Regulatory change management is a component of governance, risk and compliance. In its simplest definition, regulatory change management is the management of “regulatory, policy, and or procedure changes that apply to your organisation for your industry”.

But there’s a problem. The number of financial regulations in existence is reaching overwhelming levels, with different regions and regulators publishing policies on an increasingly regular basis: GDPR and the California Consumer Privacy Act are just two major regulations that businesses have to comply with.

To identify the scale of the problem, JWG — a London-based think tank focusing on regulations — has estimated that over 300 million pages of regulatory documents will be published by 2020, and over 600 legislative initiatives will need to be catalogued by a medium-sized sell-side institution.

The serviceable addressable market for RegTech in the financial sector, in the US, is $5 billion.

The regulatory change management challenge

This is the challenge; the volume and pace of regulatory change facing the financial services industry (let alone every other industry) is reaching unmanageable levels. “It’s tedious, manual and expensive,” explained Kayvan Alikhani, CEO and co-founder of Compliance.ai.

There are so many different institutions releasing regulation policies, and in financial services, this phenomenon is shared across AML, KYC, mortgage lending, commercial lending and more. “The ever-increasing volume of regulation content being published is too much to keep up with,” continued Alikhani in Compliance.ai’s headquarters in San Francisco.

What’s changed? Ten years ago, the ability to manage regulatory requirements was easy, but now with the emergence of things like crowdfunding and initial coin offerings, the landscape is much more complex and fast-paced — this is the main driver for the adoption of RegTech solutions.

Trying to address this, companies are spending a lot of time, money and labour on reading the regulation and determining whether it’s relevant to them. This status-quo approach of throwing bodies at regulation and compliance is not working, it’s inefficient and costly. But, the financial and reputational consequences of ignoring the modern regulation challenge are not worth it. Globally, there have been $342 billion in banking fines and $850 billion erased in profits.

Currently, “many financial services organisations are using Excel to manage regulatory changes, which is not appropriate. Compliance is not a cost centre” — Alikhani.

Is there a solution or a modern approach to regulatory change management?

Modern regulatory change management: the solution

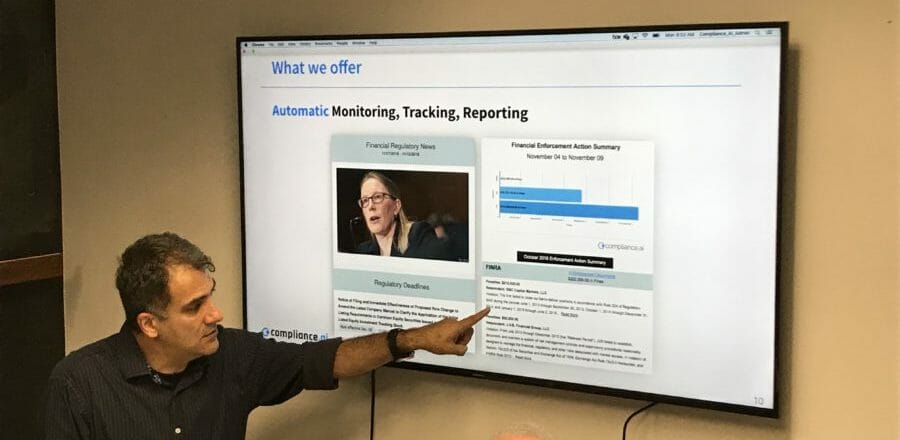

Compliance.ai offers a solution for financial services organisations, allowing them to manage the overwhelming level of regulations coming at them from all corners of the globe.

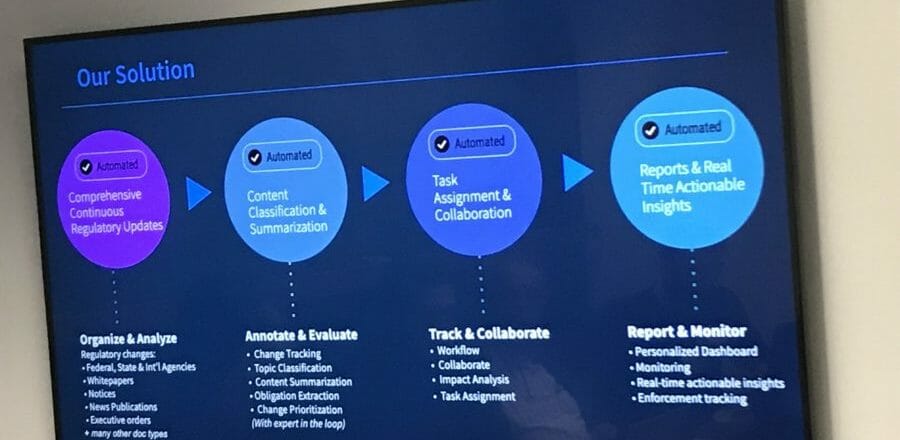

The cloud-based, automated SaaS platform provides:

1. Comprehensive and continuous regulatory updates: effectively an automatic data collection process that analyses regulatory policies, whitepapers, notices, news publications, executive orders and many other document types.

2. Content classification and summarisation: the platform helps dissect the lengthy regulatory documents and identifies the listed obligations (what must be done); “our AI extracts key obligations within minutes, instead of a group of lawyers that could take months,” said Alikhani.

3. Task assignment and collaboration: the platform then advises Who does what; workflow, collaboration and risk analysis. It automates the process of task assignment.

4. Reports and real-time actionable insights: the personalised dashboard then produces actionable insights; what needs to happen, how many regulatory changes, how many changes are relevant to my business etcetera.

This ‘expert in the loop approach’ uses AI used to determine which regulation changes are relevant to the business and to what area of the business. It’s based on ML and modelling and continually learns via neural networks to provide a real-time, modern approach to regulatory change management.

Who cares? Chief compliance officers, regulation change managers and regulation consultants have emerged in recent years, asking; is this regulation relevant to my company and if so, what aspect of my business will it impact?

It should be noted that Compliance.ai serves regulatory management, not the individuals who actually make the change to a company’s policies. The solution identifies what needs changing and how to change it. It’s a machine learning platform that produces regulatory intelligence.

“We’re extracting the law from the regulatory documents, not generating any narrative,” said Alikhani.

Investment in regulatory technology expected to grow, but manual processes leave firms exposed

Time to value

The time to value is rapid and there is not a lot of onboarding — organisations can get value and intelligence quickly, leading to the next step, which is; if I know a policy has changed, then my organisation can update it.

Not a black box

Importantly, this is not a black box solution. Dealing with regulators, banks and other financial institutions have to be able to explain how it came to a decision. “It must be transparent, explainable and audible,” confirmed Alikhani.

Use case

Providing an example of how the platform could introduce a modern approach to regulatory change management, Alikhani explained that the solution can create savings on the number of people an organisation needs to hire in order to adhere to regulation changes.

“Compliance.ai can advise how many people are needed in your regulatory department to effectively cope with the changes needed based on the updated regulatory requirements,” he said. The business can then hire or refocus individuals accordingly.

Related articles

The governance, risk and compliance landscape is changing

Regulatory compliance: data management and the EU-US privacy shield

Increasing governance and compliance burdens must be addressed by an effective GRC solution

Updating RegTech trends for what really matters in 2019