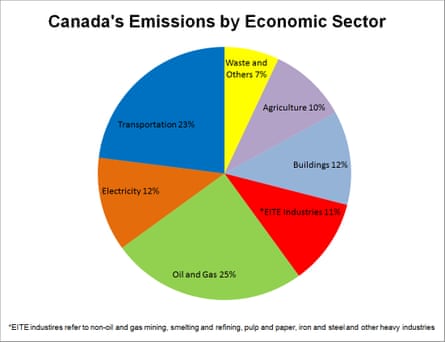

By 2030, Canada intends to see its greenhouse gas emissions fall 30% from the 2005 levels of 749 megatonnes. To get there, the country expects its businesses to play an important role in a new plan that will include a program to make companies pay for their carbon emissions.

Under the new government, led by Prime Minister Justin Trudeau, Canada expects to unveil a carbon pricing program as early as this fall. “We’re going to make sure there is a strong price on carbon right across the country,” Trudeau said during a TV interview last week.

The announcement of a carbon pricing program represents a dramatic departure from the previous administration under Stephen Harper, who championed the expansion of the country’s oil industry and sidelined climate change causes. The current emissions reduction goal in Canada – 30% by 2030 – came from the Harper era and falls far below those set by the European Union and the US.

Carbon pricing can be an effective weapon against global warming. But it’s also a concept that historically has drawn a lukewarm reception from businesses, which tend to fight its financial impact on them.

The two most commonly used carbon pricing systems are carbon tax and the so-called cap-and-trade. A tax would simply set a price for each ton of greenhouse gas emitted. A cap-and-trade will set limits on the amount of emissions that businesses can release and give them permits for the allotted amount. Those that emit above their limits will have to buy permits from companies that pollute below the limits.

Carbon pricing programs typically focus on regulating heavy polluters such as power plant owners, oil refineries, big factories and airlines.

Around 40 countries and more than 20 cities, states and regions are putting in place or already have a price on carbon, which translates to 12% of global emissions and an annual value of $50bn, according to the World Bank. The European Union runs the world’s largest cap-and-trade program, launched in 2005, which involves 31 countries and covers 45% of its greenhouse gas emissions. The US Congress attempted to create a carbon pricing program after Barack Obama became president but failed to gain enough support.

The business community is typically reluctant to support any taxes or policy that will cost them money. For example, the carbon tax levied by the province of British Columbia, Canada, has drawn criticism from cement makers, who contend that the tax hurts their ability to remain competitive and gives cement exporters from China and the US an unfair advantage because they don’t have to pay the tax.

But a study from researchers at Duke University and the University of Ottawa that looked at the effect of British Columbia’s carbon tax on its overall economy concluded that it had “little net impact”.

Carbon pricing could become more widely used as nations start to figure out ways to achieve the goal of the Paris climate agreement to keep temperature increases at below 2C. That likelihood has prompted some businesses to band together to try to and shape carbon pricing legislation. One such effort in Canada comes from the Carbon Pricing Leadership Coalition, which lined up 20 Canadian companies as members earlier this month, including Air Canada and IKEA Canada.

At least 435 firms, including Microsoft, Google and BP have voluntarily set their own internal price on emissions, up from 150 companies in 2014, according to the Carbon Disclosure Project, which works with businesses to measure their greenhouse gas emissions. Assigning values to their own emissions can help businesses better manage environmental risks, make investment decisions to reduce them and get ready for legislation on carbon pricing.

Policymakers hope carbon pricing will also spark innovations that lower emissions, such as technology to capture pollutants from power plants before they get into the atmosphere.

John Stackhouse, a senior vice president at the Royal Bank of Canada, the country’s biggest bank and a new member of the Carbon Pricing Leadership Coalition, said carbon pricing is good for ensuring a business’s longevity.

“There’s a strong consensus among Canadian business that carbon pricing can actually be a business friendly approach to better managing the planet’s carbon resources,” Stackhouse said.

Whether a carbon pricing program will be effective in Canada will depend largely how the government structures the program and sets the prices. The government has yet to reveal much about the program, though it’s likely that it will set a minimum carbon price that provinces must meet, and each jurisdiction will be allowed to decide what type of pricing scheme they will follow, said Mark Thurber, associate director of the Program on Energy and Sustainable Development at Stanford University.

Trudeau’s carbon pricing program won’t be the only one within Canada. Four of the country’s 10 provinces either already have a carbon pricing scheme in place, or are in the process of introducing one. Having a national program on top of regional efforts, which run on different rules, could draw protests from businesses and the regional governments, said Benjamin Dachis, associate director of research at the CD Howe Institute, a Canadian public policy thinktank.

“Outsiders need to remember the immense power of provincial governments here,” Dachis said. “There are deep questions about what the federal government needs to do on top of or in place of provinces.”

Carbon prices vary considerably around the world, from less than $1 per tonne of emissions in countries such as Mexico to $130 per tonne in Sweden, with 85% of countries pricing carbon at below $10. Thurber believes Canada will set the price at around $15 per tonne.

“It’s been pretty well established that that’s a level that drives some abatement activities but the economic impact is fairly minor,” he said. “It’s big enough to be meaningful but it’s not going to cripple them in the slightest.”

The business community hopes the government will craft a business-friendly program, said Stackhouse. Transparency is critical, he said, especially in setting clear prices and the rules for how they might increase in the years ahead.

“Consumers and shareholders, as well as regulators, have a greater awareness of the carbon risks to the economy. We don’t think that level of interest is going to decline,” Stackhouse said.

Comments (…)

Sign in or create your Guardian account to join the discussion