Among buyers, if not among sellers, Amazon had long held a reputation for transparency and customer service. This is, after all, the company whose margins are so low it has historically had trouble turning a profit despite an annual revenue stream that recently crossed $100 billion. (Recent quarters have been gangbusters, though that’s thanks in large part to the company’s cloud computing service.)

An investigation out Tuesday from ProPublica challenges the idea that Amazon is always giving you the best deal on your socks, books, and toothpaste. The reporters, Julia Angwin and Surya Mattu, analyzed 250 listings and showed that Amazon’s algorithms often automatically prioritize the placement of products that aren’t the cheapest—but are sold by Amazon, or by companies that participate in its shipping program, Fulfilled by Amazon. It’s a sign of how Amazon is using its power as a marketplace to advance its business in shipping and logistics.

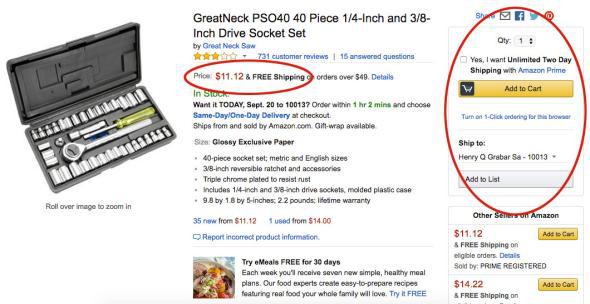

Here’s how that works. Click on a product page on Amazon—such as this one for a socket wrench set—and you’ll find it’s sold by dozens of sellers. Amazon automatically selects one for its “buy box,” at right, which features a big, yellow “Add to Cart” button. Other sellers are shunted into a less prominent list below.

Screenshot via Amazon.com

It’s your choice, of course. But outside analysts tell ProPublica that the buy box dominates Amazon sales simply by appearing to be the default option. And the buy box favorite seems to be determined by an algorithm that omits shipping costs for Amazon and Amazon-shipped products, though with shipping costs included, they are often more expensive. Unless you’re an Amazon Prime customer, or buying more than $49 worth of stuff, that’s not an honest representation of the price.

So, our socket wrench set is sold by Great Neck Saw, which has an Amazon shipping agreement, for $11.12 plus free shipping, according to the first listing you see. You can see why the Great Neck Saw’s product is in the buy box, even if that “free shipping” label comes with a big asterisk. You have to click through to another page to see that the same socket wrench kit is available from Interstate Tractor Co., which has a 93 percent positive rating, for just $8.50.

For the 250 listings that Angwin and Surya analyzed, the average price difference between the buy box and the actual cheapest option was $7.88 per product. Not exactly Walmart’s fraction-of-a-penny mass margins. (Amazon told ProPublica its buy box accounts for factors beyond price.)

The system puts pressure on both buyers and sellers to be further integrated into Amazon’s ecosystem. For buyers, the buy box only aligns with your wallet if you’re an Amazon Prime member and all shipping is free. Because it doesn’t include shipping costs, the buy box is basically only accessible to sellers who have signed up for Amazon’s shipping services.

It’s part of a trend I observed earlier this year on Prime Day. As Amazon grows to envelop a larger and larger share of American commerce, transactions in which the company merely links buyer to seller aren’t just discouraged, they stop making sense: “[C]omparisons to what things cost beyond Amazon are no longer relevant,” I wrote, “because the price of everything you buy from the company only exists in the context of all the other things you buy from the company.”

Follow the buy box choice all the way to checkout, and you’re reminded that free shipping is only available to subscribers to Amazon Prime. If you buy it anyway, with standard shipping, you’ll have spent $18.89 (shipping included) on a socket wrench. The same set was available for $15.63 (shipping included), but Amazon buried it.

*Update, 6:00 p.m. The algorithm is designed for big orders and Prime orders, which ship for free, the company said. “With Prime and Free Shipping (which requires no membership and ships orders above $49 for free), the vast majority of items ordered*—9 out of 10—can ship for free,” Amazon wrote to me in a statement. “The sorting algorithms the article refers to are designed for that 90% of orders, where shipping costs do not apply.”

Of course, the sorting algorithms also produce those sorts of orders, by nudging consumers to select products that qualify for free shipping.

*Correction, September 21, 2016: Due to a mistake in a statement from Amazon, the updated post originally implied that 90 percent of orders, rather than 90 percent of items, could ship for free.