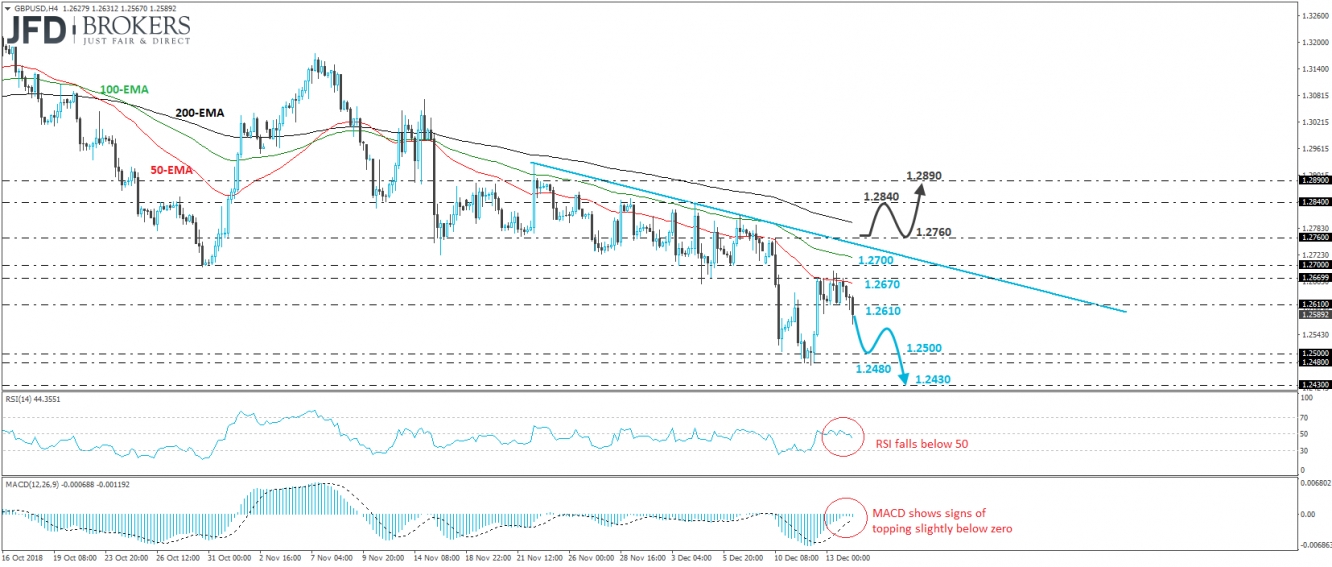

GBP/USD slid during the European morning Friday, breaking below the 1.2610 barrier, marked by yesterday’s low. The pair has been under some selling interest since it hit resistance near 1.2670 yesterday, with the slide accelerating somewhat after the dip below 1.2610. Cable continues to trade below the short-term downside resistance line taken from the peak of the 22nd of November, and thus, we would still see a negative picture.

We believe that the dip below 1.2610 may have opened the way for another test near the psychological territory of 1.2500. That said, we would like to see a decisive break below 1.2480 before we get confident on more bearish extensions. Such a dip would drive the rate into territories last seen in April 2017 and could set the stage for the 1.2430 barrier, defined by the inside swing peak of the 10th of that month.

Looking at our short-term momentum studies, we see that the RSI turned down and fell back below its 50 barrier, while the MACD, already negative, shows signs of topping slightly below zero. It could cross below its trigger line soon. These indicators suggest that the negative momentum has started building up again, supporting our view for some further declines, at least towards the 1.2500 zone.

On the upside, we would like to see a decisive rise above 1.2760 before we start considering the case of a near-term positive reversal. Such a move could confirm the break above the aforementioned downside line and may see scope for extensions towards the 1.2840 area. Another break above 1.2840 may allow the bulls to drive the battle towards 1.2890.