The low-cost airline Virgin America made its first filings today that indicate its intention to sell shares to the public in an US-based public offering. The documents submitted to the Securities and Exchange Commission detail the airline’s finances and intentions, but there are few new revelations, because US air carrier regulations require periodic disclosure of operating metrics.

In discussing its growth strategy, however, Virgin offered a glimpse of the paradox it faces as a low-cost carrier that disproportionately relies on high-paying customers.

According to the filing, 30% of Virgin America’s 6.3 million passengers in 2013 booked their flights less than 14 days in advance of travel, when tickets are expensive. Those passengers accounted for 40% of the airline’s revenue—$570 million. (According to Quartz calculations, a ticket bought within two weeks of departure costs at least 55% more than all other tickets on average. Based on the filing, the average markup could be as high as 85%, but Virgin America did not return requests to clarify the figures.)

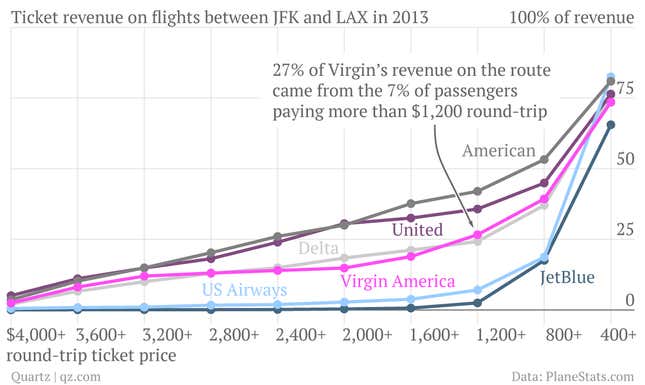

Data on the most popular route in the US—between New York and Los Angeles—shows Virgin can be just as dependent on high-paying customers as a legacy airline such as Delta. On that route, 27% of Virgin’s revenue comes from round-trip tickets priced higher than $1,200, according to data compiled by PlaneStats.com, more than the 24% of its revenue that Delta books at that price point. JetBlue, another low-cost airline, made just 2.5% of its revenue from tickets priced above $1,200 on the route from New York to LA.