Skift Take

All of this new-found airline industry health is proving to be a game-changer for Southwest in that its formerly inept competitors are starting to get their act together. The next chapter obviously has yet to be written.

It was a reality check yesterday from Southwest Airlines CEO Gary Kelly during the airline’s fourth quarter earnings call, which marked Southwest’s 42nd consecutive year of profitability.

The so-called Southwest Advantage, which includes a U.S. industry-leading low-cost structure, propelled by its simplified fleet of Boeing 717s and 737s, point-to-point route network eschewing hubs, prejudice toward secondary airports, and ability to gain market share through low fares and a lack of bag fees, has been diminished because of what Kelly cites as “an evolved” competitive environment.

Southwest’s profits beat analysts’ expectations in the fourth quarter and saw a 3.8 percent dip in costs per available seat mile because of plummeting jet-fuel costs, but the competition is making gains, Kelly said.

Bankruptcies, airline mergers, profits spurred by sales of ancillary services and just better-run airlines have all contributed to competitors breathing down Southwest’s neck.

Candid Talk

Here’s Kelly describing it all: “Our compeittors have lower relative costs than they have had in generation. They are producing handsome profits unlike they have done in a generation. They are running better operations than they have done historically. At least from our view of the world, they are stronger competitors. Period.

“And we are mindful of that. And it is incumbent upon us to step up our game accordingly. So it was just an acknowledgement that the competitive landscape has changed where you go back 10 years ago, and they were floundering, and they are not floundering now. And that’s good. That’s good for us and it makes us better. All I was trying to point out is that we are up to that task. I will put my money on the Southwest people any day.”

One of those not-floundering legacy airlines is Delta, and its CEO Richard Anderson argues that it is the best run airline in the industry.

In the fourth quarter, Anderson told analysts, Delta increased its operating margin to 13.1 percent, a four-point jump. “Our ROIC (Return On Invested Capital) was 20.7 percent,” Anderson said. “Our ROIC goal is 15 percent to 18 percent. We hit 20.7 percent.”

The Gap is Narrowing

Airline consultant Robert W. Mann Jr. agrees with Kelly that the Southwest Advantage is less so these days.

“This acknowledges the narrower margin between Southwest’s cost structure and network carriers’, and that network carriers are achieving better operating results as a function of cutting flights (many of them 50-seat and smaller regional jets) which at the margin has reduced enroute and hub delays on an inverse exponential basis, while Southwest’s focus on aircraft utilization has created difficulty with on-time and baggage handling,” Mann says.

“On the revenue/earnings side of the equation, Southwest cannot produce the premiums that a differentiated F/Y fare structure and multi-cabin product can produce, but their ‘low fare’ halo may be achieving better stage length adjusted coach yields on both nonstops and connecting journeys,” Mann says. “That said, they’re all making bank for a change.”

Under Attack

Answering a question during the fourth quarter earnings call about Southwest’s multiple negotiations with its labor unions, Kelly candidly acknowledged that Southwest’s competitive position has been “under attack.”

“We must keep Southwest Airlines competitive,” Kelly said. “And this is now an evolved environment where our legacy competitors are stronger than ever. And it is more important for us than ever to maintain our low-cost position and preserve our low-fare brand. So that has been under attack as the other airlines have gone through bankruptcy.

“I just point that out again to reiterate that’s as much a component of the current environment as anything else. And if it takes time to get the right contracts negotiated for the parties then it takes time. So we are determined to do the right thing by the people and the company. My hope is that we can get that done this year.”

Is Southwest Up To The Challenge?

Kelly thinks Southwest is up to the challenge. What else would he say, actually.

But Mann thinks so too.

“At the end, Southwest is poised to grow cross-border to Mexico and Canada, into the Caribbean, and eventually to Hawaii, all of which mean significant new opportunities for labor,” Mann says. “With that table laid, and with the long-overdue choice of Amadeus for reservations and airport systems (which I think will migrate over to the domestic operation as well, once pricing is negotiated), yes, I think they are up to the task.”

Kelly expresses confidence in the people factor at Southwest, and Mann believes Southwest culture is an asset, too.

“The difference is the culture has not gone nearly irreversibly south, as it had at most network carriers, some only recently and expensively recovered,” Mann says. “With the culture intact, and with the opportunities they have, the best of Southwest is yet to come.”

With Southwest completing the Airtran merger and dialing up international destinations, Mann predicts that Southwest “may want to look for another name within 10 years.”

And like the legacy U.S. carriers that are catching up, Southwest may eventually hop on board a potential upcoming consolidation bandwagon, Mann believes, arguing that Southwest “may figure in the upcoming consolidation of low-cost carriers/ultra low-cost carriers into a fourth global network.”

Now that would truly make for an “evolved” set of competitive dynamics.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: delta air lines, earnings, low-cost carriers, southwest airlines

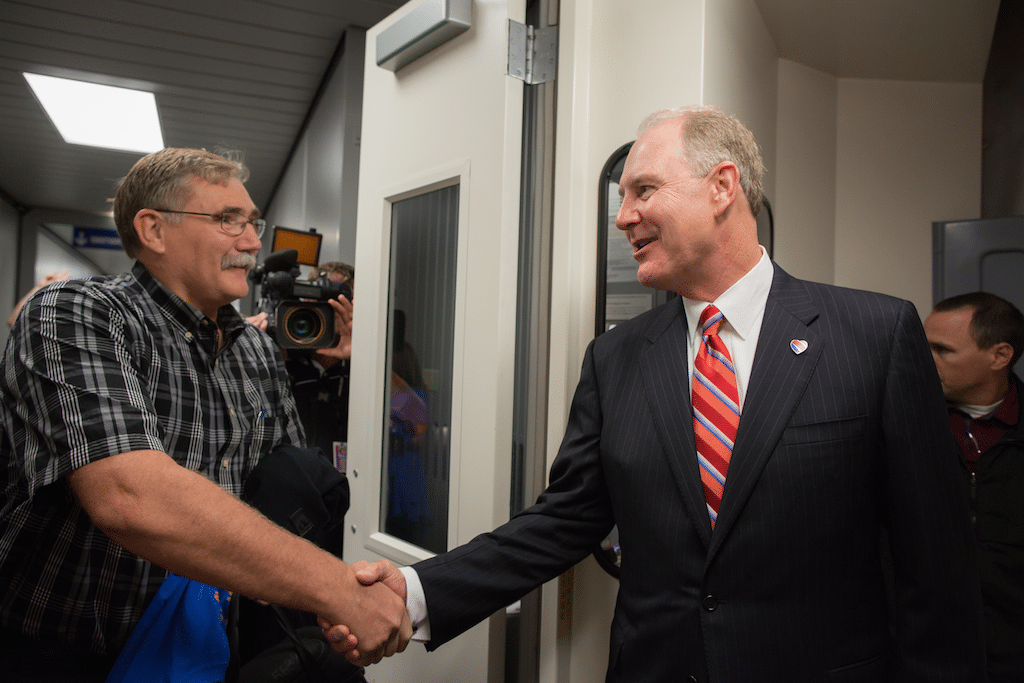

Photo credit: Southwest Airlines CEO Gary Kelly greets customers on the first non-stop flight out of Dallas Love Field on October 13, 2014. Stephen M. Keller / Southwest Airlines