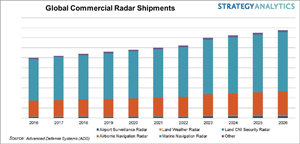

The global commercial radar market will grow at a CAGR of 4.5 percent representing growth across traditional platforms as well as growth opportunities to address emerging threats. The Strategy Analytics Advanced Defense Systems (ADS) service report, "Commercial Radar Market Outlook 2016-2026," predicts the total number of commercial radar shipments will reach 17,516 units in 2026.

A number of factors will drive the market for commercial radars. For airports, this includes new airport development projects and upgrades to existing facilities, driven by continued growth in air traffic, which will also drive demand for airborne radars. Other factors that will drive growth across the land and maritime domains will include:

- IMO (International Maritime Organisation) requirements pushing for vessels operating compliant radar systems.

- Ensuring perimeter security and intrusion detection to combat asymmetric threats.

- Developing robust counter-drone strategies.

"Technology advancements around Doppler processing, dual-polarisation, electronic digital beamforming, solid-state transceivers, pulsed-compression, direct digital data conversion, signal processing algorithms, 3-D displays and data analytics are adding impetus to radar spending globally through both upgrades on existing systems as well as new radar procurements," noted Eric Higham, North American director for ADS.

The adoption of solid-state semiconductors RF transmitters in longer range, higher power ATC (Air Traffic Control) primary radars is still at an early stage but Hensoldt's ASR-NG system is one example of a GaN-based system that is available on the market. Meanwhile, companies such as Blighter Surveillance Systems and Kelvin Hughes (which is being acquired by Hensoldt), have replaced vacuum tube RF transmitters with GaAs and GaN respectively for perimeter protection, counter-drone, marine radar (for smaller vessels, e.g. recreational) and other commercial radar systems that require an optimal balance between performance and cost.

"Companies need to avoid trying to shoehorn expensive military systems into the commercial space if they are going to successfully address the commercial radar opportunity. This is why we are starting to see the beginning of a mergers and acquisition cycle in this space," observed Asif Anwar, ADS director at Strategy Analytics. "Industry will need to understand which segments of the commercial radar market will drive growth, what technologies will underpin the high-power RF requirements and which strategies, whether it be mergers, acquisitions or partnerships, will provide the best return on investment. This report and the associated data models are designed to provide the first steps in understanding this opportunity."