Prediction for 2018: Mid-Core Games

This post is written by Anil Das-Gupta, Michail Katkoff and Andrew Payton.

As always, we want to thank our powerful sponsors: Sensor Tower and Matchmade

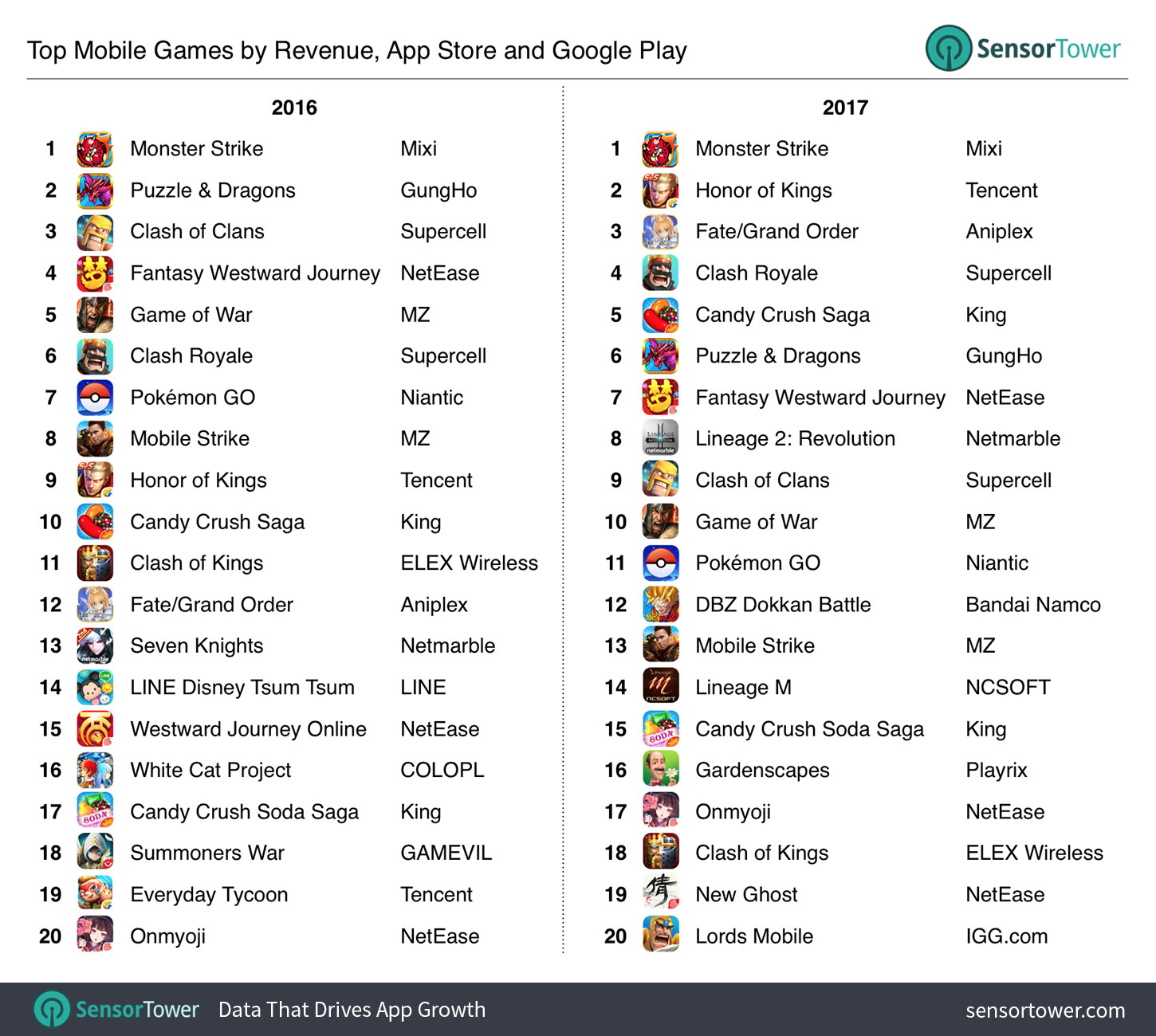

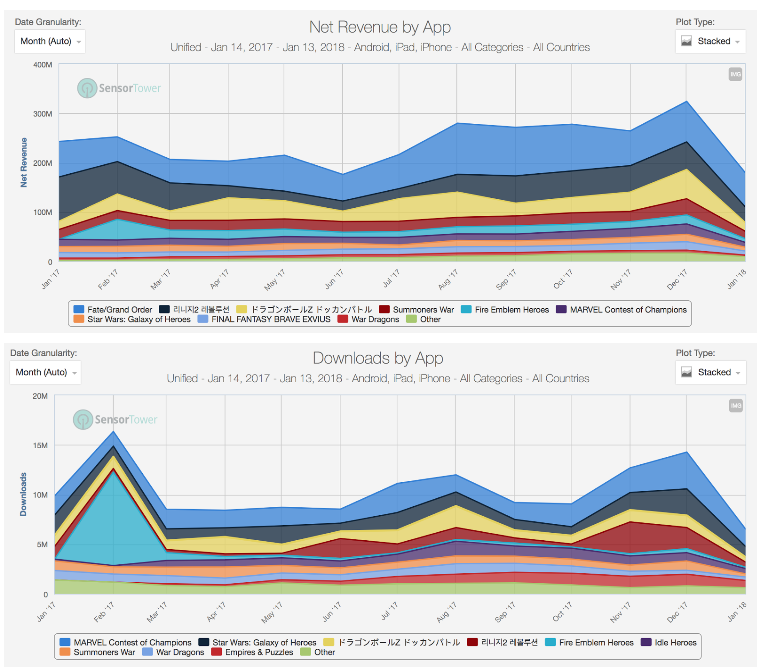

Midcore games generate the highest revenues in mobile games. In 2016, 11 out of 15 of the top grossing games globally could be categorized as midcore games. In 2017 only one of the top 15 games was not midcore and that game was the ever powerful Candy Crush Saga. In other words, despite the ever growing casual games sector, the top mega hits worldwide fall into the midcore category.

Before diving deeper into our bold(ish) predictions for 2018, let us establish what we mean by mid- and hardcore games on mobile.

At Deconstructor of Fun, we position midcore as a lighter, more accessible take on a hardcore theme or a genre. The portion of male players in these games is typically from 60% to 75%

Hardcore games are usually but not exclusively, targeted toward a predominantly male audience with men contributing up to 90% of the player base. These are large games with huge amounts of complexity and depth such as those found on PC’s or home consoles.

Midcore games generate the highest revenues in mobile games. In 2016, 11 out of 15 of the top grossing games globally could be categorized as midcore games.

With the definition of midcore established, 2017 can be described as the year when midcore got even more serious. As both gameplay and player experiences shifted more towards traditional hardcore games and meta complexity continued to get deeper and more sophisticated.

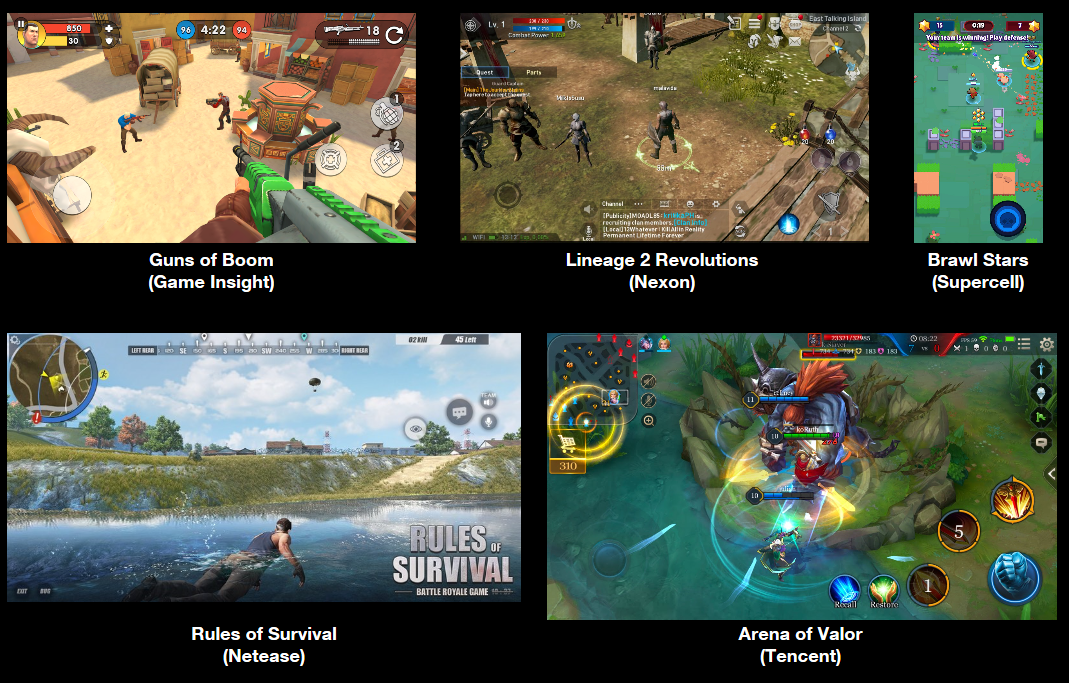

One of the most interesting trends in the market this year was the resurgence of both the virtual D-pad and landscape games (i.e., games played in landscape mode). Multiple titles disrupted the download and grossing charts with high fidelity 3D graphics and d-pad controls such as Guns of Boom, Lineage 2: Revolutions, and Rules of Survival. Interestingly. these games make accommodations to increase accessibility with Guns of Boom pioneering a innovative auto-firing and aided aim system and with Lineage 2 allowing for auto-play.

Even the mighty Supercell is trialing the d-pad in their overhead shooter / MOBA hybrid Brawl Stars currently firmly stuck in soft launch. Also notable are that these games offer unlimited session length with game loops in excess of 5 minutes. This is a major change given that the short, sub-five-minute session length has been a part of the mobile midcore game design gospel for the past 6 years.

As the midcore genre encompasses so many different genres and game types, we’ve separated out the category into nine (!) sub-categories:

- 4X Games (March Battlers)

- RPG’s

- MMORPG’s

- Synchronous Strategy Games

- MOBA’s, Shooters and Brawlers

- Hunting Games

- Battle Royale

- Games with User Generated Content

- Augmented Reality Games

Given how wildly different each of these genres can be, it shows the incredible depth of the midcore category and the size of the market within. This doesn’t even take into account Sports games, which appeal to typical midcore demographic, but for which we’ll look at in another article in the future.

4X Games aka. March Battlers

4X games are midcore strategy games that have a heavy focus on meta systems and progression with almost zero core gameplay, such as Game of War and Vikings: War of Clans.

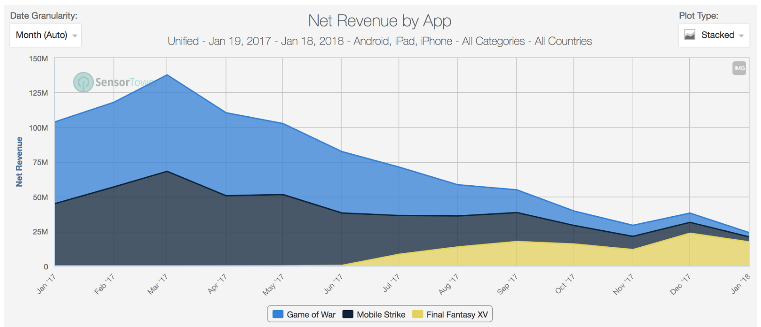

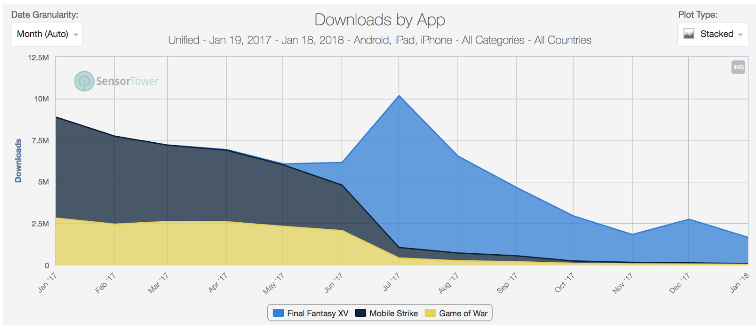

Looking at 2017 worldwide revenue charts, the biggest change in this hyper competitive category was the fall of Machine Zone with both of its dominant 4X games dropping out from a top 10 position in the grossing charts. To be more precise, according to Sensor Tower, Game of War’s revenue dropped 39% from $630M to $387M while Mobile Strike suffered a drop of 34% going from $549M to $363M. And whilst MZ launched Final Fantasy XV: A New Empire, it’s clear that they are spending far less money on user acquisition and have fewer players playing their titles.

The cut of advertising spend has without a doubt significantly improved the profitability of both Mobile Strike and Game of War. Only Machine Zone can answer whether this results in overall better return compared to their previous phase of hyper aggressive marketing campaigns.

The decline of revenue of MZ games in 2017 can be described as dramatic.

Downloads of MZ titles worldwide. It seems like the marketing on both Game of War and Mobile Strike stopped as soon as Final Fantasy XV was globally launched.

While MZ suffered, IGG and FunPlus made big strides in the same space. IGG's Lords Mobile made around $280M while FunPlus' King of Avalon made $210M, not to mention that FunPlus' new title, Guns of Glory, is already in the top 50 grossing titles in the USA. Additionally, Camel Games’ War and Order grossed $75M annually whilst Warner Bros, also got in on the act with their 4x game using the Game of Thrones IP grossing over $12M since its launch in October.

Whilst most of these titles copy a vast amount of their elements from MZ titles, Lords Mobile introduced more features, increasing its overall complexity while also making it more digestible in places. The game has base building elements and a Summoners War-style role-playing loop in an addition to the genre-specific territory captures. Lords Mobile is the first successful game to add more proven midcore mechanics to a 4X game, which accompanied with a typical midcore art style and high production values brought new players into the genre.

Lords Mobile apart, there were no real gameplay innovations, which meant the game of LTV over CPI pushed publishers to innovate on the marketing side. We saw several publishers test (and cross) the limits of what is legal in performance marketing. We also saw innovation in themes with games like Guns of Glory combining steampunk and Napoleonic wars into a theme that intrigues players and decreases costs per install. Zynga, on the other hand, learned the value of a theme the hard way as Mafia Wars was canceled in soft launch. Our assumption why Mafia Wars was canceled is not because the game was of lower quality. Rather we believe that the theme and the IP didn't perform as well as expected thus increasing CPIs and making it unprofitable to compete in this highly competitive genre. Based on our experience, we know that organized crime has been one of the worst converting themes in mobile ads over the last 3 years.

^ Some breakout 4X games over the last 18 months going clockwise include Lords Mobile (IGG), King of Avalon (Fun Plus), War and Order (Camel Games), Game of Thrones: Conquest (Warner Bros), and Guns of Glory (also Fun Plus).

While we could talk more about the winners and the losers in the category, the real truth is that the net revenues of the top ten publishers dropped by 30% year-on-year while the cost to acquire new users has continued to go up. Now we can attribute the drop to MZ, which just a year ago accounted for 50% of the revenues, but the fact is that no one really took MZ’s place as the de facto leader in the category. Instead, we have several games that have grown to a point and then stalled, likely due to outrageous CPIs driven by the incredibly intense competition.

We predict that:

4X games will continue to see innovation along the lines of Lords Mobile, with more midcore themes, mechanics, and art styles being introduced. This works because midcore has largely gotten rid of building and battling due to the dominance of Clash Royale.

Publishers will come up with ever more captivating themes as reskins for their games with a goal of lowering CPIs.

The market size in terms of revenue will continue declining slowly due to oversaturation. Growth will be seen only via reskins that have a known IP or an interesting theme.

Role Playing Games

The top 10 role playing games continued to grow in terms of revenues driven largely by Asian smash hits Fate/Grand Order, Dragon Ball Z, and Summoners War. While the enviable revenues of Asian role playing games in their home countries are nothing new, in 2017 we saw Fire Emblem Heroes, Final Fantasy Brave Exvius, and Lineage 2 break out in the West just like Summoners War did a couple of years ago.

What’s becoming clear is that the Western gaming audience is maturing across the board and becoming more accepting of deeper game systems typical for RPGs. After all, three years ago gacha was a novelty and now it is a must in every game. And as the Western audience becomes more accepting of these deeper systems, the market for RPGs continues to grow.

the revenues of top 10 RPG games have been growing as have been the downloads.

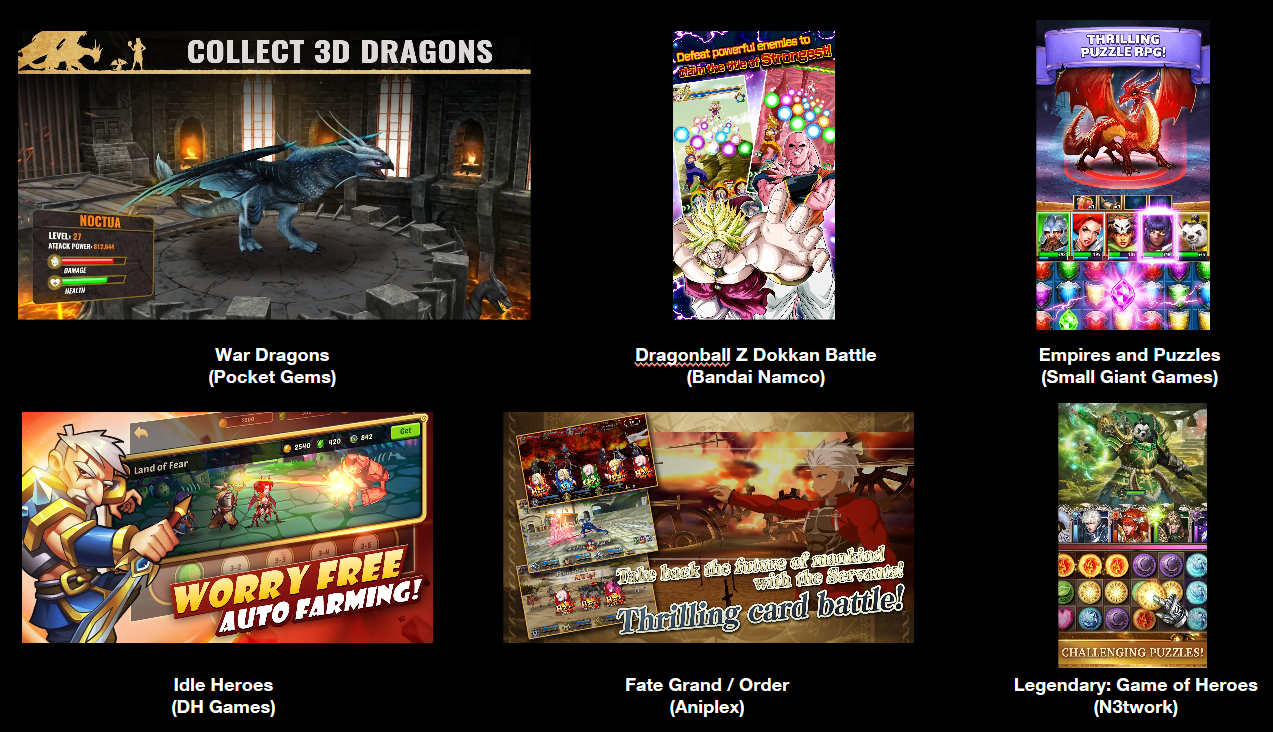

What makes the RPG category very interesting and highly attractive is the diversity tha ranges from idle games to puzzle and strategy games.

The RPG category continues to be a very lucrative one that also shows signs of innovation in multiple areas. Marvel: Contest of Champions and Star Wars: Galaxy of Heroes have proven over a few years now that RPG games with heavy use of IP is a recipe for success, and have been joined by Nintendo with Fire Emblem: Heroes, Bandai Namco with Dragonball Z: Dokkan Battle, and occasionally by Sony / Aniplex’s Fate/Grand Order. Each of these games shows us the importance of live operations and new content tied to the power of gacha mechanics with Dragonball Z achieving top grossing in the USA multiple times through well-executed events. It also shows that a classical Asian IP has an audience in the US, which one assumes is not just driven by expats but also by international fans and players looking for deeper experiences.

An unexpected failure in this IP category came from Kabam and their Transformers: Forged to Fight game. Though the studio can seemingly do no wrong with Contest of Champions, the Transformers game, while incredibly well executed and visually stunning, was a letdown financially. It will be interesting to see if Kabam/Netmarble chooses another IP for their next title, or doubles down on their existing ones for 2018.

A special mention must also go to two upstarts that made good headway into the RPG space in 2017 with Small Giant Games’ Empires and Puzzles and N3twork’s Legendary: Game of Heroes. Both of these games take the Puzzle & Dragons match-3 RPG format but add to it proven midcore features such as raids, guilds, and guild wars. Empires and Puzzles even adds a city-building element for a true mish-mash of genres that shows once again the power of the Finnish mobile games cluster.

^ War Dragons recently added a Wars feature with Guild versus Guild territory control.

On top of these titles, Pocket Gems also surprised us with War Dragons. A company more renowned for their casual slate of invest and express titles, as well as their breakout hit “Episodes”, also seemingly knows how to develop a midcore RPG game with high fidelity 3D graphics. War Dragons boasts an extremely impressive revenue per install figure and remains a consistent performer in the top 50 grossing games in the USA. It too has added more hardcore features to a traditional RPG loop with a territory conquest mode known as Wars and heavy use of guild features to achieve success.

Idle Heroes showed a new way on how to win in the diverse RPG category

Finally DH Games’ Idle Heroes shows us an entirely different direction to go in that can also achieve success. Its selling point is that it literally plays itself to allow you to automatically farm for loot and help improve and progress your characters. A major motivation for mobile gamers is progression of characters and through a game world, so Idle Heroes takes advantage of the trend of passive gameplay to allow collectors and number hunters to get their kicks in a fast and lightweight manner. Interestingly, this mechanic is also found in Lineage 2, one of the titles we will talk about in the next section.

We predict that:

We expect that franchises will be the name of the game in 2018, helping to maintain the RPG category as a perennial strength in the grossing rankings.

Original-IP games like War Dragons, Idle Heroes, Legendary, Empires & Puzzles, etc. that have innovated to create new, successful, proven designs in the RPG market will become targets for replication. We expect the market share of the games above to decrease in 2018 due to direct competition.

Massively Multiplayer Online Role-Playing Games

Worthy of its very own category is a specific type of RPG which, after years of Asian domination, has started to make waves in the West: Massively Multiplayer Online Role-Playing Games (MMORPGs). These are huge and expansive worlds as seen in Western PC titles such as World of Warcraft, EverQuest, and Star Wars: The Old Republic. These are experiences that can hold players for years at a time.

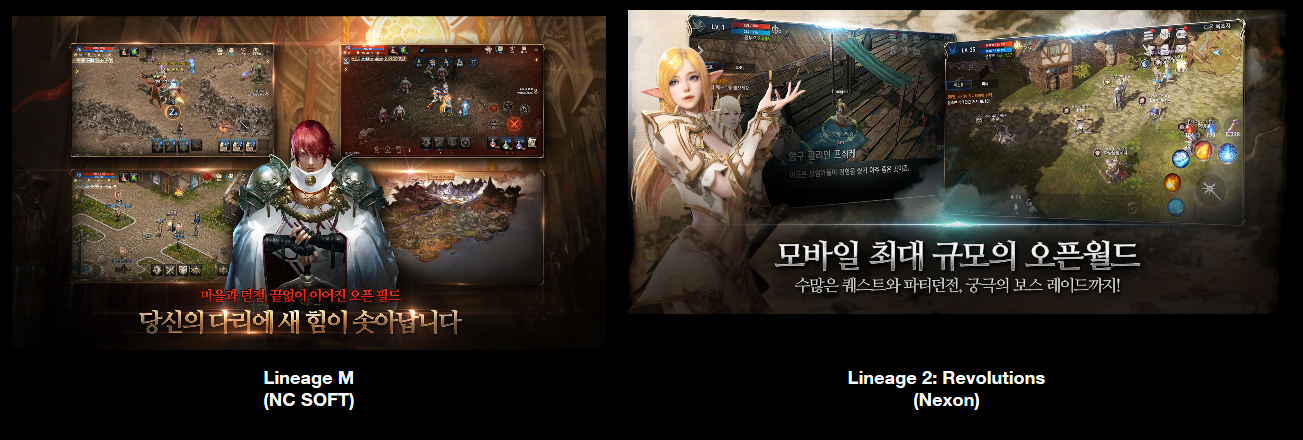

Lineage is one of the most prominent MMORPG hits

Asia leads the way in this more serious take on gaming. Two Lineage titles from Korea have entered the overall top 15 grossing titles worldwide and though just Lineage 2: Revolutions is out in North America, it has established itself as a top 100 grossing game. The game is a “full fat” MMORPG with a huge world and leveling systems, but mixed with the unique feature that allows the game to play itself automatically. Perhaps this gives us our best insight into where MMORPG games may go in 2018 and 2019: super deep games that also allow less invested players to progress meaningfully without having to do much work.

People often say that trends in Asia don’t cross over the ocean very well, citing Monster Strike and Puzzle & Dragons as titles that are giants in their homeland but minor players at best in the West. However, it's important to note that aspects of these games did work in the West, with gacha mechanics now commonplace, Monster Strike being a front-runner for real-time mobile gaming, and guild and alliance systems being pioneered in Asian games.

2017 has shown us that there is still a huge demand for progression- and system-based games, despite the revelation that was Clash Royale in 2016. Games like The Last Day on Earth (Kefir) are ones to keep an eye on in terms of titles that take system design and progression to a new depth in a fresh genre and setting to achieve success. It evokes some feelings of a traditional full-on MMORPG and as a result, we expect to see more MMORPG’s make an appearance, and that a handful will do very well. Lineage 2 had a successful debut in the West and though NetEase’s Crusaders of Light failed, it was extremely well polished and may lead to a more Western themed version doing well. Blizzard is rumored to be working on a new mobile title and would be an obvious choice for an MMORPG given their rich heritage in the genre.

^ The Last Day on Earth by Russian studio Kefir was a breakout midcore hit of 2017. Featuring exploration, zombies, survival, and base building, it brings a rather fresh feel to mobile inspired by games such as Day Z on PC. We’d classify it as a form of MMORPG given the feeling of exploration in the game, though it has far less character and narrative, and far bigger emphasis on survival. This is a theme that has become popular both in TV and Cinema (The Walking Dead, World War Z, etc.) and in gaming (Day Z, Player Unknowns BattleGrounds, etc.) so we expect to see more survival style games with heavier emphasis on crafting and exploration this year too, and think this game will continue to grow.

We predict that:

More MMORPG games enter the market with even more complexity to their metagame but retaining accessibility features such as auto-questing.

A well-respected Western developer (such as Riot, Blizzard, and/or EA) will announce or release a mobile-first MMORPG title.

Synchronous Strategy Games

The popular misconception that prevails in the industry is that you can create a slightly improved version of the category killer and grab a percentage of their revenues. We’ve seen this happen on PC with publishers chasing after the monstrous revenues of World of Warcraft and League of Legends. And it has always resulted in these follow ups battling for the crumbs instead of taking a bite of their juicy bread.

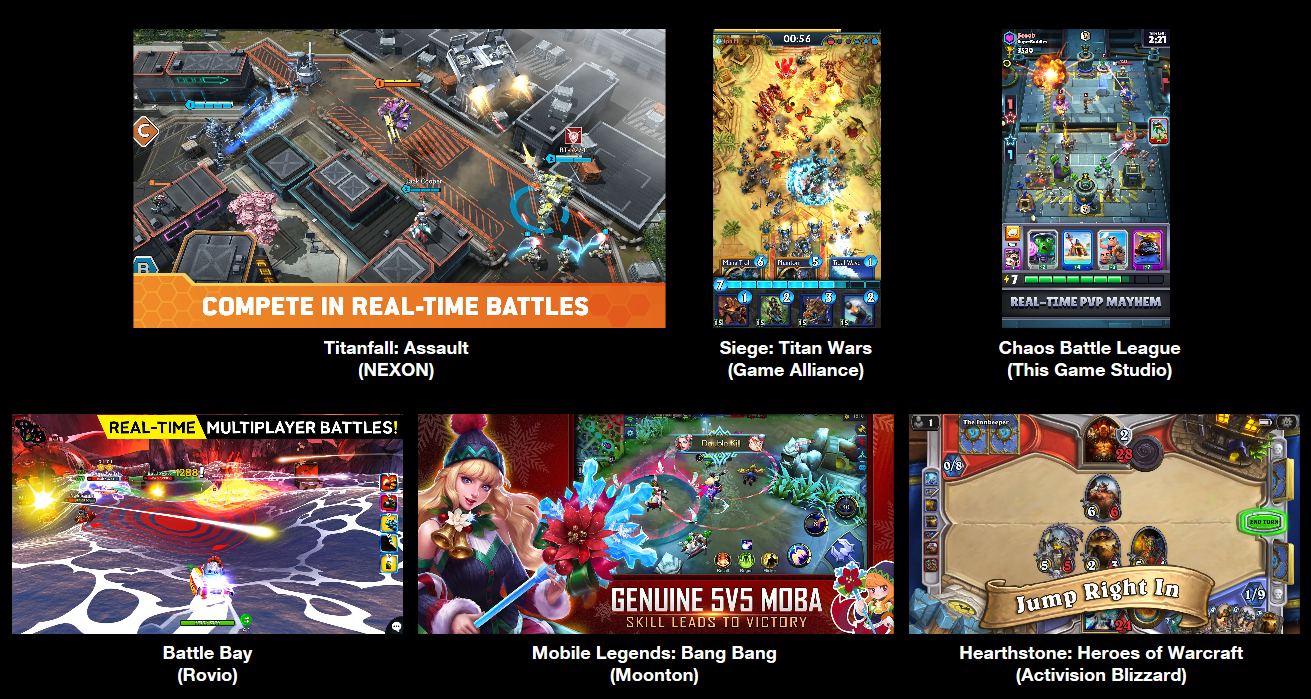

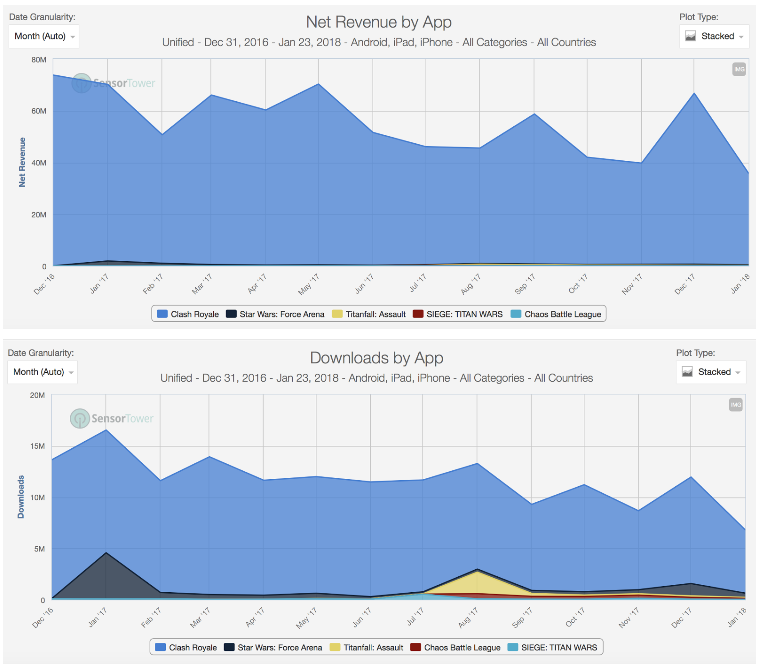

After Clash Royale launched in 2016, the industry trend of ‘fast following’ was inevitable. The clones and slightly altered clones did indeed hit the market with titles such as Titanfall: Assault (Nexon), Star Wars: Force Arena (Netmarble), Siege: Titan Wars (Game Alliance), and Chaos Battle League (This Game Studio). While these were high profile titles that received significant featuring support, they didn’t even show up on the radar of Clash Royale’s revenues.

Several high-profile Clash Royle type of games launched during the year, yet none of them made a dent in the revenues of the category showing the power of Supercell's monopoly in the synchronous strategy games.

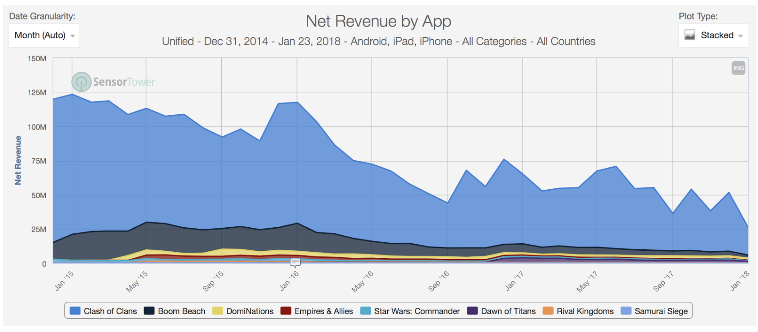

This is not to say that follow up titles are doomed. Games inspired by Clash of Clans such as Space Ape’s Samurai Siege, Disney’s Star Wars: Commander, and Nexon’s DomiNations definitely did find success in the same space. But then again, Clash of Clans and Supercell’s own follow-up, Boom Beach, grabbed together 95% of the category lifetime revenues. The third best build-and-battle game, DomiNations, which by all accounts was a great title, grossed less than a fifth of what Boom Beach did.

The graph above shows the power of Clash of Clans and Supecell over three years. The most important takeaway is that any fast-follow to Supercell's category defining hit is doomed no matter how good it may be. Unless it's a fast-follow by Supercellians themselves.

We predict that:

The strategy category will remain Supercell’s monopoly as it has been since the launch of Clash of Clans 6 years ago.

We will see at least one more big entry in the strategy category as one of the big Western publishers will aim to take a piece of the Supercell's pie and fail badly. This is hardly a prediction. As shown before, anyone to challenge Supercell's category monopoly over last six years has been destined to fail.

The Clash Royale World Championship Finals held in London were truly extraordinary to witness and a testament of how far mobile gaming has developed over the last 10 years.

MOBAs, Shooters and, Brawlers

You have to be either fool or genius to make a MOBA (multiplayer online battle arena). These games are very difficult to build, they monetize extremely poorly per play, they are known for the notorious steep learning curve, the production costs of a game that pits tens of 3D characters with multiple animations is very expensive, and on top of all the touch controls are not suited for classical MOBA gameplay. Not to mention the fact that every MOBA lives in the shadow of League of Legends and its 100 million monthly active players.

Vainglory was seen as the challenged for the status quo. When Vainglory launched three years ago, game makers around the world held their breath. Was this beautiful game the new League of Legends for mobile? It took us only a few weeks to realize that it wasn’t. Despite all the featuring from Apple, a partnership with Twitch, georgious graphic, genious propietary engine and the high-riding eSports production, Vainglory has never been a consistent performer in the grossing charts. The reason for Vainglory’s lack of success is that the game is designed by gamers for gamers on a platform that is not designed for gamers.

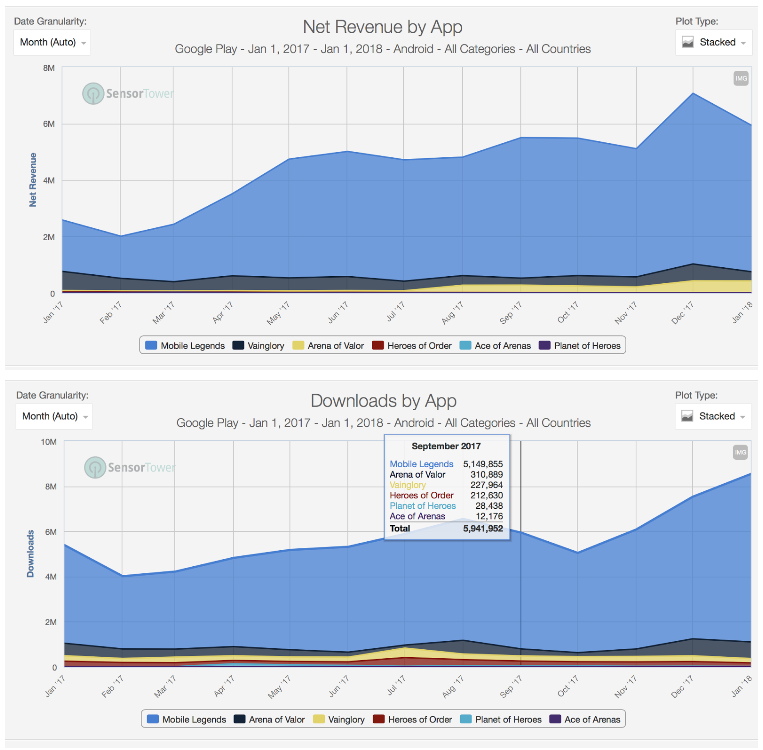

Vainglory’s failure to grow into anything but a niche seemed a sure sign that we would never see a mobile MOBA again. But in mid-2016 things changed rapidly. Tencent released Strike of Kings (Arena of Valor in the West), which quickly became the biggest mobile game in the world with its more accessible design. While Tencent was busy conquering the Chinese market, Moonton, another Chinese developer, made a strategic move and launched its mobile MOBA, Mobile Legends: Bang Bang, into markets outside China with the goal of beating Tencent in its expansion. The bet paid off and Moonton’s Mobile Legends established and controls the mobile MOBA market outside China.

Moonton's Mobile Legends beat Tencent to a punch and became the prominent mobile MOBA of the West. A position, which Vainglory failed to capture after giving their all for the past 3 years.

On the other spectrum of MOBAs there are the shooters. A genre largely defined by the powerful Wargaming and its World of Tanks and World of Warship franchises. What makes shooters different from MOBAs is mainly the progression mechanic: in MOBAs each match essentially starts from the beginning and player’s goal is to level up his character during the match. In Sshooters progression occurs outside the match with players enter the battle with vehicles they’ve been upgrading for sometimes months.

From monetization perspective Shooters are far more appealing since they offer progression based on time spent in the game. And as we all know, nothing monetizes better than offering players a chance to skip timers over and over again. In other words, while in Shooters players get better automatically over time by purchasing better vehicles and weapons, in MOBAs players get better only as their skills improve.

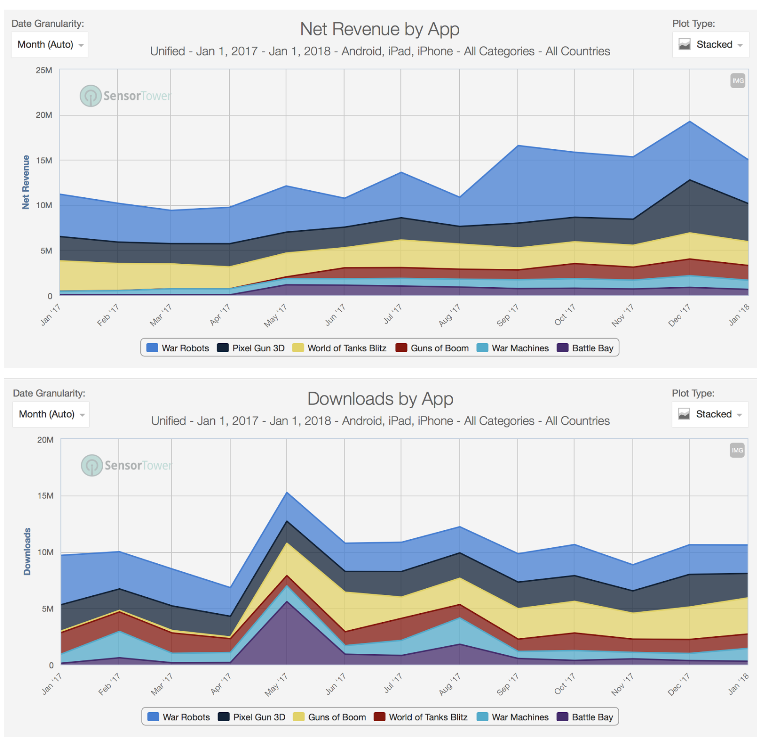

On mobile, World of Tanks Blitz (deconstruction of World of Tanks Blitz) has been the premier shooter for years. Yet despite having the franchise, the experience and, the years head start, Wargaming failed to grow the market and own it. At the moment, Blitz has slipped into a third place with War Robots and Pixel Gun outplaying it while Guns of Boom is closing the distance every month.

Shooters category has seen several market entries that grew the market and took it from Wargaming, the creator of the category.

Guns of Boom by Game Insight was a surprise hit. A mobile FPS with automated firing appears to be a winning formula and this is a game that has grown over the year and which we expect to see grow even further in 2018. Other, similar games, e.g., Battle Bay, have also enjoyed a modicum of success.

Brawlers is the new emerging category which takes the progression mechanics from Shooters and combines it with the gameplay of MOBAs.

While we saw category leaders emerge in both MOBA and Shooter category, what’s most interesting in 2018 is the fact that the seeds for a new category known as Brawlers were laid. Brawler is a category sandwiched between MOBAs and Shooters. The games are from the isometric angle and focus on heroes, just like MOBAs. The difference is that brawlers have moved the progression elements outside the match, like Shooters. In other words, it’s a category that borrows the best of the two and tries to avoid the complexities of both MOBAs and Shooters.

Supercell’s Brawl Stars (Can Supercell do it Again?), which is currently in soft launch, is much to be credited for the birth of this genre. While there are no winners, let alone an apparent market for brawlers, it is clear that we will see several brawlers launched in 2018 as the category is born.

We predict that:

Tencent’s Arena of Valor will fail to make it in the West.

Mobile Legends will own the MOBA category in the West.

Vainglory’s maker, Super Evil Megacorp, will be acquired. Despite not having success with their game, they have a fantastic team, strong eSports organization and, a magnificent proprietary engine.

Supercell will cancel Brawl Stars due to underperformance in revenue per user metrics.

Dozens of Brawlers will be launched and the category will become extremely competitive.

Battle Royale

Right at the end of 2017, we saw a big power play from Chinese publisher NetEase with not one, not two, but three Battle Royale games released in the Western market. Citing the success of the phenomenon that is PlayerUnknowns Battlegrounds, Chinese mobile developers have been extremely quick to react with Rules of Survival already racking up over 40M downloads and Knives Out at over 45M downloads. The monetisation depth in these games hasn’t yet been anything to write home about, but the volume of downloads and crazy success of PUBG makes this potentially the most bloody of battlegrounds in 2018.

Chinese publisher NetEase jumped on the PC phenomenon that is PUBG with multiple attempts on mobile already out worldwide.

*numbers not inclusive of China Android

As a result, Tencent’s mobile version of PlayerUnknown’s Battlegrounds is a sure bet for most disruptive game in China next year, and it will be interesting to see how it fares in the West given that it’s huge on PC, is both solo and team-based PvP, has fresh gameplay (for mobile) and a franchise behind it. At DoF we expect this to make a big impact, especially given that Rules of Survival by Netease has perennially been in the top 50 downloads in the USA since release and already has a huge player base globally.

Tencent is releasing two versions of PlayerUnknown’s BattleGrounds on mobile in 2018. One version already has at the time of writing more than 17M pre-registrations in China alone.

We predict that:

Tencent’s version of PUBG mobile will become a top grossing game in China but will struggle to overthrow Netease’s Rules of Survival. Tencent doesn’t have the same strength in the West (as evidenced by Arena of Valor)

More competitors join the mobile battle royale craze with the mode added to existing FPS titles such as Guns of Boom and new games developed in the west that are targeted at western consumers.

Hunting Games / Snipers

Just as new genres can be born as in the case of Battle Royale games, others can die as evidence the decline of Hunting games in 2017. Once a very profitable category for a few players such as Glu and Hothead, this genre seems to be falling out of favor as real-time shooting games on mobile take their place instead.

While we saw the birth of the new categories in 2017, we also saw death of others. Hunting games are all but done by now.

These games barely make a dent in the top 500 grossing games in the USA, and perhaps their decline was best summed up in Glu’s sale of their Moscow studio who ran their once lucrative Deer Hunter franchise. A few new titles have also been trialed in this space in 2017 with GREE’s ambitious three games in one game Guardians of Haven failing to meet expectations and resulting in the closure of its US operations, and Ubisoft’s soft launch of Tom Clancy’s Shadowbreak, an extremely polished variant of Hunting games which is full PvP and wrapped around a Clash Royale metagame. However, despite being very well executed, like the rest of the games in this genre, predict further decline and the genre becoming less relevant as time goes by.

Deer Hunter was once a category leader. It still is, only the category is not much to be marvel at.

We predict that:

Hunting games continue to decline year-on-year as real time shooters take their market share.

Tom Clancy’s Shadowbreak fails to make a mark.

User-Generated Content and Subscriptions

Games built around a heavy use of user-generated content and auto-renewing subscriptions was one of the biggest trends of 2017; however, it was entirely isolated to the casual space, with emphasis on the female and children demographics. Games like ROBLOX, Episodes/Choices, and Design Home have shown the power of UGC and subscriptions to drive games to the top of the grossing rankings. Subscriptions, in particular, have been a massive part of the larger mobile monetization story of 2017 with apps like Netflix, Pandora, Tinder, HBO NOW, etc. leading to what’s been described as a “thawing” of the top grossing charts. That is, after years of games dominating the top grossing charts, apps across a number of verticals (and especially streaming video) are now giving games a run for their money.

For years no-one was able to touch Minecraft. This has changed with the rise of Roblox that is destined to surpass Minecraft in the near future.

While efforts to date have been focused on casual games, there is a long history of these mediums working for more “core” and male gamers, dating back at least to the era of “gamebooks” that featured the likes of Joe Dever’s Lone Wolf series and the “Choose Your Own Adventure” series. The combination of lower dev costs via heavier reliance on UGC, a reliable income stream via subscriptions (plus the reduction to a 15% fee after one year), and the strong retention/monetization characteristic of successful midcore games, coheres into an extremely enticing proposition.

We predict that:

A breakout UGC/Subscription-focused midcore game will emerge in 2018.

Augmented Reality

Given the hype around AR leading into 2018, we would be remiss if we didn’t weigh in. AMC has already announced an AR game for The Walking Dead, which was a very popular idea we heard many independent mentions of after Pokemon Go released. Niantic and Warner Bros have also announced a partnership to release a Harry Potter AR game. Clearly there is strong interest in AR in the gaming space.

However, we fear that the “AR effect” is really a “Pokemon effect”. AR titles run a very strong risk of either copying Pokemon Go’s formula and thus not delivering on an appreciably different experience, or forging the much more challenging path of trying to create an innovative experience that resonates with consumers while also being significantly different from Pokemon Go. This leaves us very hesitant about the prospects for the AR space in 2018.

We predict that:

We suspect AR will be a major initiative but will struggle to make a meaningful dent in the grossing rankings. While the Harry Potter title likely has the strongest chance of success given the strength of the brand and the brand’s utter void in the mobile gaming space, it does not appear to be positioned as a midcore title and therefore may struggle with monetization. It also runs the risk of diving into a head-on competition with Pokemon Go.

Summary of Predictions for 2018

Genre Predictions:

4X games by MZ, FunPlus, etc. remain consistent performers, but instead of seeing one dominant player, the overall market is shared between multiple companies. Newer and 4X games add additional system depth and sub-loops to core game design; however, the overall market size continues to shrink slightly year-on-year.

RPG titles continue to perform well as a category thanks to IP-based products that follow up on the innovators of 2017.

Mobile MMOs finally become a bona fide category and Western studios enter the market.

Clash Royale maintains its place as the best performing midcore game in the West.

PUBG Mobile becomes the top grossing game in China on a mobile, and is a top 50 grossing game in the West. It spawns its own sub-genre that is one of the most competitive of all in 2018.

Brawl Stars is released globally but underperforms compared to Clash Royale and Clash of Clans once the initial buzz dies down.

AR is a miss in 2018.

Midcore sees the rise of UGC/subscription-based games.

Meta-Predictions:

A clear diversification emerges within Midcore between two main tracks:

Heavy system-based games with deep metagames.

Instance-based PvP games with heavy emphasis on action and light metagames.

Related to this, 2018 will see lots of innovation and blending of genres in order to try to find success in an increasingly competitive marketplace, particularly in the red-hot emergent subcategories of Brawlers, Shooters, and MOBAs, but also in genres on the decline like 4X. Whilst we won’t see crazy innovation in the app store in order to beat existing lynchpin midcore games, companies will have to offer fresh gameplay experiences with new competitive mechanics.

The virtual d-pad and landscape mode are back, and session times grow. These all flow from the newly-emergent sub-categories that emphasize instance-based action gaming.

Franchises/IP will continue to be an important factor, perhaps even more so than in the past couple of years. This is likely to be driven by the emergence of new subgenres where points of differentiation are an especially valuable commodity, as well via exposed flanks among top grossing original-IP games in categories like RPG. Potential disruption is also likely to come from PUBG (Tencent), the long-awaited new Call of Duty mobile game (King), and from the inevitable new version of FIFA that will launch alongside the FIFA World Cup in June.

Midcore remains one of the most lucrative spaces in mobile, but we see fewer top titles and a bigger spread among multiple titles, leading to fewer midcore titles being seen in the top grossing games list as they are replaced by casual titles.

Team-based PvP gaming will eventually win out over solo PvP much like it has done on PC. Though players will still be able to experience 1v1 gameplay, 2v2 battles has proven to be popular in Clash Royale and upcoming Battle Royale games will allow team play as they try to forge into the world of eSports.

The gap between midcore and hardcore will become increasingly blurred in 2018 as the traditional midcore games get more serious while the hardcore games become more accessible.