Having access to capital is a necessary ingredient for upward mobility in life. But it’s also a challenging problem that hits young people especially hard. So how can the younger generation, saddled with college debt, sky-high housing prices and a potentially subpar credit history, get a financial leg up?

Enter a company called Upstart. The online lending startup does not use traditional credit scores to determine loan worthiness. Instead, it uses artificial intelligence and machine learning to weigh factors like education and earning potential. Co-founder and Head of Operations at Upstart, Anna Counselman, spoke with RewardExpert about the Upstart advantage.

Bringing More Access to Credit

Upstart got its start while Counselman and her co-founders were working at Google. They noticed that getting access to credit was a particularly challenging situation, even for highly-educated and highly-employable young people.

“If you have a short credit history, even if it’s perfect, you’re considered high risk because there’s just not enough data available,” said Counselman. “Credit card companies are the only people that really underwrite younger people and we thought it was particularly troublesome because that’s a phase of your life where you have a lot of need for capital.”

The company started with the mission of helping young people get loans, but has since expanded to helping anyone get access to the credit that can help change their lives. Currently, Upstart offers personal loans that consumers use for a variety of purposes, including credit card consolidation, as well as educational and other expenses. Loan amounts range from $1,000 to $50,000.

An Alternative Approval Process

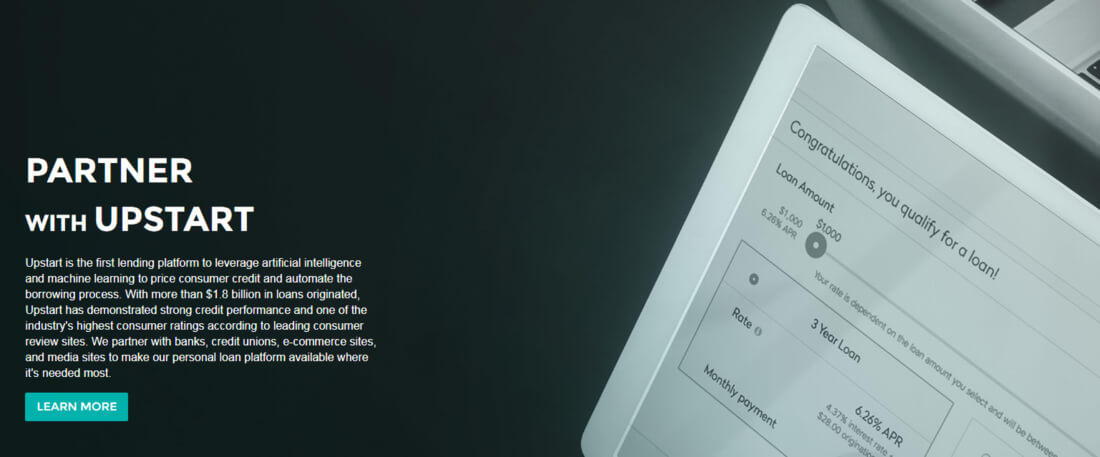

Upstart uses alternative data in its underwriting process instead of just relying on traditional credit history. Alternative data includes analysis of a FICO score, education, area of study, job history and more through artificial intelligence. In fact, the Upstart model really zeroes in on a person’s life, studying everything from where you went to school and what you studied to the field you work in.

“We’re leveraging this technology to separate the good credit risks from the bad credit risks and what that allows us to do is lower the price of credit for everyone,” stated Counselman. “This allows us to provide each person with a very personalized interest rate so we are basically able to pinpoint the borrowers who are less likely to pay you back.”

Passing on Savings

Upstart has seen great success with its model, leading to lower default rates and savings across the board. “We are able to achieve nearly half the loss rates of other online lenders using conventional, FICO-based underwriting models. That allows us to offer better-priced credit to more consumers,” explained Counselman. According to the Upstart website, an Upstart borrower saves an average of 23 percent on their credit card debt.

A Quick and Easy Approval Process

With Upstart, the approval process is quick and easy. The rates for many loans are checked in just two minutes, and half of accepted clients have money in their pocket by the next business day. Counselman said Upstart has put a lot of effort into customer experience, and that has resulted in nearly instant processing of close to 50 percent of the loans originated. “We believe an important point in providing access to credit is making it effortless,” she said.

An Investment Alternative

Besides lending money, Upstart is also an investment platform. It allows a way to diversify portfolios, and investors are buying a variety of loans from a lot of different people. Most of the investors are institutional, with a small selection being retail investors.

A Fast-Growing Startup

Since its first loan in 2014, Upstart has seen massive growth. It has originated approximately $1.8 billion loans to over 140,000 borrowers. It’s also the number one consumer rated credit loan company on Credit Karma. “I feel like we’ve definitely been able to have an impact, but we have a long way to go,” said Counselman.

To see if Upstart is right for your financial needs, check out upstart.com.