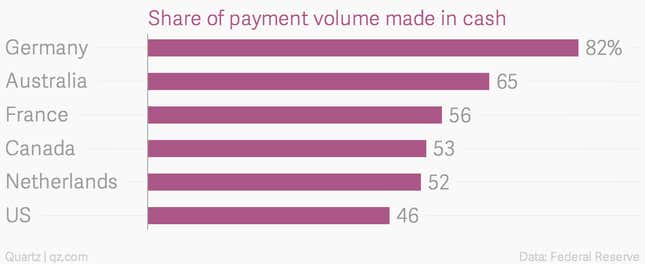

As banks, technology giants and would-be disruptors such as Square scrummage over the payment system of the future, German consumers seem perfectly happy with the payment system of the past. Germany remains one of the most cash-intensive advanced economies on earth.

On average, wallets in Germany hold nearly twice as much cash—about $123 worth—as those in Australia, the US, France and Holland, according to a recent Federal Reserve report on how consumers paid for things in seven countries. Roughly 80% of all transactions in Germany are conducted in cash. (In the US, it’s less than 50%.) And cash is the dominant form of payment there even for large transactions.

No one knows precisely why Germans have such a strong preference for cash, though survey data offer some hints. German respondents suggested that using cash makes it easier to keep track of their money and spending [pdf].

“A glance into one’s pocket provides a signal about the extent of expenses and the remaining budget. With a large cash share of expenditures, the quality of the signal is high. We conjecture that for some consumers this signal is of value and hence they choose to use cash,” wrote ECB analysts who studied the phenomenon.

Other responses suggest Germans like the anonymity of cash, in keeping with their general enthusiasm for tightly protecting privacy.

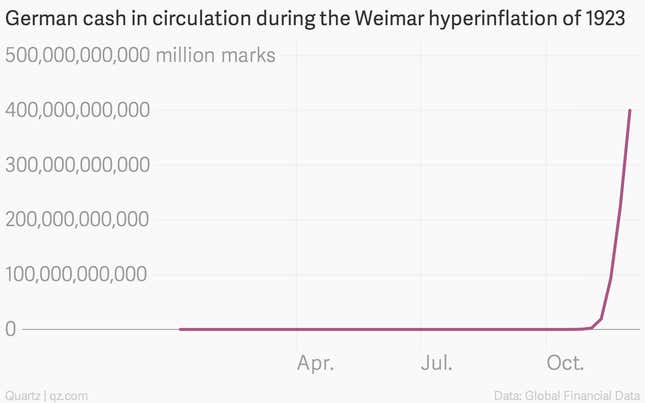

But, of course, their attitudes toward currency must owe something to Germany’s tumultuous monetary history. During the Weimar-era hyperinflation that peaked in 1923, prices rose roughly a trillion-fold, as Germany attempted to pay its onerous war reparations with devalued marks.

The sheer lunacy of the sums involved make this everyone’s favorite hyperinflation.

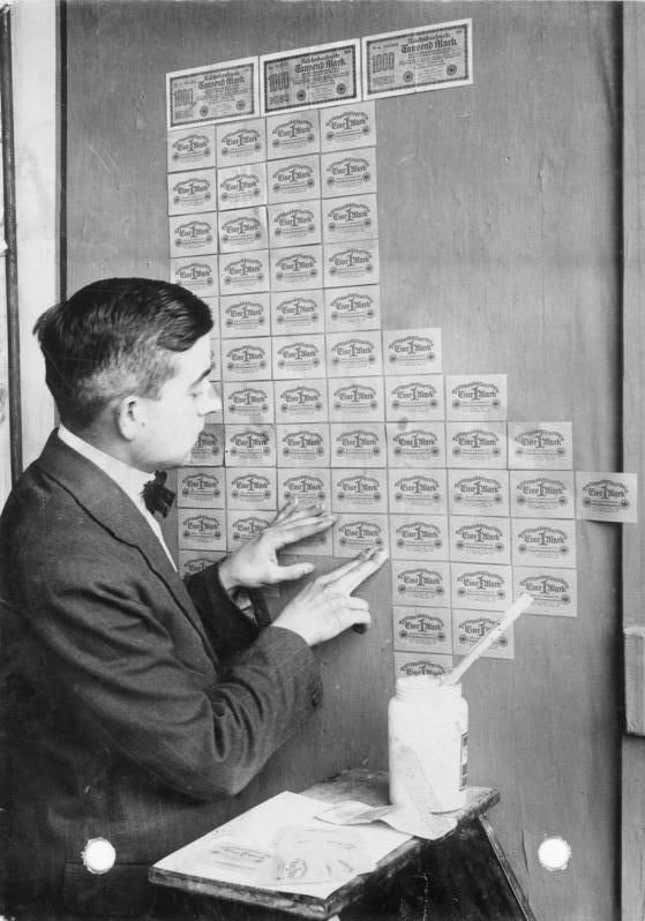

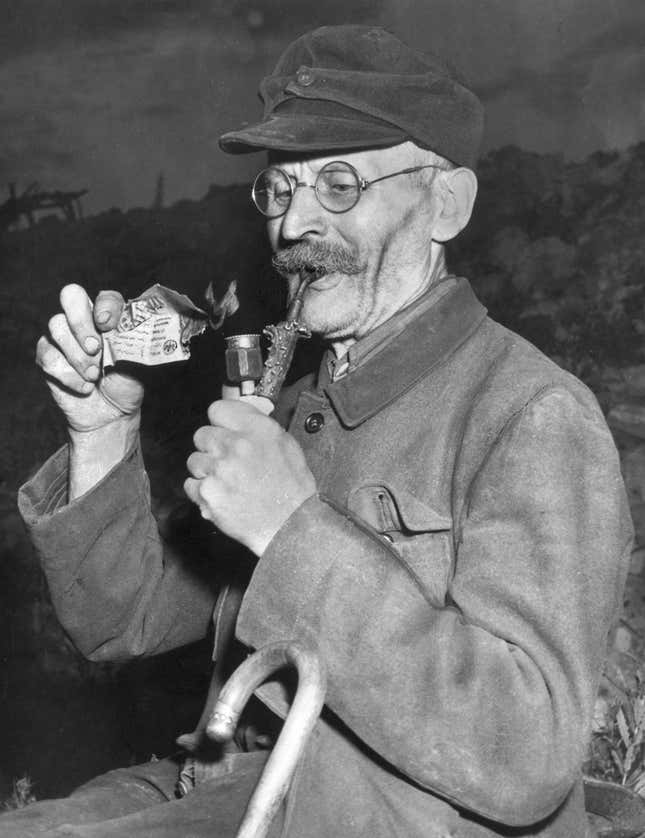

At the end of it, a loaf of bread cost 428 billion marks, a kilo of butter would run you roughly 6 trillion. Employers would halt work in the middle of morning to pay out bales of banknotes to workers—who sometimes collected them in laundry baskets—and the workday would be suspended for an hour or so as employees were given time to run around and purchase as much as they could before the money became worthless. (They would barter it later.) And, of course, people were using the worthless banknotes for all sorts of silly things, such as wallpaper, furnace fuel and kites.

But this wasn’t the last time Germany’s currency was rendered worthless in the 20th century. After World War II, the reichsmark was again in disarray. Hitler had largely financed the war by printing money, keeping inflation at bay through a uniquely fascist policy of strict price controls and violent threats. (“Inflation is a lack of discipline,” Hitler once said. “I’ll see to it that prices remain stable. That’s what my storm troopers are for.”)

During the postwar occupation, the Allies kept wage and price controls and rationing in effect. But more and more economic activity moved to the black market. Packs of Camels and Chesterfields, nylon stockings and Parker pens—which US servicemen stationed in Germany could easily buy at their bases—became de facto currencies.

The currency reform of June 20, 1948, in which Germans were forced to convert their cash into the newly introduced deutsche marks at a rate of more than 10 reichsmarks to the D-mark, was painful too, vaporizing more than 90% of an individual’s savings (paywall).

But the new currency helped pull hoarded goods back into shops and tamped down on the enervating effects of the black market. It was widely viewed as a tough, but necessary step that put Germany’s post-war economic resurgence in motion.

As such, the deutsche mark became a point of pride, first for West Germany, and in 1990 for those who lived in the former Communist east as well. (They were able to exchange their worthless ostmarks for deutsche marks at a generous rate of one-for-one.) It was with some consternation that Germany changed over to the euro in 2002.

So what role does this history play in the preference for cash?

One explanation is that, as researchers have found, memories of hyperinflation have quite a bit of staying power. People in countries that suffered banking crises quite sensibly often prefer to save in cash—though typically in foreign currencies such as US dollars—rather than put money in the bank. (Federal Reserve Bank of New York economists found that demand for US dollars rises for at least a generation in countries after they suffer a searing experience with high inflation.) And countries such as Bulgaria and Romania, which have recent histories of currency instability and financial crises, also are quite heavy users of cash.

But the real point isn’t that Germans love cash. It’s that—for the same historical reasons—they loathe debt. (Armchair anthropologists have also long noted that German word for debt—Schulden—comes from the word for guilt, Schuld.)

Levels of consumer debt in Germany are remarkably low. German aversion to mortgage debt is part of the reason why the country has some of the lowest homeownership rates in the developed world. Just 33% of Germans said they had a credit card back in 2011. And most of those hardly ever get used. In 2013, only 18% of payments in Germany were made via cards, compared to 50% in France and 59% in the UK.

The national preference for cash, then, seems to be the flip side of aversion to debt, which, in turn, can be interpreted as a sign of deep-seated doubt about the future. (German businesspeople are also notorious for their pessimism about the future.) And fear of the future, of course, is rooted in the past.

In other words, the German tendency to settle up in cash undeniably reflects the fact that for much of the last century, Germany has been either on the brink of, in the midst of, or struggling to recover from, disaster. And traumas like that are bound to leave, if you’ll excuse the pun, a mark.