The EpiPen profit figures that Heather Bresch, CEO of EpiPen maker Mylan, Inc., proudly displayed on a giant chart to the seething House Oversight and Government Reform Committee last week were misleading at best and a flat-out lie at worst, according to a filing to the Securities and Exchange Commission.

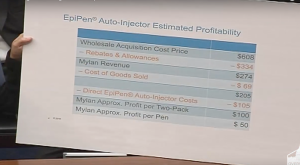

Bresch, who was called before the committee to explain steep price hikes of the life-saving devices, insisted that the company only makes $100 profit per two-pack of EpiPens. The list price for such a two pack now stands at $608. However, back in 2007, before Mylan bought the rights to the pens and raised the price 15 times, an EpiPen was priced at around just $50.

In her testimony, Bresch blamed the puzzlingly small profit on undefined costs and America’s complicated healthcare system. The committee, however, didn’t buy that—and rightly so.

It turns out that the $100 profit figure was calculated by applying a 37.5 percent tax rate, which the company likely doesn’t pay. And the post-tax product was actually incorrect—it should have been $104 per two pack. So, the real, pre-tax profit from an EpiPen two pack is $166, a 66 percent increase from what Bresch told Congress.

Mylan said that including the statutory tax rate was standard, but experts shook their heads. A 37.5 percent tax rate “has nothing to do with reality,” Ryan Baum, an analyst with SSR Health LLC, a health-care investment-research firm, told the Wall Street Journal. Baum noted that the company only had a 7.4 percent tax rate overall last year and a tax rate close to zero in the US.

"It is intellectually dishonest to include tax provisions for US taxes that aren't due and that the company does not in fact anticipate ever having to pay," Edward Kleinbard, a professor of law and business at the University of Southern California, told the Los Angeles Times.

Another expert, Ronny Gal, an analyst at Sanford C. Bernstein, told the Wall Street Journal: “If EpiPen was its own company, it would be taxed at 37.5 percent. It’s just that it’s being taxed at a much lower rate because of the tax-avoidance schemes that [Mylan] and many other companies use.”

Last year, Mylan incorporated in the Netherlands to avoid paying US taxes. The company still operates out of Pennsylvania.

The new filing reveals that Mylan made $671 million from EpiPen sales this year, a ninefold increase from 2008 profits of $71 million. The company sells about 4 million EpiPen two-packs a year.

reader comments

107