As service providers continue to migrate toward offering more software-based virtual services to businesses, the adoption of smart central offices is growing.

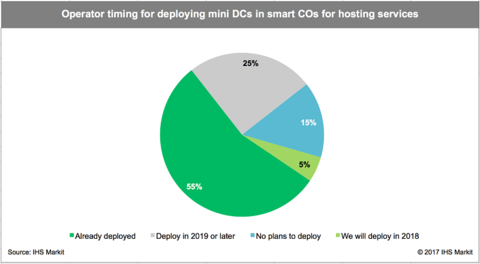

A new IHS Markit study, which was created through conversations with Tier 1 service providers, revealed that in 2018, 85% of respondents said they plan to create or will have already deployed smart central offices.

A smart central office consists of a service provider installing servers, storage and switching to create mini data centers in selected existing COs.

RELATED: CenturyLink says CORD will reduce costs, increase broadband response times

“In a large metropolitan area, there might be 10 or more smart central offices aggregating traffic from smaller end offices,” said IHS in the research note. “Based on our discussions with operators around the world, a common long-range plan is to identify 10% to 25% of central offices as smart central office locations—all candidates for CORD [central office rearchitected as a data center].”

Additionally, the smart central office is driving optical and routing vendors to build platforms to address data center interconnection.

“The smart central office is the new location of the IP edge, which is creating a need for a new class of optical transport equipment and a new class of routers designed for data center interconnect (DCI) applications,” IHS said.

Out of these mini data centers, service providers would offer cloud services as well as install the NFV infrastructure on which to run virtualized network functions (VNFs) such as vRouter, firewall, CG-NAT and IP/MPLS VPNs. These central offices with mini data centers are often referred to as either “cloud central offices” or “smart central offices.”

IHS found that more than half (55%) of the service providers surveyed plan to move each of 10 different router functions from physical edge routers to VNFs running on commercial servers in mini data centers in smart central offices, including customer edge router, route reflector and others.

The research firm found that 7 out of 10 respondents plan to deploy CORD in smart central offices. Further, service providers expect that 44% of their central offices will have mini data centers (or smart central offices) by 2023, and they plan to deploy CORD in half of those central offices.