Wealth managers are confident that technology will be a key enabler in achieving efficiency, delivering highly personalized services, and enhancing customer experience, according to a new survey by Temenos and Forbes Insights.

In a report titled The Next Generation Wealth Manager: Advancing Services and Personalization with Technology, Temenos and Forbes share findings of a survey of 305 high-level executives to understand the value of technology from the perspectives of both wealth managers and clients.

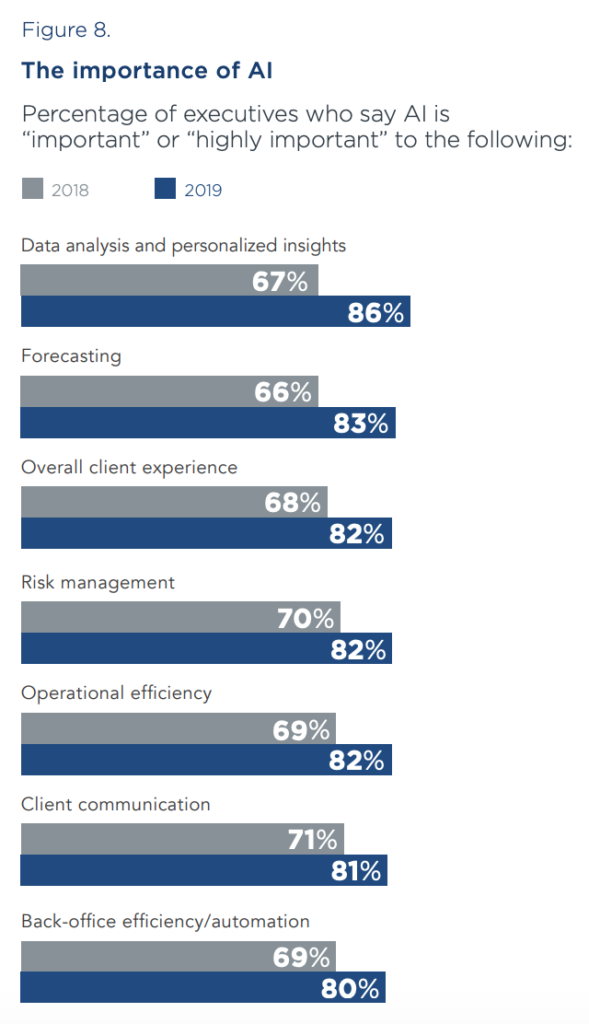

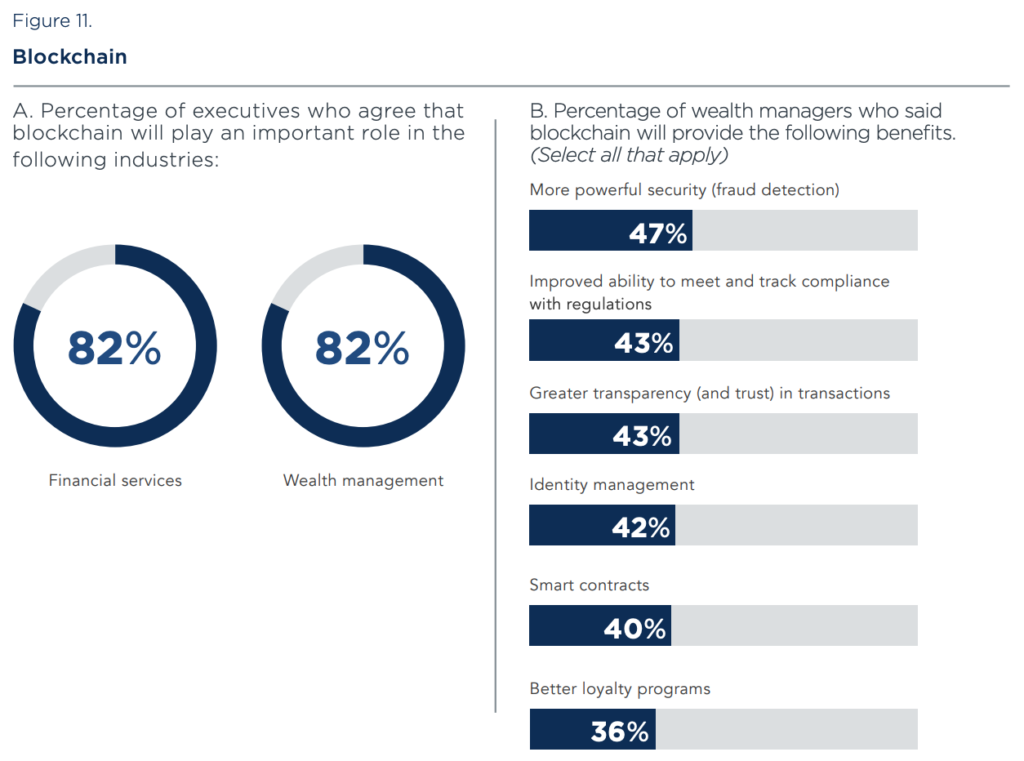

Technologies including artificial intelligence (AI), machine learning, process automation and blockchain are considerably transforming the wealth management experience for advisors at private banks and the high net worth individuals (HNWIs) they serve. It is now imperative for the industry to leverage these technologies to provide customers with the level of customization and experience that’s now requested.

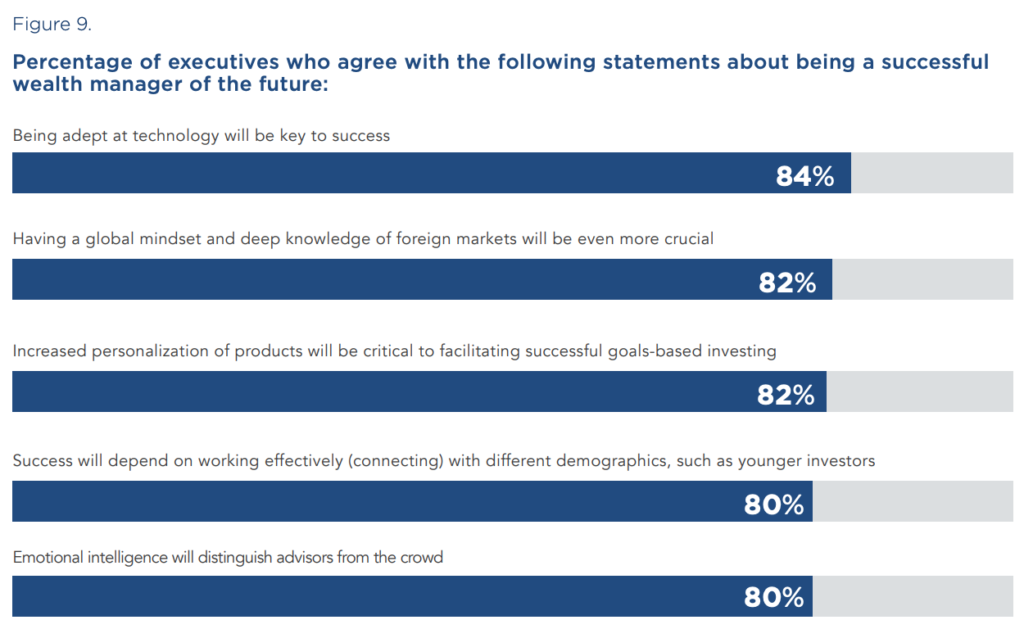

Wealth managers are confident that technology will play a key part in the future of their industry, with almost every wealth manager (92%) believing that digitalization of wealth management services is either a good thing or essential, and 84% of the executives surveyed stating that being adept at technology will be key to become a successful wealth manager in the future.

Almost seven in 10 wealth managers said that a virtual platform is an essential way to enhance the client experience, and 64% think that digitalization is essential for communication and service enhancement.

AI and blockchain in particular, are perceived as two of the most disruptive technologies for wealth management. 86% of wealth managers believe AI is important in data analysis and personalized insights, and 83% perceive blockchain as a powerful technology to wealth management for its ability to bring more powerful security (47%) and greater transparency and trust in transactions (43%).

The study also found that high net worth individuals (HNWIs) are rapidly warming up to technology. Over the past three years, acceptance of technology among HNWIs has significantly expanded, with now 87% of respondents stating they accept technology in their investment experience.

In fact, HNWIs and mass-affluent investors want technology to play an even greater role in their advisor relationships, underscoring the imperative at investment banks and private banks to continue digital transformation, the report says.

“Both HNWIs and mass affluent investors want to enhance their relationships with wealth managers through more personalized services,” said Pierre Bouquieaux, Product Director Wealth at Temenos.

“Technology from the client perspective, should facilitate more active portfolio management, unlock new insights through predictive analytics and reveal opportunities that may exists in alternative investments.

“Delivering personalized customer experiences will become the key differentiator for wealth managers.”

According to the report, “the key to [wealth managers’] success will be understanding and using technology effectively to advance client services in line with the goals and needs of new investors.”

“The modern client-advisor relationship is powered by mobile platforms and digitization — and AI technologies like machine learning — but it remains at its core a very human one,” the research says. “Technologies should be seen as a means to a business end, with the goal being increased client satisfaction from understanding the three pathways to success covered in this report.”

The report highlights three pathways to success that will define the next generation wealth manager:

Customer experience enhanced by digital client services and personalization: Personalization is the ultimate goal for wealth managers as it is at the heart of the customer experience. As wealth managers use technology in more sophisticated ways, a key differentiator will be their ability to segment clients at an even more refined level than today.

Insight gained through AI and analytics: AI technologies are the foundation of advanced wealth management analytics that can power more accurate and predictive guidance and returns.

New markets defined by the mass affluent and alternative investments: Being adept at technology and personalizing service around goal-based investor will be the future of the industry. Such skills will also provide an entry into the mass affluent segment.

Featured image credit: Edited from Freepik