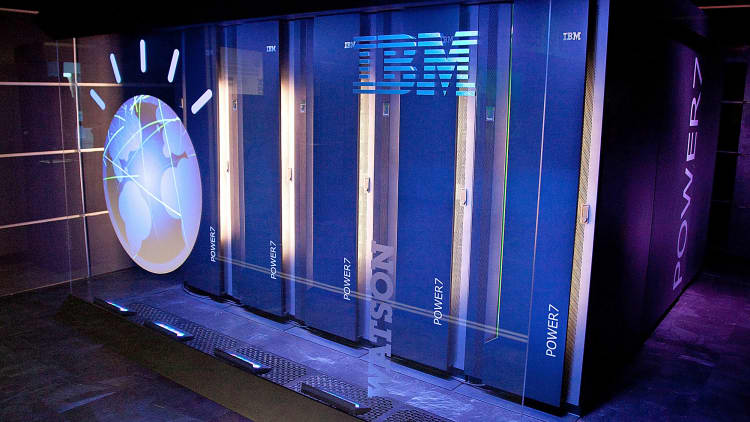

IBM isn't at the forefront of artificial intelligence, Social Capital CEO and founder Chamath Palihapitiya told CNBC on Monday, and he certainly isn't a fan of IBM's Watson.

"Watson is a joke, just to be completely honest," he said in an interview with "Closing Bell" on the sidelines of the Sohn Investment Conference in New York.

"The companies that are advancing machine learning and AI don't brand it with some nominally specious name that's named after a Sherlock Holmes character."

Watson is named after IBM's first CEO, Thomas J. Watson.

"I think what IBM is excellent at is using their sales and marketing infrastructure to convince people who have asymmetrically less knowledge to pay for something," Palihapitiya added. "I put them and Oracle in somewhat of the same bucket."

More from the Sohn Conference:

Activist investor Keith Meister recommends CenturyLink at Sohn

Bill Ackman recommends Howard Hughes Corp. at Sohn

After calling Amazon's surge last year, Social's Palihapitiya picks Tesla at this year's Sohn

IBM responded to Palihapitiya's comments early Tuesday.

"Watson is not a consumer gadget but the A.I. platform for real business. Watson is in clinical use in the U.S. and 5 other countries. It has been trained on 6 types of cancers with plans to add 8 more this year," the company said in a statement. "Beyond oncology, Watson is in use by nearly half of the top 25 life sciences companies, major manufacturers for IoT applications, retail and financial services firms, and partners like GM, H&R and SalesForce.com. Does any serious person consider saving lives, enhancing customer service and driving business innovation a joke?"

When it comes to investing in tech companies, Palihapitiya believes people should bet on the CEOs like Tesla's Elon Musk and Amazon's Jeff Bezos, rather than the company's business model.

"At the end of the day, when you are making deep methodical investments in technology companies, it is fundamentally first and foremost about the jockey," he said.

In fact, Musk "is probably the closest thing to Thomas Edison we have in our generation," Palihapitiya added.

He recommended Tesla's convertible bonds at the 22nd annual Sohn Conference, pointing out that it was effectively like buying the equity but with the downside protection of a bond.

At last year's Sohn Conference, Palihapitiya recommended Amazon, whose stock is up 40 percent in the past year.

Watch: Chamath Palihapitiya buys Tesla 2022 convertible bonds