The initial coin offering and the future of finance

The entrepreneurial and investor worlds are in a frenzy to raise tokens and invest in them. You should begin paying attention to this sector now.

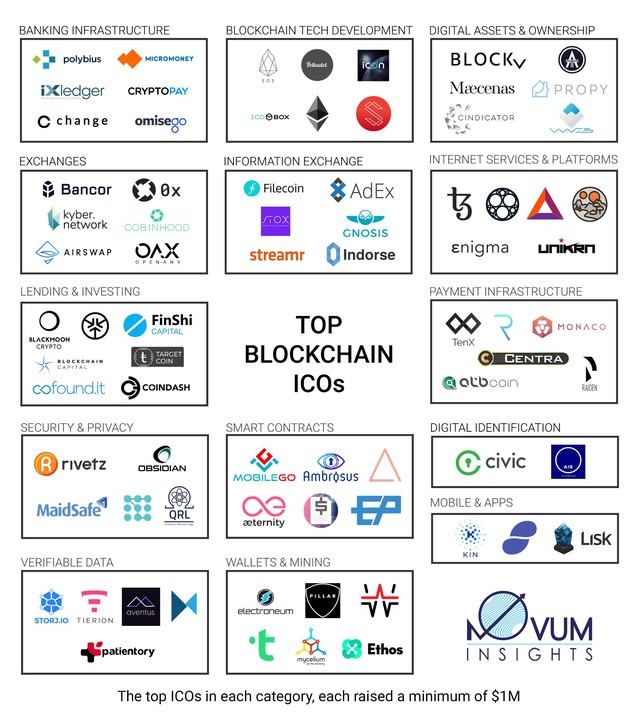

Entrepreneurs with massive visions are working on raising huge sums of capital, and it is not uncommon to meet initial coin offering hustlers jabbering about how we are getting a chance to live through something akin to the dot.com era: the blockchain era. Initial coin offerings have now raised $3.2bn this year, Novum Insights data shows, which seemingly puts a new sector on course to take a decent chunk of the wider venture capital industry.

The excitement is driven by the ability to raise coins instead of equity to finance ideas, with the coins generally having some form of utility as well as fluctuating value. This is leading to greater funds being raised by entrepreneurs than would typically come from angels and venture capitalists as well as the likelihood of entrepreneurs retaining greater control of their company’s operations. There is much talk of grandiose ideas and the use of smart contracts based on Ethereum. In some cases these contracts are working, but in many others they are a work in a progress. Yet like in the early days of the world wide web, there is strong hope that some of the tokens being used today will dominate a new “internet of value”. The concept is that your online activity and identity will lead to cryptocurrency rewards, generating a better valuation of all our actions.

With many sold on this vision, entrepreneurs, which are at the seed stage, who only last year may have raised £500k to £1m to prove out their project, are attempting to raise tens and even hundreds of millions of dollars, as crypto fever sweeps the investment and entrepreneurial worlds.

This vision of an internet of value has been a driving force propelling cryptocurrencies led by Bitcoin and Ethereum to repeated new highs this year – with their current valuation pegged at more than $293bn, according to CoinMarketCap. In turn this has led to holders of crypto assets looking to diversify their holdings.

This interest is booming because the entrepreneurial community is warming to the idea of an internet of value, as well as the huge funds available for winners. Investors are attracted by the huge gains made by those in the sector and for those with cryptocurrencies already, in part because they are keen not to pay capital gains tax on their gains, which they would have to do if they converted the money back into fiat currency like the dollar or the euro. Because of this cryptocurrency holders have diversified their crypto assets into other lesser known tokens. This has often proven a great trade to make, although at some stage there will likely be a crypto crash.

It was enjoyable and interesting watching one of the co-founders of one of the biggest new tokens Bancor, Galia Benartzi, present twice this month, in Amsterdam at the e/d/t Global Foundation launch and at Davos in the D10E ICO event. With the great energy and confidence of being a frontier entrepreneur, Benartzi responded in a highly upbeat way, to an audience member challenging her on the relatively poor performance of the token, which has slid significantly against Ethereum, despite it having raised more than $150m in an ICO.

She explained much of the funds were being used to stand behind the currency and also made the case that by raising the funds in a token the group was going to the people and its users rather than the venture industry, which she argued had been a poor allocator of capital. The audience was certainly more sympathetic after hearing her present, although most observers of particular ICOs have significant questions.

The crypto world is certainly not for the faint of heart. Its boom at some stage will be followed by a crash, although there is huge momentum behind the cryptocurrencies at present. The ability to remain anonymous using some exchanges mean that there is significant criminal interest in the sector from money laundering to illicit activities. The organisations running tokens themselves severely lack the kind of reporting and governance, which you would expect from groups managing millions of dollars of others’ money. A worrying number of tokens are also scams, which will doubtless damage the sector’s reputation, although while investor paper profits are booming this is being overlooked by many.

Yet the money is coming to cryptocurrencies and initial coin offerings because the returns have been eye-popping and the technological vision for the use of funds is often immense. For this reason at Novum Insights we are keeping a close eye on all tokens, and are on the look out for those which can stand out from the rest.

Novum Insights is the data provider for complex technological sectors, with blockchain the first area we have mapped, and artificial intelligence the next sector on our radar.

To download our blockchain report’s first chapters, and receive intelligence updates, as well as request a demo of our upcoming software product, go here.

Read the slides for our presentation at the World Congress Centre in Davos at the D10E ICO event earlier this month.

SOAR / SIEM / XDR / ZTNA / IAM

6yExcellent assessment Toby Lewis, thank you!