year, Honey members have saved about $5 billion worth of items to their Droplist. In return, Honey has found more than $450 million in savings for those products.

While habitual spending and impulse spending are commonly seen as being one and the same, there are indeed different things, points out Mariel Beasley, a principal of Common Cents, which conducts studies on behavioral economics. Habitual spending includes buying coffee every morning on the way into work, always ordering a drink when going out to dinner, or browsing online shopping sites when bored. Impulse spending is making purchases on things you weren’t planning on buying, but rather decide to in the moment, says Beasley. For example, you wander through a grocery store and buy things that weren’t on your shopping list, you grab a candy bar or magazine in the checkout aisle because it catches your eye, or you decide to get dessert when the server at a restaurant offers it to you. “Spending habits might be behavioral patterns that are hard to break,” explains Beasley. "And put us in places that tempt us to overspend on additional impulse purchases.”

If you’re trying to avoid impulse purchases, understand when you have the least amount of self-control, suggests Beasley. Then avoid temptation in those moments by reducing your ability to act on that temptation.

“For example: If you know that you tend to buy more than you intend to at the grocery store, make a list before you go in and don’t go down aisles that don’t have items on your list,” says Beasley. “Or, if you always end up ordering a second drink at dinner, only bring cash and just enough for the cost of dinner, one drink, and a tip.”

Not feeling motivated to change a habit? Von Bargen suggests running the numbers. “Almost every habit we have has a monetary value attached to it,” says Von Bargen. “How much does your 'buy lunch at work' habit cost on a yearly basis? How much does your ‘happy habit’ cost?”

Along the same lines, our good habits can save up hundreds or thousands of dollars a year.

“How much money do you save each year by biking to work?” says Von Bargen. “Do you have a healthy habit that's allowed you to get off some medications? How much did you save?”

Likewise, when shopping on Amazon, do you use Honey's Best-Price Detection or Price History tools? The first compares the exact product you're viewing with others — same size, color, and features — offered by the many retailers available in the mega-marketplace. Best-Price Detection also factors in details like shipping delays and benefits to ensure you're getting the best value. With Price History enabled, you can watch an item's fluctuations in costs for 30, 60, or 120 days, allowing you to see where potential dips in price are and if you should wait or stock up on a steal. Would you call using both these tools good habits? We think so.

There’s something to be said for the feel-good factor of purchase, or that you’re jiving with a company’s mission or founder’s story. You might buy the same products time and again because you have a preference for it, or had a good experience using it in the past. Brand loyalty and relationships you have with that brand can influence your spending choices. Research reveals that one of the three main parts of brand loyalty is emotional loyalty. Consumers might stay devoted to a particular brand because they feel emotionally engaged, feel a sense of delight by it, or would recommend it to their friends and family.

If you love a particular pressed juice company that donates money to charities, you’ll buy a few bottles, even if you should go lean on your food spending that week. Or maybe you reap reward points each time you purchase certain brands through a popular shopping app.

For better or for worse, habits form when our decision-making goes into autopilot. Getting your head around how habits influence what we buy and our spending behaviors can help us reinforce solid tendencies and break the damaging ones.