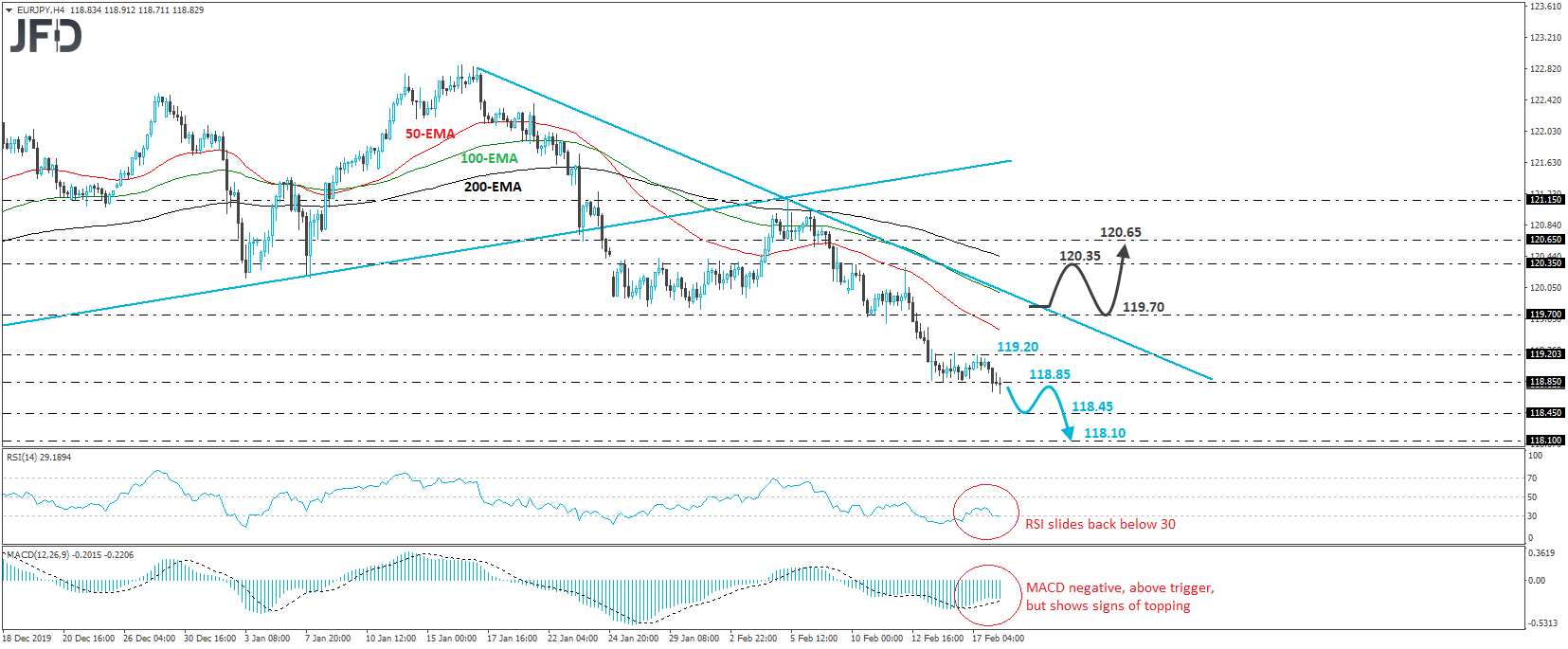

EUR/JPY had been trading in a consolidative manner, between 118.85 and 119.20, since February 13th. Today, the rate dipped slightly below 118.85, but rebounded to oscillate around that zone. Overall, EUR/JPY is trading below the downside resistance line drawn from the high of January 17th, as well as below the prior medium-term upside one taken from the low of September 3rd. So, having all these technical signs in mind, we would consider the short-term picture to be negative.

If the bears manage to distance themselves from the 118.85 hurdle, we could see them diving towards the 118.45 area, defined as a support by the inside swing peak of September 27th. If they are not willing to throw their swords away and push below that level as well, the slide may get extended towards the 118.10 territory, marked by the inside swing high of October 9th.

Taking a look at our short-term oscillators, we see that the RSI turned down and touched its toe back below the 30 line, while the MACD, although above its trigger line, shows signs of topping within its negative territory. Both indicators suggest that the rate may start picking strong downside speed again, which enhances our view for some further near-term declines.

On the upside, we would like to see a strong recovery above the downside line drawn from the high of January 17th before we start examining whether the bulls have gained the upper hand. Such a break may see scope for extensions towards the high of February 10th, at around 120.35. The bulls may decide to take a break after hitting that zone, and thereby allow a setback. Nonetheless, as long as such a potential setback stays limited above the pre-mentioned downside line, we would expect the bulls to charge again and push above the 120.35 zone, perhaps targeting the 120.65 obstacle, marked by the peak of February 5th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'