GEAB 126

The world is on the brink of a wave of unprecedented development which is poised to sweep over the Middle East, Africa, India, Southeast Asia, the United States and the planet as a whole. The foundations on which this new world will be built are becoming clearer and clearer: A globalised electric grid, networks of financial centres, new commercial roads, crypto-currencies, e-economies, reinvented global governance etc. All these provide the infrastructure which will shape this unimaginable phase of multipolar and multiconnected development, which we will attempt to describe in the following paragraphs.

Exponential or explo-sive?

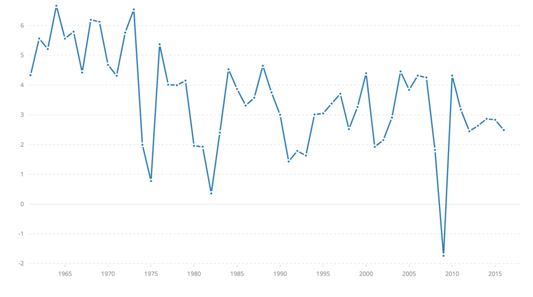

If we look at the growth of world GDP since 1960,[1] we see that it is growing at a surprisingly steady rate, with the exception of one recessive jolt in 2008-2009. This is not really surprising since the production of wealth has been intrinsically dependent on the presence of raw materials to be processed, on the labour available to produce, on the quantity of solvent consumers to transform this production into cash, on sufficient money to reinvest and on well-trained brains to constantly reinvent the process. In the real world, all this raw material for growth is only available in limited quantity, thus providing a strict framework for potential growth.

Growth of Global GDP (%), 1960-2016. Source: World Bank

However, from 2020, we are expecting a trend towards a triple paradigm shift in growth limits:

- Firstly, with the arrival on the world production market of a whole series of new regions bringing along human resources, raw materials and innovative brains. But this increase is still based on materiality where growth is extended through the adjunction of. 1.2 billion Africans, 430 million South Americans, 70 million Centro-Asians, 640 million south-eastern Asians and 1.2 billion Indians.[2]

- Secondly – and this is where we start talking about exponential development and no longer of simple acceleration – the transition to an e-economy will literally dissociate growth from material goods (human, energy, monetary). Artificial intelligence, increasing dematerialisation of consumer products, a monetary system freed from the issuing capacities of central banks alone; all this is already on the table, but we have not seen anything (especially in the West) of the real potentialities that it creates, knowing that this year, $1 trillion has gone into the digital transformation of society;[3]

- Finally, let us add that growth will also be liberated from planet Earth thanks to an unlimited conquest of space, now fully open for trade (space economy). [4]

The exponential characteristics seen in this phase of development not only make it possible to draw attention to the opportunities, but also to the risks of such a rapid change – risks that will require the presence of global instances of process control.

E-economy: We haven’t seen anything yet

In the West, we are still much too invested in the real economy. Looking at China, however, we can get an idea of what an e-economy will look like. In August 2017, China accounted for 40% of global online transactions, making 11 times more online transactions than the United States.[5] In this instance, China has the immense advantage over the West to build its market economy directly on the Internet. Emerging powers like Africa[6] and India,[7] in particular, will also have this advantage. Also, e-economy is not just real economy duplicated on the web. It is a whole new ecosystem, or even ‘eco-paradigm’, developed from specific principles (so specific that the economy is built purely on this new foundation, free from any previous reference).[8]

To give a particularly eloquent example of the growing divergence between the economy and the e-economy: The current inflation rates recorded in the material economy are not found in e-economy! Online prices are falling in absolute terms and relative to traditional inflation measures. Online inflation is literally 200 points below the official consumer price index (CPI). Incidentally, this says a lot about our mantra on the need to create new statistical tools[9] measuring economic activity.[10]

In other words, the GDP curves we examined at the beginning of this article are unable to take account of the growth of activity and virtual wealth of this e-economy. If they could, the start of this exponential development would probably be reflected in them.[11] But it is not clear that the figures of the ‘real’ and virtual ecosystems are intended to be mixed up, according to the good old adage: ‘Don’t compare apples with oranges.’ Instead, they should have two separate statistical systems.[12]

Cryptocurrencies… changing our relation to money

As you know, we certainly encourage caution when it comes to bitcoin. At the same time, we have long been convinced that virtual currencies/cryptocurrencies/e-currencies are part of the future. The most recent proof of this is the launch on 13th June 2018 of a cryptocurrency exchange in the very serious country of Switzerland.[13] That said, we believe that we are only at the beginning and therefore prefer to save you from being part of the first experiments of development… Besides, we have always said that these currencies need to leave behind the speculative mentality in order to provide real models for the future (although the speculative nature of bitcoin has served to draw attention to this monetary future). All the more a reason why we prefer to talk more about investment potential (ICOs) than speculation (bitcoins).

With regards to the dematerialisation of the economy, the principle of limited quantity, which has characterised the currency so far, has been seriously undermined:

- By the large-scale printing of money that the world’s citizens have witnessed over the last ten years

- By the appearance of virtual currencies

Currency is dematerialised and, in the process, goes back to what it probably was to begin with – a tool and not a good in itself. Also, it is now looking like a tool that anyone can create. In terms of collective psychology, the impact is immense and, in some senses, puts an end to the capitalistic principle of ‘what I own, others do not’. There is, indeed, no interest in accumulating virtual currency except to use/exchange it. What future e-billionaires will keep in their virtual coffers – and this will be one of the features of tomorrow’s business model – will be based on activity rather than wealth.

For the same reasons, the system of nation-states, central banks[14], etc., will gradually merge into a financial system of a new nature, characterised by a multiplicity of players, disintermediation, fluidity and logical hubs.[15]

The currencies of the future must be able to be easily created, on an immediate basis, linked directly to activity, instead of being the result of the arbitrary decisions of central bankers creating ultra-complex mechanisms to generate a currency which doesn’t know where to go and, in the absence of a better option, inevitably ends up in the pockets of big players. From now on, the tools of disintermediation will be there. It started with crowdfunding that is already becoming sophisticated by combining with new virtual currencies, or serious investment tools that are ICOs. We therefore have no doubt about this trend of monetary-financial transformation by 2040, even if we are perfectly aware of the regulations that will channel these developments… and which are also desirable.

At this point, we already have a significantly increased number of relevant individual players, capable of trading the same product billions of times (course, music, film, photo, etc.). They are now endowed with investment tools linked to the unlimited nature of the money supply. An exponential development…

Login

For the past two years, we have been witnessing the meticulous dismantling of the world order that has prevailed since 1945. Unable to adapt to new realities, this world order [...]

The Common Agricultural Policy (CAP), which is supposed to guarantee food independence and food quality for all Europeans, has been in crisis for many years without the citizens seeing any [...]

- Chinese market - New banks - Real estate: Owning your home, it's over! - Your information system: diversify by sectors Chinese market China has an instrumental role in the [...]

Comments