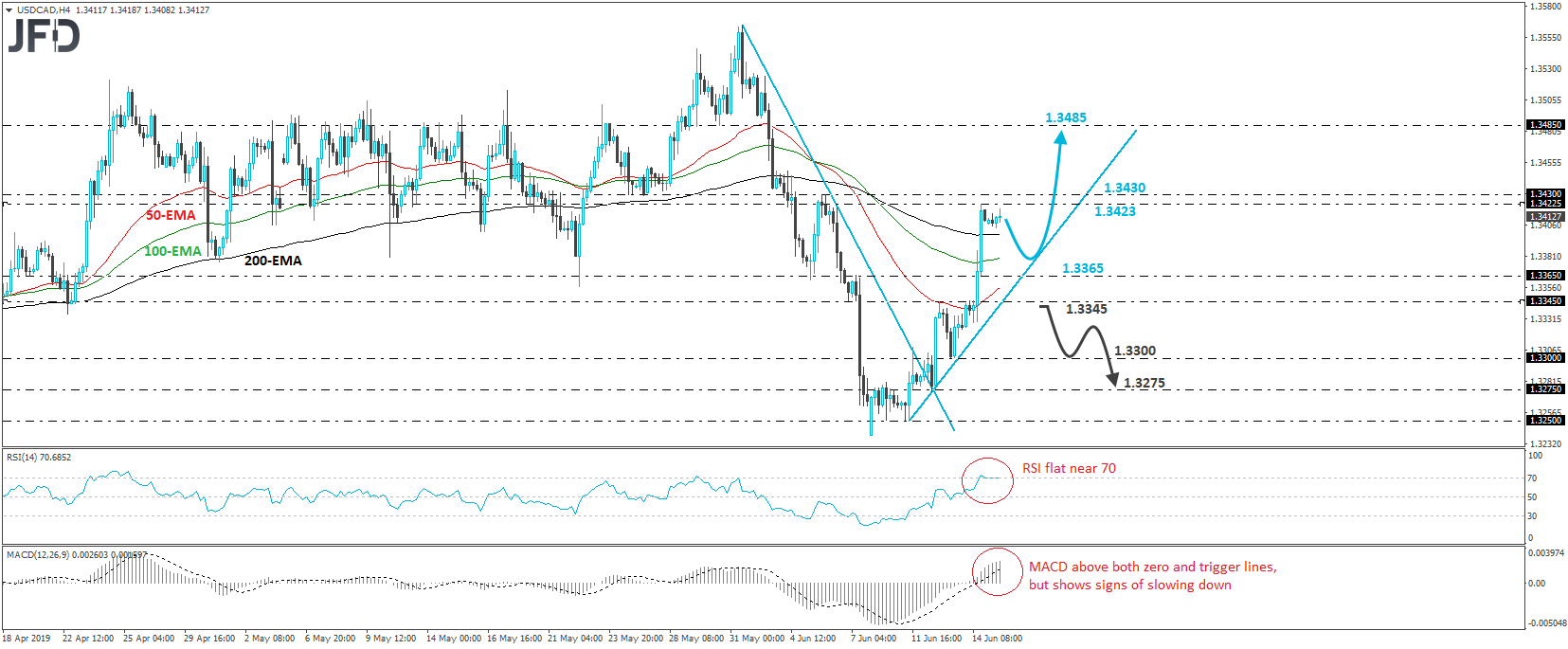

USD/CAD surged on Friday, breaking above two resistance (now turned into support barriers) in a row. That said, the rally was stopped near the 1.3423 level, and today, the pair has been oscillating slightly below that barrier. Last Wednesday, the pair emerged above the steep downside resistance line drawn from the high of May 31st, and then, it started forming higher peaks and higher troughs above a new upside tentative line, taken from the low of June 11th. Therefore, having all these technical signs in mind, we will hold a positive stance with regards to the short-term picture.

In order to get confident on more bullish extensions though, we would like to see a decisive push above the 13430 zone, a resistance defined by the highs of June 5th and 6th. Something like that could open the door for another rally, perhaps towards the 1.3485 area, marked by the inside swing low of May 30th. That said, before the next leg north, we see the case for a corrective setback, perhaps for the rate to challenge the aforementioned tentative upside line, from where the bulls could take the reins again.

The case for such a retreat is supported by our short-term oscillators, which detect slowing upside speed. The RSI edged up but flattened near its 70 line. The MACD, although above both its zero and trigger lines, has started showing signs of topping.

Nevertheless, we repeat that as long as a potential retreat stays above the tentative upside line, we would still see a decent chance for the bulls to jump back into the action. In order to start examining whether they have abandoned the battlefield, we would like to see a decisive dip below 1.3345. Such a move would confirm a break below the upside support line and may initially pave the way towards the low of June 13th, at around 1.3300. Another break, below 1.3300, could extend the slide towards the low of the previous day, near 1.3275.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.