We’ve finished our holiday shopping, and if you’re like me, you may have spent a little more than you originally planned. So often, we get into the frenzy of wanting everything to be perfect for our families, and before we know it, January rolls around, bringing the tell-tale credit card and bank statements. After a season of gift-giving (and if I’m honest about my indulgence), now would be a great time to shift my focus to saving.

The best part about it is that you can incorporate the kids and turn this into a weekly lesson on budgeting with a money-saving challenge. (Hello, easy New Year’s Resolution!) Honestly, I can remember some of those early lessons I learned as a kid, and they stayed with me for the rest of my life. So for my littles, I want to foster an understanding of saving now rather than later.

The average allowance an American child now receives is about $780 per year, or $65 per month, according to a recent study by the American Institute of CPAs.

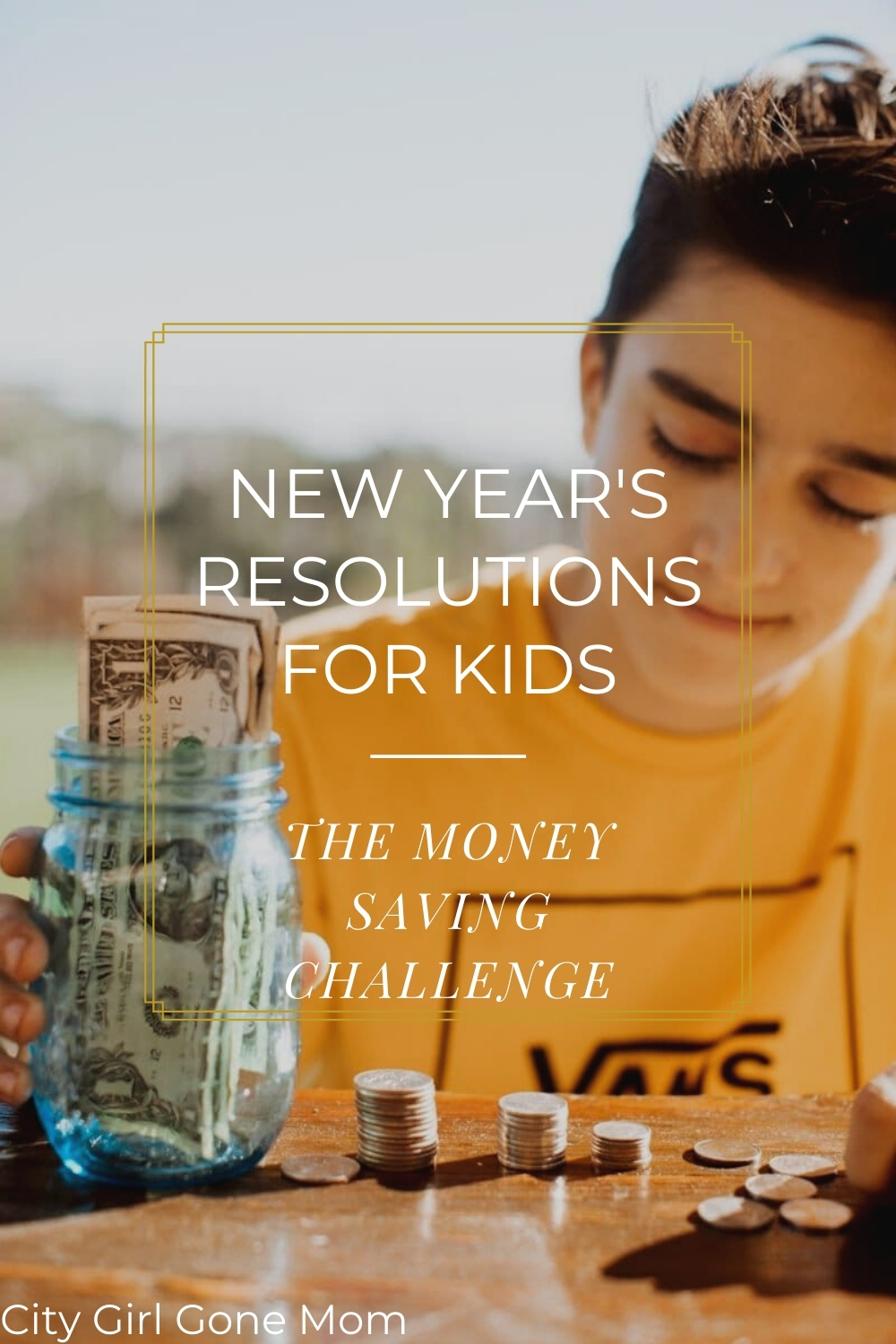

How the Money Saving Challenge Works

Have you heard of the 52-week money-saving challenge? Many of us have seen one version or another floating around social media, but most of us haven’t actually done it. This year, I’m changing that. Not only is it a great opportunity to teach my children about the importance of saving, but the money we save can go directly toward our holiday spending at the end of this year. It’s a win-win situation!

In case you aren’t familiar or need a refresher, the 52-week money-saving challenge works like this — for every week of the year, you will add that corresponding amount of money to savings. So, if it’s week one, you will add $1, if it’s week 12, you will add $12, and if it’s week 50, you will add $50. Every week builds upon itself, and at the end of the year, you’ll have a whopping $1,378!

Ways to Make It Easy and Fun

Many people find it convenient to set up automatic transfers to a savings account through their bank or certain apps, but when you’re doing this with kids, it might be best to do this the old-fashioned way. Use a transparent container so that, every week, you will all have that visual reminder of how much your efforts are beginning to pay off. There’s something so gratifying about being able to actually see how much money you are saving!

To keep track of everything, create and/or print out a chart and use it as a teaching tool with your kids. Show them how much money is being added and how that affects the overall balance of the savings. Involve them by allowing them to add money to the container, even if it means breaking up a dollar into quarters. By participating themselves, they’ll be even more invested in the lesson!

Need more parenting videos? Subscribe to City Girl Gone Mom on YouTube!

Engaging the Kids In Financial Learning

As the year goes on and the savings grow, talk about how they want to use the money. Do they want to keep saving for something big, or do they want to use it for Christmas time? This can lead to great discussions on budgeting and allocating resources. Older kids and teens may be especially surprised by how much work it takes to save money and how quickly it can disappear. This really is a great activity that will keep you and your kids engaged all year long.

I’m really excited about the year ahead, and I’m looking forward to seeing our little savings jar grow over the next 52 weeks! It’s a great reminder that, as a mom, by setting aside just a few minutes every week, I can teach my children lessons that can last a lifetime. That’s the bigger message here, isn’t it? Investing a little bit at a time can really pay off in the long run. Okay, I’m feeling inspired, and I’ve got a million ideas for making my jar fashionably fabulous!

Check out more family fun and follow us on City Girl Gone Mom TikTok!

The U.S. Treasury says that Americans hold about $15 billion in loose change.

YOU MAY ALSO LIKE

SHOP THE LOOKS

Pin This Post

I’m on it!

I love this! These little nuggets make huge life changes as we teach our children through real life experience! Thanks again for another engaging and thoughtful moment!

What a great idea! My oldest son is 4 and we are starting to teach him about money. Watching us save is a great teaching tool.

thanks love

I was just thinking about starting to save 10% of my salary each month. This seems very interesting, I wasn’t sure whether I got it right, but I ran the numbers, and it turns out if you try to do it each day of the week (each day of the first week, put one dollar in the jar, each day of the 30th week, put 30 dollars in the jar), at the end of the year you save a little over 9000 dollars! I think I will give it a try! Thanks for the opportunity!

Its so cool….. keep me posted on how you do…

I’m 32 and I need this money saving challenge! Such a great idea!

This is such a great idea! My son is only 2 1/2 and doesn’t understand currency too much yet, but I would love to start doing this with him. Thanks for sharing!

This is such a great idea to instill that its important to save in kids while they’re young. Need to keep this in mind for the future.

We have always wanted to do this challenge! I totally am behind by a couple weeks but better to start now than never.

I really like this post. my younger brother is saving his daily pocket money in a box and he is doing this since he was just 9 years old. He open that box after completion of year and each year he bought a new thing. I like the way he is saving.

Such great ideas for how to treat them, kids, for saving

Relevant information and best selection of words really thanks for share it.

you have a amazing blog and best to read thanks for share

Looks actually ideal and helpful post thanks for share…

Looks great.

Amazing blog.

This is one of the best websites that I’ve ever come across, all the content displayed is pretty unique and informative and from now onwards I’ll make it a point to go through the website regularly.

I admire your expertise and experience input. Your article is incredibly remarkable. Your website has an astounding amount of information.

There are so many resolutions I set to myself.

This is a fantastic post. My younger brother has been saving his daily pocket money in a box since he was nine years old. He opened the box at the end of the year, and each year he bought something new. I enjoy the way he saves.