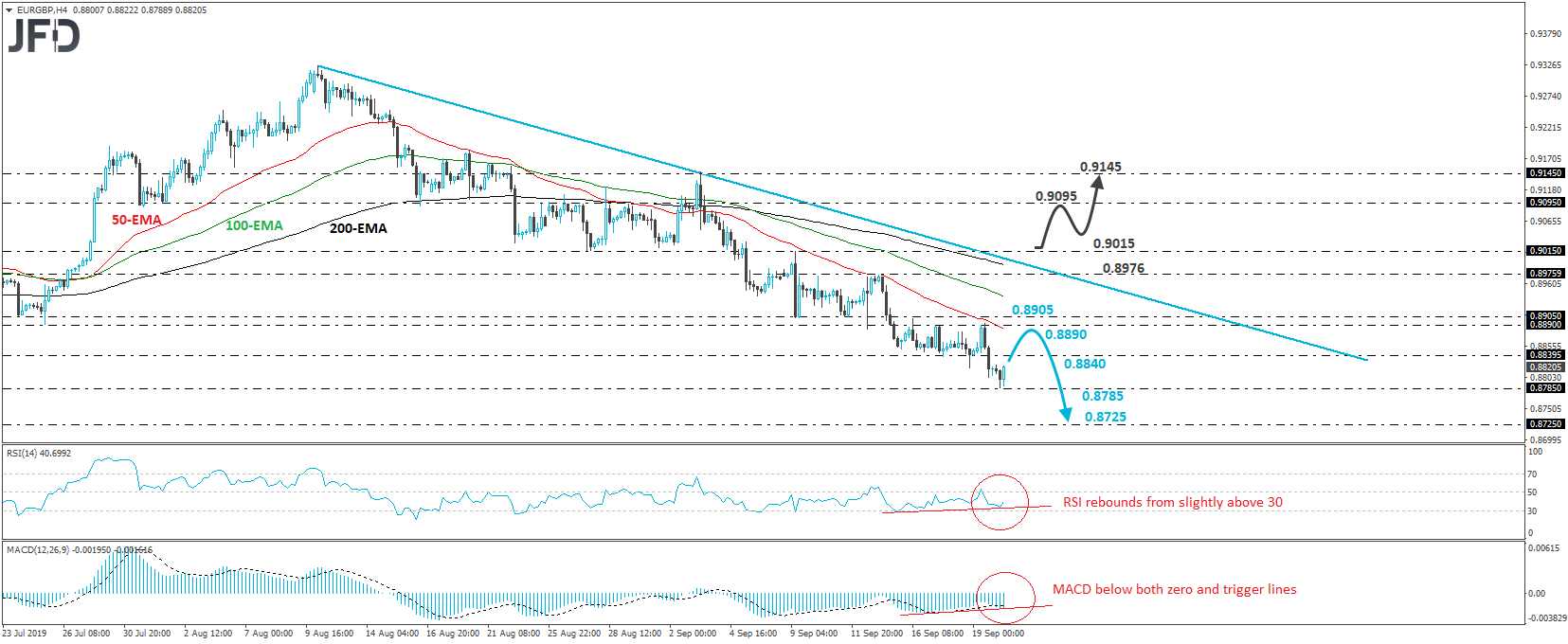

EUR/GBP traded lower yesterday, breaking below the support (now turned into resistance) barrier of 0.8840. That said, the slide was stopped by the 0.8785 level today and then the rate rebounded somewhat. Overall, the price structure remains of lower peaks and lower troughs below the downside resistance line drawn from the high of August 12th, and thus, we would consider the near-term picture to be negative, although the rate could continue correcting higher for a while more.

A clear move back above 0.8840 could signal that there is scope for more recovery, perhaps towards the 0.8890 or the 0.8905 barriers. Nevertheless, EUR/GBP would still be trading below the aforementioned downside line and thus, we would see decent chances for the bears to jump back into the action and push the rate down for another test near 0.8785. If, this time, they are not willing to hit the brakes near that zone, a break lower would confirm a forthcoming lower low and may extend the slide towards the 0.8725 zone, marked as a support by the low of May 21st.

Looking at our short-term oscillators, we see that the RSI rebounded from slightly above its 30 line, while the MACD, although below both its zero and trigger lines, shows signs that it could bottom as well. What’s more, there is positive divergence between both the indicators and the price action. All these signs suggest that the downtrend is losing some speed and corroborate our view for some further recovery before the next negative leg.

In order to start examining the case of a bullish reversal though, we would like to see a decisive move above the 0.9015 territory, which provided resistance on September 9th, while earlier, it acted as a support on August 27th and 30th. Such a move would also place the rate above the downside resistance line drawn from the high of August 12th and may initially set the stage for the 0.9095 area. Another break, above 0.9095, could encourage the bulls to put the 0.9145 level on their radars, which is near the high of September 3rd.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.