At the end of November 2012, Atul Kapadia and Sujeet Kumar hosted the staff of their startup company for a holiday lunch of Mexican food at a Palo Alto, California restaurant. For days, the pair—the CEO and CTO, respectively, of a lithium-ion battery company called Envia Systems—had awaited an email from General Motors.

It was to contain a deal rare to an industry newcomer—a contract worth tens and possibly hundreds of millions of dollars to provide the electric central nervous system for two showcase GM models including the next-generation Chevy Volt. Untested small suppliers almost never get in the door of the world’s major automakers, which regard them as too risky to rely on. But GM was won over by what seemed to be the world’s best lithium-ion battery—a cell that, if all went well, would catapult the company to a commanding position in the industry with a middle-class electric car that traveled 200 miles on a single charge and rid motorists of the “range anxiety” that disquieted them about such vehicles. GM would have the jump on the high-end Tesla S, the only other major model with that range but one that would cost much more. For Envia, the contract could lead to an IPO that would make both men rich.

But the talking had gone on so long and with such uncertainty that neither man had even told Envia’s staff scientists of the impending deal. Even if they felt more confident, they could not have said anything, since such news could affect GM’s share price. Word had leaked around the Envia lab anyway. An edginess hung over the lunch.

Kapadia’s cell phone rang as he drove back from the holiday party. It was General Motors: Senior management had finally signed the documents. They were on their way by email. Kapadia turned off the phone but tried not to let on.

Back at Envia, situated across the bay in the industrial city of Newark, company employees gathered in the conference room for a regularly scheduled office meeting. Kapadia stood before some papers. He said it was the company’s first licensing deal, one involving the biggest and most prestigious possible customer of all—General Motors.

“Just to let you know this is not my achievement. This is your achievement,” the CEO said. “And I am signing on behalf of you.” The room erupted as Kapadia bent over and initialed the papers. Envia’s three-dozen scientists and business staff sounded like 200. They cat-called and screamed. The administrative staff jumped up and down.

A year later, the deal is in tatters, GM has accused Envia of misrepresenting its technology, and a document suggests why the carmaker may be right. The startup’s unraveling is a blow for GM as it transitions to a new regime next month under CEO-designate Mary Barra, setting back its ambitions in the potentially gigantic future electric-car industry. It also risks making Envia, the recipient of several small federal grants, another punching bag for critics of US government funding of advanced battery companies.

Envia meanwhile is mired in two angry civil suits and the two executives are at daggers drawn, with Kapadia accusing Kumar of fraud and intellectual property theft, and Kumar dismissing the allegations as the rants of an ousted executive who performed badly. Envia “was an illusion,” alleges Michael Pak, the plaintiff in an IP theft suit against Kumar. “While the illusion is there, you can sell the company and run away. But illusion doesn’t last forever.”

The Great Battery Race

Four years ago, the US and China set in motion a race for dominance of electric vehicles. At the cusp of two crises—the collapse of Detroit and of the global financial industry—lithium-ion batteries and electric cars seemed among the likeliest chances for driving the kind of fast economic growth that the high-tech and semiconductor industries had led in the past. President Barack Obama declared that the US would have one million electric vehicles on the road in 2015, and China vowed to accomplish the same. Both envisioned besting Japan, which had established an early lead with Toyota’s Prius, along with consumer-product juggernaut South Korea.

Central to Obama’s calculus was the creation of a lithium-ion battery manufacturing industry, an aim that Congress primed with $2 billion of direct stimulus grants and an additional $400 million for Arpa-E, a funding unit for frontier innovation within the Department of Energy. First invented in 1800, batteries are an old technology, but the financial stakes should anyone crack their confounding physics have resulted in waves of unusually motivated scientists, industrial leaders and politicians. A breakthrough in batteries could not only allow cars to go farther, but smartphones and emerging wearable devices such as smart watches to last longer, and solar and wind generators to better store the power they produce.

Seeming to effortlessly navigate the bewildering juncture of big science, big business and big geopolitics, Envia was a showcase success for Arpa-E. It was one of the most promising of a clutch of electric-car battery startups that won federal grants, and the GM deal was one of the highest-level endorsements possible for its technology.

This story is the product of dozens of interviews that I conducted with Kumar, Kapadia and their staff members over the last two years, in addition to the lawsuits filed in recent weeks.

An immigrant’s story

Kumar, the Envia CTO, grew up in the eastern Indian city of Patna, the pampered youngest son of a civil engineer. Frequent blackouts meant that Kumar studied by kerosene lamp at night, and when he was accepted to a doctoral program in materials science at the University of Rochester, it was the first time anyone in the family had studied abroad. Kumar describes arriving penniless in New York in 1990 on his way to a full, four-year scholarship, a $1,000-a-month stipend and a series of campus jobs.

When he graduated in 1996, Kumar’s only offer was in Silicon Valley, where he became the first employee of NanoGram, an East Bay battery-and-electronics development startup. A decade, some cashed-in stock options and a few changes-of-hands later, he was hired to lead a development team from scratch at NanoeXa, a lithium-ion battery startup founded by Pak, a South Korean-born entrepreneur. Those who knew Kumar found him to have an intuitive grasp of electrochemistry. And, in an industry characterized by an unusual degree of exaggeration, he was “a man of his word,” according to a scientist who met him at the time. “He would do what he said.”

The first task was to find potentially winning intellectual property around which to build NanoeXa. When it comes to innovation in battery development, there are three main options—you can improve the anode, the cathode or the electrolyte. The anode and cathode are the negative and positive electrodes between which the lithium shuttles, the act that creates electricity. The electrolyte sits in the middle and facilitates this shuttling motion. The ideal battery will first hold a lot of lithium and then send as much as possible of it into the shuttling motion without causing the especially sensitive cathode to collapse. If you can do those two things, your car will go a long distance.

An additional plus for electric car batteries is the ability to draw out the lithium fast—that is the power that allows a driver to speed up immediately on depressing the accelerator. But these traits tend to work against each other—you can pack in a lot of lithium, but only draw it out of the two electrodes slowly, which means that you can drive non-stop between New York and Washington, but may be in trouble if you need to quickly maneuver out of someone’s way. Or you can choose the alternative—you can generally accelerate fast, but go only a relatively short distance on a single charge. On top of these features, you would like your battery not to catch fire, a non-negotiable requirement, especially when it comes to consumer batteries. That is where the electrolyte comes in—depending on the additive, it can reduce the tendency for the volatile technology to burst into flames.

NanoeXa aimed its IP search on the cathode, where the easiest performance gains are achievable since they still have far to go to catch up to the capacity of the standard graphite anode. Kumar and the company’s early team perused patents and journal papers and consulted experts before settling on a promising cathode invented by Argonne National Laboratory outside Chicago. The cathode combined nickel, manganese and cobalt into an exceptional composite that astonishingly had not attracted a single licensee. NanoeXa became the first customer for the chemistry, which is called NMC for short.

What Kumar noticed was that NMC possessed all the necessary traits. Workhorse batteries based on lithium-cobalt-oxide chemistry—the type contained in most AA and laptop batteries—deliver around 150 milliamp-hours of specific capacity per gram (a measure of how densely they can store electricity). But Argonne researchers had managed at lab scale to push an exotic formulation of NMC to 250 and even 280 milliamp hours per gram, a 66% jump. The composition also provided pep—the lithium could be shuttled fast. And, made with manganese, NMC is one of the safest lithium-ion formulations; lithium-cobalt-oxide is much more prone to catching fire.

When you license an invention from a national lab, what you generally receive is not a working technology but rights to a relatively raw, bench-scale patent that must be built up into a commercial product. That was what NMC was—it needed to be optimized in the lab. But, all in all, Argonne’s NMC composite seemed to be a top candidate to enable an electric car that could begin to compete with the economics of incumbent gasoline-fueled vehicles.

Kumar decides to create his own startup

About a year later, Kumar resigned. As justification, Pak said in an interview, Kumar cited personal differences with him. The 2007 departure was a shock for NanoeXa, which was left “in chaos,” Pak said. “Without any notice, my main engineering guy left. I was counting on him a lot.” Kumar gave assurances that he would not compete with NanoeXa using NMC technology, but instead would seek employment “in another company,” Pak said.

But Kumar and a NanoeXa colleague, Mike Sinkula, had in fact decided to form their own lithium-ion battery startup. They describe holing up immediately at Palo Alto Library, where they began to make cellphone calls, send emails and put together a slide deck to raise about $3 million in venture capital to fund a team that would produce a prototype. The basis of their pitch was a fresh NMC term sheet that Kumar had negotiated with Argonne. Kumar and Sinkula would not say so publicly for awhile, but they intended to make a go using the same technology as NanoeXa and in pursuit of the same market—electric automobiles.

Kumar and Sinkula were entering the lithium-ion battery business at the cusp of a rush of inventors and capital into renewable energy generally and energy storage in particular. At MIT, Berkeley, Stanford, the national labs and universities around the world, attention turned to a new era when it was thought that the electric car could finally be adapted to mass use. The push coincided with an eagerness by governments and private investment funds to get behind such new inventions.

Kumar did not reply to emails and SMS messages requesting comment for this article. In a statement, Envia denied that Kumar wrongfully took anything from NanoeXa. After the exchange of a few emails, Envia’s public-relations firm said in an email, “Due to the highly litigious nature of this case, I have been instructed by counsel to provide no further comment.”

What Pak’s civil suit alleges is that, in venturing into this fresh opportunity, Kumar took with him NanoeXa’s year of work on enabling NMC, in addition to its marketing strategy, downloading the information from his work computer onto an external memory device. In essence, NanoeXa was the source of the core of Kumar’s product and business strategy for what was to become Envia, according to Pak.

Among Kumar’s first calls was to Kapadia, whose wife had attended Rochester with the battery man. The Mumbai-born Kapadia is a bookish Stanford MBA with a steady, quiet patter who worked as an engineer at Sun Microsystems before moving to an establishment Palo Alto venture firm called Bay Partners. According to Kapadia’s account, he was so impressed with Kumar that it almost did not matter how much he wanted—he was eager to invest in him. Two hours later, he called Kumar and said he would arrange the entire $3.2 million that Kumar sought.

In the summer of 2007, Bay ended up investing alongside Redpoint Ventures, another Silicon Valley firm whose earlier investments included Juniper Networks and Netflix. They sent Kumar a check for $500,000 so he and Sinkula could get going before the rest of the money worked through the funding system. Sinkula proposed a name for the company: “En” for energy, and “via,” the Spanish for “way”—the way to energy.

Over the next two years, Kumar and Sinkula worked their way into paid research work for potential licensees including Honda and GM. They announced what they said was an optimized version of the NMC, which they trademarked as a “High Capacity Manganese Rich” cathode. This was the beginning stages of the slow, years-long process of establishing a supplier relationship with one of the major auto companies.

Bay and Redpoint invested another $7 million in the company a year or so after the first tranche. But the startup was burning through the cash while potential customers were slow to commit. In 2009, while vacationing with his family in India, Kapadia received a call from Kumar: Come back and help to save Envia. As the two executives told the story in their good days, Kapadia had assured Kumar from the outset that he would always be there if he was needed. Kapadia flew back and, pressed by both Kumar and a couple of board members, he agreed to become CEO.

About the same time, Kumar heard about a competition organized by Arpa-E, the Department of Energy’s new research funding unit. It would be Arpa-E’s first set of grants for ideas promising profound leaps in energy technology. They would range from $500,000 to $10 million and confer considerable prestige on the winners.

Kumar thought that his best chance to win one was to twin his in-house cathode with an anode made of a silicon composite. The combination could be the most powerful electric-car battery in the world.

Revolutionizing the second battery electrode

The Obama Administration’s investments in the US battery industry were bearing their first fruits. A123 Systems, an MIT lithium-ion battery startup, became the biggest IPO of 2009 after winning $249 million in matching federal stimulus money for a factory in Livonia, Michigan. EnerDel won $118 million for an Indiana battery plant. But they and other battery researchers and companies were paying so much attention to the cathode that now it was time to turn to potential advances in the anode, the negative electrode.

The anode is the staging point for the lithium. When a battery is being discharged–for instance when it is propelling an electric car–the lithium moves from the anode to the cathode. When it is being charged, the lithium moves back to the anode, where it is absorbed. Anodes are judged by how much lithium they can store and the rate at which it can be extracted, delivering distance and acceleration. Now, a competition began to improve the anode, and Kumar wanted to play.

The graphite anode was invented by Bell Labs in the 1970s. One of the leading ideas was to replace it with an anode made of silicon, a metal that could absorb a much larger ratio of lithium. Next to pure lithium metal, silicon was the most powerful possible anode. Such an anode had the potential to perform an order of magnitude better than graphite, whose specific capacity was about 400 milliamp hours per gram. In practical use, the anode would not deliver 10 times the capacity of graphite, but researchers thought that with work, it could produce about 1,400 milliamp hours per gram, which would more than triple the standard anode’s performance.

But silicon has a problem. For practical use in an automobile, you need an anode to last for at least 1,000 charge-discharge cycles before the battery needs replacing. But as you move lithium into a silicon anode, it expands tremendously. Graphite also expands, but nowhere near as much as silicon, which blows up three or four times in size. Quickly, it pulverizes and kills the battery.

Argonne National Lab, the source of Kumar’s cathode, now had an interesting concept for silicon. So Kumar applied for the Arpa-E competition in collaboration with Argonne. Their joint submission said that if you started with Envia’s High Capacity Manganese Rich cathode, you would achieve energy density of about 280 watt-hours per kilogram, another measure used to evaluate batteries and their electrodes. When you coupled it with a silicon-carbon anode, you could get a 400-watt-hour-per-kilogram battery, sufficient to power a car 300 miles on a single charge at half the cost of current technology, eclipsing every model on the market. That seemed to Kumar to meet Arpa-E’s requirement for a transformational breakthrough.

In all, Arpa-E received some 3,700 submissions. Thirty-seven, or 1%, were selected. Envia was among them. It won a $4 million Arpa-E grant for the work to be carried out jointly with Argonne.

In February 2012, Arpa-E director Arun Majumdar spoke to a hushed audience in a large, darkened hall at the Gaylord Convention Center outside Washington (video 11:53). It was the third annual Arpa-E Summit, which had already heard introductory remarks by former president Bill Clinton and Microsoft co-founder Bill Gates.

Majumdar projected a slide on three gigantic screens. It was Kumar and his Envia team. Envia, he said, had just reported (pdf) the achievement of “the world record in energy density of a rechargeable lithium-ion battery.” It had produced a prototype car battery cell that demonstrated energy density between 378 and 418 watt-hours per kilogram. Envia said the achievement had been validated by Crane, the Indiana-based testing facility of the US Naval Surface Warfare Center, which cycled the cell 22 times. In testimony the next month before Congress, Majumdar said the battery is “not yet ready for prime time. But if we were to use the Envia battery today, it would cut the battery cost by half and they are trying to reduce the cost even further.”

The announcement triggered a stir in the industry and the media. Such a cell—if proven in an actual electric-car battery pack—would be an enormous breakthrough that could change the market. By stuffing in more energy and reducing battery costs so significantly, cars could travel much further and high prices could come down. Kapadia, as Envia’s new CEO, was deluged with calls. One reporter declared the startup “the Golden Child” of the summit. Scientific American recalled Envia’s humble beginnings in the Palo Alto Library. Among those listening, including General Motors, there seemed to be much more focus on Majumdar’s second sentence and not the first: The allure of a cost-competitive electric car had obscured the question of how close the battery was to commercial availability.

Breaking into GM

One thing that makes car companies economically powerful is that they outsource virtually everything. Dollars spent on a car move through the economy into countless large and small parts and component suppliers in the US. Quality control is therefore one of Detroit’s biggest tasks. The big carmakers rely almost entirely on incumbent suppliers with long histories of reliability, so that new models are close to flawless at launch and public-relations disasters are minimized. In the case of lithium-ion batteries—volatile technologies, liable to catch fire—the carmakers contract exclusively with big Japanese and South Korean chemical companies with decades-long track records. New firms, regardless of the quality of their product, can rarely withstand the scrutiny required to win these multi-billion-dollar contracts.

GM had even greater reason for caution: In 2008, the company was forced into bankruptcy and required a $49 billion federal bailout in order to regroup. The government came to own 61% of the company. Two years later, GM, now out of bankruptcy, held a $20 billion IPO and began again to earn money. In 2011, it trumpeted its return to the leading edge of mainstream carmaking by launching the Volt, a plug-in hybrid that Motor Trend magazine named its Car of the Year. But it remained highly cautious and defensive about its continued reliance on government capital.

The Volt’s battery was supplied by South Korea’s LG Chemical. But in 2009, GM’s research division began to take a look at Envia and asked for a sample of its cathode. The results were not perfect—the Envia battery failed to pass muster on a couple of metrics. But it performed well enough that the following year, GM’s ventures unit led a $17 million fundraising round for Envia; GM itself put in $7 million and Jon Lauckner, its ventures chief and future CTO, took a seat as an observer on the board.

GM said it would allow no employee to speak to Quartz for this article and direct emails sent to executives went unanswered. But GM employees interviewed over the last couple of years said the opinion of the engineers in such supply cases usually trumps everyone else’s since they are ultimately responsible should anything go wrong with a vehicle. And GM’s engineers recommended that, for the sake of reliability, the carmaker continue its supply relationship with LG for the Volt’s battery, according to a source familiar with this internal debate.

That made it remarkable when, after the Arpa-E Summit, GM began to negotiate a deal to license Envia’s batteries for two critically important new models. GM’s R&D and venture units had prevailed over the engineers.

Under the proposed contract, Envia would provide a cathode for the next-generation Volt, to be launched in the 2015 model year, that would cut 30% off the cost of the current battery technology. GM loses money on each Volt it sells, and such a shift in economics could make the next-generation version profitable. Envia was also to provide the complete Arpa-E battery cells for an electric car that could go 200 miles on a single charge in 2016. (When you scale up a laboratory-size 300-mile battery into a full electric-car pack, then account for GM’s usual margin of error, you end up with approximately a 200-mile car.)

Crucially for Envia, it would receive $2 million a quarter from GM, adding up to $8 million a year for at least four years. That money was sufficient to pay all of the startup’s bills, representing its entire burn rate. On top of that would be royalties once the cars began to be manufactured. Depending on car sales, the contract could be worth hundreds of millions of dollars.

The November 2012 contract was a triumph not just for Envia but for Arpa-E, none of whose other investments had yet turned into commercial products. US energy secretary Steven Chu remarked on the deal between GM and Envia publicly (video).

The draft contract went on to be quite specific: For the 200-mile car, Envia was to provide a working battery delivering around 350 watt-hours per kilogram that could endure 1,000 charge-discharge cycles. The requirement was not 400 watt-hours per kilogram—again, what you achieved in a lab could never be matched when you scaled up to the battery pack that actually went into a car. But it remained a tremendous challenge since Kumar still had to overcome the silicon expansion on the anode side, in addition to flaws in the cathode.

Kumar’s deadline for the 200-mile battery was October 2013. After that, adjustments could be made to optimize the performance until Aug. 15, 2014. But that was a full-stop deadline—Kumar could make no changes to the battery after the latter date. This point was critical to GM because once the battery was ready, all the other deadlines could follow, ending with the pure electric car’s actual launch in 2016.

In August 2012, GM CEO Dan Akerson described Envia’s exploits in a closed meeting with employees. Listening in was an Associated Press reporter, who was sitting alongside someone authorized to be on the conference call. “We’ve got better than a 50-50 chance to develop a car that will go to 200 miles on a charge,” Akerson said, according to the report. That car could be in GM’s fleet by 2016, he said, and if so it “would be a game changer.” “These little companies come out of nowhere and they surprise you,” Akerson said.

On Nov. 30, 2012, Kapadia signed the licensing agreement. Now Kumar spoke directly to his scientists. “The business guys have delivered. Now it is our time. The onus is on us,” he said. “There are no excuses. Get this done. Put the chemistry in the car.”

Much precious development time had been lost. Envia had hoped for a high-profile announcement that would push one or two other carmakers with which they had been working to sign licensing contracts as well. Kumar and Kapadia had hired Goldman Sachs to parlay the contracts into a sale of the company or an IPO, as A123 had done three years before. In the end, the Envia board’s decision was to seek an acquisition by a large company. The value under discussion was several hundred million dollars.

But given the stringent deadline, every day counted. GM decided to delay publicly announcing the deal. Instead, the carmaker rushed a planning team to Newark three days later—on Dec. 3—to create a quarter-by-quarter schedule of milestones that ended with delivery of the battery technology for its two signature models. As Envia hit each quarterly target, it would receive $2 million.

By the end of the following day, the two teams had agreed. The milestones were “pretty tough,” Kumar said at the time. “I would say the timeline is aggressive.” But he was also “very happy” with the contract. After the five years of work, Envia had arrived. The foundation stone was laid for large cash flow and a considerable fortune. The board was delighted. It awarded new stock options to 25 employees, about 45% of them to the three-man business team led by Kapadia.

“We cannot replicate the Arpa-E results”

While Kumar got started on the GM contract, Kapadia moved forward on the plan to sell the company. Goldman Sachs took the acquisition proposal to Asia, sending queries to, among other potential suitors, Japan’s Asahi Kasei and South Korea’s LG and Samsung.

But now that Kumar had seemed on his way to what he had coveted, it all began to unravel.

At the end of February 2013, Envia’s business development team received an urgent message from GM: Initial tests were complete on the 400-watt-hour-per-kilogram battery. But so far, they did not replicate the results announced at Arpa-E. Could Envia explain why?

Increasingly alarmed queries piled up from GM in phone calls and meetings. The Arpa-E results could not be reproduced—not by a long shot. Meeting a team from the carmaker on March 4, Kumar “struggled to allay GM’s concerns,” according to Kapadia’s lawsuit. A document provides a sense of why GM was concerned.

In reporting this article, Quartz asked Envia for the outside evaluation that underpinned its February 2012 claims for the Arpa-E cell—the one produced by the US Navy’s Crane Division. Rather than that evaluation, Envia sent a 20-page, subsequent Crane report that both summarized the earlier, Arpa-E validation and evaluated another cell of the same type.

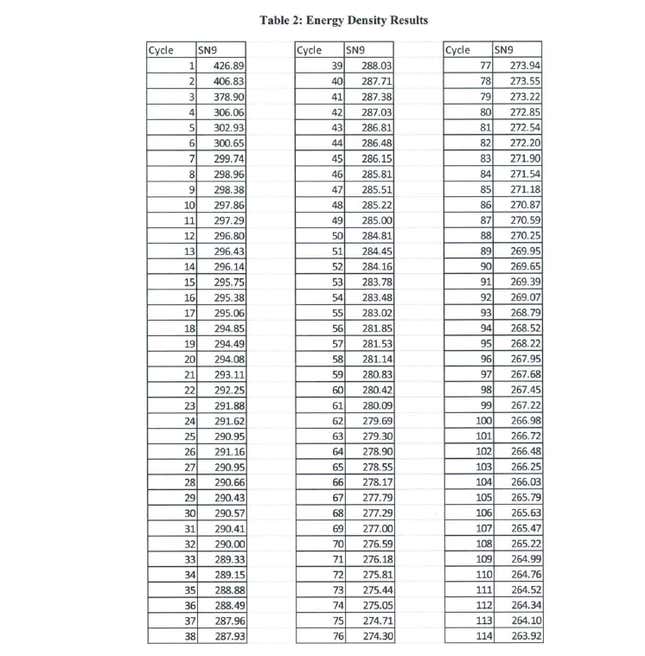

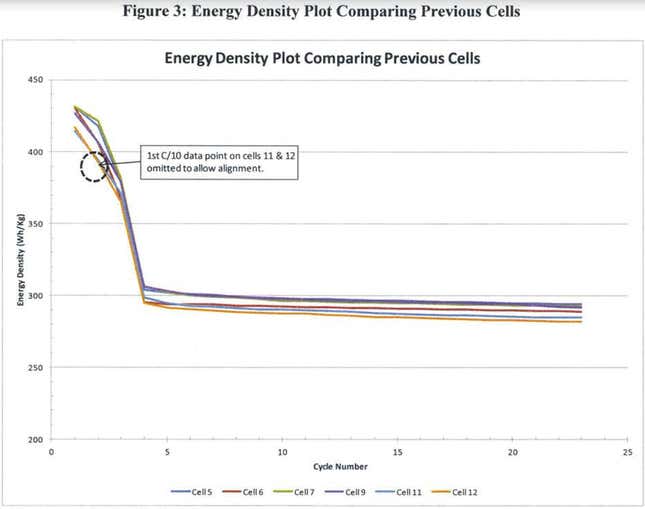

According to this report, dated June 28, 2012, Envia’s claim was accurate—its cell demonstrated energy density of 378 to 426 watt-hours per kilogram and had been put through 409 charge-discharge cycles. But the superlative energy density registered only in the first three cycles. After that, its performance plunged: By the 25th cycle, the density was down to 290 watt-hours per kilogram. At the 100th, it was at 266. At the 200th, it was below 250, and by the 300th at 237.

By the last charge-discharge cycle—the 409th—the cell’s energy density had fallen to 222 watt-hours per kilogram, or just 55% of the 400 that the startup had claimed. A chart showed that the result aligned with that found for the earlier Arpa-E cell that Crane Division had tested (see below). And the trend suggested no flattening out ahead, but that energy density would continue falling and become less than half of the claimed 400.

Jeff Dahn, head of battery research at Dalhousie University, said in an interview for this article that technically speaking, Envia was being truthful—the cell did produce 400 watt hours per kilogram and it did cycle the 300 times it claimed at Arpa-E. But for the many who presumed that Envia had delivered the record result for all 300 cycles, the announcement’s accuracy was only technical. “With battery people,” Dahn said, “you have to make sure that a statement applies to all parts of the sentence.”

GM was not impressed. In a March 14, 2013, letter to Envia, Matthus Joshua, head of purchasing for GM’s hybrid group, formally complained that the cell provided as part of the contract failed to meet the promised Arpa-E performance and that Envia had misrepresented its technology. Joshua “(demanded) an explanation of the performance deficiency relative to the one announced exactly a year prior,” Kapadia said in a lawsuit.

On March 26, the Envia and GM teams gathered for the first quarterly meeting of their new relationship. GM’s team—led by Joshua and Larry Nitz, head of engineering for GM’s hybrids—again raised the enormous discrepancy between the stated and actual performance of the Arpa-E cell. The Envia cell inexplicably could not match what the startup had announced.

Kumar responded with an offer—if GM were patient for another three months, he was confident he could deliver the promised result. The GM team agreed.

“Next cell—build or bust,” Nitz told him.

But the performance was only the beginning of the trouble at Envia. Over the prior weeks, Kapadia had become increasingly suspicious that the Arpa-E cell was in fact not entirely the startup’s intellectual property as claimed. A member of Kumar’s scientific team had raised that possibility—the silicon-carbon anode material, this scientist said, was purchased outside the company and was not Envia’s.

Confronted internally, Kumar denied the assertion, Kapadia said in his lawsuit. But on March 14—12 days prior to the meeting with GM—he conceded that the scientist was right, according to the suit. The cell reported to Arpa-E and sent to GM contained anode material purchased in a confidential deal from Shin-Etsu, a Japanese supplier.

Kumar said Shin-Etsu’s role was unimportant—the anode’s true value emerged in the processing steps he had developed that allowed the anode to cycle hundreds of times without shattering. Shin-Etsu, he said, was providing only the basic material with which he worked, according to the lawsuit and Envia itself. But Kapadia disagreed: If Envia said that the anode material was proprietary, as it had asserted to the industry at conferences, to the media and in the negotiation for its license with GM, it had to be so. If it was someone else’s—freely available for purchase—Envia had to explicitly disclose that fact. The anode material was, plain and simple, not Envia’s intellectual property, said Kapadia. And without the anode, the cell did not get to 400 watt-hours per kilogram; it didn’t even near it. Envia was no better than the crowd, and a 200-mile electric car really wasn’t possible.

The dispute grew into a massive internal row. Kumar and at least one board member—a small Envia investor named Purnesh Seegopaul, a partner with Vancouver-based Pangaea Ventures—were dismayed that Kapadia repeatedly committed his views to writing in messages to board members, according to the lawsuit. Any future buyer of Envia would presumably have to be given such internal correspondence during the due diligence process. Earlier in the year, Arun Majumdar, the Arpa-E director who had touted Envia’s reported breakthrough, joined the startup’s board of directors. The previous year, he had left the Department of Energy and joined Google. He was drawn into the discussion over Shin-Etsu as well.

According to Kapadia, Seegopaul seemed less concerned about the anode’s origins than that its discovery could upset the chances for his venture fund to cash out. Seegopaul did not respond to an email from Quartz and Envia declined to reply specifically to the assertion about him.

At this point, the board told Kapadia that his duties as CEO were henceforth narrowed—he was solely to attempt to sell the company and settle an outstanding lawsuit by Kumar’s former employer, NanoeXa’s Pak. Afterward, Kapadia’s employment with Envia would terminate.

Quashing Pak’s lawsuit seemed to be the easy part: Filed in 2012, it claimed that Envia’s cathode was stolen from NanoeXa, but Pak would not even identify what intellectual property had been pilfered, making it seem likely that a judge would dismiss the case.

Canceling the deal

Kumar said in an interview at the time that his team was “going crazy” attempting to replicate the Arpa-E results. He finally told GM about the purchase of Shin-Etsu’s anode material. After the news settled, Joshua and Nitz said they in fact did not care who produced it—as long as Kumar delivered the promised cell performance. Kumar continued to assure them that he would.

But Kumar told me that it was not a realistic aim in the timeframe required. If GM was willing to settle for 315 watt-hours per kilogram, he could meet the mark, but not 350, not unless the carmaker could wait another six months or a year. In other words, the material would not be ready for the 200-mile car that GM wanted to launch in 2016, but possibly the following year or the year after that.

Meanwhile, Goldman Sachs returned with gloomy news—no one appeared prepared to acquire Envia. According to Kapadia’s lawsuit, the word was out in the market that the startup’s products did not work well. Japan’s Asahi Kasei, the most likely buyer, had finally declined. So had LG and Samsung. Honda, which Envia had regarded as its second likely licensing deal after GM, declined to extend the joint-development agreement under which the two companies had collaborated until then. The talks with Honda were over.

On July 22, 2013, GM and Envia met for their second quarterly meeting. Kumar had not met the milestones promised for the Arpa-E material nor the second-generation 2015 Volt. GM’s Joshua was blunt. Kumar had “made material misrepresentations during contract negotiations,” he said. The Arpa-E results were not replicated and “the anode material is not Envia’s.” Nitz said Envia had earned “a failed grade for this quarter.” Kumar apologized, but the coveted contract seemed to be in peril.

Two weeks later, Envia received a letter from Joshua, who wrote:

Envia has failed to move the project forward or replicate the results on a timetable that could conceivably support the vehicle development process. In fact, Envia was unable even to replicate prior reported test results even when utilizing the third-party anode that had purportedly been utilized in the Arpa-E test battery.

GM, Joshua continued, was therefore “well within its rights to terminate the December 2012 agreement.”

Envia’s executives and board now saw no chance to salvage the contract. The deal that all hoped could lead to a substantial payoff was sure to be canceled. But the fallout could be worse if GM sued or demanded its money back.

On Aug. 28, Kapadia and a subordinate boarded a red-eye flight to Detroit. Meeting the next day at GM’s offices in the Detroit suburb of Warren, they confronted a “visibly and justifiably angry” Joshua and Nitz, according to Kapadia. Kapadia tried to appeal to their sense of decency. Envia had committed mistakes but the two companies should try “to mitigate the employment and immigration risk on the hard-working scientists at Envia who were likely to be adversely affected” if the startup collapsed, Kapadia argued.

Remarkably, the GM men agreed, according to sources involved with the deal. The GM executives signed a waiver relieving Envia of the threat of a lawsuit, the sources say. Also, Envia would be paid for the quarter and would not have to return any money already received. But the contract was canceled. GM was relinquishing its license to the Arpa-E material.

The fallout

On Aug. 30, 2013, Kapadia appeared before the board and announced the good news—there would be no suit nor immediate financial ruin. Hearing this, the board fired him along with his two subordinates. Seegopaul, the Pangaea investor, assumed Kapadia’s duties. In a meeting with Kapadia’s team nine months to the day after the deal was signed, Seegopaul said they had “done a poor job negotiating the GM agreement,” according to Kapadia’s lawsuit. Seegopaul said, “The milestones in the agreement were very demanding and … no company in the world could achieve them.”

Three months later, Kapadia and his two-man team filed their 52-page civil suit in Alameda County against Envia and Kumar personally alleging fraud, retaliation and wrongful termination. “We were only trying to do what was right,” Kapadia said.

The complaint borrowed much from the lawsuit filed last year by NanoeXa’s Pak. When examined together, the suits allege that Envia, while claiming to be marketing proprietary technology, in fact relied almost entirely on IP that it either stole or appropriated without attribution from other companies. In terms of the cathode, Kapadia alleged that Kumar downloaded about 100 files at NanoeXa, including a flurry in his last days and hours at the company. In an interview, Pak put his hand on a stack of papers that he described as the product of a private forensic investigator who examined Kumar’s work computer. Pak said he has shown the files to federal and Alameda County prosecutors.

The men have different aims. Kapadia says he is seeking financial damages but that he will donate any award to an as-yet unidentified charity. Pak says he is looking for “punishment of someone who did wrong,” and suggests that means a criminal penalty for Kumar.

Envia has responded with great caution. It hired Sitrick and Co., a crisis management firm, which for a day released a series of statements and documents. Kapadia’s lawsuit, Sitrick said, “is nothing more than the spurious allegations of three disgruntled former employees.” A second statement attacked the rationale behind GM’s cancellation of the contract. The Arpa-E cell was never intended for development into a product, but “to establish proof of concept.” The next step was to turn the Arpa-E cell to the “R&D cell stage and then, later, to produce the battery for commercial use.” In addition, Envia bought “silicon-based raw material from multiple suppliers,” and not a “fully developed anode.” This was done “with full knowledge of Arpa-E.” Then Sitrick said it would have no further statements.

Over Thai food with me three weeks after their fallout, Kumar blamed the mess on Kapadia. During the entire negotiation, he said, Kapadia had run “a black-box operation.” Within Envia, only Kapadia and his business team were privy to the details of the GM deal. The business team had committed Envia to unrealistic milestones and Kumar to an unattainable timeline. The chances for an IPO or an acquisition were likewise squandered. “When something gets achieved, you see the CEO on CNBC. When it goes wrong, you blame the technology guys,” Kumar said, his arms crossed. “They get the commission, we get the blame. It’s always like that.”

Key elements of Envia’s and Kumar’s explanations contradict the record. Internal emails showed that Kapadia’s team checked the technological commitments and timeline with Kumar, who approved them. In Envia’s announcement of the Arpa-E breakthrough on Feb. 27, 2012, Kumar said, “Rather than just a proof-of-concept of energy density, I am pleased that our team was successful in actually delivering 400 [watt-hour per kilogram] automotive grade 45 [ampere-hour] lithium-ion rechargeable cells.” The same news release spoke of “Envia’s proprietary Si-C (silicon-carbon) anode.” Contrary to what Sitrick claimed on behalf of Envia, Kumar was suggesting that he was ready to develop his prototype into a commercial product.

In canceling the contract, GM made it plain that it expected a product that would be put directly into the two vehicles. In an Aug. 8, 2013, letter to the startup, GM said the contract was “predicated on a number of statements and representations made by Envia and Envia’s representatives that, in retrospect and in light of more recent statements by Envia, appear to have been inaccurate and misleading.”

Life after Envia

When the subject of Envia arose over the last couple of years, GM executives would express enthusiasm but add that they never bet everything on a single technology. The stakes are too high, they would say, suggesting that the company was not depending solely on Envia for the next-generation Volt and the 200-mile electric car. That is rational, and it is true that GM rapidly cut its operative ties with Envia, relinquishing the license to the Arpa-E material, which a cool head might have retained in the off chance that Kumar could later make it work. GM’s Lauckner, GM’s CTO and head of its ventures unit, continues to serve as an observer on Envia’s board, but that could be the matter of GM’s continued investment in the startup.

John Voelcker, editor of Green Car Reports, said it is “naïve” to conclude that GM lacks alternatives to Envia’s technology. One reason for the push behind the 200-mile car had been to blunt Tesla Motors (paywall), whose CEO, Elon Musk, has boasted of plans for a $35,000, 200-mile pure electric vehicle. About a month after the divorce with Envia, a GM executive told reporters that the carmaker has a battery to produce a 200-mile car but that it still costs too much for commercial use. “GM is a competitive company. They have no intention to let Tesla own the market for $35,000, 200-mile cars,” Voelcker said.

Yet the timing could slip. Envia in fact was the only company at least publicly promising such exceptional performance—since Envia, other companies including BASF and Japan’s Toda had licensed the Argonne material as well, but neither boasted the big performance jump promoted by the startup. Meanwhile some of the other startup competition—A123 and Ener1, the parent company of EnerDel—declared bankruptcy in 2012 and were acquired, respectively, by Chinese and Russian companies.

One would not be surprised to see the new Volt perhaps in 2016, but with less of a price difference than Envia promised. The pure 200-mile electric could launch in 2018 or later. As for Envia itself, it has suffered its first layoffs. But earlier this year it won a $3 million Department of Energy grant. Along with Stanford University and UC Berkeley, it will develop a new battery with a silicon-carbon anode.

Public attention has seized on Tesla. With his sleek, high-tech Model S, Musk has made electric vehicles a commercial and Wall Street sensation. But he has not revolutionized electrochemistry. Rather, Musk’s cars are powered by thousands of off-the-shelf Panasonic nickel-cobalt-aluminum cylindrical cells—big, heavy and volatile batteries that push the base price of the 200-mile version of the Model S to $71,000. They are a design-and-engineering solution to the problem of making electrics competitive with cheaper gasoline-propelled vehicles. While sexy, their price makes it far from certain that Musk’s approach will lead to large-scale consumer adoption.

Envia’s collapse extinguishes what had been arguably better news for electric cars, which was a singular advance in the battery itself. Its described refinement of Argonne’s NMC was superior to the incremental improvements marked by every other known cathode-anode coupling on the planet. Kumar and Kapadia persuaded GM, along with Arpa-E and many, many others, that Chevy, propelled by Envia batteries, would assume the early lead in the global electric car race. GM was perhaps not snookered, but it was credulous when it should have understood the chart in the Crane appraisal, which one must presume it demanded and was provided.

Over the last two or three years, Kapadia and Kumar themselves appeared to believe the promise for their cell, too. The electric car age was truly here, they seemed to say. Their failure does not mean that electrochemistry cannot prevail. But the winning formulation is still nowhere in plain view.