Excel Calculator: Invest Now or Pay Off Debt

A sophisticated way to score the decision to pay off debt or invest as it relates to the ability to grow the investment amount.

Video Tutorial:

This model is geared to someone who is in a situation where they want to invest in something, but have some debt with varying terms, remaining balances, and interest rates. So, they need to think about what makes more sense:

1. Paying off all the debt and investing what they have left in the investment they want.

2. Paying off the debt over time and investing a lot more money in the investment now.

As you start to dive into the mechanics here, you will see that the expected annual rate of return on the investment vs. the total debt and the mechanics of that debt will play a huge role in the results.

The biggest assumption of this model is that in the scenario where you will pay off all the debt at once and then invest what’s left, you will then invest the money you would be using for the monthly debt service of those loans into the investment going forward.

In #2 above, you would be able to use the difference between the total starting debt service and what is remaining (so as you start to pay that debt down) as contributions to the running investment you have.

Once all the debt is finally paid off, there are no more assumed contributions.

The model goes out for a period of 42 years.

The measure of what ‘wins’ is what situation has a higher net investment position (investment value less current debt owed) in a given year in the future.

The investment will compound interest every month.

You will see it is not as easy as just saying you will pay off the debt if it has a higher interest rate than the investment. There are a lot of other factors that have a material impact on what results in having a higher investment value sooner.

Similar Products

Other customers were also interested in...

Crowdlending (P2P) Platform – 5 Year Financi...

Financial Model providing an advanced 5-year financial plan for a startup Crowdlending (Peer-to-Peer... Read more

Multi-Member Investment Fund Portfolio and Distrib...

A fund management tool to track many positions over time as well as distributions to up to 20 member... Read more

Lending Company Financial Model – 5 Year Forecas...

This Financial model template presents a business scenario of a corporation engaged in granting loan... Read more

Discounted Big Bundle Real Estate Valuation and Fi...

One Excel file for this bundle of Valuation and Financial forecasting models. Storage Parks, Hotels,... Read more

The Realtors Quintessential ALL-IN-ONE Toolkit

Professional Realtors need a professional Toolkit which allows them to operate at a higher level. Th... Read more

Amortization Schedules Template (Loans, Mortgages,...

User friendly template including Amortization Schedules for Loans, Mortgages, Operating and Finance ... Read more

Savings Bank Financial Model Excel Template

Savings Bank Budget Template There's power in Cash Flow Projections and the insight they can provide... Read more

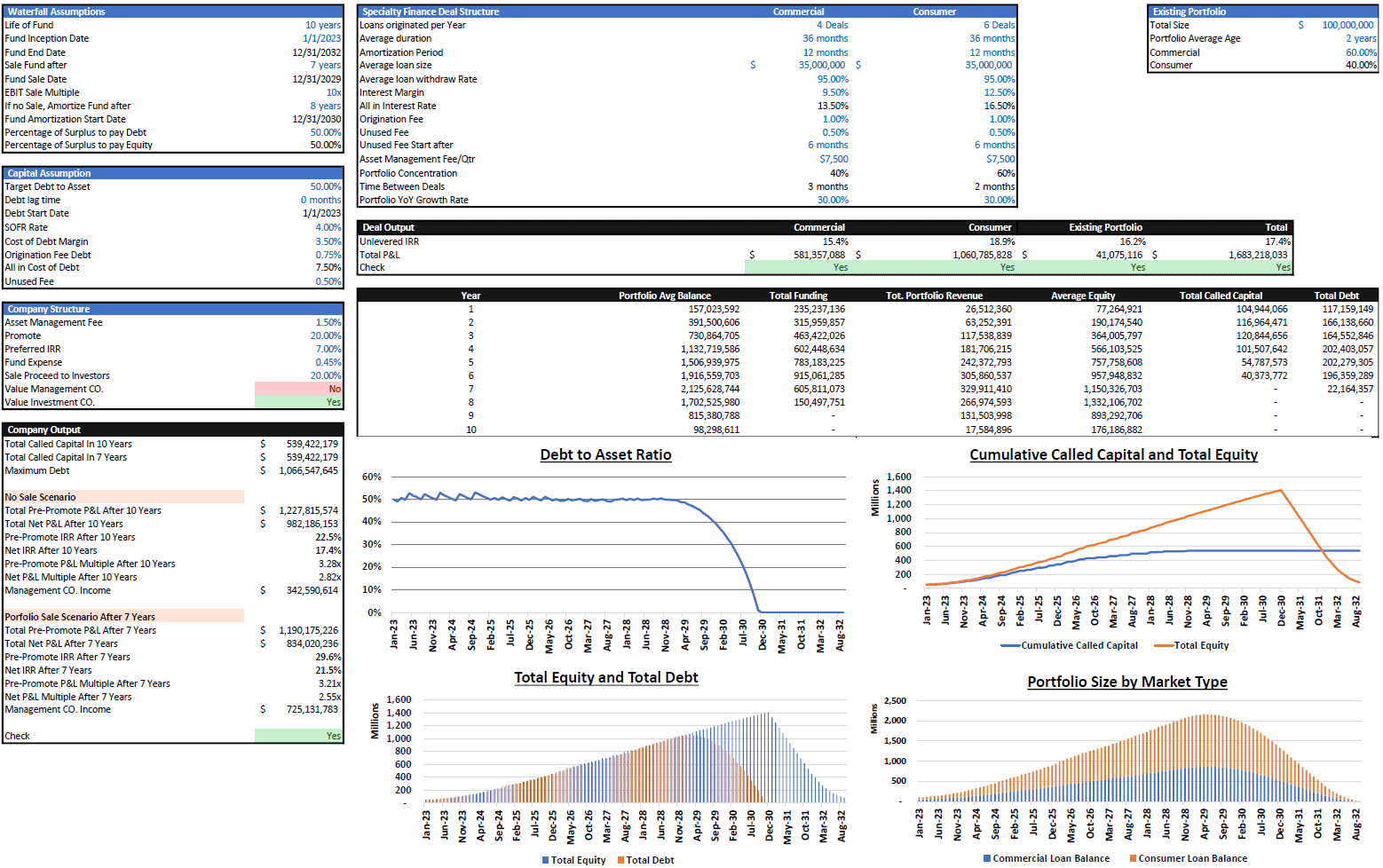

Debt Fund Excel Model

Explore the Debt Fund Excel Model, a comprehensive tool for evaluating new credit fund opportunities... Read more

Leasing Company Financial Model – 5 Year Forecas...

Financial leasing companies engage in financing the purchase of several types of assets. Though a le... Read more

Collateralized Mortgage Obligations Model

Collateralized Mortgage Obligations Model presents a simple model where mortgage backed securities a... Read more

You must log in to submit a review.