In the land of payment gateways and credit card processors, the options are seemingly endless. In this article, I want to expose some of the fees that payment gateways try to hide and help you choose the right payment gateway for you.

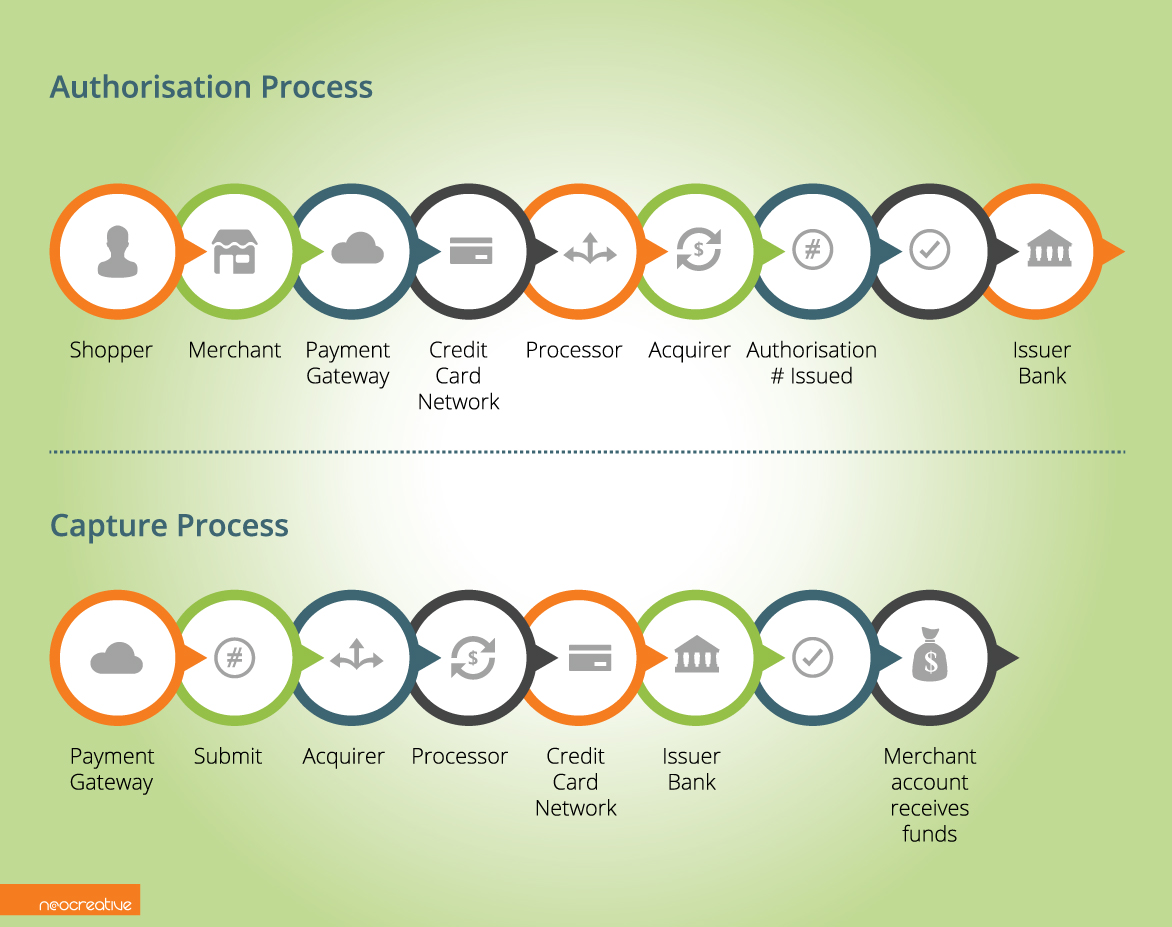

Payment gateways and credit card processes are, on a high level, the same thing. A payment gateway facilitates the processing of credit cards and merchants don’t usually interact directly with credit card processing.

What are payment gateways?

Payment gateways facilitate the online transaction between banks and their account holders and the merchant who is requesting the transaction. They provide a quick and safe method to request funds with from banks with a real-time response.

Why do online merchants need them?

Payment gateways are an essential link between your product and getting paid. You can think of the payment gateway like an online EFTPOS machine that enables a merchant to take credit card information from your buyers to give to VISA or Mastercard, which then, in turn, give that money to the merchant.

What’s the difference between payment gateway fees and credit card processing fees?

Credit Card fees are associated with using the credit card network that connects buyers with their bank accounts. Banks who issue these cards ask for a percentage payment every time they are used.

Payment gateway fees are associated with the service of the transaction in its entirety. Payment gateways communicate with credit card network to take the payment and safely put it into your merchant account.

E-way

E-way is a respected Australian payment gateway service and operates in the traditional way that payment gateways do. They require you to open your own merchant account with the bank and link it with them. Eway’s new pricing structure is to shift some of the price blame to Visa and Mastercard. For example, E-way charge 0.99% + 30cents for their services and also charge whatever Visa or Mastercard charge them.

Shopify

Shopify piggybacks off the stripe gateway and uses a similar pricing structure with some plan dependent quirks.

If you are looking at starting a Shopify store, remember that Shopify charges a percentage fee for transactions if you use external payment gateways. This includes PayPal, taking the overall cost of a Paypal transaction to almost 5% of your sale price. That’s not including the 30c per transaction fixed fee. Shopify needs to take a cut of the transaction to pay for their service but this means it’s unfeasible to use any other payment gateway with Shopify.

Braintree

Braintree is a payment gateway company owned by PayPal. Unlike Paypal, however, Braintree accepts credit card information directly from users. As a Paypal subsidiary, Braintree brings the same amount of trust and dependability that any of the longer standing payment gateways offer.

Stripe

Started in 2010 by two brothers, Stripe has quickly risen in fame among payment gateways and have partnered with multiple major ecommerce platforms to have their solutions built in. Stripe is a rising star in the payment gateway world, but they have had some growing pains getting there. Surprisingly, Stripe’s pricing is clear and transparent with an industry standard pricing of 1.75%. On the whole, Stripe has received good feedback within the industry.

Paypal

With around 188 million users and many of which use PayPal as their sole way to purchase goods off the internet. Paypal’s prices are a little on the higher side but that’s because their service is all encompassing. They act as a merchant as well as a payment gateway so instead of paying a monthly fee to the bank you pay more per transaction. The positive around this is, for small businesses, you only pay money when you make money. Paypal’s fees are around 2.6% plus the standard 30 cent transaction fee.

Payment gateways are not a one size fits all solution. You have to choose the right one to fit your business, minimise your fees and maximise your profits.