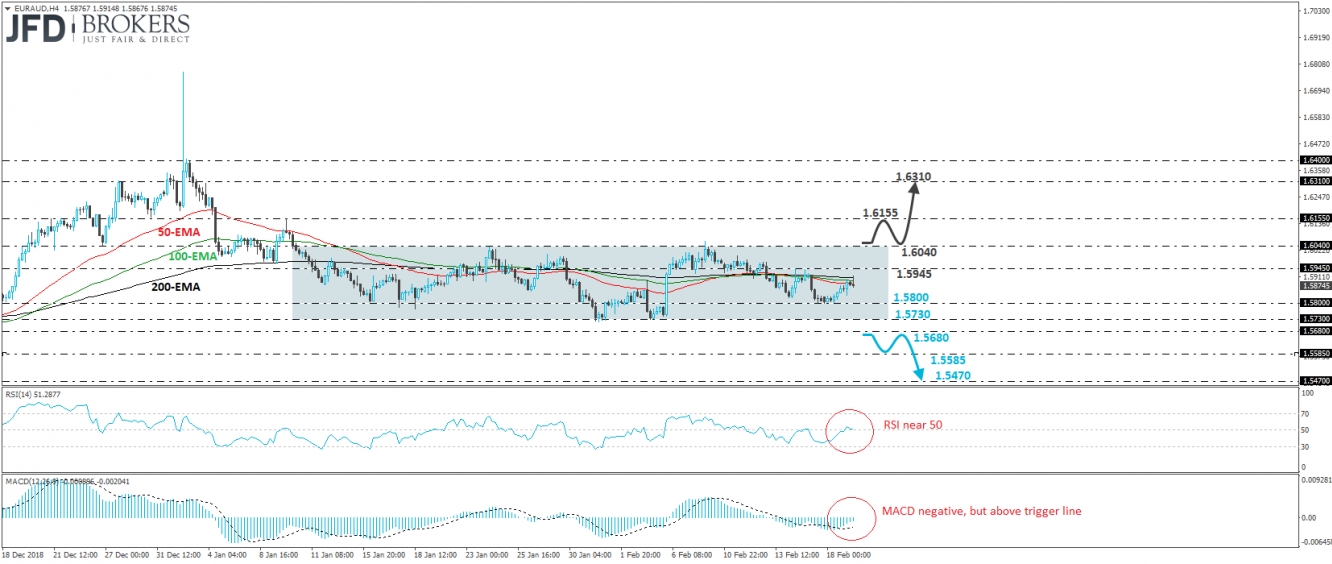

EUR/AUD traded higher yesterday after it hit support near 1.5800. However, today the rate has been trading in a consolidative manner, near all three of our moving averages, which point flat. Overall, the pair has been trading in a sideways range between 1.5730 and 1.6040 since January 10th and thus, we would consider the near-term outlook to be neutral for now. We would like to see a clear exit out of the range before we start examining the pair’s forthcoming directional path.

On the downside, we would like to see a clear dip below 1.5730, or even better below 1.5680, support defined by the lows of December 11th, 12th and 13th, before we get confident that the bears have gained the upper hand. Such a dip may initially pave the way towards the 1.5585 zone, marked by the inside swing high of November 30th, the break of which may allow extensions towards our next support zone of 1.5470.

On the upside, we believe that a clear close above 1.6040 is needed for the outlook to turn positive. Such a break would confirm a forthcoming higher high on the daily chart and could encourage the bulls to push the battle towards the peak of January 10th, at around 1.6155. Another move higher, above 1.6155, could carry more bullish implications, perhaps paving the way towards the 1.6310 zone, near the highs of December 27th and January 4th.

Taking a look at our short-term oscillators, we see that the RSI moved above 50 yesterday, but turned down again today, sitting near that equilibrium line, while the MACD lies within its negative territory, above its trigger line, and shows signs of flattening near zero. Both indicators suggest lack of short-term directional momentum, further supporting our choice to stay sidelined for now.