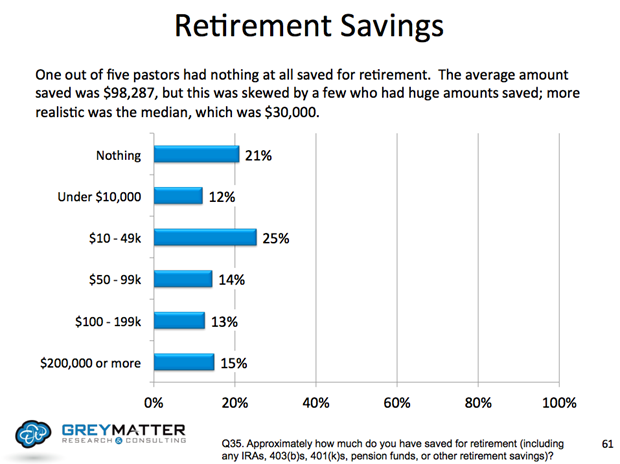

Almost one-third of American pastors (29%) have no money in personal savings.

Another third (33%) have less than $10,000 put away for retirement. And half make less than the national median household income of $51,939.

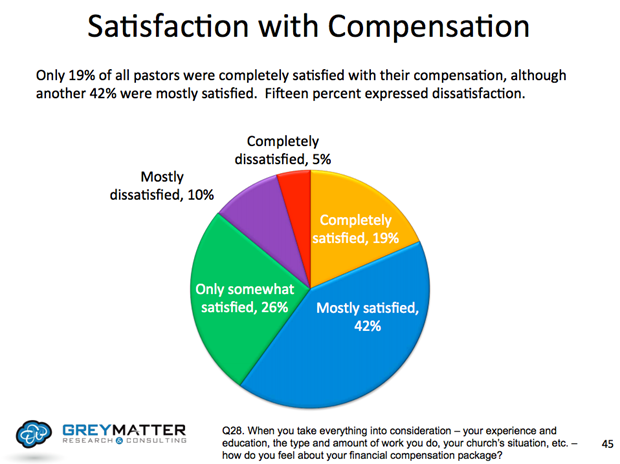

Yet most say they are satisfied with their salaries.

That’s according to a recently released study of more than 4,200 pastors commissioned by the National Association of Evangelicals (NAE) and conducted by Grey Matter Research last summer.

“The vast majority of pastors do not have their own radio or TV show, robust church staff, or megachurch attendance,” stated Leith Anderson, NAE president. “Rather they faithfully serve in small churches and face financial challenges stemming from student debt, low salaries, and medical expenses. And sadly, they often feel they have no one to turn to for help.”

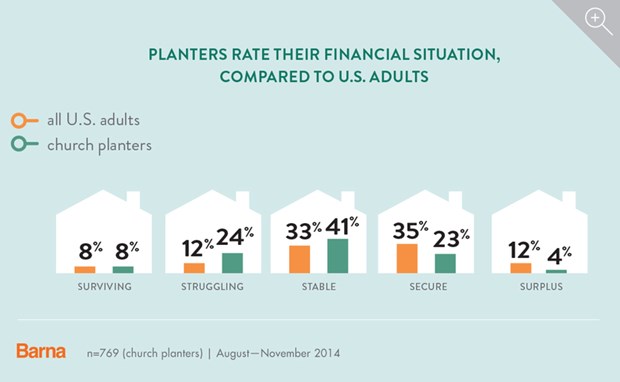

Those numbers are even worse for church planters: 3 out of 5 make less than the national average, and 1 out of 5 make less than $35,000, according to a new Barna Group survey on behalf of Thrivent Financial.

It’s not that churches are being stingy, according to the NAE survey. About 4 out of 5 pastors serve congregations with less than 200 people; a quarter of them serve congregations of less than 50. And the smaller the church, the shakier its finances: 17 percent of churches with fewer than 50 congregants are on shaky ground financially, compared to only 2 percent of churches with more than 300 members.

Half of pastors are working with church budgets of less than $125,000 that must stretch to cover facilities and programming along with salaries.

More than most, pastors know the limitations of their church budgets. The majority (63%) reported that their church couldn’t afford to pay them any more than it does. That percentage went up for small churches—80 percent of pastors in churches with fewer than 50 people said their church couldn’t pay them more. Almost 7 in 10 pastors of churches with fewer than 100 people reported the same (69%).

That’s likely why three out of five pastors said they were mostly or completely satisfied with their compensation (61%), while another quarter were somewhat satisfied (26%). And most pastors used at least one positive word (respectful, transparent, generous, organized, constructive, professional, or unifying) to describe their church’s finances (92%) or their compensation (85%).

There is one major benefit to sweeten the deal: 7 out of 10 pastors get a housing allowance, and 28 percent are supplied with a parsonage.

But beyond housing, the compensation benefits aren’t great. Less than half of pastors receive health insurance (43%), retirement funding (38%), or dental insurance (23%).

The median combined income of a pastor’s salary and housing allowance is $49,500. The median amount of money a pastor has in a personal savings account is $3,800.

Most also carry non-mortgage debt (74%), such as student loan debt (31%) and medical debt (23%).

And pastors are worried about it.

Almost one-third of pastors (31%) say they are under quite a lot of financial pressure. The pressure for church planters is even greater: 3 out of 4 told Barna they were either “just making ends meet” (41%), “struggling to keep up with day-to-day expenses” (24%), or “require financial assistance to get by” (8%).

The main things pastors are worried about are their lack of retirement savings (92%) and emergency funds (84%), according to the NAE report. More than half worry about saving for big purchases (83%) or being able to send their children to college (54%).

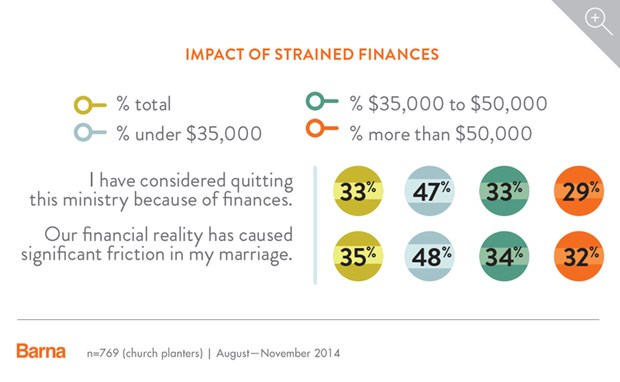

In fact, money problems have caused about a third of pastors to consider leaving their church (33%) or the ministry altogether (36%). And 3 out of 4 pastors know someone who has already left the ministry because of financial stress.

A similar percentage of church planters said financial stress has made them consider quitting (33%) or has caused “significant friction” in their marriages (35%), Barna reported.

It can be hard for a pastor to know where to turn for help. More than a third (37%) said they weren’t sure if their denomination offered personal financial training or resources, the NAE reported. The same number (37%) said they have no one to talk to about money outside of their immediate family; of those, more than half of those wished they had somebody (59%).

Even though they’re worried, only 11 percent of pastors think they’re in a worse situation than other pastors. A third believe they are typical (33%), and 45 percent believe their situation is better than their colleagues.

“Obviously, many of them simply cannot be right,” stated the NAE report. “Some pastors have optimism that is unwarranted.”

The study is the beginning of a $1 million initiative the NAE has launched, in connection with the Lilly Endowment, to help pastors, churches, and denominations achieve stronger financial health.

Support Our Work

Subscribe to CT for less than $4.25/month