How to Build Your Own Silicon Valley and Keep Your Soul

It's the everlasting question that cities and countries around the world have: How to grow their startup, technology and innovation ecosystem, but remain authentic to their origins.

They want to be like Silicon Valley and many have used that name for themselves: Silicon Alley in New York City, Silicon Beach in Los Angeles, and, my favorite, Silicon Roundabout in London.

I’m actually sitting in Tirana, Albania right now hoping they name theirs Silicon Pyramid after the dictator-built museum that is being turned into an IT hub.

But are they there yet? The quantitative and qualitative measures say no.

I've visited over 100 early startup ecosystems, as well as invested in over 100 international startups and even though there are intelligent and resourceful founders everywhere, the majority of the world’s startup unicorns are based in the US at 54 percent (CB Insights, 2017).

Only China is closing that gap with 23 percent. After China it's India and the UK at 4 percent each, then Germany and South Korea at 2 percent each.

It's also worth noting that no other country has three or more private companies valued at over $1B.

High and wide Silicon Valley (and more often than naught San Francisco) still reigns Queen above all.

So, how does one build an ecosystem similar to what Silicon Valley has done? It’s a question that isn’t new. Well, put simply, Silicon Valley had a healthy head start and good timing.

'Silicon' valley, named after the element of the same name used in semiconductor computer chips that were created there, started around the 1950s. This gave the region an approximately 60+ year head start in not just creating a technology companies, but also venture capital.

Brad Feld, the co-founder of TechStars and author of Startup Communities: Building an Entrepreneurial Ecosystem in Your City, famously said, “A startup community needs a 20-year time horizon,” because it takes decades to build an innovative community in a geography.

Venture capitalists only came about after making money on their technology companies (think Sun Microsystems, HP, Intel, and Xerox) and deciding to reinvest in new high-tech companies that had exponential growth potential. Thus, this spurred the startup scene as we know it, and that pinwheel of innovation is how it was accomplished.

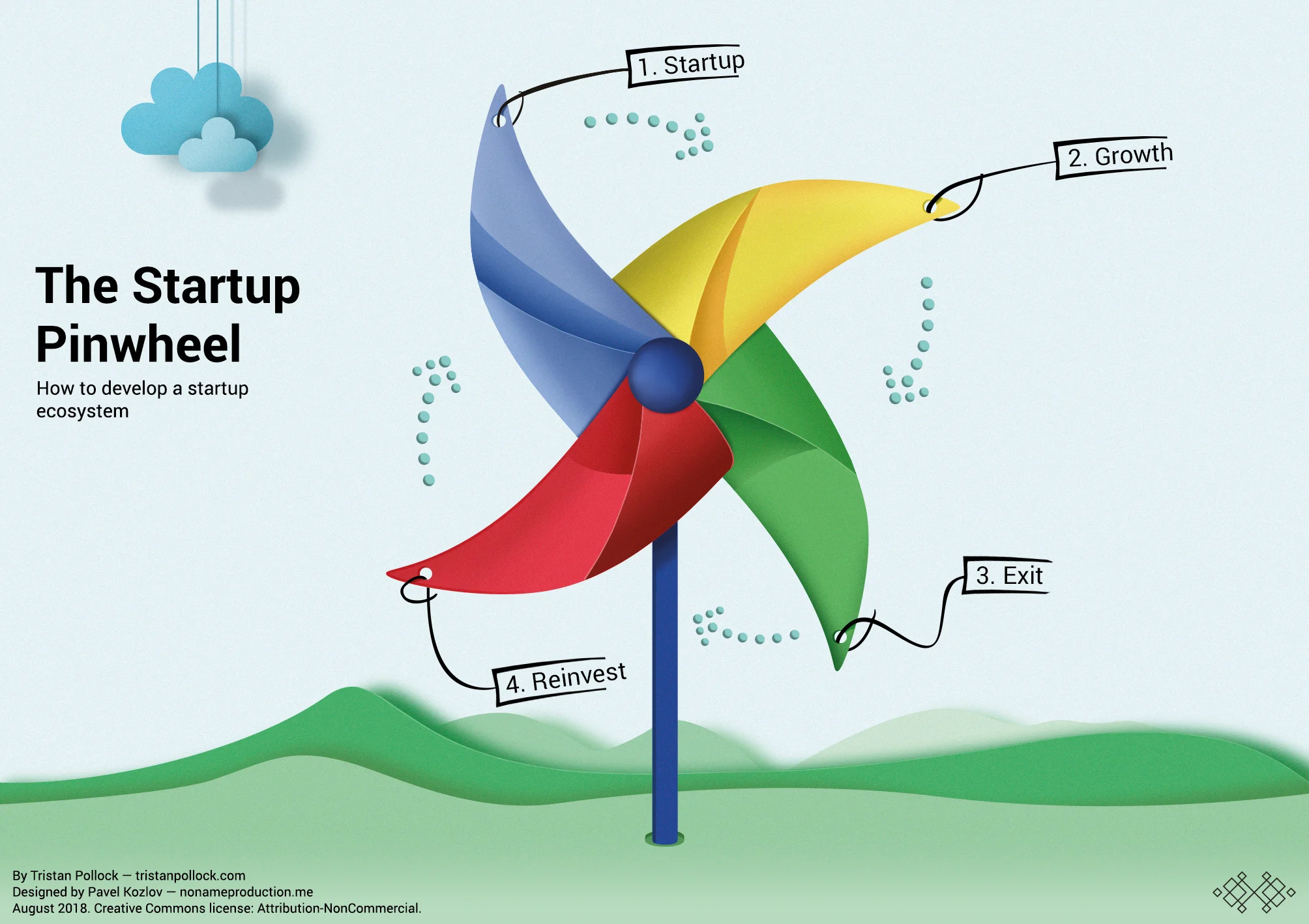

Introducing the Startup Pinwheel

Often times in startup lingo we ask what it takes to get the flywheel going. In essence, how will the startup takeoff with rocketship speed that fuels continued growth. Pictured is the startup pinwheel necessary to build a startup ecosystem locally. It starts by making winners who reinvest into new startups.

Then after a few rounds of hardware tech winners, Paypal came. The creation of the Paypal Mafia (the founders and employees who became millionaires after the company IPO-ed and was bought by eBay for $1.5B) fueled Google, Facebook, LinkedIn and the Web 2.0 movement. The x movement. The sharing economy movement to Uber, Lyft, and Airbnb. The movements and trends continued in tech and Silicon Valley and more recently San Francisco carved out their niche.

Of course, to start the pinwheel from the beginning there are a variety of ingredients you want to mix into the soup as a fledgling or growing startup ecosystem.

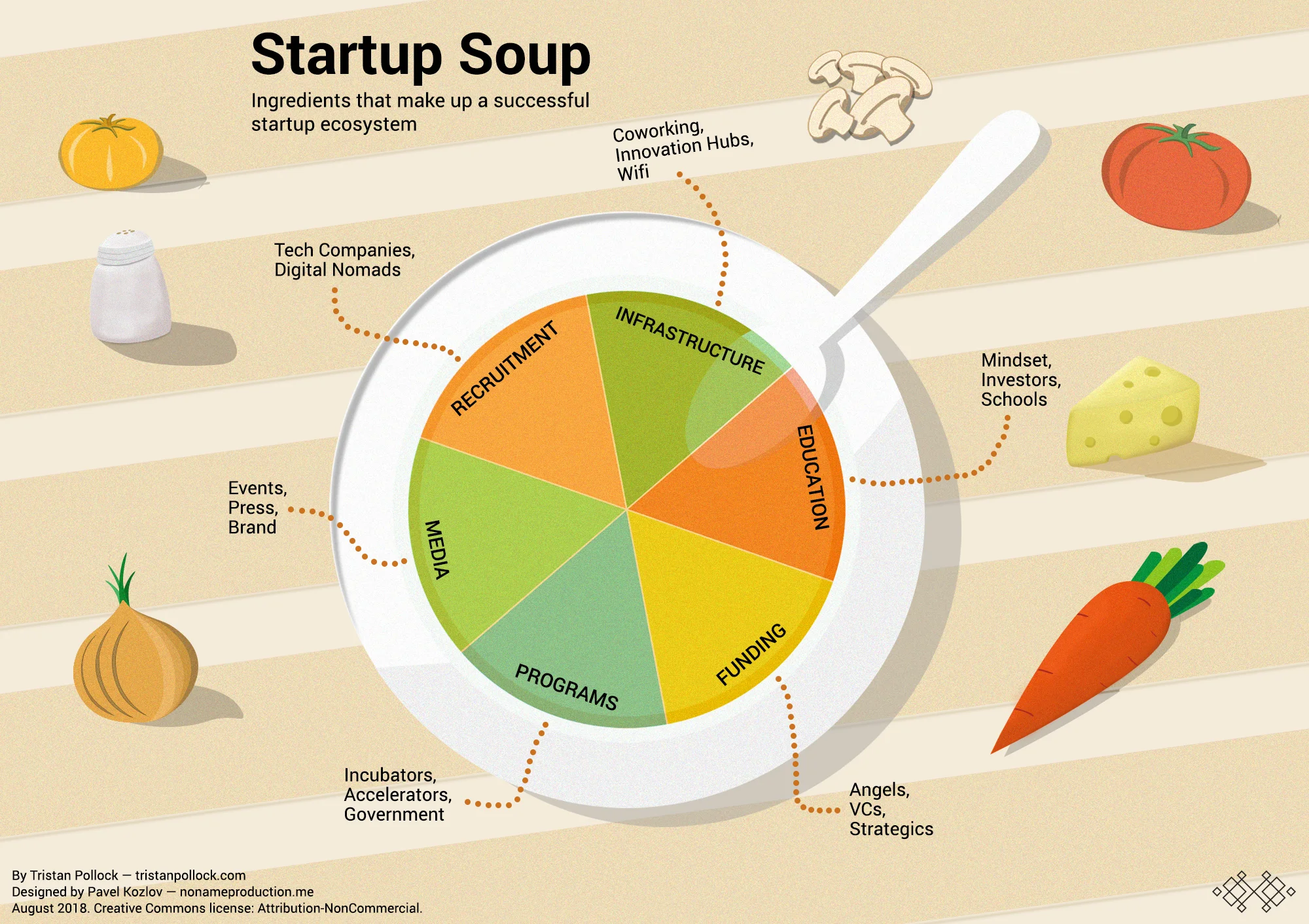

What Startup Soup Looks Like

Successful cities are a mixing pot of people. So goes the Startup Soup in a city. This infographic shows the key components that can support a growing startup ecosystem. With strong entrepreneur-centric initiatives and early-stage investor education, cities and countries can find their niche in the tech world.

So, let’s look at each of these ingredients a little closer to explain in more detail what a region needs to do to truly create an ecosystem that works.

Education. This is the middle mindset of the soup, because it spans every party involved. Investor education about startup investing, entrepreneurial education, developer training via universities and bootcamps. The startup mentality needs to be spread collaboratively and meshed collectively. This can come from experienced entrepreneurs locally as well as from visiting founders and investors. Think about values such as risk taking, failure acceptance, lean startup, smoke testing, fair equity compensation, and so on.

Media. Stories need to be told of the ecosystem partners, startup opportunities, startup successes, and tech events. They should be in both English and the local language to bridge the gap. Also, branding the startup scene means branding a country’s image. I like to use the example of Minnesota rebranding as “The North” of the United States.

Recruitment. To build a tech scene faster you need to recruit the right players. Think big technology companies that are expanding globally and need regional offices. Digital nomads are another focus. Try to move your country or city up ‘best places to live and work’ lists, such as NomadList. You can also consider entrepreneurial visitation programs like Brisbane or Vermont are doing. Even bringing in big startup players like 500 Startups and Techstars is a goal to set your eyes on.

Infrastructure. Coworking spaces, technology and business parks, and innovation hubs all centralize the startup community, which allows for more collaborative collisions. That’s what makes the startup scene work. Also, consider the Internet speeds and other technical infrastructure that builds efficiency to any startup system. Without being competitive with basic startup needs you won’t even be a second thought.

Programs. From incubators to accelerators to corporate startup programs, there’s a right mix to support your local startups. You don’t want so many programs that it discourages growing revenue in lieu of government handouts, but you also need to help startup founders at the earliest level and support each level after (i.e. concept, MVP, early stage, growth stage).

Funding. Funding also needs to be spread evenly across the startup lifecycle. Venture capitalists and venture funds like to come in at early to late stage. Angels have some overlap, but also invest earlier. Corporations may run an accelerator program, or only write big checks. Whatever the reasoning, you need the right mix of funding and players to create an environment where you help grow successful and big companies locally.

The perfect percentage of each ingredient is. It’s a balance and a path. You must lay the groundwork at the earlier stages in order to build to the later stages of ecosystem development. Some ecosystems need to instill a lean startup mentality and do away with Tall Poppy Syndrome (the idea that those who stand out and take risks are shunned by the community). Some ecosystems need more tech talent from their local universities. Most need early-stage funding to support entrepreneurs.

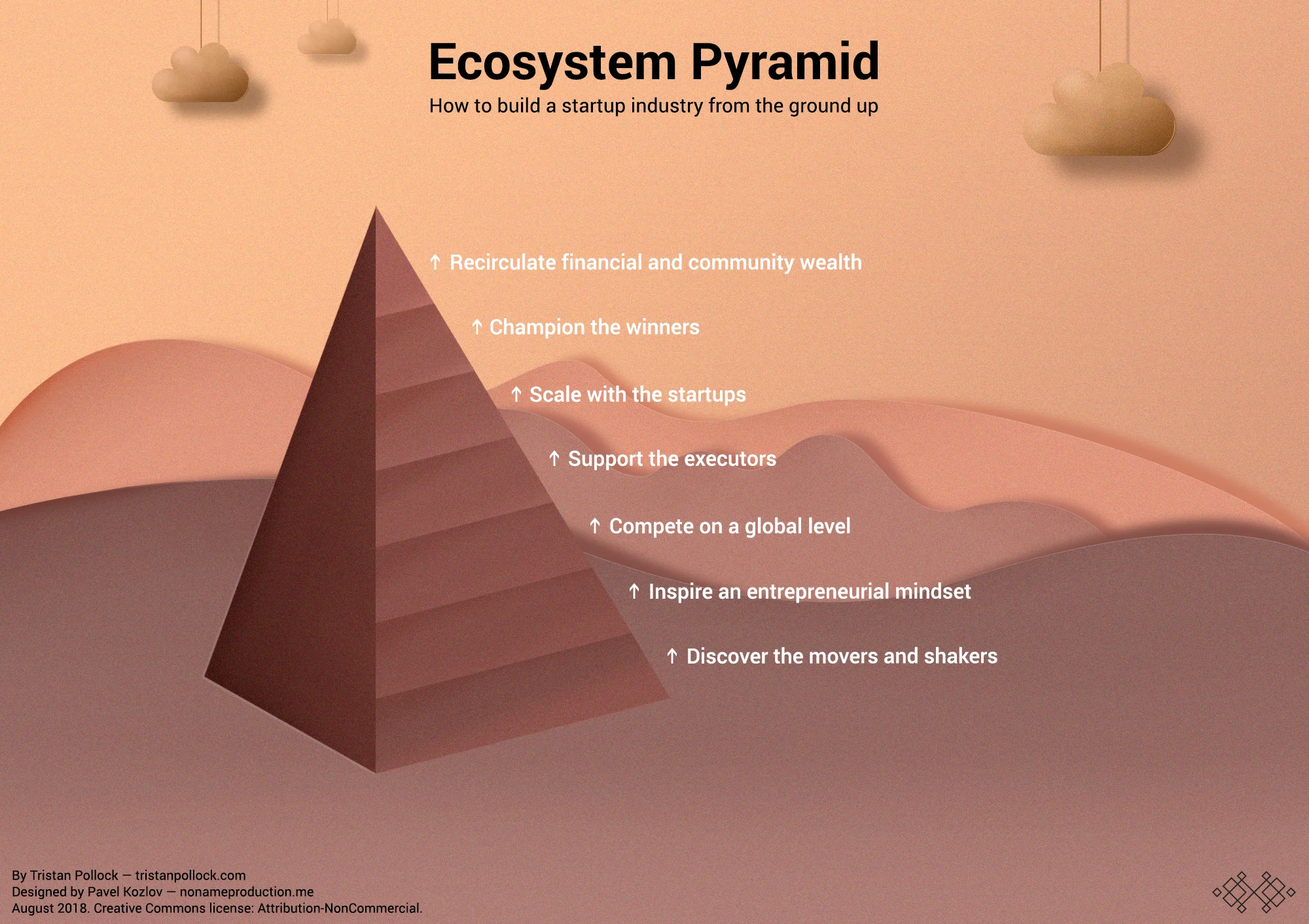

Stages:

Discover the movers and shakers

Inspire an entrepreneurial mindset

Compete on a global level

Support the executors

Scale with the startups

Champion the winners

Recirculate financial and community wealth

It's just a matter of time before the pendulum swings to technology specializations all over the world. It's already happening in Japan with robotics, Rwanda with drones, Hong Kong with fintech, and the list goes on.

The idea of geographic niches is an especially important factor to note. Every ecosystem has a unique industry and cultural background that should be explored first and foremost. It’s what tells the region’s story and where it’s seen success. Most likely this brand, the products and services that make a country a country, is also valued beyond its borders. It will attract those who see themselves in the reflection and thus should be leaned into.

As I sit here in Tirana, Albania I see the history as well as the growth of agriculture and tourism. It’s a stunning natural country, much like Croatia but still undiscovered, that has unique factors (like a 40-year North Korea-like dictatorship that ended in 1991) that have kept this land a secret. The history isn’t glamorous, but it has kept big ag out and thus the variety and tastes of fruits and vegetables is incredible. It’s also opened up for adventurers to discover the many castles, mountains, forests, waters and other hidden treasures that outsiders weren’t aware of before. Enter innovation and rapid expansion in the tourism industry.

Albania is an example that is close to home and heart for me right now, but you can apply the same context to other countries and regions who are being true to their authentic selves. There comes a true opportunity inside that uniqueness. The real question is, who will find it next?

Thank you to Clayton Bryan, Arjun Ahora, Swiss Contact and everyone else who inspired this article.

Tristan Pollock is an American entrepreneur and investor. He has been building startup ecosystems for the last decade from Minnesota to New Zealand to San Francisco and now Moscow. Tristan’s background includes building and selling two startups, investing in 218 startups as a venture partner at 500 Startups, and being named Forbes 30 under 30. He’s currently traveling around the world with his soul partner in life, Danyelle, helping startups wherever they are and sharing their stories via WeDidThat. You can say hello to him on Twitter or view all his writing at TristanToday.com.