Securities watchdog backs away from front-seat role in Hong Kong’s stock listing process

Hong Kong’s securities watchdog has agreed to back out of a front-seat role in approving new stock listings in the city, conceding to overwhelming opposition by stockbrokers, listed company representatives and other financial professionals after a five-month consultation.

The Securities & Futures Commission (SFC) and the Hong Kong Exchanges & Clearing Limited (HKEX) will soon unveil a watered down conclusion of their consultation, whereby the HKEX will retain its primacy in approving listings in the city, according to two sources familiar with the matter.

The SFC will be represented in a new committee that’s to be established for setting listing policies, but will not be able to appraise the performance of the HKEX’s listing division staff, the sources said.

The retreat underscores the challenges facing Hong Kong’s financial regulators, as they try to reshape the city’s capital markets and regulatory framework to remain competitive as a destination for companies to raise capital.

The stakes are high for a city that imagines itself to be Asia’s financial hub. The city needed to reform its listing process to instil financial discipline and enhance the quality of its listed companies, while sprucing up the market environment to attract more companies to list. The SFC in recent months has stepped up its crackdown of market malpractices including meting out penalties and trading suspensions.

Initial public offerings (IPOs) in Hong Kong fell 19.5 per cent during the first six months of 2017 to a combined US$5.8 billion, compared with the same period last year, when the city was top of the league table for new global listings, according to Thomson Reuters’ data.

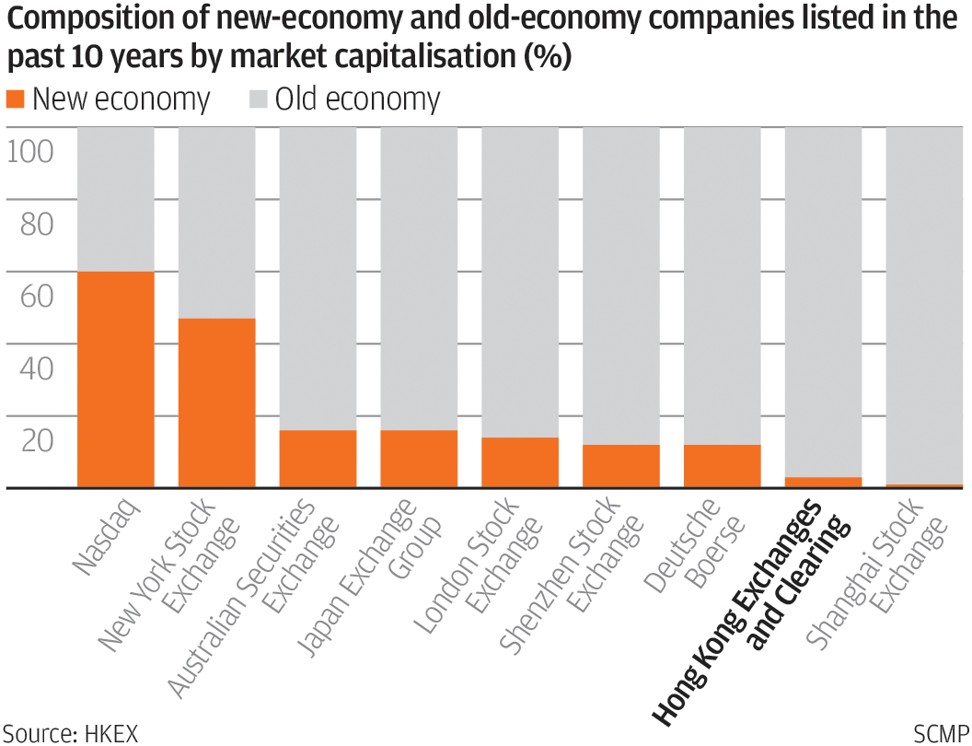

More critically, companies that chose to raise funds in Hong Kong were dominated by the financial industry, making up 59 per cent of funds raised during the period, while technology companies raised the equivalent of 0.8 per cent of capital. The proportion of so-called New Economy companies as a percentage of market capitalisation was the second lowest in Hong Kong in the past decade, out of nine global markets, according to HKEX data.

A dearth of technology IPOs knocked Hong Kong off the top of last year’s league table to third place in the first half. The New York stock exchange took the crown, with companies including Snap raising a combined US$18.2 billion in fresh capital. Shanghai was the second largest, with US$9.6 billion raised, according to data of Thomson Reuters.

The SFC and the HKEX -- respectively the regulator and the operator of Asia’s third-largest capital market -- called for public consultation in June last year on a controversial plan to set up two committees with equal representation by both to set listing policies, and approve IPOs.

The proposal differs from the status quo by putting the SFC on the front seat with the HKEX in approving listings. In a process that twice extended its deadline, as many as 8,500 submissions were made by brokers, listed company representatives and financial professionals. An overwhelming 94 per cent of respondents opposed the proposed reforms and opted to keep the SFC on the back end of the listing process.

While some commentators see the proposal as a turf war between the SFC and the HKEX, the regulator and the market operator said they will move forward together to focus on another vital piece of reform: the creation of a third board to attract start-ups and technology companies to raise funds in Hong Kong.

HKEX in August ended a two-month consultation for setting the third board. Accountants, bankers, brokers and lawyers are divided over whether a third board is needed, in addition to the existing main board and the growth enterprises market (GEM) for start-ups.

HKEX chief executive Charles Li Xiaojia said there would be another round of consultation for the third board. If it gains support, the new board would be launched some time next year.