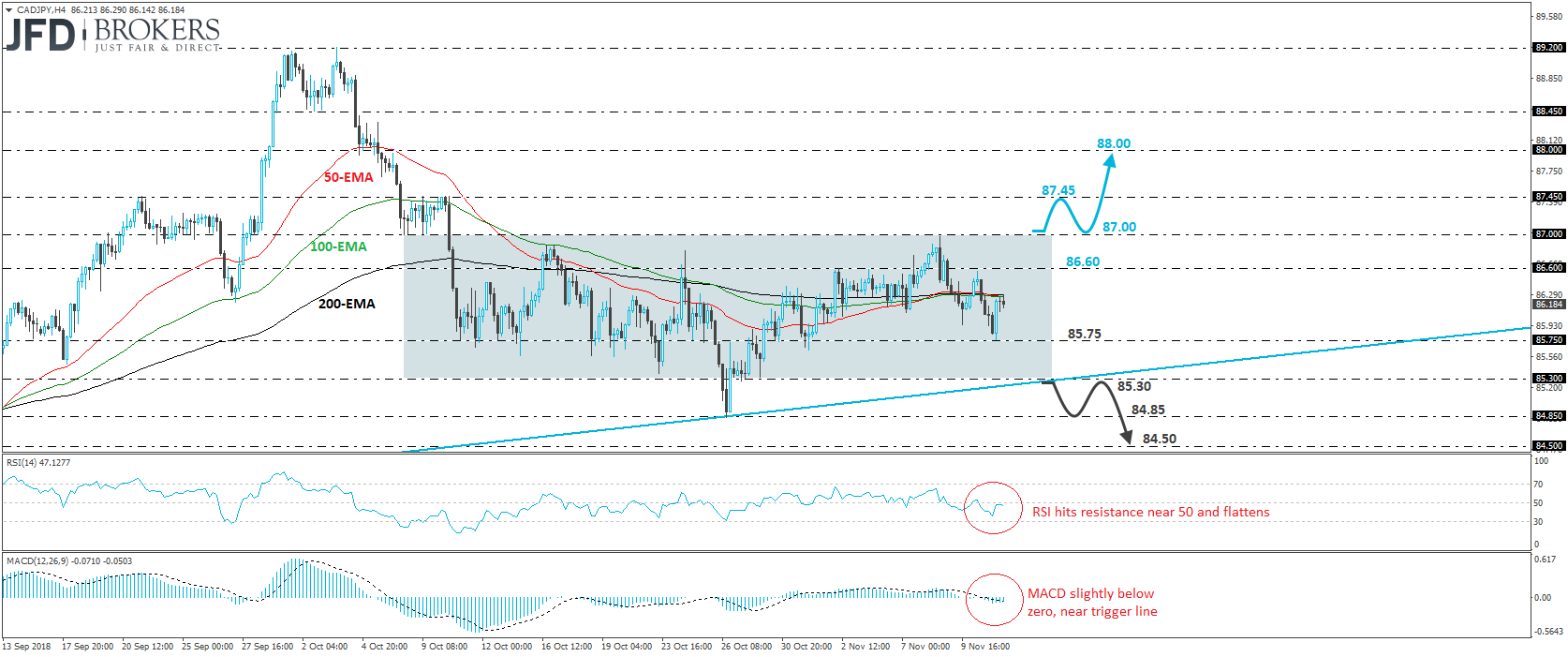

CAD/JPY traded lower yesterday, after it hit resistance near the 86.60 zone. However, the slide was stopped by the 85.75 level and then, the rate rebounded. The pair continues to trade within the sideways range between 85.30 and 87.00, which has been containing most of the price action since the 10th of October and thus, we prefer to remain sidelined for now. That said, bearing in mind that the rate also holds above the medium-term upside support line drawn from the low of the 22nd of June, we would see slightly more chances for an upside exit out of the range, rather than a downside one.

If this is the case and the bulls manage to overcome the 87.00 key hurdle soon, then we may see them initially aiming for the 87.45 obstacle, defined by the peaks of the 9th and 10th of October. Another break above 87.45 may carry more bullish extensions and perhaps open the way for the high of the 8th of October, near the 88.00 territory.

Taking a look at our short-term oscillators, we see that the RSI rebounded, but hit resistance near 50 and then it flattened. The MACD lies slightly below both its zero and trigger lines but shows signs that it could bottom soon. These neutral signs suggest lack of near-term momentum and support our choice to stand pat until the rate exits the aforementioned sideways range.

On the downside, we would like to see a clear dip below 85.30, which is the lower end of the near-term range, as well as a break below the upside support line drawn from the low of the 22nd of June, before we start assessing whether the bears have gained the upper hand. Such a move could initially open the path for the low of the 26th of October, at around 84.85, the break of which could target our next support at 84.50, marked by an intraday low formed on the 11th of September.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.