Self Employed Taxes are fun and exciting, said no one ever!

We all know managing our taxes can be stressful if you’re self-employed. The best way to combat the stress is to get organized way before tax season rolls around.

Self Employed Taxes – Top Organization Tips

I have come up with a list of tax tips that will help you get a handle on your tax return and better prepare for tax season.

- Gather all your tax records in advance

• This includes receipts, canceled checks, bills etc.

• You also want to make sure to keep original documents. Although there are great tools like this Neat Desk Receipt Scanner, you always need to keep originals for yourself.

• Categorize your Receipts. - Set a Tax Prep Day

• Set aside a time and day every month or quarterly to get your taxes in order. Doing so will save you a ton of time and sanity. It will also reduce the chances of missing items. - Review your documents & hire an accountant.

• You are a boss now! You need to do as the bosses do and get an accountant. Taxes and laws change each year and only a tax preparer keeps up to date on the changes and works with you to maximize your return or minimize your tax payments. Not only that but they are there to help and guide you with the important things like understanding retirement accounts & savings.

• Pro Tip: shop around for an accountant, make sure they have expertise in your line of business and if they are certified with a CPA License. - Estimated Tax Payments

• This is a method used to pay tax on income that is not subject to withholding. If you fail to make quarterly payments, you may be penalized for underpayment at the end of the tax year. - Income & Expense Record-Keeping is Key

• To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your field of business. A necessary expense is one that is helpful and appropriate for your business - Set up a Retirement Plan

• Plan for the future and reduce your current tax liability. Contributions to your retirement fund are a deduction, so why not do it? No excuses. - Donate

• Pick your favorite charity and donate a little or a lot. These donations are tax deductions too!

Self Employed Taxes – How To Organize Your Paperwork

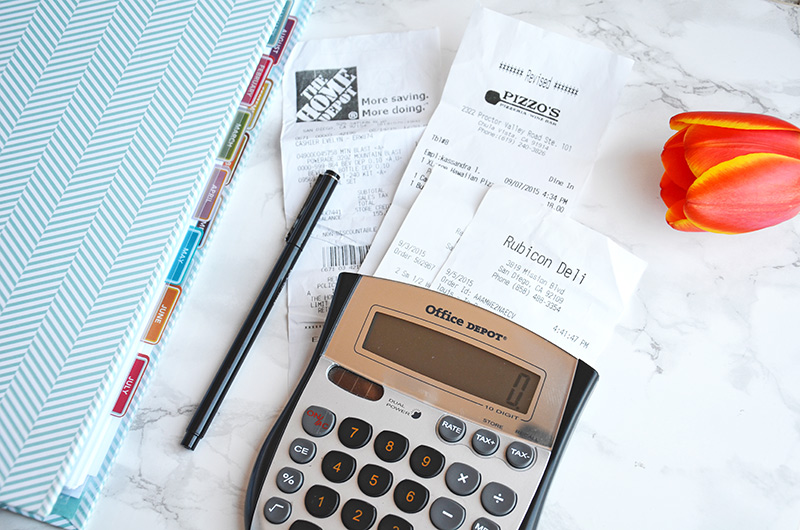

Although there are a ton of online tools to simplify the organization process, I find that pen & paper still work best for me. I just don’t think you need to pay an arm and a leg for fancy accounting software, especially if you’re operating a solo business or just have a couple employees.

Since I know that most people suffer from tax anxiety as I do, I created a clean, effective and fairly simple to implement method of tracking all of our tax records. This method includes some vibrant, premium printables that will not only get you tax ready, but they might actually get you to look forward to getting your taxes done.

The first step in organizing your businesses paperwork is gathering all your records.

Having a clear list of all the items you need to take to your accountant is the first step in getting organized.

This list includes:

- Personal Information

- Income

- IRA Info

- Rental Income

- Employee Info

- Education Payments

- Savings & Investments

- Vehicle Info

- Self-Employment & forms

- Pension Income

Next, you are going to need to find out your deductions. I have included a lengthy list of the most common small business deductions.

I highly suggest you either get yourself a binder as I did or set up a designated filing station as a catch-all for all new paperwork coming in.

I have included tabs & divider pages in this printable set to make it easier for you to get started right away if you already have a binder. That way there is no need to run to the store for any supplies.

The tabs are as follows:

- Invoices

- Income

- Expenses

- Receipts

- Contractors

- Mileage

Tax Preparation Printables

Let’s go ahead and take a look at what is included in the Tax Preparation Printables:

- Cover page

- 6 divider pages and tabs

- Family Details page – Everything you need from each family member when you visit your accountant.

- Tax Checklist

- Deduction Guide

- Donation Records

- Income Tracker

- Travel Expense Worksheet – track lodging, transportation, fuel, meals, entertainment, phone, & miscellaneous.

- Invoice Tracker

- Tax Deduction Worksheet

- Tax Payment Worksheet

- Vehicle Log

- Disclaimer

That’s 17 printable pages to get your Self Employed Taxes in top shape.

That’s how I prepare for tax season! Are your ready to tackle Tax Season like a pro?

Get your printables below.

Ashley

Thank you , great help