The escalating trade war between China and the United States threatens to halt surging U.S. crude oil exports to China, which has become the biggest Asian market for American drillers over the last 2½ years.

Beijing on Friday announced plans to slap a 25 percent duty on U.S. crude oil in response to President Donald Trump's decision to hit $50 billion in Chinese goods with an equivalent tariff.

The impact on overall U.S. crude oil exports could be muted in the near-term, provided drillers are able to find other buyers. But if the standoff persists, it could destroy a huge source of future demand growth, drive down the cost of U.S. crude and weigh on the balance sheets of America's shale drillers.

China is now surpassing Canada as the biggest purchaser of U.S. crude in some months. Shortly after the U.S. lifted the 40-year ban on crude exports in 2015, China went from not buying a single barrel of American crude to consuming a record 448,000 barrels a day last October.

Chinese companies spent nearly $2 billion to import American crude oil in the first quarter of the year, according to S&P Global Platts.

While Canada has long provided a steady market for U.S. crude, China's purchases have been growing, and the country has capacity to buy even more, said Matt Smith, director of commodity research at tanker-tracking firm ClipperData.

"If [the sanctions] get applied, then it means that we're going to see U.S. supplies to its largest market being cut," Smith told CNBC.

China, Europe and other regions have been buying so much American oil largely because it has been trading at a steep discount to international benchmarks like . Weekly shipments are now regularly surpassing 2 million barrels a day.

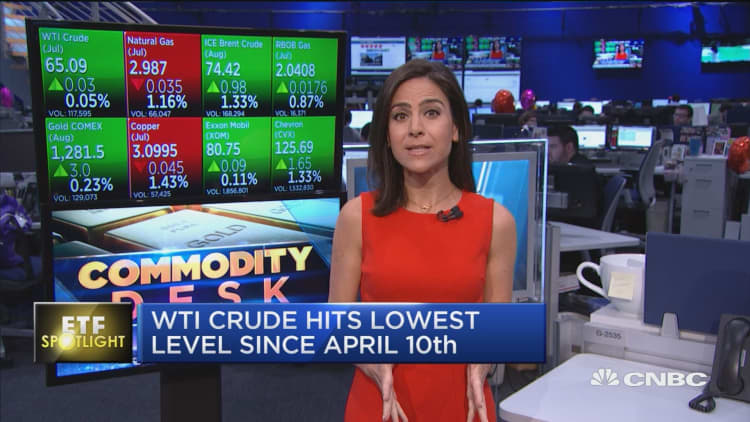

But with U.S. West Texas Intermediate crude trading at nearly $66 a barrel, the Chinese tariffs would tack an additional $16 to $17 onto the cost, said Suresh Sivanandam, senior manager for Asia refining at energy research firm Wood Mackenzie. That would more than wipe out U.S. crude's current $9.50 discount to Brent crude, so American oil would no longer be competitive.

"A 25-percent tariff is a huge number," Sivanandam said. "The discount has to be nearly double for it to make sense for China" to import U.S. crude, factoring in shipping costs.

It's possible that overall U.S. crude exports could remain stable immediately after Chinese demand dries up, said Sivanandam. That's because Chinese buyers would turn to other countries for the kind of medium sour and light crude grades that they previously purchased from the United States. American companies would then have an opportunity to supply markets that lost barrels to Chinese buyers.

However, American drillers stand to miss out on growing Chinese demand if the tariffs remained in place. Wood Mackenzie projects that U.S. crude exports to China could double through 2023 in a free trade environment, but the tariffs mean shipments could fall short of that forecast.

"While China could secure the crude from alternative sources such as West Africa, which has similar quality as the U.S. crude, U.S. would find it hard to find an alternative market that is as big as China," Wood Mackenzie said in a briefing on Monday.

Other American crude grades from Texas are trading at even steeper discounts to Brent than West Texas Intermediate, as drillers face a shortage of pipeline capacity to accommodate a boom in production from the Permian basin. But the tariffs would also whittle away that advantage, potentially leaving that oil stranded just as drillers work through the bottlenecks next year, according to Smith at ClipperData.

That leaves two likely outcomes for U.S. drillers, neither of which are good. U.S. prices would have to fall even lower relative to foreign crude to make it attractive to Chinese buyers, or American oil would have to sell at a discount in other markets.

"You would see other market players coming in being able to pick that crude up at bargain basement prices," Smith said.

That could include India, South Korea, Taiwan and Thailand, all of which are emerging as steady buyers.

Trump could benefit in one respect because lower oil prices would keep a lid on the cost of gasoline under his watch. But the Chinese tariffs would hurt the growing U.S. oil industry, a key part of his base, and undermine his goal of narrowing the trade deficit with China.