Q: I recently read the Q&A you wrote regarding the differences between an independent contractor and an employee. However, my question is a little bit different. I’m planning on being an independent contractor, as I’m training out of a few different barns. Is there anything I need to know, particularly regarding the legalities of this?

A: Definitely! The number one thing that you need, from an equestrian legal perspective, is proper insurance.

Equestrian sport is not without risk, and, as an independent contractor trainer, you want to ensure that you’re protected against those potential risks, such as rider or horse injury. For this, you’ll want to look into a Commercial Equine Liability Policy.

If the farms that you’re teaching out of are business and insurance savvy, they make ask you for proof of this – and they may ask to be added to the policy as an “Additional Insured.” This covers the farm- or property-owners solely in relation to your training and lessons.

Some farms may also offer to add you to their farm’s liability policy that they already have in place. However, that only protects you at that specific farm, so if you’re training at multiple locations, you’ll likely still need your own Commercial Equine Liability Policy.

Depending on where you reside, you may also need to register with the local tax collector and acquire a tax registration certificate or business license. Some independent contractors skip this step, thinking it does not pertain to them, but again, based on your area of residence, the penalties for working without a license could be hundreds of dollars. Some areas even consider it a misdemeanor to do business without a license!

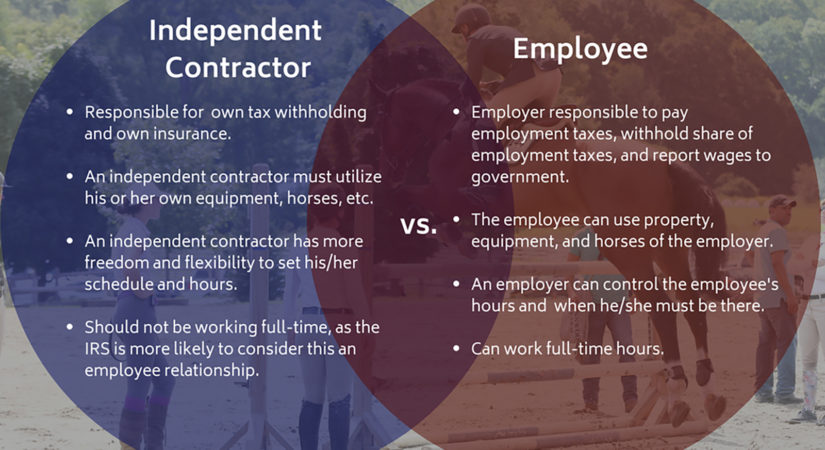

In addition to a tax registration certificate, you’ll need to be prepared to pay your own taxes. If you’re used to an employee position, you’re likely used to your taxes being withheld from your paycheck – and maybe even getting money back in your tax return! As an independent contractor, you must handle all of your own taxes, so be sure to be setting aside money to pay them each year.

Once you have your insurance and taxes arranged, it’s wise to have one other thing: a plan. It’s important to have both a financial plan for yourself and, even with proper insurance in place, a plan to reduce your risk of liability.

A few pointers for reducing your liability risks include:

- inspecting the properties where you’re teaching and ensuring that there isn’t anything that could lead to injury while you’re training, such as broken infrastructure, footing problems, etc.

- following barn rules. If the barn has rules in place, ensure that the students you’re training are following them. If the barn does not have any rules, consider developing your own set of guidelines for your students, such as always mandating proper helmets and footwear.

- having your students or the guardian of young students sign a waiver for participation in your lessons. They may have also already signed a waiver for the farm, but it’s smart to have them sign one for training with you as well

With that, you should be set to begin training as an independent contractor! Best of luck and enjoy it!