Microsoft has long dominated the corporate-software market, and its new CEO Satya Nadella has set his sights on owning all things related to productivity and the cloud. But Google—fueled by its search-advertising business and consumer popularity—has been coming on strong for years with lower-priced, cloud-based services such as email and calendars, productivity apps, video hangouts, and storage. And among certain types of customers, it is succeeding.

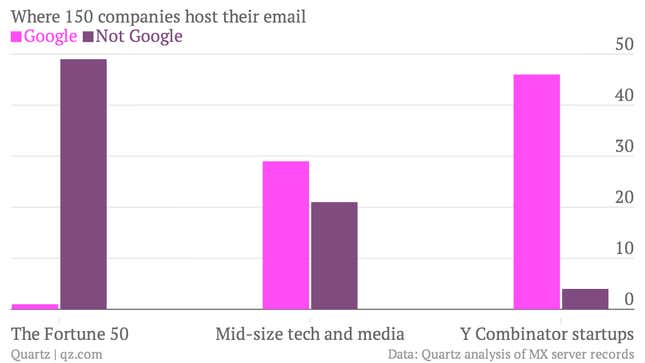

For a snapshot of Google’s progress, Quartz looked up the email-hosting MX records for 150 companies across three general size categories: the “Fortune 50” largest US companies; a group of mid-size tech and media companies, both public and private; and 50 startups from the last Y Combinator incubator class in Silicon Valley. The results are…exactly what you might expect!

Among the Fortune 50, only one company—Google—had its mail records pointed at Google’s servers. Among the mid-size companies, almost 60% host their email with Google, including corporations like Twitter, Dropbox, Box, Airbnb, Square, Uber, and Etsy. And among the Y Combinator startups—mostly very small companies with some funding, but often tight budgets—92% host their email with Google.

This says two things. First, Microsoft and other vendors like IBM still have a tight grip on the largest companies. Gartner analyst Tom Eid—who predicts that enterprise email alone will be a $5 billion global industry this year, growing about 10% from last year—confirms this. He estimates that Microsoft still commands 75% of the market’s spending, versus about 3% to 5% for Google.

But Google is capturing Microsoft’s future customer base. Perhaps this doesn’t hurt as much now, but as today’s smaller companies grow into tomorrow’s leaders, will they eventually switch to Microsoft products? Or will they stick with Google? (Or, also possible—but less dramatic—both?)

Another question is whether Google will get some competition here. Microsoft has entered cloud-based email and apps markets, and said in its most recent earnings report that commercial Office 365 subscription sales—which includes email as well as Office apps—grew more than 100% year-over-year. Still, its legacy business of licensing software to corporations—the one under attack—generated $42 billion in highly profitable sales last fiscal year, barely growing.

Dropbox and Box, two cloud-storage upstarts, both seem like potential rivals someday. Dropbox purchased Mailbox, an app for reading and creating email, but has not yet launched an email-hosting service. Its founder Drew Houston did not respond to an email for comment. But Box chief Aaron Levie says it’s not on his short list of things to do: “We want to go after spaces where we think we can have a differentiated position and proposition for companies.”

Pricing is another issue. Google, which generates 90% its revenue from advertising, charges very little for Google Apps—just $5 per user, per month, or $10 for unlimited storage. Box’s published rates for “business” storage and collaboration plans are three or more times that much. Huge Microsoft enterprise contracts—which typically include many services—can be much more. (Microsoft smartly starts Exchange Online subscriptions at $4 per user, per month. Broader Office 365 subscriptions are more.)

This leaves Microsoft in the lead—technically, for now. But Google’s disruptive plan is working.