How Big Tech Threatens Economic Liberty

An excited entrepreneur in the social-media space takes a walk with Mark Zuckerberg through the woods. He reportedly shares his product road map with Zuckerberg, and then reads a few weeks later that Facebook has launched a rival product. Facebook’s appropriation of an upstart’s features, including Snapchat’s Stories, is legendary. Facebook went so far as to spy on what users did outside of its platform “to decide which companies to acquire, and which to treat as a threat.” Similar examples abound in the tech world, including the way Amazon acquired Diapers.com as the culmination of a price war.

In his recent book Can American Capitalism Survive?, Steven Pearlstein highlights the difference between voluntary exchange and economic coercion: “The moral case for market capitalism rests on two principles that strike us as fair and just. The first is that markets are rooted in voluntary exchange….The second principle is that people are entitled to own and keep what they produce.” Pearlstein goes on to note that an entrepreneur’s “just deserts” should include compensation for “talent, ingenuity, and risk-taking that we bring to that effort,” in addition for one’s time and effort to bring a product to market.

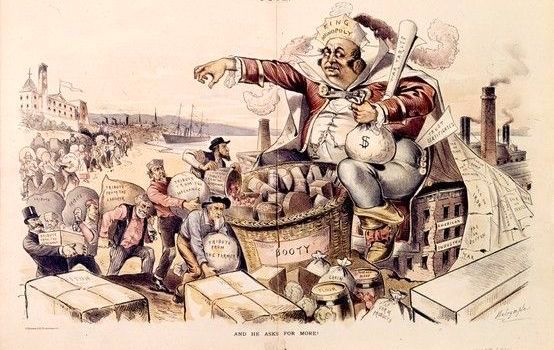

And yet the exchange between online merchants and content creators—“edge providers”—on the one hand, and tech platforms such as Amazon, Facebook, and Google, on the other, is not strictly voluntary. These platforms dominate their respective fiefdoms, set the rules of engagement in their ecosystems, exploit information advantages owing to platform ownership, and discriminate in favor of their own content and against similarly situated independents. And the rewards for edge innovation are dampened by runaway appropriation. Indeed, the dealings between platform and edge providers have all the hallmarks of coercion, strongly suggesting that few input providers capture anything close to their value added, and that even acquired firms may not receive their “just deserts” despite the seemingly impressive payouts.

Perhaps capitalism will survive, but the economic prospects for independents in the internet economy—and edge innovation generally—will be dismal.

In a recent issue of The Economist, venture capitalists referred to the area around the tech giants in which startups are squashed as the “kill-zone.” Classic examples of new ventures that have flown too close to the sun include BareBones WorkWear, Beauty Bridge, Collectible Supplies, Diapers.com, and Rain Design (in Amazon’s orbit); Foundem.com, TripAdvisor, and Shopping.com (in Google’s orbit); and Grubhub, Snapchat, and Timehop (in Facebook’s orbit). New research using PitchBook data reveals that broadly defined industries in the Amazon/Google/Facebook orbit experienced a collapse in first financings since 2015, a reduction not observed in comparable tech sectors.

A 2017 survey of two dozen Silicon Valley investors suggests that Facebook’s appropriation of app functionality from edge providers is “having a profound impact on innovation in Silicon Valley.” Facebook engages in what I call “pure appropriation”—that is, the victim of its appropriation was not trying to gain access to Facebook’s platform, but instead was simply minding its own business on the web when Facebook stole its functionality.

The method by which Amazon and Google appropriate ideas is different from Facebook’s—appropriation followed by discrimination—but just as threatening to edge innovation. Google created a “One Box” for its search results, and then populates that coveted real estate exclusively with its own content, including local restaurant reviews. Amazon mimics lucrative businesses on its e-commerce platform, often undercutting the entrant’s prices, and steers users to its private-label clone through preferential placement in its “Buy Box.” Amazon’s private-label products are projected to reach $25 billion in online sales by 2022, and its private labels are the fourth most purchased brand in clothing and footwear on its platform.

Under the current power dynamics in the tech industry, the best way for an entrepreneur to monetize her idea is to sell out to the platform. Competing against the platform on the merits is a fool’s errand as the platform can tilt the playing field in favor of its affiliated application—or in the case of Facebook, by simply stealing the functionality. Setting aside the distinct prospect of getting below fair-market value in a sale—the platform can appropriate the independent’s idea if its buyout offer is rejected—there is something unseemly about surrendering one’s sweat equity to the platform.

The sheer number and value of occasions in which an upstart assented to a platform’s acquisitive demands are impressive. Amazon spent $1.65 billion on acquisitions in 2018—the third time in its history that buyouts exceeded $1 billion in a single year—and the tech giant “is snapping up companies at a rate not seen since the dot-com era.” Wikipedia logs 94 Amazon acquisitions since 1998; notable buyouts include Alexa Internet, Audible, iMDb, Goodreads, PillPack, Ring, Twitch, and Zappos. Facebook acquired 76 companies since 2005, including Instagram, Oculus, and WhatsApp. And Google has acquired a staggering 225 companies since 2001, including DoubleClick, ITA Software, Nest, Waze, and YouTube, or about one firm per month, every month, for the last 17 years. No only do these acquisitions eliminate potential competition for the platform, but they also provide the incumbents even more data with which to leverage and extend their hegemony.

The Federal Trade Commission (FTC) considered most of these acquisitions to be “vertical,” in the sense that the acquired firm was not a direct competitor to the platform—and waived them through. However, in many of these cases the target was a “complementor” to the platform, in the sense that it complemented and thus depended on the neutrality of the platform for its economic survival. In their study “Competing With Complementors,” economists Feng Zhu of Harvard University and Qihong Liu of the University of Oklahoma found that Amazon entered several new product lines (nearly 5,000 items) in a short span between 2013 and 2014, and that those invasions had the effect of chasing independents off the platform relative to unaffected sellers.

This dependency on the platform, combined with the threat of appropriation in the event of no deal, means that many sales to dominant tech platforms are not voluntary in a strict sense. One entrepreneur told me that he

went through the process when I sold an earlier company, and one thing that is very prevalent is a big competitor tells you they want to acquire you, you sign NDAs and then they get all your data and business insight. They can then go off and do it on their own or now have complete visibility into a rival’s operations. That is why I now tell people not to share any data unless you get a signed [letter of intent] with a price on it. These are fishing expeditions.

This brand of economic coercion violates the notion of self-determination. To an economist, coercion can be thought of as the ability of a dominant firm to induce an economic agent to submit to certain terms, sometimes exclusionary, by ensuring that the agent would be made worse off by refusing them. Why should my idea, the innovator asks, be exploited by someone else? It’s not as if an entrepreneur has four or five blockbusters in her pocket; one great idea is the mode of the distribution of successful startups, and the mean number of great ideas across all tech startups is likely close to zero. By structuring their ecosystems in this manner, the tech platforms are engaged in conduct that infringes on economic freedom.

And that should offend our sensibilities, even if the remedy is a modest government intervention in the marketplace. In the late 1980s, cable operators, the dominant platform of that era, discovered that they could appropriate ideas from content providers operating at the edge and capture the ancillary (advertising and license fee) margins previously earned by independents. Sound familiar? In 1992, Congress recognized this threat to independent cable networks, and so barred cable operators “from requiring a financial interest in a program service as a condition for carriage,” and “from coercing a video programming vendor to provide…exclusive rights…as a condition of carriage on a system.” (emphasis added). Congress also created a forum in which independents could lodge discrimination complaints against cable operators that favored similarly situated programming. More on how that remedy would apply here in a bit.

There is a conservative tradition of defending self-reliance as a virtue. Indeed, the conservative tenet of self-determination dates as far back as Edmund Burke, who wrote in 1790, “It is better to cherish virtue and humanity by leaving much to free will, even with some loss to the object, than to attempt to make men mere machines and instruments of a political benevolence.” Libertarians interpret this warning narrowly to imply that the only threat of economic liberty is government. But corporations that wield economic power are also capable of infringing our economic liberties, and conservatives are rightly skeptical of centralized and concentrated enclaves of power, regardless of whether the threat to economic liberty comes from the private or public sector.

Amazon’s treatment of independent merchants is especially exploitative, denying startups the basic right to self-determination. Amazon charges third-party vendors on its marketplace fees just to participate, as well as additional fees for storage and shipping services. The fee business is so profitable that Amazon forced thousands of wholesalers in March to convert to third-party sellers. Amazon’s storage fees have increased, a sign of heightened market power, and serve as a de facto tax on platform users. The byzantine rules by which Amazon governs its marketplace requires sellers to hire “fixers” who are experts at prevailing in Amazon’s court. (Yes, Amazon has its own court, an unusual indicator of market power.)

Amazon’s market share in online commerce is 49.1 percent, and the next largest platform is eBay with 6.6 percent. The notion that a merchant foreclosed (or chased off) Amazon’s platform can pack up its bags and find a comparable online outlet elsewhere is fanciful. In response to the growing “techlash,” Amazon, in April of this year, unilaterally scaled down or relocated promotions of its private label products, which previously appeared at the top of search results or next to the “Buy Box” of a competitor’s product page.

The assault on independent content providers has prompted a handful of senators to propose legislative remedies. In July 2018, Democratic Senator Mark Warner of Virginia suggested in a tech manifesto that Congress should import the non-discrimination protections used to police vertically integrated cable operators (mentioned above). For example, the FTC could adjudicate complaints brought by independents against tech platforms pursuant to a non-discrimination standard. A neutral factfinder would determine whether the complainant had proved that its content/merchandise was similarly situated to the platform’s affiliated clone; that its inferior treatment was owing to its lack of affiliation; and that, as a result, it was materially impaired in its ability to compete effectively.

Meanwhile, in March 2019, Democratic Senator Elizabeth Warren of Massachusetts proposed that online platforms with global revenue above $25 billion be structurally separated—a line of business restriction that would bar, say, Amazon from serving as a merchant on its e-commerce platform—and “be required to meet a standard of fair, reasonable, and nondiscriminatory dealing with users.” Platforms with revenues below $25 billion would be subjected to the non-discrimination standard only.

The typical rank-and-file conservative likely believes in some form of self-determination and would view economic coercion by the tech platforms as fundamentally unjust and undesirable. According to a June 2018 Pew Research Center survey, 44 percent of Republicans (or leaning Republicans) thought major tech companies should be regulated more than they are currently today (compared to just 12 percent who said less). Despite this sentiment, there has been little offered on the Republican side of the aisle when it comes to protecting independents. Republican Senator Josh Hawley of Missouri recently told The Verge that “Monopoly control of markets that is anti-competitive, that keeps new competition out, that is not pro-free market. That is not something as a part of conservatism that I’ve recognized.” Republican Senator Ted Cruz of Texas has railed against platform discrimination, but alas his concern is alleged discrimination on the basis of political affiliation rather than business affiliation.

Republican politicians pepper their stump speeches with appeals to “hard work” and “entrepreneurship.” Yet this campaign-trail rhetoric is far removed from reality. If self-determination is really central to a conservative’s principles, then the Republican Party should get behind efforts to rein in the tech platforms and create some breathing room for independents to flourish. Our economic freedom depends on it.

Hal Singer is a managing director at Econ One, a litigation consulting firm, and an adjunct professor at Georgetown’s McDonough School of Business, where he teaches pricing to MBA candidates. This article was supported by the Ewing Marion Kauffman Foundation. The contents of this publication are solely the responsibility of the authors.

Comments