Walla.by: Optimize Your Credit Card Spending for Rewards, Interest, Cash Flow – or All Three

Do you have several rewards credit cards but don’t want to put in the time or effort to figure out how to maximize your rewards during every purchase? Or, perhaps you’d like to earn credit card rewards but don’t know how to get started. Wallaby’s suite of products might be able to help

Matthew Goldman and Todd Zino founded Wallaby Financial in 2012. The company initially created an app that tells users which credit card will earn them the most rewards for a given purchase.

We interviewed Goldman and discussed the evolution of the Wallaby app and company, which Bankrate bought in 2015. We also asked him which cards he keeps in his wallet.

Louis DeNicola: You started Wallaby in 2012 and sold it to Bankrate at the end of 2014. How has the company changed, and how has your position changed, in the last few years?

Matthew Goldman: Personally, I’m still leading the Wallaby brand and I also lead all of the product management function for the credit cards division of Bankrate. So, my team is both people who started at Wallaby, people who we hired in Pasadena where Wallaby was based, and the credit cards division of Bankrate in Austin, Texas. The combined team, along with the combined technology teams, build the products for CreditCards.com, Wallaby, CreditCardForum.com, and other sites that we own and operate in the credit cards space.

Being part of a bigger company provides a lot of great resources, and we can invest more into our products and bring them to larger audiences. Some of the core technologies that we originally developed at Wallaby are still being used. There are also other Bankrate brands, like CreditCards.com, which have some similar features and applications to what we put together.

Are there any interesting products that you’ve either recently released or that are coming out soon?

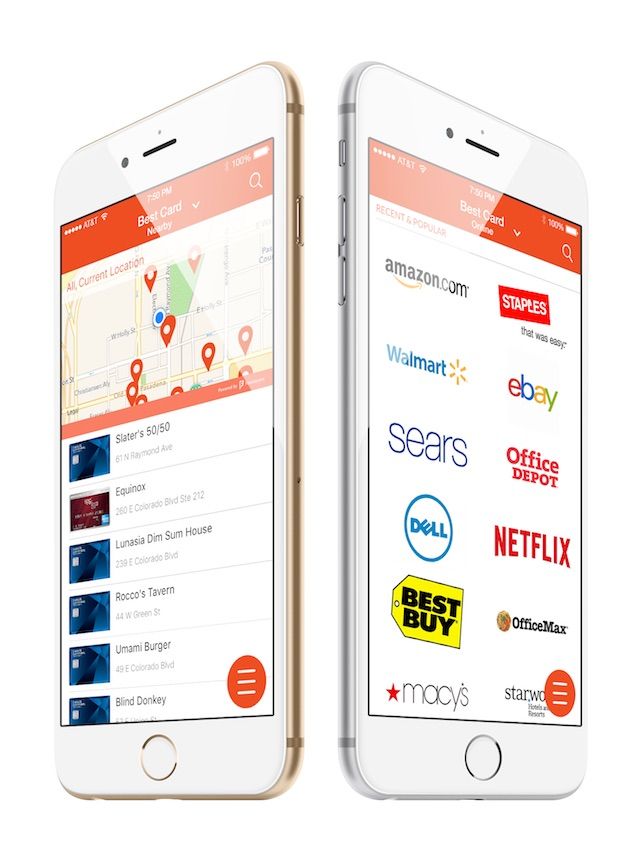

There is always innovation in our core product line. One thing that we did with Wallaby, which I think is awesome and is something we’ve been working on for a long time, is ambient alerts. If you turn it on and give permission for the software to monitor your location in the background, we can send you an alert when we have high confidence about where you are and we can suggest how to earn credit card rewards.

Ambient alerts don’t go off all the time because we don’t want to annoy you. But say you’ve been sitting at Joe’s Diner for five minutes, you might get an alert about which card will give you the most points per dollar at restaurants.

The other big consumer-facing product that we’ve launched this year is an app under the CreditCards.com brand called Score & Report. It’s a simple free credit report and score app that you can use to monitor your credit. It comes with new account alerts, inquiry alerts, and things like that.

There are quite a few different sites that offer credit scores, but we think a lot of them have made it complicated to understand what’s going on and which factors influence your score. We’ve tried to make something that’s simple, easy, and accessible on your phone. We have a website as well, but I think the app is pretty unique. It’s currently out for iPhones, and it’ll be coming to Android soon.

We’re also rolling out a standalone app called Spend Monitor. You can connect your cards and bank accounts to our systems, like you would with a service like Mint, and we’ll monitor your account for when you might have used the wrong card for rewards.

We’ll also warn you about anything that looks fraudulent or suspicious. Banks do an excellent job at finding fraud on one card, but we’re looking across your whole portfolio of cards, looking for things like duplicate transactions, and will alert you to those.

We focused on a hands-off approach while building spending alerts into the app. We’re looking at a category level, at the individual cards, and across your entire wallet. The machine learns from your spending patterns and can alert you to unusual spending behavior. It doesn’t require you to sit there and build a budget or make you feel bad every time you go a little bit over.

What’s the breakdown of people that use Walla.by to maximize rewards and those who want to minimize fees or improve their credit?

Everyone that we talked to has a little bit of everything, but I think people tend to have a different focus at different times.

Inside the Wallaby app, we have a feature called recipes, which are the different ways that we determine the right card to use at the right time. The app comes with four built-in recipes: maximize rewards, minimize interest, optimize cash flow, and a custom recipe option. We also have a pre-built combination of those we call Wallaby Smart Choice, which effectively attempts to maximize rewards with some eye towards watching your credit limits and watching when your statements close.

There are a lot of calculations going on: knowing what you spend, what your credit limit is, and all these other things. The recipes make it easy for people to switch their attention briefly, and make sure their cards are helping them save money, not causing them problems or costing them money in fees.

The focus of our app is making it easy for you to get high-quality real-time advice that’s just for you.

You mentioned minimizing fees, is there also advice for which card to use based on purchase protections, car rental insurance, or some of the other lesser-known credit card perks?

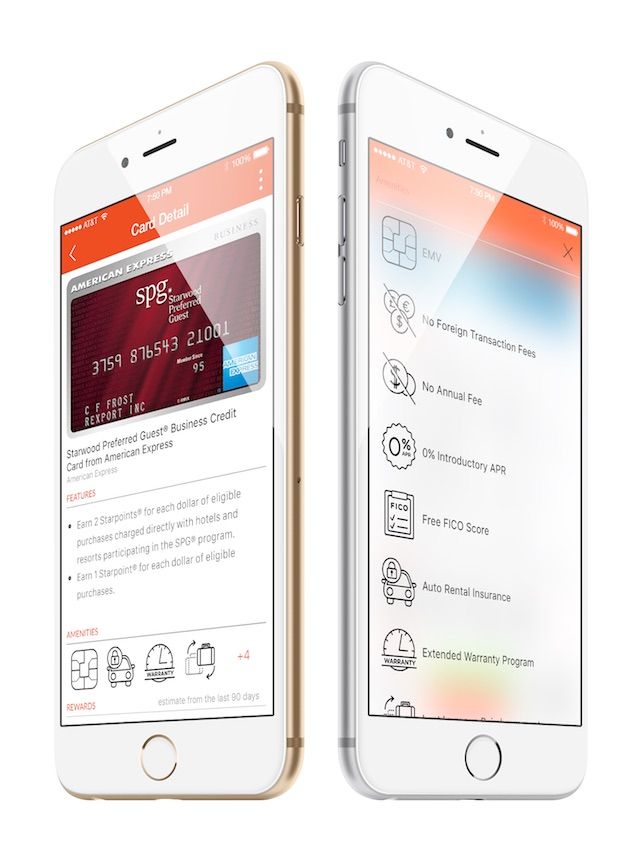

We take most of that into account when people are asking us for recommendations for a new card, but not necessarily when they’re making purchases. However, at any time you can go into your virtual wallet on the Wallaby app and look at that information and features. We made it easy to understand what’s available to you using simple iconography and consistent terms; it will be a lot easier than finding the information in the terms and conditions.

How about recommendations based on security? Do you go through someone’s previous purchases and point out that they were at a store where there was a recent data breach?

We don’t feel that those types of alerts are particularly helpful. We know some apps make that play, but by the time a particular card is breached or stolen your bank has often already contacted you. If we follow up the next day, we’re just adding to the noise and confusion, and we don’t think that adds any value.

There were plans for a Wallaby card at one point, and there are now competitors that have a physical card. Is there a future for physical cards that help people optimize rewards?

I don’t think there is a future for the physical products. We did initially hope to build the Wallaby card, but we weren’t able to get that product launched, and we decided that it was better to focus on the optimization software. We’re working on something we’re really good at rather than trying to re-invent the plastic card, which is clearly in its final stages of life

The payments market continues to shift and what was interesting five years ago when I started Wallaby and what’s interesting today are not the same thing. We think physical cards are the wrong approach because payments are going fully digital. We hope to see digital wallets adopting technology, like ours, that helps you make smart decisions when making a payment.

To change gears a bit, which cards do you keep in your wallet? How do you optimize rewards for yourself?

I have a lot of cards, no surprise. I do try to maximize the rewards, and I’m a heavy user of Wallaby because I can’t keep track of everything.

I recently got the new Chase Sapphire Reserve, a very popular new card, and I’m excited to be earning triple points on some purchases. I have the triple combo, with Chase Sapphire Reserve, Chase Freedom, and Chase Freedom Unlimited, which lets me get three points on some categories, five on others, and one-point-five on everything else.

I’m also a big user of the American Express Starwood Preferred Guest card because I travel a lot and often stay at Starwood hotels. Also, the Virgin America Visa card because I fly Virgin and it’s been great for me. I think Virgin points are very valuable, so even though you only earn one point per dollar on most transactions I value those at more than two cents. To me, it’s like earning over two percent cash back.

Do you have any great travel stories involving the use of points or miles?

I just did some booking this week. I booked a trip for the four of us, I have two kids, to travel first class to Hawaii during my kids’ spring break.

I had a lot of Virgin America points, but I also transferred some points from American Express and Starwood Preferred Guest to be able to afford the redemption. Then I used the leftover Starwood points to book a hotel in Hawaii.

One of the big secrets is understanding how points transfer between programs and using that to achieve your travel goals.

What advice do you have for someone who’s intrigued by credit card rewards, but they don’t know where to get started.

An easy starting point is to think about a travel goal. Is there a trip you want to take, or one you take frequently? Maybe every summer you fly home on American Airlines, or you want to go to Europe. With the first example, an American Airlines credit card might make the most sense.

If you don’t have a specific goal, pick a transferrable rewards program and figure it out later. Whether it’s Citi ThankYou Rewards, Chase Ultimate Rewards, or American Express Membership Rewards, they’re all transferrable, and they all have a variety of related credit cards. You can pick the card that’s right for you, and after you’ve amassed a lot of points you can figure out the redemption that’s best for you.

To plug myself a bit, we have a tool called WalletBoost that’ll help you pick the card that’ll best match your goal and spending pattern. You answer a quick quiz, and we’ll recommend four different cards out of the thousands in our database.

No matter which card you get, keep in mind you always want to pay your bill on time, so you don’t offset any rewards by paying a fee.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals