Only 5 million people live in Norway, but thanks to the country’s careful management of its oil wealth, the country runs the largest sovereign wealth fund in the world. Everything about the fund is big. Very big.

Reported assets, for example, totaled $890 billion at the end of June—that’s $178,000 for every Norwegian. And the fund holds around 1% of all the stocks and bonds in the world. (This nifty map lets you see just how much of every listed company it owns.)

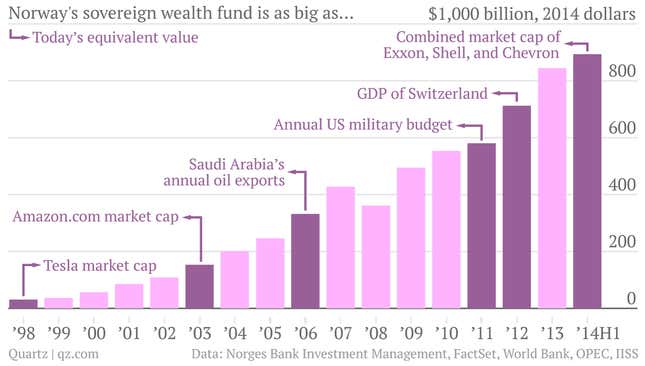

By the end of 2020 the government expects the fund—officially known as the Government Pension Fund Global—to be worth the equivalent of $1.1 trillion in today’s money. To try to put the fund’s size and growth in perspective, the chart below shows its year-end values converted into current dollars, alongside a few examples of things that fetch roughly the same amount of money today. For example, back in 2003 Norway’s fund was worth the same as Amazon.com’s current market capitalization. A decade later, it is now worth the same as the combined market cap of Exxon, Shell, and Chevron.

Since its founding in the late 1990s, the fund has amassed its vast wealth with the intention of paying for pensions in future generations, when Norway’s population ages and its oil wells run dry. The fund recently shifted its strategy (paywall) to invest more in property and emerging markets as it seeks to boost its returns in order to grow even bigger. In its latest quarterly update, the oil fund reported a 192 billion kroner ($31 billion) gain on its investments, representing a 3.3% return on assets.