When will consumers in Hong Kong ditch their wallets for the mobile version?

The city’s mobile payments transaction value is less than 0.5pc of China’s, while its infrastructure, regulation and consumer readiness lags Singapore

Three to four times a week, Stephanie Lui orders a car on ride-hailing app Grab to take her home from work in Singapore. Instead of paying cash, she pays for her rides using prepaid credits in her GrabPay mobile wallet because, for her, convenience is all that matters.

“I don’t have to think about whether I have enough cash for my ride,” said Lui, who works in the banking industry.

She made the switch from using credit cards to GrabPay during a promotion period, when the app operator would have spent aggressively on marketing and big subsidies on rides to attract customers.

Lui is just one of thousands of Grab users in Singapore who use GrabPay regularly. According to Jason Thompson, head of GrabPay, 80 per cent of Grab’s users in Singapore are going cashless and using it as the primary payment method for their rides.

GrabPay, which initially only worked for payments within the company’s ride-hailing ecosystem, has since introduced more features, such as fund transfers between Grab users. Users will also soon be able to withdraw money from their bank accounts, said Thompson.

“We want to allow customers to move their money around ... it’s important that users do not feel that their money is trapped [in the wallet],” Thompson said.

By the end of this year, users will also be able to make payments at over 1,000 merchants in Singapore, including hawker centres – open air cooked-food centres – and mom-and-pop stores which typically only accept cash.

We want to allow customers to move their money around ... it’s important that users do not feel that their money is trapped [in the wallet]

Singapore is one of several Southeast Asian markets in which digital payments are beginning to take off – thanks in part to a strong push by companies such as Grab and government efforts to strengthen the e-payments system to accelerate the country’s digital transformation.

Hong Kong, which the island state is often pitted against, is lagging behind. Mastercard’s Mobile Payments Readiness Index, which takes into account factors such as infrastructure, regulation and consumer readiness, ranks Hong Kong in 15th place, while Singapore takes the top spot.

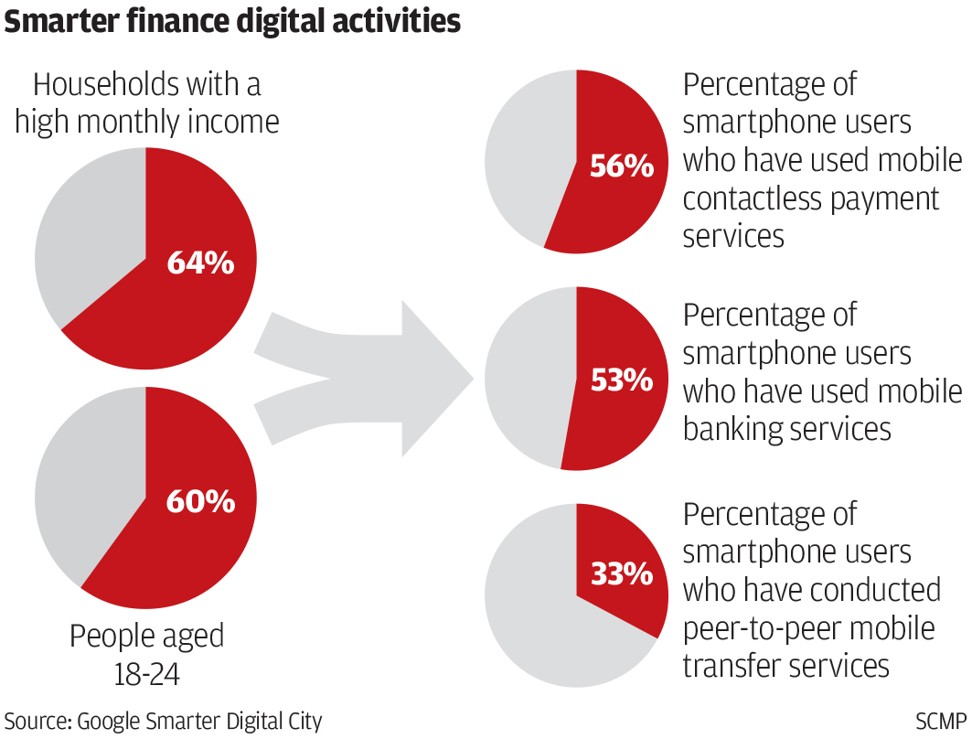

Like Singapore, Hong Kong is also widely considered to be a mature payments market, where consumers have an average of four credit cards each. But when it comes to mobile payments usage and awareness in Hong Kong, a recent Google whitepaper found that 30 per cent of Hongkongers surveyed did not know what peer-to-peer payments were, and only 56 per cent had experience with mobile payments.

Hong Kong’s low mobile payments adoption rate hasn’t stopped major mainland players like Tencent and Alibaba financial affiliate Ant Financial from launching mobile wallets WeChat Pay and AlipayHK respectively in Hong Kong.

Tencent first rolled out WeChat Pay in Hong Kong last year, allowing users to link up their bank or credit card accounts and top up the wallet. Users are able to send digital red packets to friends, or purchase movie and transport tickets via WeChat Pay.

In May, Ant Financial launched AlipayHK and started off by partnering with a variety of convenience stores and retailers such as Watsons, Sasa and Chow Tai Fook which accept AlipayHK as an in-store payment method.

And just last month, Ant Financial and Li Ka-shing’s CK Hutchison said that they would create a joint venture to operate the AlipayHK app in Hong Kong. The deal will allow Ant Financial to offer AlipayHK services to companies operated by CK Hutchison, including ports, retail, infrastructure and telecommunications businesses.

As it stands, over 3,000 merchants accept AlipayHK as a form of payment – partnerships have expanded to include smaller outlets in Hong Kong which traditionally accept only cash.

“Over 30 per cent of merchants accepting Alipay in Hong Kong are small merchants ... [Alipay] is an ideal platform for merchants to connect with numerous consumers,” said Venetia Lee, general manager of Alipay Hong Kong, Macau and Taiwan.

Over 30 per cent of merchants accepting Alipay in Hong Kong are small merchants ...

Lee added that Alipay is a “digital lifestyle platform” which enables users to not only check out special offers by merchants but also to redeem e-coupons within the app.

The company is looking to increase partnerships with smaller merchants in the city, with initiatives planned that would see it team up with places like wet markets where shop owners typically only accept cash.

But analysts say Hong Kong’s mobile payments market remains small, despite the number of e-wallet services available in the city. The Hong Kong Monetary Authority last year gave out 13 stored value facility licenses to companies, including Hong Kong fintech company TNG, which operates TNG Wallet.

He pointed out that most retail stores already accept credit cards or cashless payments via the Octopus card, the city’s stored-value smart card, meaning that users have little incentive to switch to other forms of payments.

“Where services like Alipay will flourish the most are markets that are similar to China, like certain Southeast Asia markets with low credit card usage and high smartphone penetration.”

Where services like Alipay will flourish the most are markets that are similar to China, like certain Southeast Asia markets with low credit card usage and high smartphone penetration

He said for e-wallet services such as Alipay and WeChat Pay to achieve higher adoption in Hong Kong, strong incentives and ease of use are key to attracting and retaining users.

In Hong Kong, the total value of mobile payment transactions will have reached US$529 million in 2017, according to statistics portal Statista. This is a mere fraction of China’s transaction value of US$138 billion. With the ubiquitous acceptance of mobile payments by retailers both big and small and high consumer usage, China currently dominates the world’s mobile payments market.

Forrester analyst Ng Zhi Ying pointed out that when it comes to mobile payment adoption, there is a “chicken and egg” problem.

“Consumers typically won’t adopt a payment system until it’s widely accepted by merchants, and vice versa.”

Ng said mobile-wallet service providers needed to demonstrate its advantages over current payment methods like cash and credit cards that are preferred by Hongkongers.

“Systems can spark adoption by enabling ‘must-have’ transactions that persuade consumers to sign up in the first place, or kick-start network effects by creating interoperability with other systems to reach critical mass faster and stand a far greater chance of success,” Ng said.

“The first wave for us is to look at all the offline merchants in Singapore that are using cash and not [mobile payments] and get them to start using QR. We think the way to drive mobile payment behaviour is in the offline stores, the local stores,” Thompson said. “It’s a merchant problem. Consumers in Singapore are going cashless with Grab, so why aren’t other merchants going cashless?”

Consumers typically won’t adopt a payment system until it’s widely accepted by merchants, and vice versa

GrabPay hopes to first encourage cash-reliant merchants to accept mobile payments before moving on to bigger retailers which already accept common payment methods like credit cards. The idea is that consumers will be less incentivised to use mobile payments if they can simply whip out their credit cards when paying for purchases at a large retailer.

GrabPay’s success in getting its users in Singapore to use its service is also due in part to its rewards programme.

Whenever users pay with GrabPay, they are awarded double the number of reward points than they would get with other payment methods. These points can then be used to redeem further discounts on future rides or other deals with merchants like food-delivery company Deliveroo, apparel company Cotton On and the music-streaming service, Spotify.

Earlier this month, it also unveiled a partnership with Singapore Airlines which lets users convert Grab points to air miles.

In Indonesia for instance, it functioned not just as a payment method for users – it also provided financial services, said Thompson.

The app operator plans to launch an initiative with an Indonesian bank to open up interest-bearing GrabPay accounts for Grab drivers in the country soon. Under the initiative, drivers will be able to earn interest on the money they leave in their GrabPay wallet.

“GrabPay is more than just a payments company, we’re helping to bring the middle economy to banking,” Thompson said. “A lot of lending and money transfers in the middle economy in Southeast Asia is ungoverned and unofficial, and we want to bring governance and data from this economy to the financial institutions to allow people to lend effectively at highly competitive rates.”

Demand for transportation in Southeast Asia, especially in markets where public transport systems are not efficient, is strong. This makes transport a “strong use case” for mobile payments, Thompson pointed out.

In Indonesia for example, a survey by research firm Jakpat showed that paying for transportation was the most common reason given by users for turning to digital payments, probably because both Grab and its main in-market rival, Go-Jek, offer mobile payments services to users.

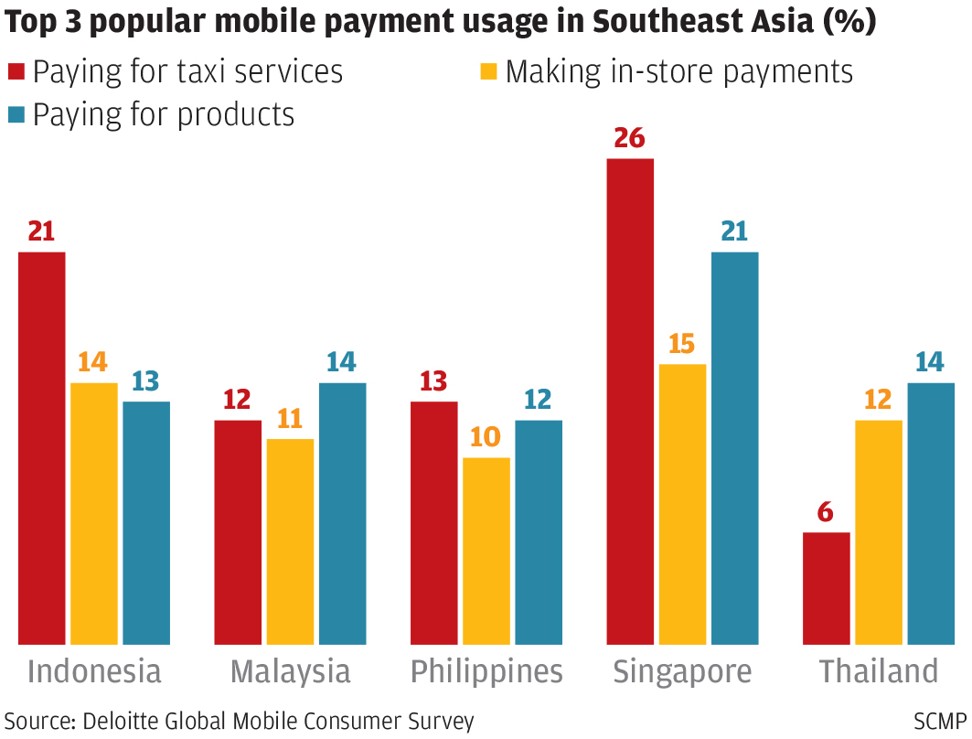

A Deloitte survey of mobile consumers released last year also found that paying for taxi services was among the top three use-cases for mobile payments in countries like Indonesia, Singapore, Malaysia, Thailand and the Philippines.