Technology

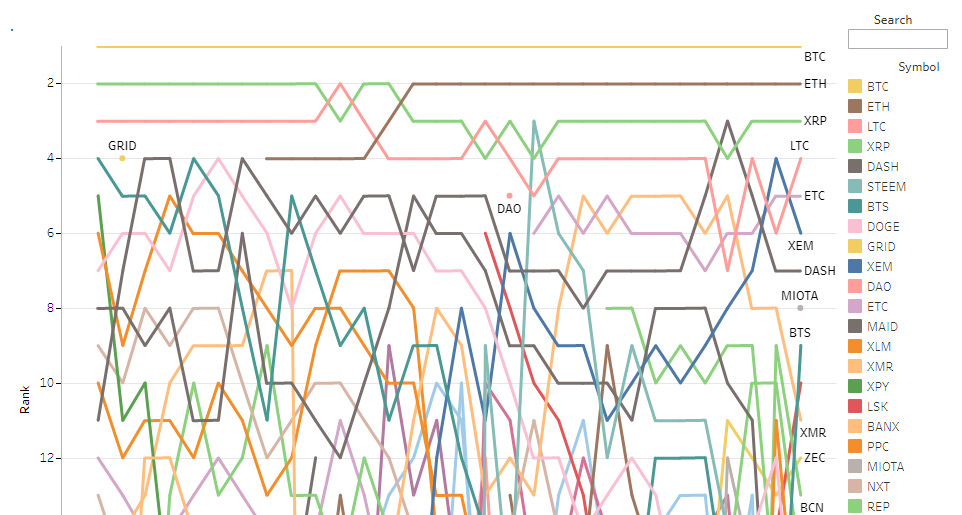

Interactive: Ranking the 20 Most Valuable Cryptocurrencies Over Time

The following interactive visualization sorts and ranks all cryptocurrencies by market capitalization.

var divElement = document.getElementById(‘viz1498757488102’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’1004px’;vizElement.style.height=’869px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

Ranking the 20 Most Valuable Cryptocurrencies Over Time

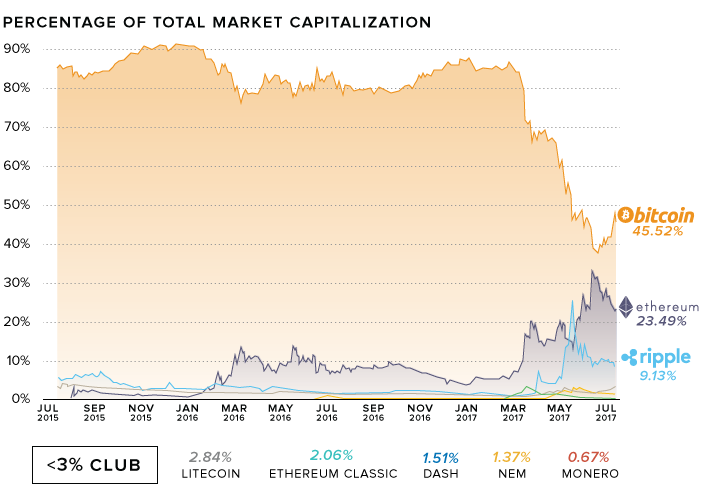

Many cryptocurrencies have followed Bitcoin, but none have been able to crack its dominance of the digital currency marketplace. The above interactive graphic, by CryptoReach, shows the top 20 cryptocurrencies ranked by market capitalization over the course of the past 2.5 years.

This ranking can teach us about the evolving market for cryptocurrencies and the direction it may take as more and more competing players emerge.

A Matter of Scale

The movement – or lack thereof – of market cap rankings as shown in the chart can be deceiving at first.

Keep in mind that the rankings, as listed, don’t take the scale of differences in market cap (or coin price) into account. The ever-increasing valuation of Bitcoin is a great example of this. With a market cap recently reaching $40 billion, it surpasses most other cryptocurrencies on the list by an order of magnitude despite only being separated from them by a few ranking points.

Cryptocurrencies Grow Across the Board

Just because a particular currency falls down the rankings doesn’t necessarily mean that its market cap is shrinking: it may simply not be keeping up with the growth of its peers. Dashcoin, for example, fell four ranking points between March and May of the past year despite nearly $200 million of growth in value.

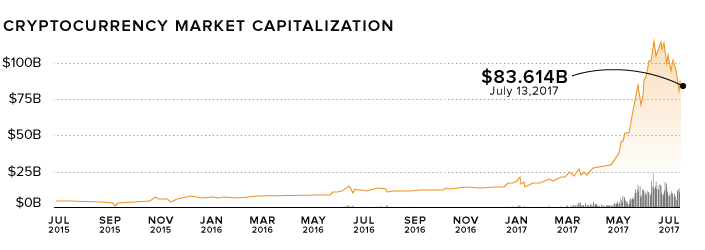

This simply reflects a much broader overall trend: the extraordinary speed at which the cryptocurrency market as a whole is growing in value – that is, until the recent pullback in the last month.

Some mainstream analysts have characterized the rapidly rising valuations of cryptocurrencies in the past several months with words like “insane”, stoking fears of a bubble set to burst. So far that hasn’t happened yet, but it is true that the coin universe has had a significant pullback after powering through $100 billion in value in June 2017.

For anyone that follows the crypto market, they know that such volatility isn’t unusual. Bitcoin has often been either best or worst performing currency in back-to-back years through its short history.

But despite this aforementioned volatility in the market, the coin universe has evolved over time to include many other cryptocurrencies. With the market assigning strong valuations to many different coins, it confirms broad interest in the sector and blockchain as a whole, while helping alleviate some signs of a “bubble about to burst”.

Rise of the Disruptors

As we can see in the above graphics and the interactive chart, Bitcoin has dominated the list of highest-valued cryptocurrency players for close to three years. However, other currencies have recently entered the mainstream, preventing Bitcoin from owning the entire market.

The appearance of the more technologically advanced currency Ethereum on the market in mid-2015 appears to have challenged for Bitcoin’s share of the market, as well as ending the ongoing battle for the second-place ranking between Ripple and Litecoin. In the short span between December 2015 and February 2016 (when it overtook Ripple for the #2 rank,) Ethereum’s market cap grew nearly eight-fold.

Technology

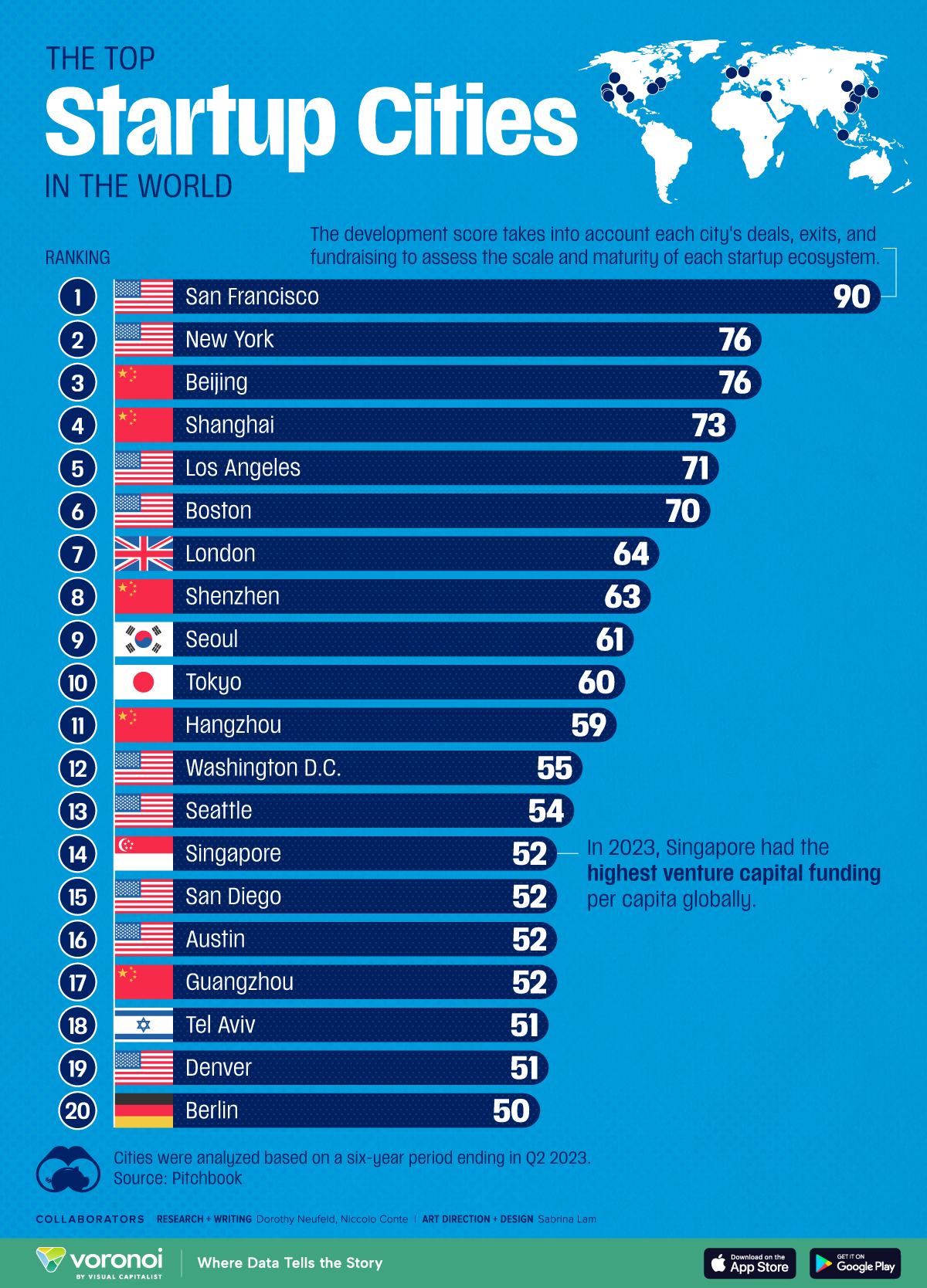

Ranked: The Top Startup Cities Around the World

Here are the global startup ecosystem rankings, highlighting the scale and maturity of major tech hubs worldwide.

The Top Startup Cities Around the World

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

A richly connected network of founders, venture capital firms, and tech talent are some of the key ingredients driving a startup ecosystem.

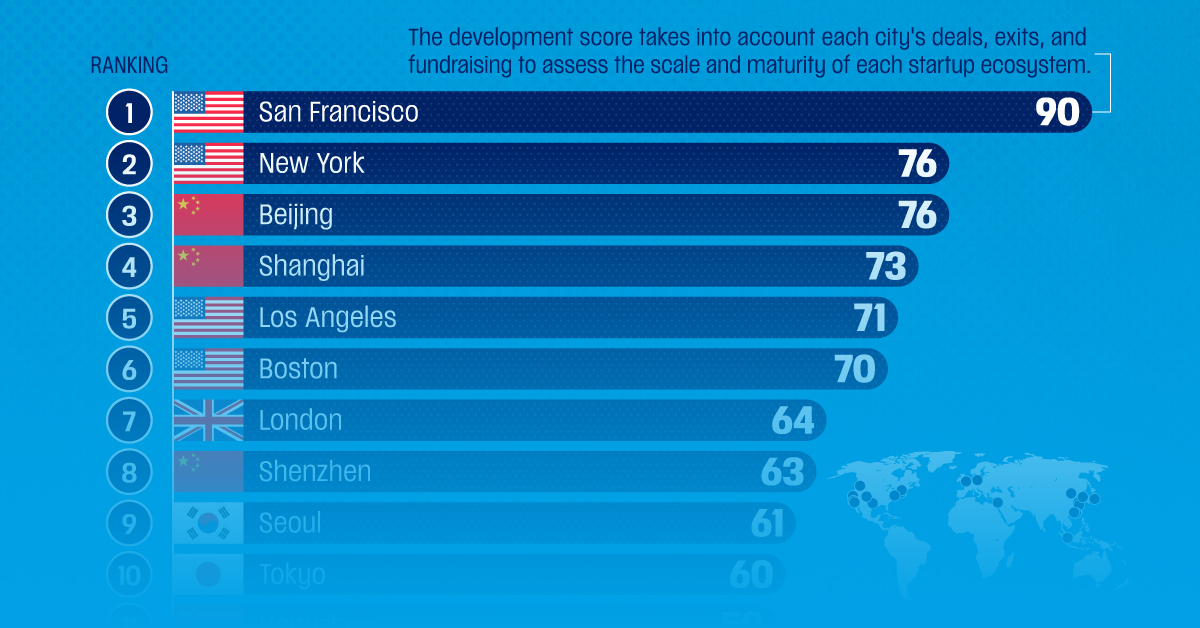

As engines of growth, these tech clusters are evolving on a global scale. While the world’s leading startup cities are concentrated in America, several ecosystems, such as Beijing and Seoul, are growing in prominence as countries focus on technological advancement to spur innovation.

This graphic shows the best startup cities worldwide, based on data from Pitchbook.

The Global Startup Ecosystem Rankings

To determine the rankings, each city was analyzed based on the scale and maturity of their startup ecosystem over a six-year period ending in the second quarter of 2023.

Among the inputs analyzed and used to calculate the overall development score were fundraising activity, venture capital deals, and exit value:

| Rank | City | Development Score | Capital Raised | Deal Count | Exit Value |

|---|---|---|---|---|---|

| 1 | 🇺🇸 San Francisco | 90 | $427.6B | 19,898 | $766.3B |

| 2 | 🇺🇸 New York | 76 | $179.9B | 13,594 | $171.7B |

| 3 | 🇨🇳 Beijing | 76 | $161.2B | 8,835 | $279.2B |

| 4 | 🇨🇳 Shanghai | 73 | $130.3B | 7,422 | $186.8B |

| 5 | 🇺🇸 Los Angeles | 71 | $144.6B | 9,781 | $181.4B |

| 6 | 🇺🇸 Boston | 70 | $117.0B | 6,044 | $172.8B |

| 7 | 🇬🇧 London | 64 | $99.0B | 11,533 | $71.9B |

| 8 | 🇨🇳 Shenzhen | 63 | $46.4B | 5,020 | $66.3B |

| 9 | 🇰🇷 Seoul | 61 | $31.1B | 6,196 | $71.0B |

| 10 | 🇯🇵 Tokyo | 60 | $26.2B | 5,590 | $28.0B |

| 11 | 🇨🇳 Hangzhou | 59 | $50.7B | 3,361 | $88.7B |

| 12 | 🇺🇸 Washington D.C. | 55 | $43.7B | 2,706 | $28.2B |

| 13 | 🇺🇸 Seattle | 54 | $31.7B | 2,693 | $35.6B |

| 14 | 🇸🇬 Singapore | 52 | $45.7B | 4,507 | $38.0B |

| 15 | 🇺🇸 San Diego | 52 | $33.5B | 2,023 | $44.7B |

| 16 | 🇺🇸 Austin | 52 | $26.4B | 2,636 | $22.9B |

| 17 | 🇨🇳 Guangzhou | 52 | $24.7B | 1,700 | $24.0B |

| 18 | 🇮🇱 Tel Aviv | 51 | $21.0B | 1,936 | $32.2B |

| 19 | 🇺🇸 Denver | 51 | $26.8B | 2,489 | $29.9B |

| 20 | 🇩🇪 Berlin | 50 | $31.2B | 2,469 | $15.9B |

San Francisco dominates the pack, with $427.6 billion in capital raised over the six-year period.

Despite a challenging funding environment, nearly 20,000 deals closed, highlighting its outsized role in launching tech startups. Both OpenAI and rival Anthropic are headquartered in the city, thanks to its broad pool of tech talent and venture capital firms. Overall, 11,812 startups were based in the San Francisco Bay Area in 2023, equal to about 20% of startups in America.

Falling next in line is New York City, which raised $179.9 billion over the same time period. Crypto firm Gemini and machine learning company, Hugging Face, are two examples of startups based in the city.

As the top-ranking hub outside of America, Beijing is home to TikTok’s parent company, ByteDance, which is one of the most valuable private companies in the world.

In recent years, much of the startup funding in China is being driven by government-backed funds. In particular, these funds are focusing heavily on “hard tech” such as semiconductor-makers and electric vehicle companies that align with the government’s strategic long-term goals.

Another leading tech hub, Singapore, has the highest venture capital funding per capita worldwide. In 2023, this was equal to an impressive $1,060 in venture funding per person. By comparison, venture funding was $345 per person in the U.S., the second-highest globally.

-

Healthcare2 weeks ago

Healthcare2 weeks agoWhich Countries Have the Highest Infant Mortality Rates?

-

Misc1 week ago

Misc1 week agoVisualizing Global Losses from Financial Scams

-

population1 week ago

population1 week agoMapped: U.S. States By Number of Cities Over 250,000 Residents

-

Culture1 week ago

Culture1 week agoCharted: How the Logos of Select Fashion Brands Have Evolved

-

United States1 week ago

United States1 week agoMapped: Countries Where Recreational Cannabis is Legal

-

Misc1 week ago

Misc1 week agoVisualized: Aircraft Carriers by Country

-

Culture1 week ago

Culture1 week agoHow Popular Snack Brand Logos Have Changed

-

Mining2 weeks ago

Mining2 weeks agoVisualizing Copper Production by Country in 2023