Fintech Malaysia Report 2019 — How is Malaysia’s Fintech Scene Doing?

by Vincent Fong December 3, 2019In 2017, we started Fintech News Malaysia with a simple goal — to help shine the spotlight on deserving fintech startups in Malaysia.

In line with that, we publish our Fintech Malaysia report on an annual basis to provide anyone who is interested to find out more about the fintech scene in Malaysia with a definitive guide.

Time sure does fly, almost without realising it, we’re now publishing the 3rd edition of our Fintech Malaysia report. This time around, we’re fortunate to receive the support of our generous sponsors like Touch ‘n Go eWallet, GHL, DAX Ventures, MoneyMatch, Jirnexu and pitchIN in helping us produce the report.

The sponsorship does not affect our editorial direction, but it does enable us to spend more time to deep dive into our research and provide our readers with more useful data and insights.

Download the full report here

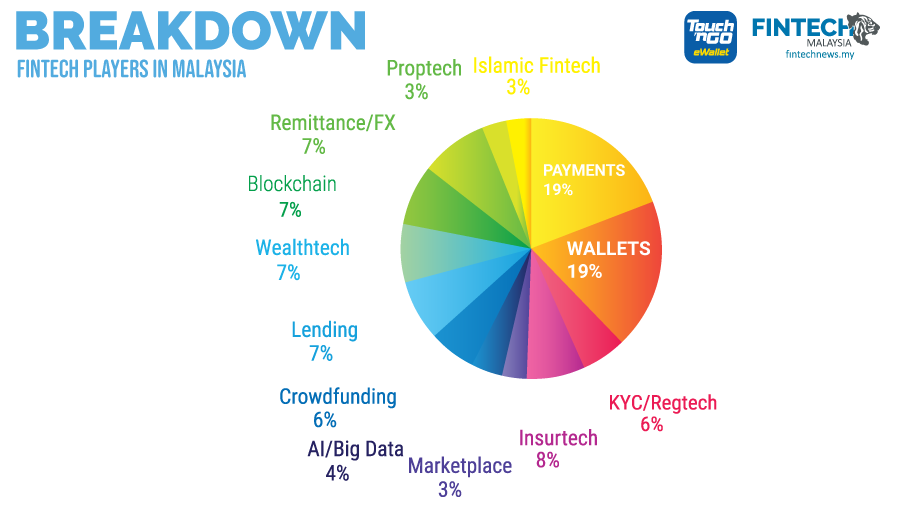

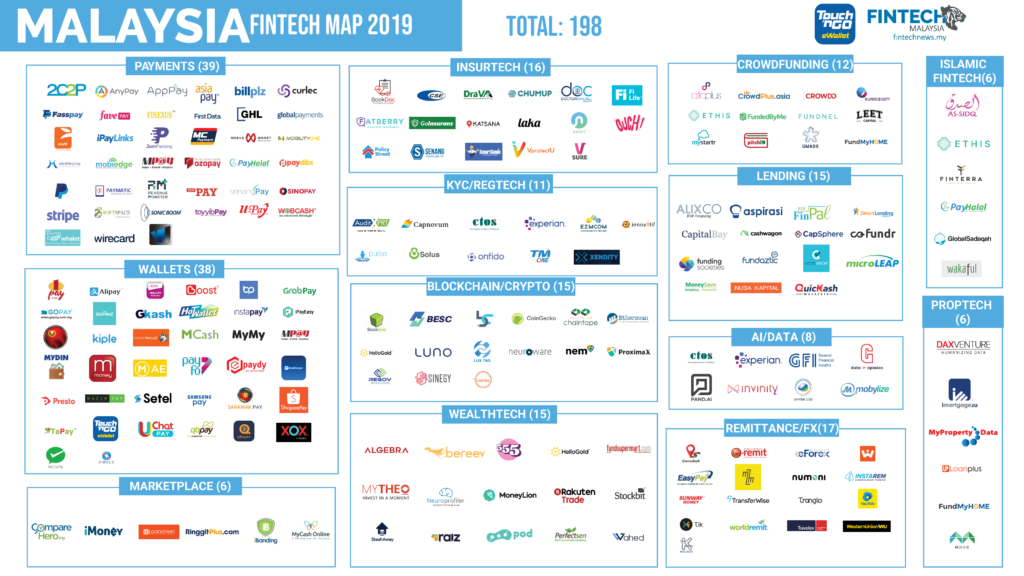

Similar to our 2017 and 2018 report this year’s “Touch ‘N Go eWallet Malaysia Fintech Report” shows that payments remain the dominant segment within Malaysia’s fintech ecosystem. E-wallets are coming in as close second despite the fact that several e-wallets like vcash and Payfy discontinuing their services.

Download the full report here

The verticals within Malaysia’s fintech scene that seen the most casualties are within the crypto and financial aggregator space.

In early 2019, there were over 50 crypto exchanges operating in Malaysia, in efforts to bring more order the market Securities Commission Malaysia issued a framework for crypto exchanges in Malaysia. As a result, there are now only 3 crypto exchanges operating in Malaysia, with Luno being the first one to be approved by the regulator.

On the financial aggregator front, we’re observing that many foreign players struggling to make headway in Malaysia with the likes of Bbaazar, GoBear, CoverGo, Qompanion closing their existing operations or scaling back in Malaysia.

Both the number of crowdfunding and lending players have gone up with Securities Commission granting several more approvals for equity crowdfunding and P2P lending.

Download the full report here

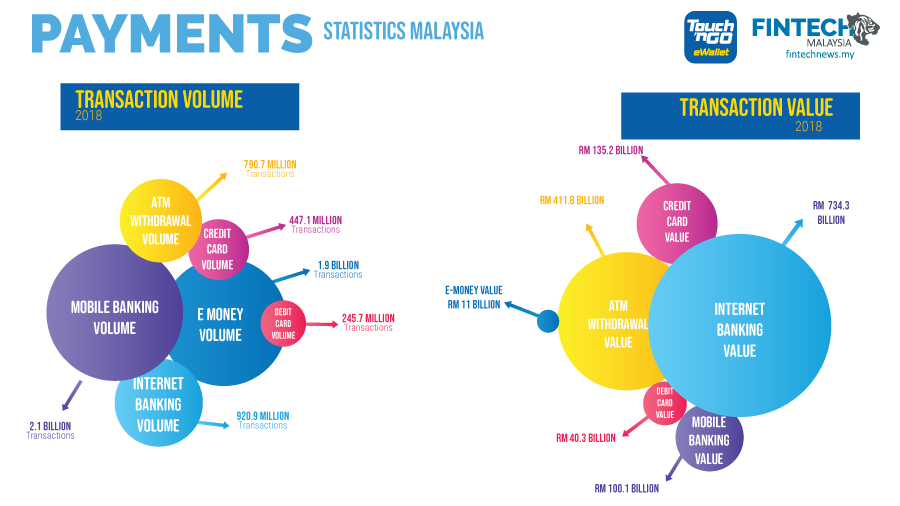

Data from Bank Negara Malaysia shows that mobile banking transaction value has grown seven times in the past five years whereas e-money’s transaction value has grown more than double in the same period. This indicates that Malaysian are increasingly becoming more comfortable with using mobile financial services.

Though Malaysia has made great strides in our cashless push, for now, cash is still king with ATM withdrawals accounting for RM411.8 Billion of transaction value in Malaysia.

Download the full report here

In the “Touch ‘n Go eWallet Malaysia Fintech Report 2019” we have compiled many more interesting sets of data that would prove useful for those who are keen to learn more about fintech in Malaysia. These include stats on e-wallets, P2P lending, equity crowdfunding, and many more.

The full report can be downloaded here.

For a full list of the companies listed in the map you can refer to our fintech directory here.