Fintech has become an important sector as technological innovation has created the opportunity for significant disintermediation of traditional financial institutions resulting in reduced costs and widening choice of financial services for consumers.

As fintech continues to grow globally with new entrepreneurs, investors and regional hub ecosystems emerging, a number of locations are thriving to become fintech leaders.

A new report titled ‘Connecting Global Fintech: Hub Review 2016’ released by Deloitte in collaboration with All Street Research, provides an overview of 21 fintech hubs emerging globally with a focus on each local market facts, figures and future trends.

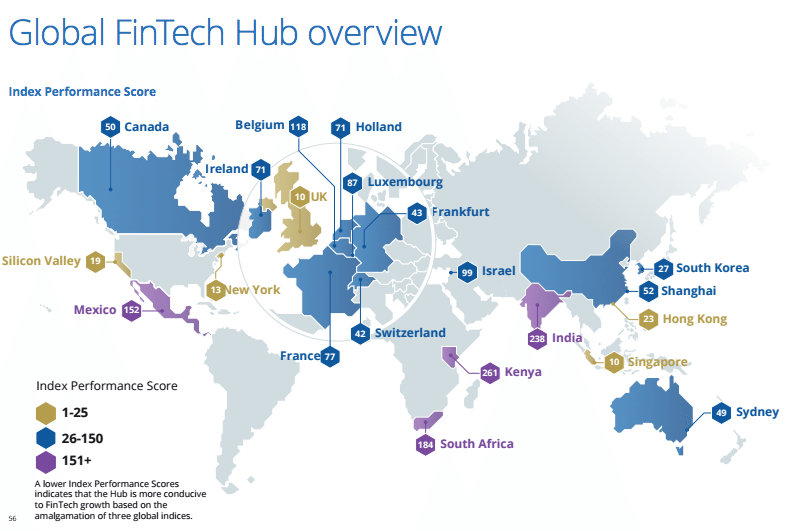

Each fintech hub gets an Index Performance Score which combines three key indices: a Global Financial Centre Index (GFCI); Doing Business 2016 (DB) score; and a Global Innovation Index (GII). A lower Index Performance Score suggests that the Hub is more favorable to the growth of fintech.

The UK, Singapore, New York, Silicon Valley and Hong Kong are the top five fintech hubs with the lowest Index Performance Score.

“This is no surprise as their leading position is based on decades of evolution as global financial centers, or in the case of Silicon Valley, in technology,” said Louise Brett, UK Fintech lead at Deloitte head of Digital and Customer Analytics at Deloitte Digital.

“These hubs already have the appropriate ingredients (i.e. specialized talent, progressive regulatory bodies, investment capital, government support, etc.) and the strong collaboration within the ecosystem that is required to develop leading global fintech sectors, and which are capable of innovating across the financial services and technology landscape.”

The top five hubs are followed by South Korea, Switzerland, Frankfurt, Sydney, Canada and Shanghai.

Global Fintech Hub overview, Connecting Global Fintech: Hub Review 2016, Deloitte

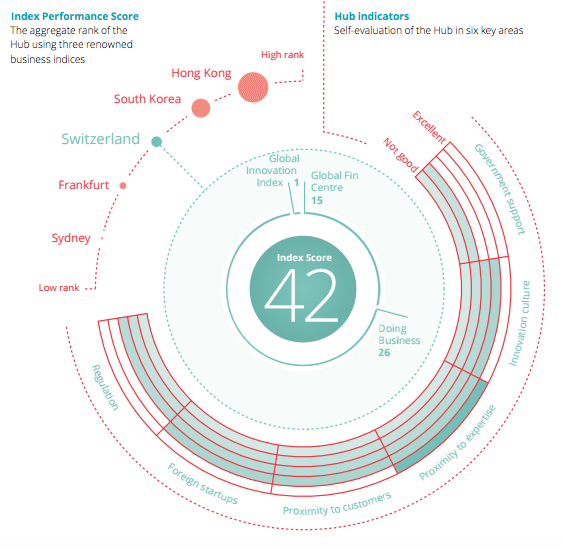

With an Index Score of 42, Switzerland sits between South Korea and Frankfurt. While its proximity to expertise is considered as being excellent and its highly educated population considered as being a strength, government support has been lacking and considered insufficient to foster a dynamic fintech industry. Additionally, Switzerland’s suboptimal legal and fiscal conditions, its risk averse culture and its underdeveloped startup ecosystem are said to be the key challenges.

Switzerland Hub Profile, Connecting Global Fintech: Hub Review 2016, Deloitte

Top fintech companies in Switzerland include Knip, an insurtech startup that has raised over US$20 million in funding; Temenos, a company specializing in software for financial services; Anivo, a regulated online insurance broker; FinanceFox, another insurance brokerage app; and Monetas, a developer of blockchain-based systems for the financial services industry.

Some of Switzerland’s biggest fintech investors have been leading telecommunications provider Swisscom; venture capital firms Lakestar and Redalpine; Swiss Startup Invest, formerly CTI Invest, a financing platform for Swiss tech startups; and the Swiss ICT Investor Club (SICTIC), an association that connects investors to seed and early stage Internet startups.

“There has been a lot of activity and learning in the past 18 months, with many market participants forming associations that drive the development and public relations around Swiss fintechs,” the report says, noting that these associations will likely play a key role in the negotiations with the Swiss Financial Market Supervisory Authority (FINMA) and the government on how to support Switzerland’s fintech sector.

The report argues that strong government support at the early stage of ecosystem formation is essential. Once the hub is established, government support, progressive regulations, a culture of innovation and collaboration, and strong financial services and private investors are the key elements that enable the growth of a fintech hub.

Featured image: Global internet connection and streaming concept by alphaspirit, via Shutterstock.com.