How should you read an import duty?

How does an import duty change the financial situation of a supplier of that product or service on which the import duty has been put?

Is import duty better or worse for the general economy in a country?

And finally which business will give you the highest return when an import duty has been put in the sector it operates in?

I think these are very basic yet important questions for any investor who is reading any sector and specifically commodity businesses which are highly susceptible to these import duty implications.

Very recently President of the United States of America, Donald Trump proposed policy on steel, of which his country is the planets biggest importer, this may cause a supply glut in India if we cant hurdle across the American tariff walls.

This reading will try to answer these questions from an academic point of view with linkage to very basic microeconomics concepts and i am hopeful that you will be able to understand any import duty impact on any sector going forward. This reading can be read again and again for future references and this reading will be very helpful in understanding businesses which sell commodities like steel, paper, rubber, cotton etc, i.e. cyclical businesses.

ADVICE

This Is Also A Lengthy Reading But Definitely An Interesting One, You Can Browse Through The Headings To See If Any Of The Headings Interest You To Read The Whole Article.

In the end we have a Takeaway Section where we will consolidate our learning in few points.

To understand the implication of import duties, we will read through various scenarios and try to answer a lot of What IF’s and understand it end to end.

Now we begin our learning with focus on steel as our candidate.

If you want to know how any event or policy will affect the economy, you must think first about how it will affect supply and demand. How will buyers and sellers behave and how will they interact with one another.

Market is a group of buyers and sellers of a particular product or service. Buyers of a product determine the demand for the product, and sellers as a group determine the supply of the product.

Steel is a perfectly competitive market because there are many buyers and many sellers and each of them has a negligible impact on the market price. Each seller has a negligible impact on the market price because other sellers are offering similar products, a seller also has no reason to charge less than the prevailing price or even more. similarly , no single buyer of steel can influence the price of steel because each buyer purchases only a small amount.

Because buyers and sellers in perfectly competitive markets must accept the price the market determines, they are said to be price takers.

Before we begin, we will try to understand very basic yet important concepts like law of demand, law of supply, consumer surplus, producer surplus and total surplus. I have tried to explain these concepts in a simple words.

The Law Of Demand –

The Law of Demand says that, when price of a product rises, quantity demanded of product falls. This is how all of us react, we definitely buy a product or service when it is put on sale ‘season sale of an e commerce company’.

Law Of Supply –

We now turn to the other side of the market and examine the behavior of sellers, the quantity supplied of any product or service is the amount the sellers are willing and able to sell at a particular price. When price of steel is high, selling steel is profitable, and so the quantity supplied is large and conversely when the prevailing steel prices are low, selling steel is not much profitable therefore quantity supplied falls.

These were two very important concepts and we have tried to explain them in couple of sentences.

Consumer Surplus –

Suppose you want to buy a television and you have allocated a budget of $1000 for it. You now go to the market and to your surprise you find a television matching your specifications and brand for $800. You are so delighted and you immediately decide to buy it. You reach home and happily tell your family that you saved $200 on the television.

We calculate our savings like this on a daily basis with every transaction, you will be surprised but this is your consumer surplus ($200). Consumer surplus is the amount a buyer is willing to pay for the product minus the amount the buyer actually pays for it.

For gaining a quick handle on consumer surplus, ‘the area below the demand curve and above the price the consumer pays, measures the consumer surplus in the market ’

Producer Surplus –

Now let’s say that you are maker of television. You can make a television out of your factory for $600 per piece and this $600 includes all expenses incurred by you to manufacture the television and put it on display in a store.

You ship the television to the store and to your surprise you find that consumers are buying your television for $1000 per piece, you become happy and sit down to calculate your gains if you tag your television for $!000. You find that you can make $400 for every television sold, and this $400 is nothing but your producer surplus. Producer surplus is the amount a seller receives for the product minus the amount he incurs in producing it.

For gaining a quick handle on producer surplus, just memorize this ‘the area above the supply curve and the price seller receives, measures the producer surplus’.

Total Surplus –

The sum of consumer and producer surplus measures the total benefits that buyers and sellers receive from the market of the Television.

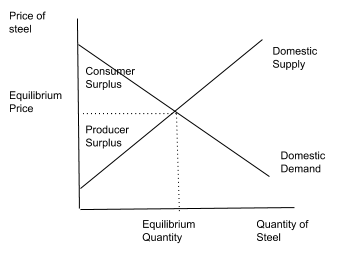

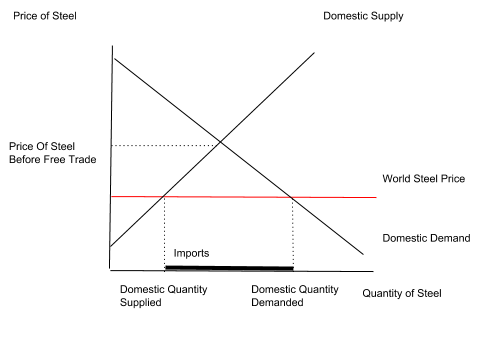

Fig 1 shows intersection of the demand and supply curve and the corresponding equilibrium price and quantity of goods or services.

The figure shows the consumer and producer surplus in equilibrium without trade.

We now have very basic understanding of few concepts, we can now begin our study of the Indian steel industry.

Assumption – Indian Government is protectionist on steel, we do not import and export steel, we have domestic suppliers of steel and domestic buyers.

Our story begins, Indian steel market is isolated from the rest of the world. By government decree, no one in India is allowed to import or export steel, and the penalty for violating the decree is so large that no one dares try.

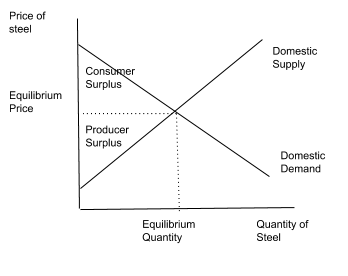

In the absence of international trade, the market for steel in India consist of Indian buyers and sellers, as shown in Fig 2, the domestic price adjusts to balance the quantity supplied by domestic sellers and quantity demanded by domestic buyers.

Fig 2

Now suppose the president elect formulates a committee of economist to evaluate the trade policy on steel and the president asks them to report back on 3 questions-

Question: if Govt allowed import and export of steel, what would happen to the price of steel and quantity of steel sold in the domestic market?

Question: Who would gain from free trade in steel and who would loose, and would gains exceed the losses?

Question: Should a Import duty or an import quota be part of the new trade policy?

Now we begin with the analysis.

The World Price And Comparative Advantage

The first issue the economist take up is whether, India is likely to become a steel importer or a steel exporter. In other words if free trade is allowed, would Indians end up buying or selling steel in the world market?

To answer this question, the economist compare the current Indian price of steel to the price of steel in other countries. We call the price prevailing in the world market as world price. If world price of steel is higher than the domestic price, then India would become an exporter of steel once trade is permitted.

Conversely if the world price is lower than the domestic price, then India would become a net importer of steel.

In essence, comparing the world steel price with the domestic steel price before permitting trade indicates whether India has a comparative advantage in producing steel.

Ultimately trade among nations is based upon comparative advantage. Trade allows nations to specialize in doing things which they do best.

By comparing world steel prices with the domestic steel prices, we can determine whether India is better or worse at producing steel than the rest of the world.

Before we start to analyze and dissect, we have to believe that Indian economy is small and the change in the trade policy in India will not have an effect on the world steel price. Indians are price takers for steel and they can either sell steel at world price and become exporters or buy steel at world price and become importers.

Let us dive deep and understand the implications of free trade policy on the steel sector, let us do a scenario study and consider what happens when India is an Exporting Nation in scenario 1 and an Importing Nation in scenario 2.

Scenario 1 – The Gains And Losses Of An Exporting Country

For India to become an exporter of steel, the domestic equilibrium steel price should be lower than the world steel price and if this is the situation then we can also say that India has comparative advantage over other nations in producing steel.

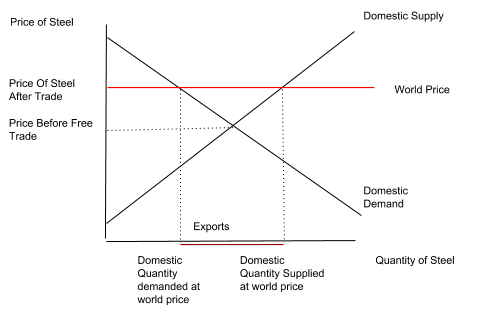

In Fig 3, we have price before free trade below the world steel price.

Fig 3

Once free trade is allowed, the domestic prices rises to equal to the world price. No seller would accept less than the world price and no buyer would pay more than the world price.

With domestic prices equal to the world prices, we see that domestic quantity supplied differs from the domestic quantity demanded.

Quantity supplied by the sellers is more than the quantity demanded by the buyers therefore India becomes an exporter.

One can view the horizontal line at the world price as demand for steel from the world, this demand is perfectly elastic because India, a small economy can sell as much steel as it wants at the world price.

Opening to international trade clearly does not benefit everyone, trade forces the domestic prices to rise to the world price. Domestic suppliers are better off because they can now sell at higher price, but domestic buyers are worse off because they have to buy at higher prices.

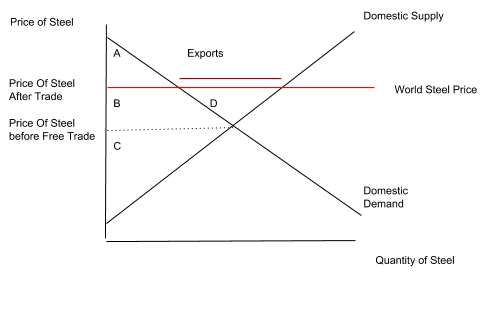

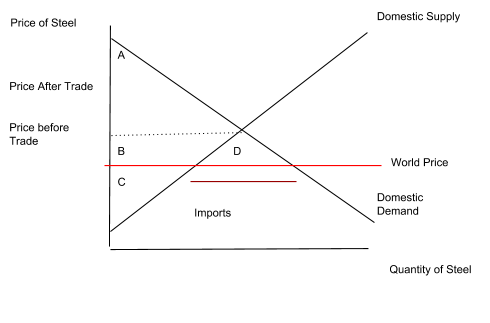

To measure the gains and losses we will now measure the changes in consumer and producer surplus from the Fig 4

Before the trade is allowed, we have an equilibrium price and quantity. Consumer surplus is equal to A+B (area between the demand curve and the equilibrium price) and the producer surplus is C (area between the equilibrium price and the supply curve), and the total surplus before the trade is the sum of consumer and producer surplus (A+B+C).

After trade is allowed, the consumer surplus contracts to only area A and the producer surplus is the area B+C+D. Total surplus is the sum of consumer and producer surplus (A+B+C+D).

If India is a net exporter of steel then in the short term sellers benefit because the producer surplus increases by area B+D. Consumers are worse off because consumer surplus decreases by area B.

Fig 4

Conclusion

Conclusion

When a country allows trade and becomes a net exporter of goods, domestic producers of goods are better off and domestic consumers are worse off.

Scenario -2 The Gains And Losses Of An Importing Country

India will import steel when the domestic steel prices are higher than the world steel prices. After we allow free trade domestic steel price must equal world price, as shown in Fig 5, domestic quantity now supplied is less than the domestic quantity demanded. The gap between the quantity supplied and quantity demanded is filled by steel imports from other countries.

Fig 5.

In this case the horizontal line represents the supply of the rest of the world, which is perfectly elastic because India is a small economy and you can buy as much steel as you want at world price.

Once again, trade forces the domestic prices to fall, domestic consumers are better off (they can buy steel at lower prices) and domestic sellers are worse off (they have to sell steel at lower prices).

To measure the gains and losses we will now measure the changes in consumer and producer surplus from the Fig 6.

Before trade, consumer surplus is area A, producer surplus is area B+C and total surplus is area A+B+C.

After trade is allowed the consumer surplus expands to area A+B+D, producer surplus is area C and total surplus is area A+B+C+D.

In an importing country buyers benefit as consumer surplus expands and sellers are worse off because their producer surplus contracts by area B.

The gains of buyers exceed the losses of sellers and total surplus increases by area D.

Fig 6

Conclusion

When a country allows trade and becomes an importer of goods, domestic consumers of goods are better off and domestic suppliers of goods are worse off.

Now we have completed our analysis of trade and we can say that compensation for losers in international trade is rare. Opening up to international trade expands the economic pie, while leaving some participants in the economy with a smaller pie.

The Effects Of Import Duties

What Are Import Duties?

These are taxes on imported goods. Import Duties on steel will have no impact if India is a net exporter of steel, if few people are interested in importing steel in India then import duty is irrelevant. Import Duty is only relevant when the domestic steel prices are higher when compared to World Steel Prices or India is an Importer.

The steel sold in India was expensive and government in order to support the consumers opened up trade with other nations who had comparative advantage and were selling steel at world price which was lower to the domestic price. Over time, profits of steel industry turned into losses, steel companies took on huge debt on their books and the debt became un-serviceable (companies were not able to pay interest and principal). These loans were provided by the banks and banks were provided this money by the depositors (people like you and me), RBI and the government became cautious, they knew that consumers are better off with cheap imports of steel but the domestic steel industry is suffering and debt is piling on their books. Government will have to take measures to support the domestic steel industry otherwise we will have no domestic steel industry.

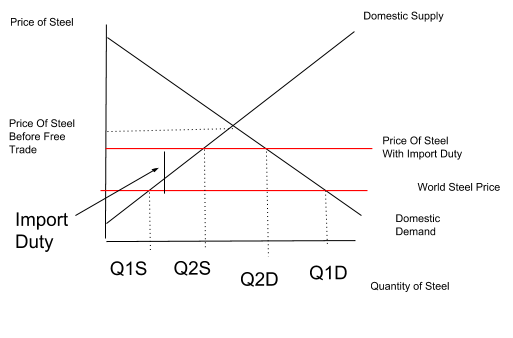

Fig 7 shows under free trade, domestic price equals world price. An import duty raises the price of imported steel by the amount of import duty. Domestic suppliers of steels who compete with imported steel can sell their goods for world price plus import duty, thus the price of steel both domestic and imported rises by amount of import duty and is closer to the price that would prevail without free international trade.

Because import duty raises prices of steel, it reduces the quantity demanded from Q1D to Q2D and raises the quantity supplied from Q1S to Q2S. Thus, import duty reduces the quantity of imports and moves the market closer to its equilibrium without trade.

Fig 7

Import Duty raises the domestic prices, domestic sellers are better off (Tata Steel, SAIL, JSW), and domestic buyers are worse off, in addition Govt. raises revenue (duty revenue).

Import Duty does two things, first Import Duty on steel raises price of domestic steel and domestic producers can charge above the world price, as a result it encourages them to increase production of steel from Q1S to Q2S. second, the Import Duty raises the price that domestic buyers have to pay and therefore encourages them to consume less form Q1D to Q2D.

The Lessons For Trade Policy

The team of economist can now write to the new president and the all his questions.

Question: If Govt allowed import and export of steel, what would happen to the price of steel and quantity of steel sold in the domestic market?

Answer: Once trade is allowed, the Indian steel price would be driven to equal the world steel price prevailing around the world.

Situation 1

If world steel price is higher than Indian steel price, the domestic steel price would rise to equal the world steel price post free trade policy implementation. Higher steel price would make Indians consume less steel and suppliers will supply more steel to countries outside India, thus India would become an exporting nation, this occurs because India has comparative advantage in producing steel.

How Come India Has Comparative Advantage?

Indian producers of steel could have various secular tailwinds in their favor –

- Low cost raw material, this could be because we have abundance of the raw materials

- Low cost labor, etc

- Cost of Capital is low

Situation 2

Conversely, if world steel price is lower than the domestic steel price, then post free trade policy implementation, domestic steel prices would drop to equal the world steel prices and this implementation will make domestic consumers to increase consumption of steel and subsequently domestic producers of steel will produce less steel, their plants will be underutilized and basically they will be worse off because imports will rise. This happens because Indian steel manufacturers do not have comparative advantage in producing steel.

Why Indian Producers Of Steel Do Not Have Comparative Advantage In Producing Steel?

Indian producers of steel would face various headwinds like –

- Expensive Raw material for steel

- High cost labor etc.

- Cost of capital is high

Question: Who would gain from free trade in steel and who would loose and would the gains exceed the losses?

Answer: The answer depends on whether the price of steel rises or falls when the free trade is allowed. If prices rises, producers of steel gain, and consumers of steel lose. If prices falls, consumers gain, and producers lose.

Question: Should an Import Duty be a part of the new trade policy?

Answer: If India has no comparative advantage in producing steel and Indian steel manufacturers have huge debts and these debts are exposed to the PSU banks, then definitely India needs a Import Duty on imported steel to lift revenues and profits of the domestic steel makers until they repay their loans, this will lower domestic consumption of steel, this will also increase the rate of inflation in the short to medium term, the Government has no alternative but to support the domestic steel industry.

Now we move on to pick businesses in a commodity industry like steel, we will try to break it down into points which should guide us in picking businesses.

Steps To Pick A Commodity Business Under Import Duty Implementation:

- Government of India has a ministry by the name of Director General of Anti Dumping And Allied Duties, this is official source of information on anti dumping duties in India. link – http://www.dgtr.gov.in

- Generally we see petition filed by various associations like of the steel, Tyre etc to the ministry. These association represent the industry and they talk to the ministry to implement safeguards duties for themselves. Go to the following link – http://www.dgtr.gov.in/anti-dumping-cases and read any document with status ‘Concluded Investigation’.

- Generally in the very first page you will find petitioners names, these petitioners should be your investing universe if the Import Duty has been implemented in that sector.

How To Pick A Business As An Investment Candidate?

After understanding the concept of producer surplus, we can conclude that any producer who can produce goods at the lowest cost will have the Greatest Producer Surplus post Import Duty implementation and it should also be your investment candidate.

Why?

The largest producer surplus candidate has advantages when compared to its peers, He may have captive mines for raw material which will bring down COGS and raise Gross Margins, lowest labor cost in the industry, lowest interest burden etc. These are very important cost which are essentially fixed in nature and will remain fixed, generally at all times.

Post Import Duty implementation, the top-line of the lowest cost producer will expand because price of commodity is rising and the fixed cost will remain fixed thus expanding the bottom line (PAT).

The lowest cost producer will command high multiples in the industry.

Conclusion

Identify the lowest cost producer among the petitioners of import duty.

When Should You Sell The Business?

This is again a very important question, i will try to answer this with whatever we have learnt until now.

We know import duties are bad for general consumers because they cause inflation in the economy, so as long as you do not find petitioners representing consumers chasing the ministry to abolish the import duty in place, you should do fine, so in short term track the consumer industry of the commodity, for steel it could be auto sector, infra, housing etc.

Current Situation Of The Domestic Steel Industry

Prior to implementation of the import duty on steel, the world price of steel was lower than the domestic price and India was an importing nation.

Soon the situation worsened for the domestic producers and they ran to the ministry to implement the import duty, which the ministry did seeing huge NPA’s on the books of PSU banks.

Producers like Tata, JSW, JSPL and SAIL flourished as seen by their financial statements and growing stock prices post implementation of import duty.

Surprisingly what happened post implementation of anti dumping duty was that the world steel price also started rising on the back of china, which said that they will cut production of steel to reduce pollution, soon the world steel price rose which gave further room for domestic price of steel to rise.

How Long Can This Continue?

If you can track the world steel price of steel and domestic steel price on a regular basis, you will accurately come to know when you have to sell the business.

As long as there is a Positive delta in the world steel price and the domestic steel price, you can stay invested and when this reverses you will find petitioners from the consumer of steel in India going to the ministry to abolish the import duty.

World Steel Price – Domestic Steel Price = Positive DELTA, stay invested.

World Steel Price – Domestic Steel Price = Negative DELTA, time to start folding your position in the stock.

Disclaimers :

The information herein is used as per the available sources of bseindia.com, company’s annual reports & other public database sources. Alpha Invesco is not responsible for any discrepancy in the above mentioned data. Investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents.

Author of the report has investment positions in the stock at the time of publishing this post.

Future estimates mentioned herein are personal opinions & views of the author. For queries / grievances – support@alphainvesco.com or call our support desk at 020-65108952.

SEBI registration No : INA000003106

Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is not a recommendation to buy or sell securities. Alpha Invesco & its representatives do not have any vested interest in above mentioned securities at the time of this publication, and none of its directors, associates have any positions / financial interest in the securities mentioned above.

Alpha Invesco, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report.

Alpha Invesco & it’s representatives do not have more than 1% of the company’s total shareholding. Company ownership of the stock : No, Served as a director / employee of the mentioned companies in the report : No. Any material conflict of interest at the time of publishing the report : No.

The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Stay Updated With Our Market Insights.

Our Weekly Newsletter Keeps You Updated On Sectors & Stocks That Our Research Desk Is Currently Reading & Common Sense Approach That Works In Real Investment World.